简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Abstract:ThinkMarkets holds a notable WikiFX score of 7.75 with regulation from the FCA and ASIC, yet a recent surge in 78 user complaints regarding withdrawals suggests significant operational risks. This audit weighs its strong regulatory framework against user-reported friction.

Executive Summary

In this in-depth review, we analyze the key metrics and operational history of ThinkMarkets (智汇). The broker was established in 2012 and has successfully expanded its footprint to hold authorizations from multiple top-tier financial authorities. As a prominent broker entity, ThinkMarkets distinguishes itself with proprietary technology and low costs.

However, despite a high WikiFX score of 7.75 and an “AA” trade environment ranking, recent data highlights a significant volume of user complaints. This review aims to reconcile the broker's strong regulatory credentials with the practical challenges traders face today.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation ThinkMarkets operates under. The broker maintains a robust multi-jurisdictional compliance structure, including:

- Tier 1: UK Financial Conduct Authority (FCA) and Australian Securities & Investment Commission (ASIC).

- Other Tiers: CySEC (Cyprus), FSCA (South Africa), and the FSA (Seychelles) for offshore operations.

While the oversight from bodies like the FCA implies high safety standards, traders must verify which specific entity holds their account. Global clients are often onboarded under the Seychelles entity, which offers less strict regulation compared to the UK or Australian branches. This distinction is vital for understanding your deposit insurance and recourse options.

2. Forex Trading Conditions

For traders focusing on Forex instruments, ThinkMarkets offers an aggressive pricing structure designed to appeal to scalpers and algorithmic traders.

- Leverage: The broker offers leverage up to 1:500 on standard accounts and potentially higher on the ThinkTrader app. This high leverage amplifies risk significantly.

- Spreads: The “ThinkZero” account boasts spreads starting from 0.0 pips with a commission, while the Standard account offers spreads from 0.4 pips.

Does Forex pricing compete with top-tier providers? Yes, the costs are objectively low, and the “Perfect” rating for costs in the WikiFX database supports this. However, low costs are only beneficial if trade execution is reliable.

3. User Feedback & Complaints

A critical component of this audit is the analysis of recent user interactions. In the last three months alone, WikiFX has received 78 complaints, which is a red flag for a broker with such high regulatory standing.

Patterns in the `casesText` data reveal serious concerns:

- Withdrawal Delays: Multiple users from Taiwan, Egypt, and Ghana report withdrawals pending for weeks or being rejected without clear cause.

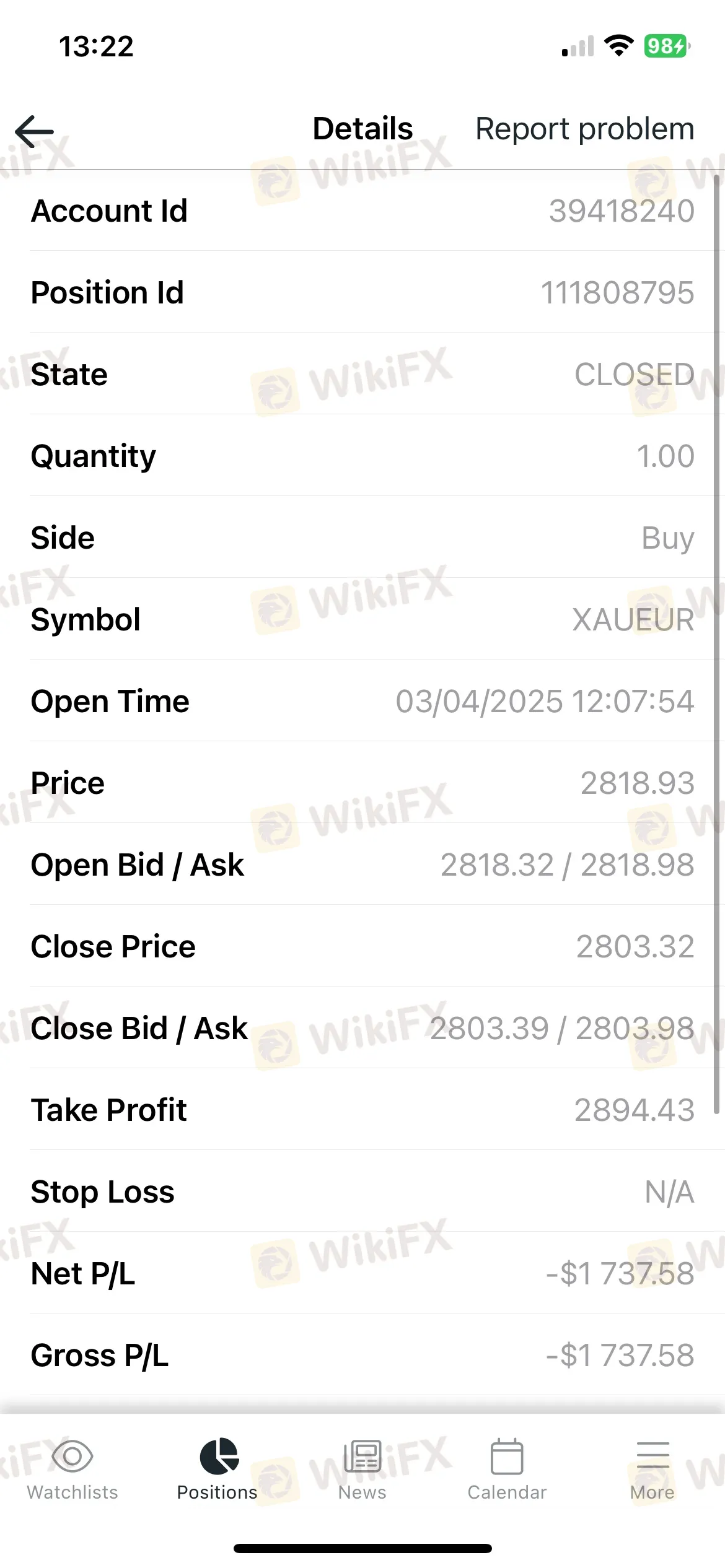

- Platform Instability: Users have reported difficulties with their login stability and platform freezing. Specific complaints (e.g., Case 8 and Case 18) describe scenarios where the system “refused to close the trade” or lagged significantly during volatility, resulting in losses.

<quote>

“I try to close the trade but I cant... the system refused close the trade till my account Margin.”

4. Software & Access

ThinkMarkets offers the industry-standard MT4 and MT5, alongside its proprietary ThinkTrader app.

- Security: To access the platform, traders must complete the login security steps. While the platforms are generally robust, the audit notes a lack of biometric authentication on some desktop interfaces.

- Accessibility: The login process is streamlined across mobile and web terminals, but as noted in the user feedback section, successful access does not always guarantee stable order execution during high-traffic periods.

Final Verdict

ThinkMarkets presents a complex profile: it is a heavily regulated broker with excellent theoretical trading conditions but is currently plagued by a high volume of verified complaints regarding fund withdrawals and execution errors.

Pros:

- Regulated by FCA, ASIC, and CySEC.

- Competitive Forex spreads from 0.0 pips.

Cons:

- Surge in complaints (78 in 3 months).

- Reports of withdrawal dragging and platform freezing.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App to avoid cloning scams and monitor the complaint resolution rate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Bitget Review: A Regulatory Ghost Running a Phishing Playground

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Global Bond Shift: India Dumps US Treasuries Amid ‘Sell America’ Narratives

RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

Morgan Stanley Looks to Expand in Asia

Currency Calculator