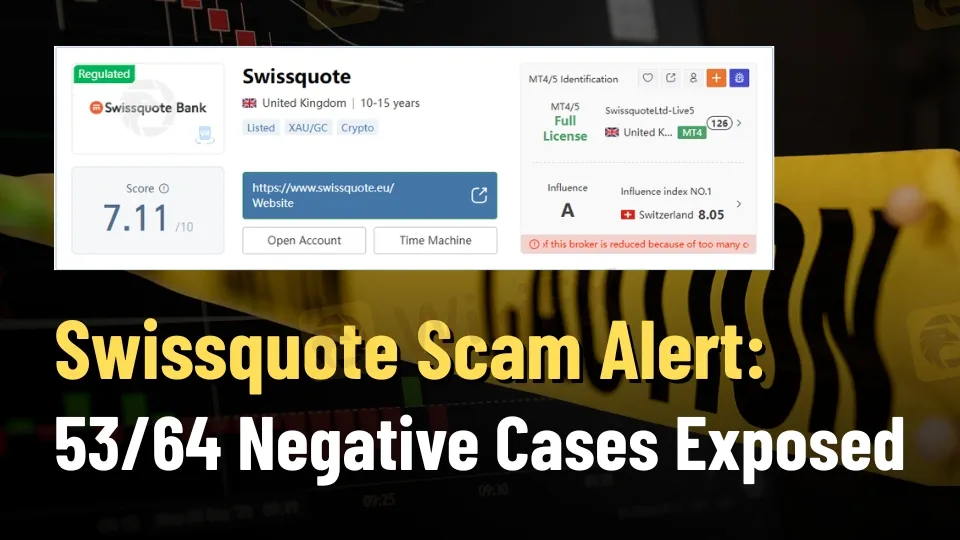

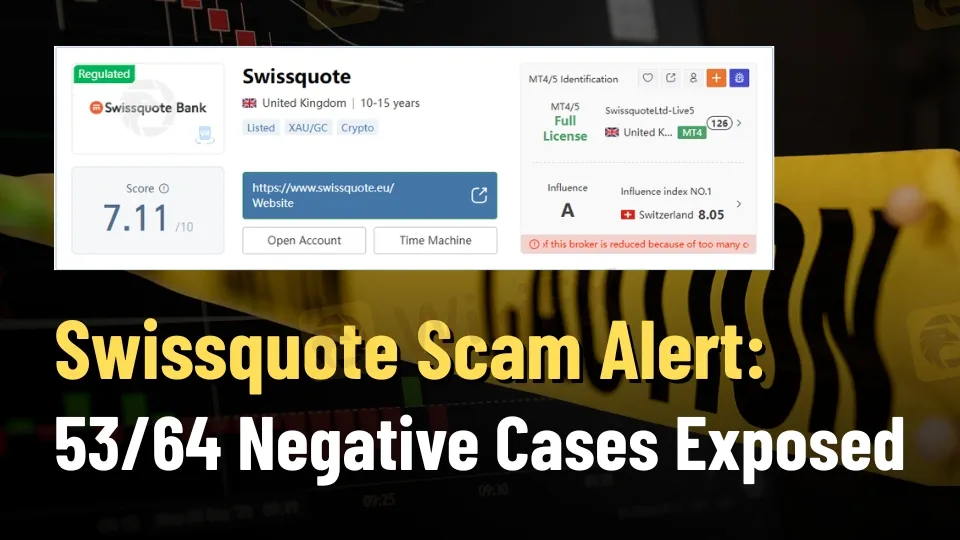

Abstract:Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Swissquote Is Widely Presented as a Regulated Online Trading Broker, but the Exposure Data on the WikiFX App Shows a Very Different Risk Picture That Traders Must Not Ignore. Out of 64 User Cases Logged on the Platform, 53 Are Negative, Indicating Problematic Customer Service, Account Handling, and Fund Security Concerns That Can Resemble Forex Broker Scams if Traders Are Not Extremely Cautious.

Brief Overview of Swissquote

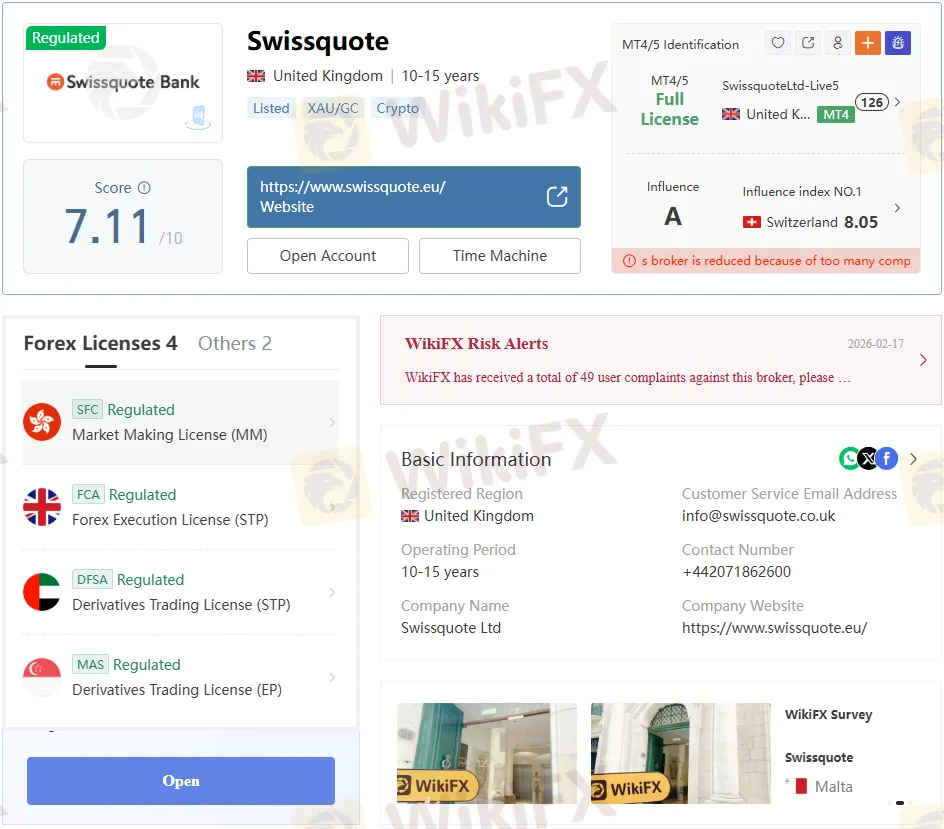

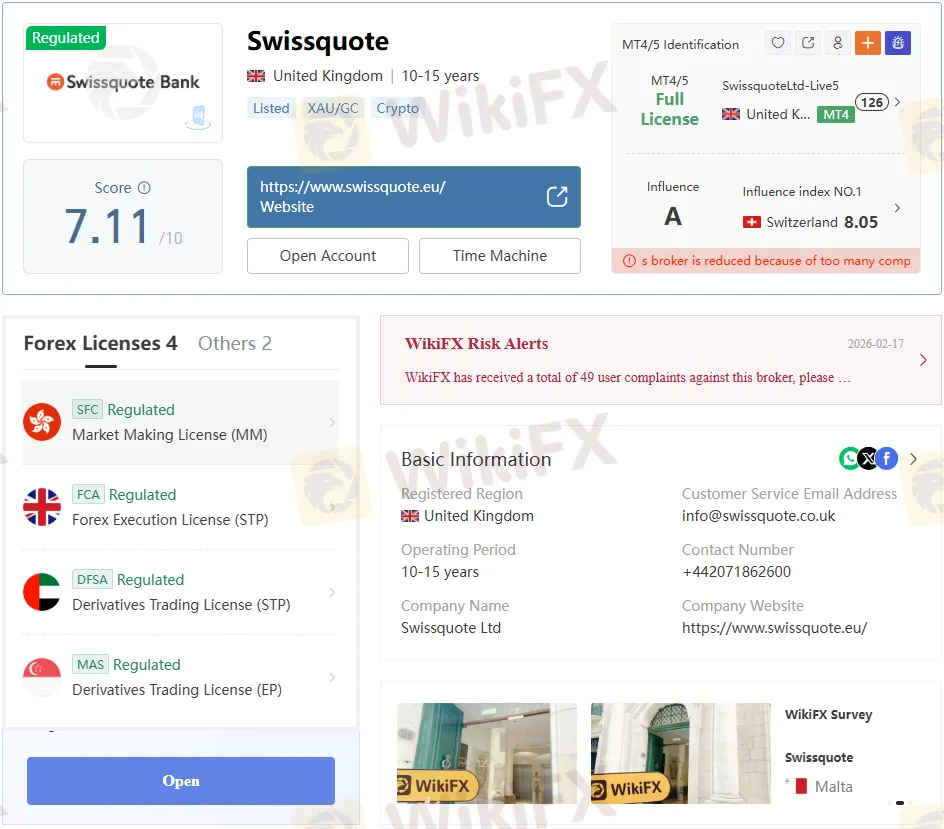

According to Its WikiFX Broker Page, Swissquote Was Founded in 1996 and Is Headquartered in Gland, Switzerland. The Broker Is Shown as Regulated Under Multiple Entities: FINMA in Switzerland, FCA in the United Kingdom, DFSA in Dubai, and MFSA in Malta, and It Markets Itself as a Global Swissquote Forex and CFD Provider. Swissquote Offers Access to Forex, Indices, Commodities, Stocks, Bonds, and Cryptocurrencies via MT4, MT5, and a Proprietary Mobile App, with Leverage up to 1:30 for Retail Clients and up to 1:100 for Professional Accounts and a Minimum Deposit of 1,000 in Major Currencies.

On Paper, Swissquote Appears to Be a Fully Regulated Swissquote Broker with Competitive Spreads Starting from Around 0.6 Pips on Some Account Types and a Range of Premium, Prime, Elite, and Professional Accounts. The WikiFX App Page Highlights Demo Trading, Multiple Base Currencies, and Deposit Methods Such as Bank Transfer and Debit Card, Which Would Normally Be Positive Features in a Swissquote Review. However, the Same Page Also Aggregates Serious User Exposures That Raise a Strong Scam Alert Signal Despite This Swissquote Regulation Profile.

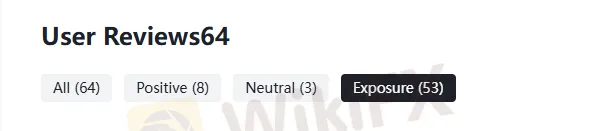

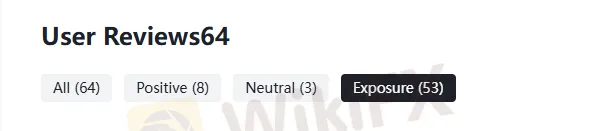

53 Out of 64 Negative Cases – Why This Matters

The Most Striking Risk Indicator Is the Ratio of Negative to Total Cases: 53 Negative Exposures Out of 64 Total Reports for Swissquote on the WikiFX App. Even for a Large, Long‑Standing Broker, Such a Concentration of Complaints Suggests That a Meaningful Number of Users Feel Harmed, Misled, or Badly Treated, Which Is Exactly the Kind of Pattern Traders Look for When Filtering Potential Forex or Online Investment Scams. While Regulation by FINMA or the FCA Is Often Seen as a Safety Net, the Exposure Data Shows That a Regulated Label Does Not Automatically Protect Traders from Problematic Practices or Forex Fraud‑Like Experiences.

In a Genuine Swissquote Review, Both the Regulated Status and the Negative Exposure Ratio Must Be Considered Together. A Regulated Swissquote Broker with Dozens of Unresolved Complaints Can Still Create Real Financial and Emotional Damage if Account Openings, Withdrawals, or Support Channels Fail in Practice. For Anyone Considering Forex Swissquote for Live Trading, This 53/64 Figure Should Trigger a Very Strong Scam Alert Mindset and Deeper Due Diligence on the WikiFX App Before Sending Any Funds.

Case 1: Complicated Account Closure and Data Concerns (Germany)

One User from Germany Describes How Simply Opening and Managing a Swissquote Account Became a Stressful Process. They Report That Account Opening Was Already Complicated and That Logging In Remained Difficult Compared with Local Swiss Banks' Apps, Suggesting a Poor User Experience and Potential Technical Risks. When the Client Tried to Close the Account, a Remaining Balance of About 460 Francs Allegedly Stayed Pending for Months without Being Returned, Which Is a Serious Red Flag in Any Alleged Forex Trading Scam.

The Same Exposure Claims That Swissquote Customer Service Demanded Information About the User‘s Last Job Five Years Ago, Even Though the Client Had Already Retired, and That the Client Allegedly Knew the Previous Employer’s Name. The Customer Openly Questioned How Swissquote Had This Data and What It Had to Do with Closing the Account, Raising Fears About Data Protection and Privacy, Which Are Often Associated with Online Trading Scams When Not Clearly Explained. While Regulated Brokers Must Perform Compliance Checks, Combining Long Withdrawal Delays with Intrusive Questioning and Unclear Data Handling Can Resemble the Tactics of Forex Broker Scams Designed to Frustrate and Exhaust Clients Until They Give Up on Their Remaining Funds.

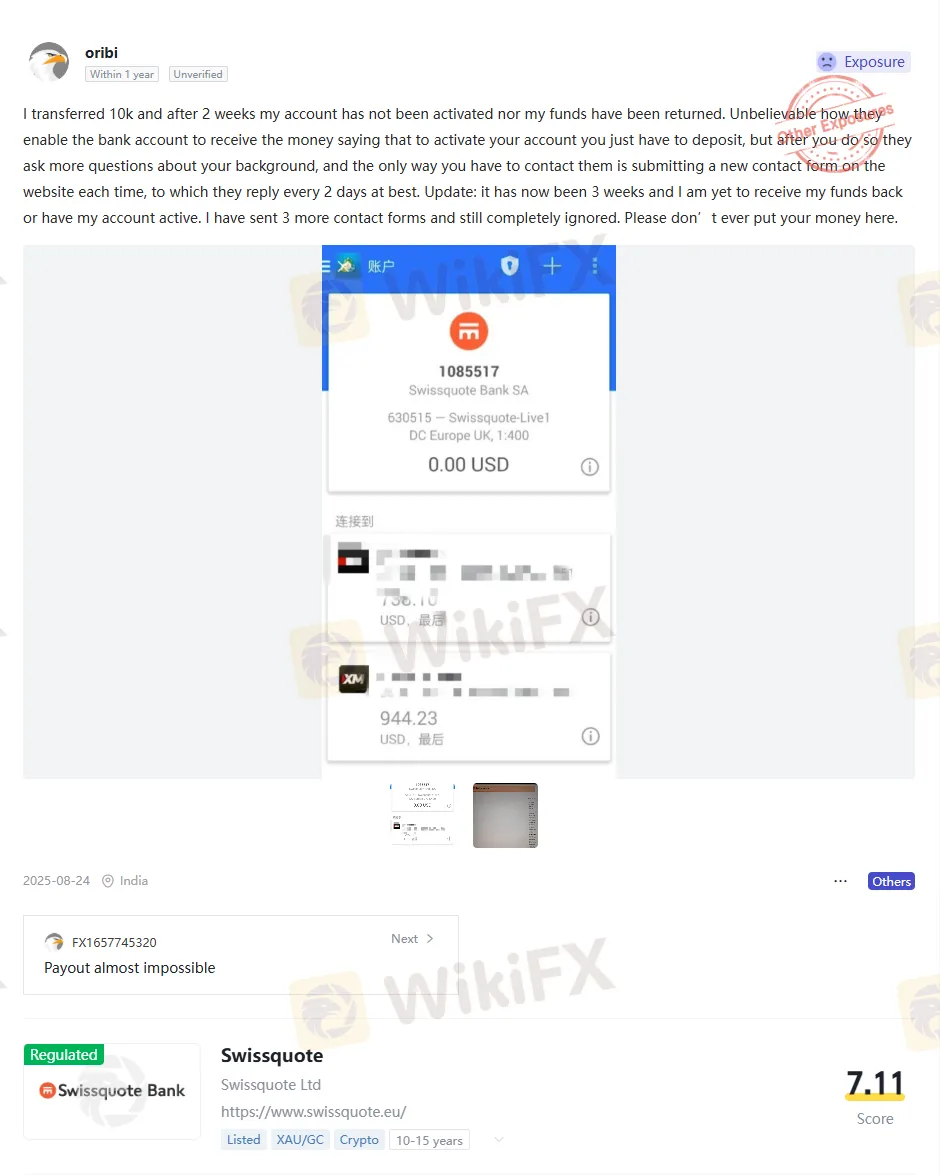

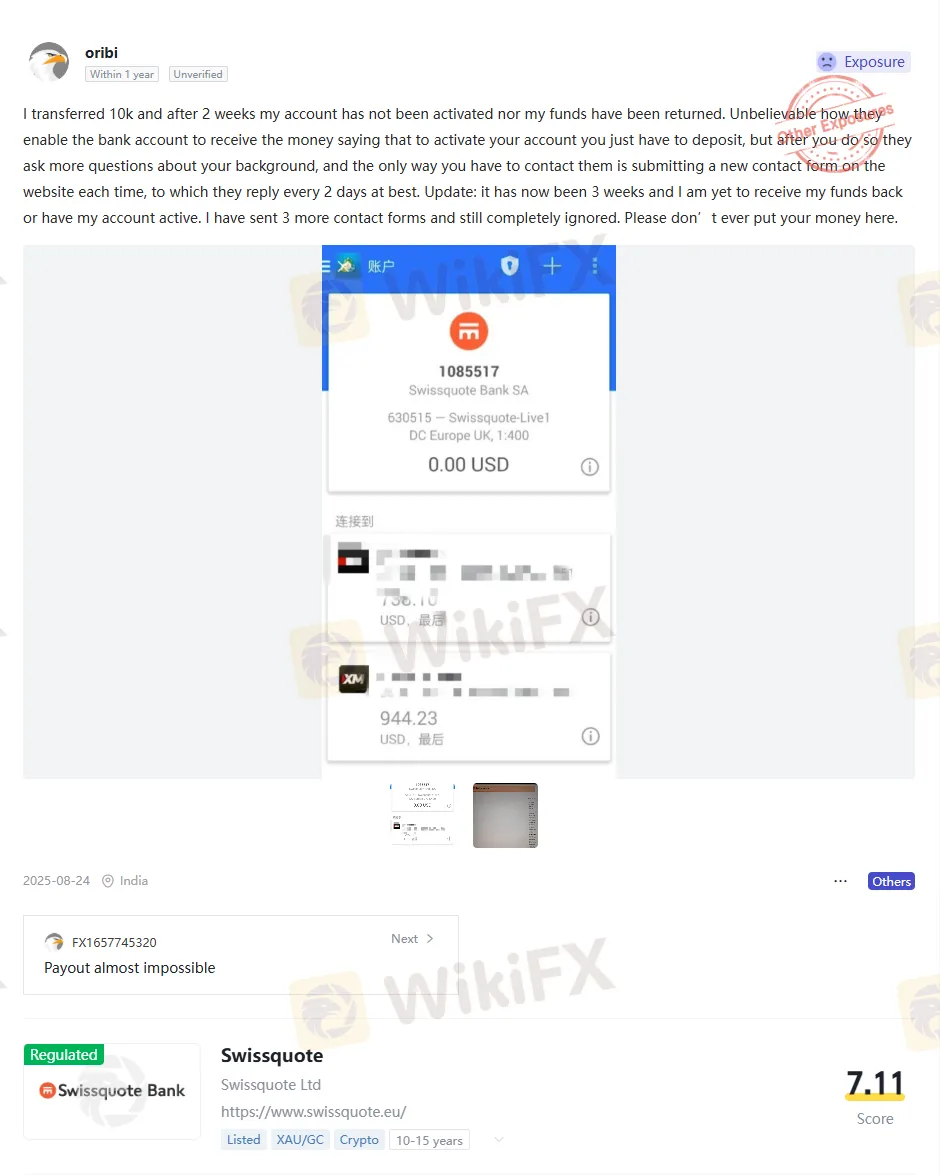

Case 2: 10,000 Deposit Stuck with No Activation (India)

Another Exposure from India Reports That the User Transferred 10,000 to Swissquote and That, Even After 2 Weeks, Neither the Account Had Been Activated nor the Funds Returned. The Client States That the Bank Account Was Fully Able to Receive the Money and That Swissquote Advertised That Simply Depositing Was Enough to Activate the Account, but After Depositing, They Were Confronted with Additional Questions About Their Background. This Pattern of “Deposit First, Then More Hurdles” Is Commonly Mentioned in Forex Investment Scams and Online Investment Scam Warnings, Especially When Timelines Are Poorly Transparent.

The Trader Also Notes That the Only Way to Contact Swissquote Was via the Websites Contact Forms, with Replies Arriving Only Every Couple of Days at Best. After Three Weeks, According to the Exposure, the User Still Had No Active Account, No Returned Funds, and Multiple Ignored Messages—Ending with a Strong Plea to Others Never to Send Money to This Broker. While Swissquote Publicly Advertises Withdrawals Processed in 1–2 Business Days, Such a Case Suggests That, at a Minimum, There Can Be Severe Service Breakdowns That Feel Indistinguishable from a Serious Online Scam When You Are the Affected Customer.

How “Regulated” Status Intersects with Scam‑Like Risk

Swissquotes Regulatory Requirements Under FINMA, FCA, DFSA, and MFSA Should, in Theory, Impose Strong Requirements for Client Fund Segregation, Capital Adequacy, and Complaint Handling. However, the Exposures Hosted on the WikiFX App Demonstrate That Regulatory Registration Alone Does Not Prevent All Potential Losses, Disputes, or Bad Behavior. When Dozens of Clients Report Delayed Withdrawals, Frozen Balances, Unclear KYC Demands, and Ignored Support Tickets, the Practical Risk Can Still Resemble a Forex Scam, Even if the Entity Is Technically Regulated.

Traders Need to Understand That Regulators Usually Act Slowly and Only After Documented Harm, and That They Do Not Guarantee Compensation in Every Dispute with a Swissquote Broker. This Is Why Tools Like the WikiFX App, Which Aggregate Real-User Experiences, Become Crucial for Spotting Early Warning Signs of Possible Forex Fraud or Systemic Service Problems. A Prudent Trader Treats Swissquotes Licenses as Only One Data Point, Weighed Alongside a Heavy Stack of Negative User Experiences.

Key Red Flags from Swissquote Exposures

From the Exposure List and Reviewed Cases, Several Recurring Warning Signs Stand Out:

Practical Safety Steps for Traders Considering Swissquote

If You Are Evaluating Swissquote Forex or Already Have an Account, Treat Every Step with Heightened Caution. Start by Installing and Using the WikiFX App to Read the Full Swissquote Exposure List in Detail and to Check for Any Recent Complaints Similar to Your Situation. Before Sending Significant Funds, Test All Processes with the Smallest Possible Amount: Account Opening, Platform Login, Trade Execution, and Especially Withdrawals Back to Your Bank Account.

Keep Complete Records of All Communication, Including Screenshots of the Platform, Copies of KYC Requests, and All Email or Form Replies, So That You Can Document Any Potential Forex Scam or Investment Scam Behavior if a Dispute Arises. If You Notice Unexplained Delays, New Documentation Demands After Funding, or Repeated Refusal to Process Withdrawals, Pause All Additional Deposits Immediately and Consider Filing an Exposure on the WikiFX App So Others Can See the Pattern. Also, Check Directly with the Listed Regulators (FINMA, FCA, DFSA, MFSA) to Verify the Exact Licensed Entity You Are Dealing with and Whether Any Enforcement Actions or Warnings Are in Place.

Final Thoughts: Treat Swissquote as High‑Risk Despite Regulation

Swissquote‘s WikiFX Profile Shows a Broker That Combines Strong Formal Regulation and a Broad Product Range with a Disturbing Volume of Negative User Reports. The Cases from Germany and India Illustrate How Complex Procedures, Delayed Fund Returns, and Unresponsive Service Can Make a Regulated Broker Feel Like an Online Trading Scam in Practice. For Now, the Safest Approach Is to Treat Swissquote with Extreme Caution, Rely on the WikiFX App for Updated Exposure Data, and Avoid Committing Large Deposits Until the Broker’s Handling of Client Funds and Complaints Shows Clear, Consistent Improvement.