abstrak:n February, most global markets continued to fall, marking the second month of broad losses for the major asset classes in 2022. Commodities and inflation-indexed government bonds are the primary exceptions.

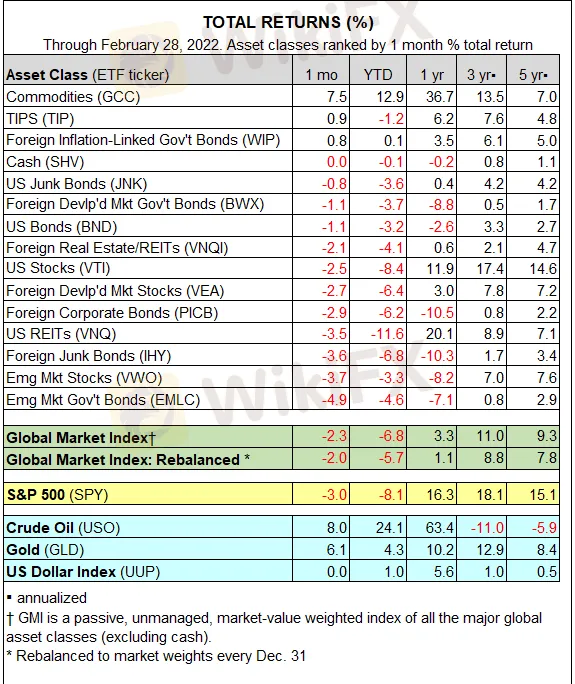

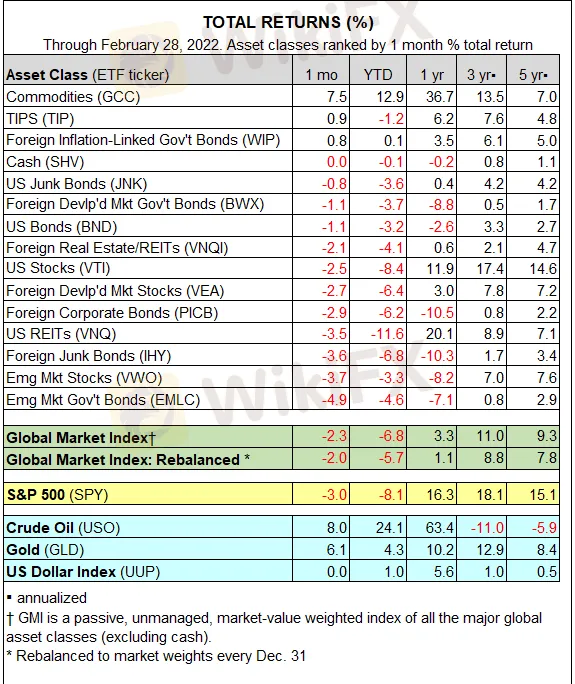

In February, most global markets continued to fall, marking the second month of broad losses for the major asset classes in 2022. Commodities and inflation-indexed government bonds are the primary exceptions.

In February, a broad index of commodities registered yet another robust monthly advance. The WisdomTree Continuous Commodity Index Fund (NYSE: GCC) gained 7.5 percent, continuing its strong monthly performance.

Inflationary pressures around the world, worsened by the conflict in Ukraine, helped raise inflation-indexed bond prices last month. A pair of ETFs that follow the inflation-indexed US and international government securities saw minor gains (TIP and WIP, respectively).

In February, though, losses were the norm. Bonds issued by emerging market governments were the hardest hit, with the VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE: EMLC) down 4.9 % last month.

In February, the Global Market Index (GMI) plummeted as well. Last month, this unmanaged benchmark (kept by CapitalSpectator.com), which holds all major asset classes in market-value weights (excluding cash), dropped 2.3 percent. GMI is down about 7% so far this year.

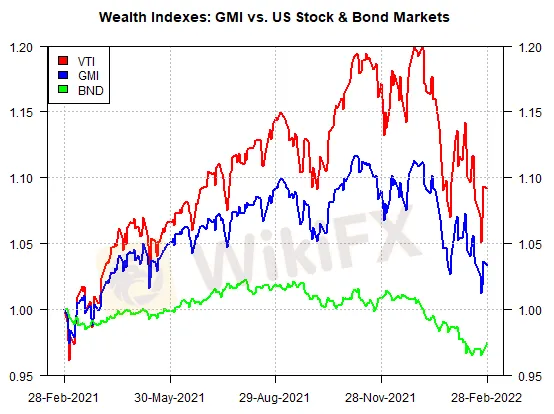

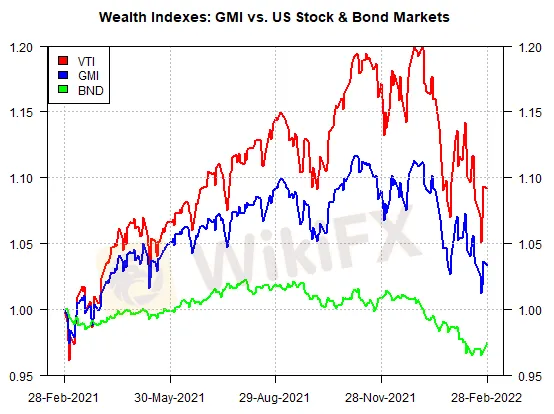

GMI's performance in comparison to US equities and bonds over the last year has remained solidly mediocre for this multi-asset-class benchmark (blue line in the chart below). For the trailing one-year window, US stocks via Vanguard Total Stock Market Index Fund ETF Shares (NYSE: VTI) earned roughly 11.9 percent. In contrast, the Vanguard Total US Bond Market via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ: BND), a comprehensive measure of US bonds, declined 2.6 percent. For the fiscal year ending Feb. 28, GMI earned 3.3 percent.