Pangunahing impormasyon

Japan

JapanKalidad

Japan

|

5-10 taon

|

Japan

|

5-10 taon

| https://www.isec.jp/en/

Website

Marka ng Indeks

Ratio ng Kapital

Good

Kapital

Impluwensiya

C

Index ng impluwensya NO.1

Japan 2.92

Japan 2.92Ratio ng Kapital

Good

Kapital

Impluwensiya

C

Index ng impluwensya NO.1

Japan 2.92

Japan 2.92 Mga Lisensya

Mga LisensyaMga Lisensya na Mga Institusyon:あい証券株式会社

Regulasyon ng Lisensya Blg.:関東財務局長(金商)第236号

solong core

1G

40G

1M*ADSL

Japan

JapanIsang Pagbisita sa i SECURITIES sa Hapon - Natagpuan ang Opisina

Ang mga surveyor ay bumisita sa i SECURITIES ayon sa plano at nakita ang pangalan ng kumpanya ng broker at logo na naka-display nang malaki sa pampublikong ipinapakita na address ng negosyo, na nagpapahiwatig ng pisikal na presensya ng negosyo ng broker. Pinapayuhan ang mga mamumuhunan na isaalang-alang ang lahat ng mga salik bago gumawa ng desisyon.

Japan

JapanIsang Pagbisita kay sa Japan - Opisyal na Kinumpirma Na Umiiral

Ang mga investigator ay nagpunta upang bisitahin ang dealer sa Tokyo, Japan tulad ng plano. Ang logo ng dealer ay matatagpuan sa address na ipinakita sa publiko, na nagpapahiwatig na ang dealer ay mayroong isang tunay na lugar ng negosyo. Sa kasamaang palad, nabigo ang mga investigator na ipasok ang kumpanya para sa karagdagang pagbisita at maaari lamang kumuha ng litrato sa pasukan, kaya't ang tiyak na sukat ng negosyo ay mananatiling hindi alam. Ang mga namumuhunan ay bilang

Japan

JapanIsang Pagbisita sa i SECURITIES sa Hapon - Natagpuan ang Opisina

Ang mga surveyor ay bumisita sa i SECURITIES ayon sa plano at nakita ang pangalan ng kumpanya ng broker at logo na naka-display nang malaki sa pampublikong ipinapakita na address ng negosyo, na nagpapahiwatig ng pisikal na presensya ng negosyo ng broker. Pinapayuhan ang mga mamumuhunan na isaalang-alang ang lahat ng mga salik bago gumawa ng desisyon.

Japan

JapanIsang Pagbisita kay sa Japan - Opisyal na Kinumpirma Na Umiiral

Ang mga investigator ay nagpunta upang bisitahin ang dealer sa Tokyo, Japan tulad ng plano. Ang logo ng dealer ay matatagpuan sa address na ipinakita sa publiko, na nagpapahiwatig na ang dealer ay mayroong isang tunay na lugar ng negosyo. Sa kasamaang palad, nabigo ang mga investigator na ipasok ang kumpanya para sa karagdagang pagbisita at maaari lamang kumuha ng litrato sa pasukan, kaya't ang tiyak na sukat ng negosyo ay mananatiling hindi alam. Ang mga namumuhunan ay bilang

Japan

Japan isec.jp

isec.jp Japan

Japan

| i SECURITIESBuod ng Pagsusuri | |

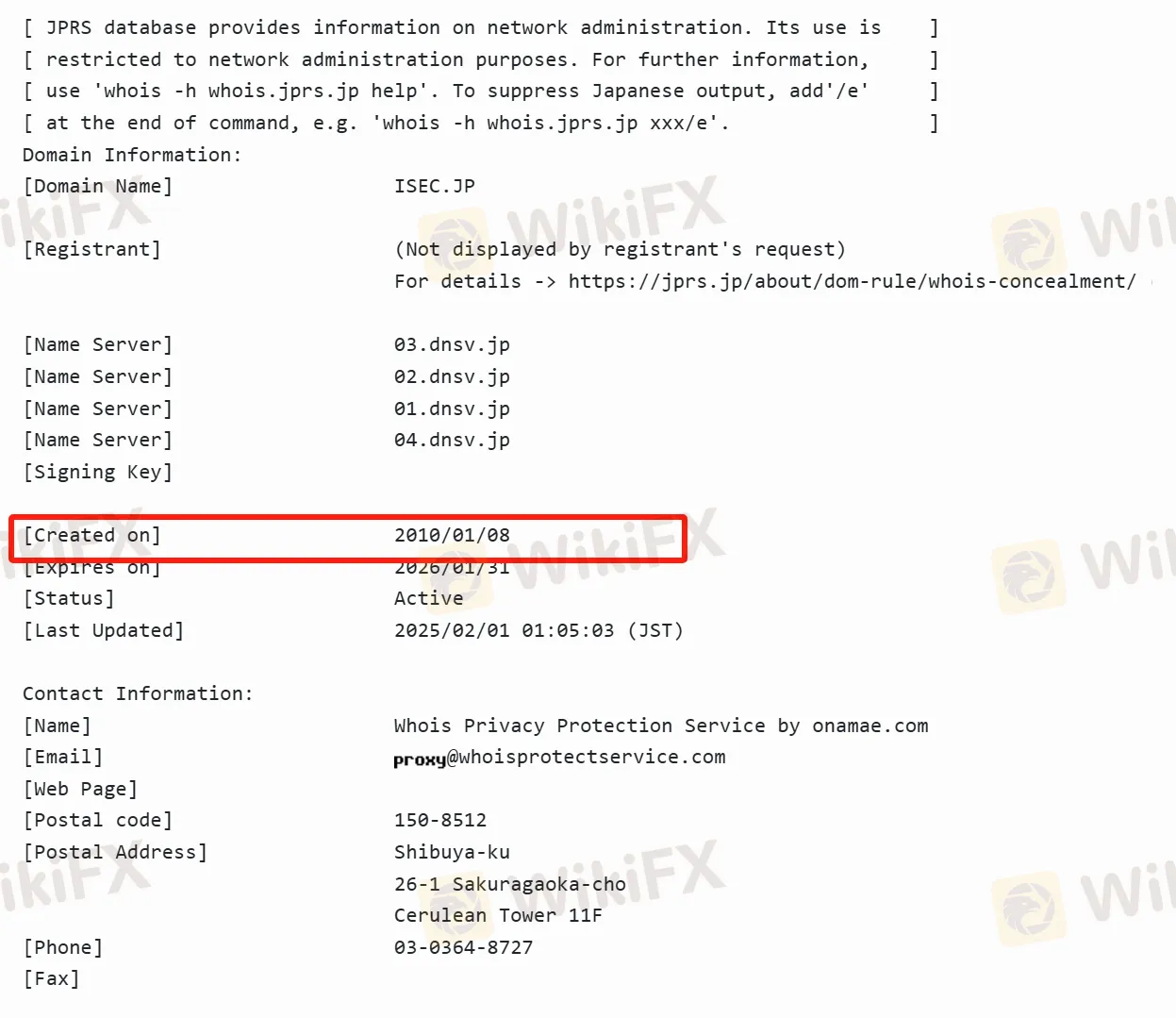

| Itinatag | 2010/01/08 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | Regulado |

| Mga Instrumento sa Merkado | Forex, CDFs, Investment Trusts, at Pondo |

| Platform ng Paggagalaw | i-Trading (Windows at Mac OS) |

| Suporta sa Customer | Tel: 03-3568-5088/0120-849-188 |

| Fax: 03-3568-5099 | |

| Email: info@isec.jp | |

| Facebook, Twitter | |

| Kalamangan | Disadvantages |

| Regulado | Barriera sa Wika (Japanese lang) |

| Iba't ibang mga instrumento at serbisyo sa pagtetrade | Mga Panganib ng mga produkto sa pagtetrade |

| Nagtutulungan sa maraming bangko | |

| Patakaran na nakatuon sa customer |

| Pamamaraan ng Trading | Komisyon sa Forex Trading | Komisyon sa CFD |

| Advanced Trading Method | 2,500 hanggang 6,000 Japanese yen bawat 100,000 units ng currency | 6,000 Japanese yen bawat lot (kasama ang consumption tax) |

| Online Trading | 300 Japanese yen bawat 10,000 units ng currency | Libre |

| Phone Order | Karagdagang 1,000 Japanese yen bawat 10,000 units ng currency | Karagdagang 1,000 Japanese yen bawat lot |

| Mobile APP/PC software available |

Ang kumpanya ay nagproseso ng mga bayarin at resibo ng margins sa pamamagitan ng FX margin account. Kapag lumampas na ang margin sa kinakailangang halaga, ang sobra ay ibinabalik sa loob ng apat na banking business days matapos ang kahilingan ng customer. Ang mga bayad para sa domestic transfer remittance ay sakop ng kumpanya, habang ang international transfers at foreign-currency transfers ay sa gastos ng customer. Ang transfer account ay limitado sa isang bank account na naka-rehistro sa pangalan ng customer.

i SECURITIES charges a commission based on the trading method. For advanced trading methods, the commission is between 2,500 and 6,000 Japanese yen per 100,000 units of currency. Online trading is more cost-effective, with a commission of 300 Japanese yen per 10,000 units of currency. These commission structures allow traders to choose the most cost-efficient method based on their trading volume and preferences. It's important to consider these fees when planning your trades, as they could impact your profitability.

i SECURITIES operates under the supervision of Japan’s Financial Services Agency (FSA), with its registration number No. 236, issued by the Director of the Kanto Local Finance Bureau. This regulatory framework ensures compliance with Japan's strict financial laws and provides an additional layer of security for investors. However, if you're trading internationally, it's important to check whether additional regulatory protections are available in your region, as i SECURITIES’ regulatory status is primarily within Japan.

One significant downside of trading with i SECURITIES is the lack of a demo account, which makes it challenging for beginners to practice trading without risking real money. Additionally, i SECURITIES only offers services in Japanese, creating a language barrier for non-Japanese speakers. Although the company provides various trading instruments, the risks associated with trading products such as Forex and CFDs should be carefully evaluated. The lack of international regulatory oversight may also be a concern for some traders looking for more extensive global protection.

i SECURITIES offers several benefits to traders, including its regulated status under the FSA, which provides a secure trading environment. The platform supports a wide range of trading instruments, such as Forex, CFDs, and investment trusts, allowing for portfolio diversification. Additionally, the company focuses on customer-centric services, collaborating with multiple banks to ensure smooth transactions. This combination of regulation and customer-focused policies makes it a reliable option for traders, especially those based in Japan. However, the primary drawback is the language barrier, as all services are provided in Japanese.

Mangyaring Ipasok...

TOP

TOP

Chrome

Extension ng Chrome

Pandaigdigang Forex Broker Regulatory Inquiry

I-browse ang mga website ng forex broker at tumpak na tukuyin ang mga legit at pandaraya na broker

I-install Ngayon