Abstract:This ZarVista Review provides an analysis based on verified public data and direct user-reported experiences. From the outset, it is essential to note that ZarVista, formerly known as Zara FX, exhibits a profile that indicates a high potential risk for traders. This conclusion is not made lightly; it is supported by its low regulatory score, a large volume of serious user complaints, and operational transparency issues.

An Immediate Look at Core Concerns

This ZarVista Review provides an analysis based on verified public data and direct user-reported experiences. From the outset, it is essential to note that ZarVista, formerly known as Zara FX, exhibits a profile that indicates a high potential risk for traders. This conclusion is not made lightly; it is supported by its low regulatory score, a large volume of serious user complaints, and operational transparency issues.

The main concerns surrounding this broker are severe and need immediate attention. The key issues we will explore in detail throughout this article include:

· Weak offshore regulation that offers minimal protection for traders.

· A disturbing pattern of user complaints, with a strong focus on withdrawal failures and claims of fund theft.

· Clear differences between the broker's marketing promises and the real-world experiences reported by its clients.

· Troubling results from field investigations that failed to verify the existence of its claimed physical offices.

The goal of this article is to deliver a clear, evidence-based analysis. We aim to provide traders with the necessary facts to make an informed and, most importantly, safe decision regarding their choice of brokerage.

ZarVista's Regulatory Framework

A broker's trustworthiness begins and ends with its regulatory status. This section critically analyzes ZarVista's licensing, explaining the practical implications for trader protection and highlighting major safety red flags that have been identified.

Offshore Licensing Details

ZarVista is officially registered in Comoros and holds a Securities Trading License (No. GB23202450) from the Financial Services Commission (FSC) of Mauritius. The broker states its operating period is between 5 and 10 years.

Jurisdictions such as the Comoros and Mauritius are widely recognized as offshore regulatory zones. For a trader, this has specific, critical consequences. Offshore regulation typically means:

· Less strict financial and operational oversight compared to top-tier regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

· The absence of, or very limited access to, investor compensation schemes. This means that if the broker becomes insolvent, traders have little to no chance of recovering their funds.

· Significant difficulties in seeking legal help or resolving disputes. Pursuing a claim against a company registered in a distant offshore location can be impractical and extremely expensive for an individual trader.

Unverified Physical Offices

A major red flag emerged from field surveys conducted by WikiFX for the broker under its previous name, Zara FX. These on-site visits are designed to verify the physical presence and legitimacy of a broker's stated office locations. The results were concerning:

· Canada Visit: The investigation concluded with a “No Office Found” result at the listed address.

· Cyprus Visit: Similarly, a visit to the claimed Cyprus location also resulted in “No Office Found.”

The inability to verify a physical business address is a significant warning sign. It raises fundamental questions about a company's transparency, accountability, and overall legitimacy. A reputable firm should be easily locatable at its registered addresses.

Implications for Fund Safety

The combination of these factors—weak offshore licensing and unverified physical offices—creates an environment where trader funds are not adequately protected. The regulatory framework lacks the power to enforce client fund protection rules, and the lack of a verifiable presence makes it difficult to hold the company accountable.

*Important Note for Traders: Regulatory status can change. We strongly advise you to verify the current licensing details and any active warnings for ZarVista or any other broker by checking their profile on a comprehensive verification platform, such as WikiFX, before depositing any funds.*

Advertised Trading Conditions

To provide a balanced perspective, it is necessary to present the trading conditions, account types, and platforms that ZarVista advertises to its potential clients. This section offers a structured overview based on the broker's own marketing information.

Account Types and Tiers

ZarVista structures its offering across four main account types, targeting traders with different levels of experience and capital. The information is best summarized in a table for clear comparison.

It is worth noting a lack of clarity regarding the minimum deposit. While one summary lists it as $50, another part of its information states it as $100. This inconsistency is a minor but notable point of confusion for new clients.

Leverage and Instruments

The broker offers a maximum leverage of up to 1:500. While high leverage can amplify potential profits, it is a double-edged sword that dramatically increases the risk of substantial, rapid losses. It should be approached with extreme caution, especially by inexperienced traders.

ZarVista provides access to a broad range of market instruments, allowing for portfolio diversification. The available asset classes include:

· Forex: Major, minor, and exotic currency pairs.

· Metals: Precious metals like Gold and Silver.

· Indices: Major global stock indices such as the S&P 500.

· Commodities: Energy and agricultural products.

· Cryptocurrencies: Popular digital currencies like Bitcoin and Ethereum.

The MT5 Trading Platform

A clear positive in ZarVista's offering is the provision of the MetaTrader 5 (MT5) platform. MT5 is a globally recognized, industry-standard platform known for its powerful features and robust performance. It offers traders advanced analytical tools, extensive charting capabilities, multi-asset trading from a single interface, and support for automated trading through Expert Advisors (EAs). The availability of a full MT5 license is a feature typically associated with established brokers.

ZarVista Pros and Cons Reality Check

This section moves beyond marketing claims to deliver a critical reality check. We compare the attractive, on-paper features with the severe, well-documented issues reported by users. This contrast reveals the true nature of the risks involved in dealing with ZarVista.

Potential On-Paper Benefits

Based on the broker's claims and a very limited pool of positive feedback, we can identify a few perceived advantages:

· Wide Range of Instruments: Access to forex, cryptocurrencies, commodities, and indices provides ample trading opportunities.

· Industry-Standard Platform: The availability of a full MT5 license offers a powerful and familiar trading environment.

· High Leverage Option: Leverage up to 1:500 is available for traders with a high-risk appetite and sophisticated risk management strategies.

· Tiered Account Structure: The three account types offer options for traders at different stages of their journey.

A few positive reviews mention good platform speed and a specific instance of helpful customer service. However, it is critical to frame this anecdotal feedback within the context of the overwhelming volume of severe negative reports, which paint a very different picture of the user experience.

Overwhelming User Complaints

A broker's character is most clearly revealed in how it handles client funds, disputes, and especially, withdrawals. An analysis of user complaints filed against ZarVista (and its former identity, Zara FX) reveals a consistent and alarming pattern of serious issues.

1. Severe Withdrawal Issues

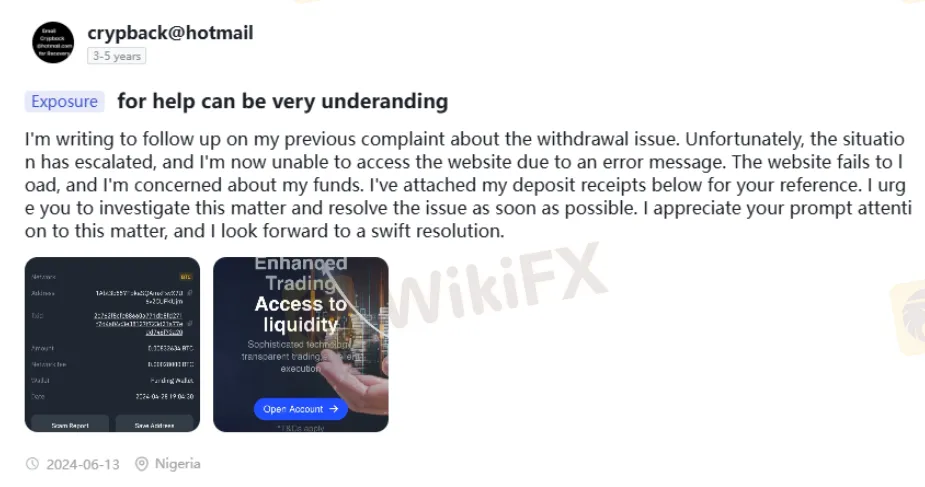

This is the most common and critical category of complaints. Users have repeatedly reported rejected withdrawals, declined refunds to credit cards, and a complete inability to access their capital. One user from Nigeria detailed a particularly distressing experience in June 2024, where, after encountering withdrawal problems, they were completely locked out of the website, preventing any access to their funds.

Another user from the United States noted in August 2024 that while spreads were low, withdrawal attempts were frequently declined by the bank, with the broker placing the responsibility entirely on the client to resolve the issue with their card issuer.

2. Claims of Fund Theft & Account Manipulation

The most serious complaints involve direct claims of financial wrongdoing.

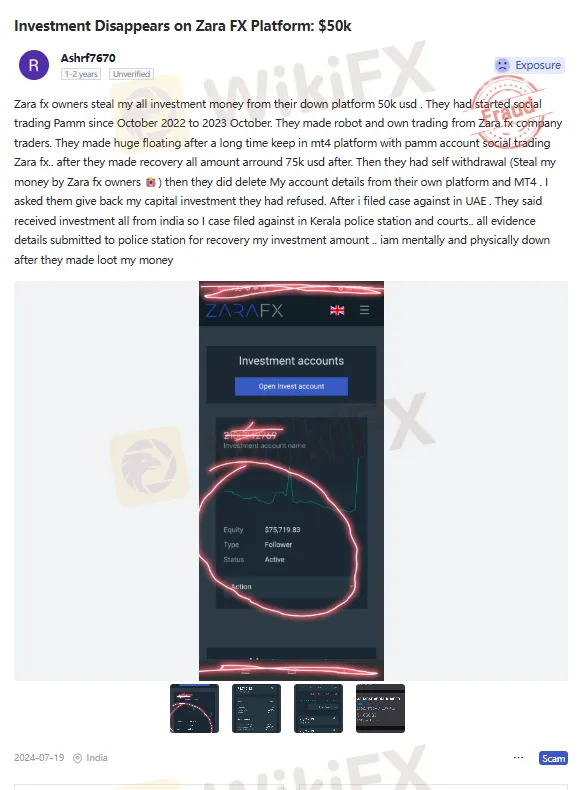

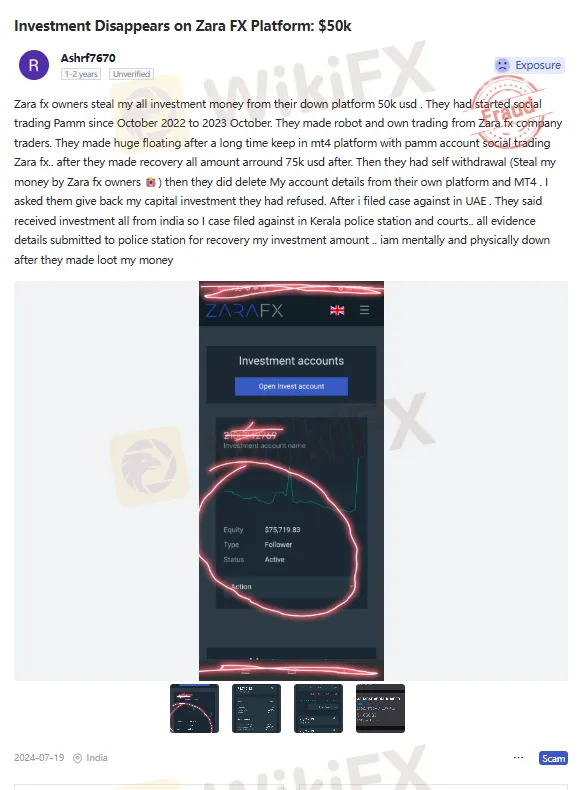

· Case Study 1: A user from India filed a detailed complaint in July 2024, claiming that $50,000 was stolen from their social trading (PAMM) account. The user claims that after the funds were recovered from a large drawdown, the broker's own team executed a withdrawal to themselves. Subsequently, the user's MT4 platform access and account details were deleted, and the broker refused to return the capital investment, leading the user to file a police case.

· Case Study 2: Another trader from India reported in April 2025 that profits generated from manual trading were rejected without any evidence of wrongdoing. The user claims the broker was manipulating platform conditions in a way that violated the terms of the MT5 trading terminal itself.

3. Platform & Access Problems

Beyond withdrawal failures, users have reported fundamental issues with platform access. The Nigerian user's complaint about being unable to load the website is a prime example. This raises concerns not only about platform stability but also about the potential for a broker to deliberately restrict access to prevent clients from managing positions or attempting to withdraw funds.

*See the Evidence Yourself: These are just a few examples from a larger pattern. We encourage traders to read the latest user reviews and exposure reports on ZarVista's WikiFX page to understand the full scope of the risks before deciding.*

A Closer Look at Features

Certain features, such as social trading and fast payments, can be highly attractive to traders. However, it is essential to examine them through the critical lens of user complaints and regulatory weaknesses already established.

Social Trading Risks

ZarVista offers PAMM/MAM accounts, which fall under the umbrella of social trading. This feature allows less experienced traders to allocate their funds to a manager and automatically copy their trades. While this can be a useful tool, it carries immense risk, especially with a lightly regulated broker.

The user complaint detailing a $50,000 loss from a PAMM account allegedly managed by the broker's own team serves as a powerful, real-world warning. It demonstrates how such systems can be exploited, leaving the investor with no recourse when funds disappear. The risk is not just in the manager's trading strategy but in the integrity of the broker facilitating the system.

Payment Claims vs Reality

ZarVista's marketing prominently features claims of “instant deposits and lightning-fast withdrawals.” This language is designed to build confidence and attract clients who value liquidity and quick access to their funds.

However, this marketing promise stands in stark contrast to the reality described in numerous, detailed user complaints. Reports of rejected withdrawals, prolonged delays, and outright fund lockouts directly contradict the broker's claims. This major disconnect between promises and actual performance is a hallmark of a high-risk operation.

Final Verdict on ZarVista

After a comprehensive review of its regulatory status, operational practices and user-reported experiences, a clear and decisive picture of ZarVista emerges.

Summary of Key Red Flags

The evidence points overwhelmingly to a high-risk environment for any trader. The key negative findings can be summarized as follows:

· Weak Offshore Regulation: The licenses from Mauritius and Comoros provide no meaningful investor protection or compensation schemes.

· Unverified Physical Offices: Investigations failed to confirm the broker's presence at its listed addresses in Canada and Cyprus, raising serious questions concerning legitimacy.

· A Significant Pattern of Severe User Complaints: There is a substantial body of evidence from users detailing critical issues, especially concerning withdrawals and alleged fund theft.

· A Major Disconnect: A clear gap exists between the broker's marketing promises of speed and security and the operational reality reported by its clients.

A Concluding Thought

While ZarVista presents a modern facade with the MT5 platform and a diverse range of account types, these features are overshadowed by fundamental and severe risks. The combination of weak regulation, a lack of transparency, and a documented history of significant user issues constitutes a serious warning that should not be ignored.

Final Due Diligence Advice

*Choosing a broker is one of the most important financial decisions a trader can make. Always prioritize safety and regulatory standing over attractive marketing claims. We urge you to use independent verification tools, such as WikiFX, to check the up-to-date regulatory status, user reviews, and risk warnings for any broker you consider.*