简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ACY Securities Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:ACY Securities holds a strong 7.44 score and a Tier-1 ASIC license, confirming it is not a fake broker. However, recent trader complaints regarding profit deductions and gold price spikes suggest significant risks for high-volume or scalping strategies.

Executive Summary: ACY Securities is a legitimate, ASIC-regulated veteran with over a decade of history and a decent WikiFX score of 7.44. However, while safey of funds is generally high for standard investors, confirmed complaints about profit invalidation and price spikes suggest caution for advanced scalpers.

Finding a trustworthy financial partner is stressful. Before you find a broker that fits your needs, you need to look past the shiny advertisements. In this review, we analyze the live data behind ACY Securities to determine if they are a safe haven for your capital or a hidden trap.

Question 1: ACY Securities Regulation & Safety: Is my money safe?

Yes, the core corporate structure is solid, but there are global warnings to consider.

The Good News:

ACY Securities operates under the strict supervision of the Australian Securities & Investments Commission (ASIC), a Tier-1 regulator. They are also regulated by the FSCA in South Africa. This is a massive “Green Flag.” In the world of regulation, an ASIC license is like a 5-star safety rating. It typically safeguards you through Segregated Accounts, meaning the broker cannot use your deposits to pay their own electricity bills or debts.

The Warning Signs:

Despite the strong Australian license, regulators in Spain (CNMV), France (AMF), and Malaysia (SCM) have issued warnings about unauthorized activity. This often means the broker accepts clients from regions where they don't have a specific local license.

Educational Moment:

Why do multiple licenses matter? If you are an international client, you might not be protected by the Australian ASIC laws. Always check which specific entity you are signing a contract with during registration.

Question 2: Are the Forex trading fees and leverage fair?

The trading conditions at ACY Securities are aggressive, which can be both a gift and a curse.

The Leverage Risk:

According to the data, ACY offers massive leverage up to 1:5000.

- The Pro: You can control huge positions with very little cash ($50 to $200 minimum deposit).

- The Con: This is a double-edged sword. With 1:5000 leverage, a market move of just 0.02% against you could wipe out your entire account instantly. This level of risk is rarely allowed by top-tier regulators for retail clients, suggesting high-leverage accounts may fall under different rules.

The Accounts:

They offer three types: ProZero, Standard, and Basic. The ProZero account claims spreads “As low as 0,” which is competitive. However, bear in mind that low spreads often come with commission fees.

Question 3: What are real traders complaining about?

While the license is good, the user feedback paints a more complex picture. Recent complaints (157 in the last 3 months) highlight specific conflicts of interest.

Complaint 1: Profit Deductions & “Arbitrage” Accusations

A trader from Taiwan reported that ACY deducted their profits, claiming the trader engaged in “latency arbitrage” (exploiting price delays). The trader denied this, stating there was no proof provided.

`Verdict:` This is a common dispute with high-leverage brokers. If you are too profitable too quickly, you may be flagged for “toxic flow.”

Complaint 2: The “Gold Spike” Anomaly

Another trader reported a massive price anomaly in XAU/USD (Gold). They claimed ACY's price spiked to 2185-2195 while the rest of the market was below 2150, causing their account to be liquidated (blown up).

`Verdict:` This usually indicates issues with the broker's liquidity providers or potential price feed instability.

Complaint 3: Surprise Fees & Customer Service

Traders have also complained about unexpected swap fees deducted during withdrawals and support tickets being ignored or deleted without resolution.

Pro Tip:

If a broker accuses you of “Arbitrage,” they are often referencing the fine print in the Terms & Conditions. Always read the policy on “Abusive Trading” before using high-frequency strategies.

Question 4: What software will I use?

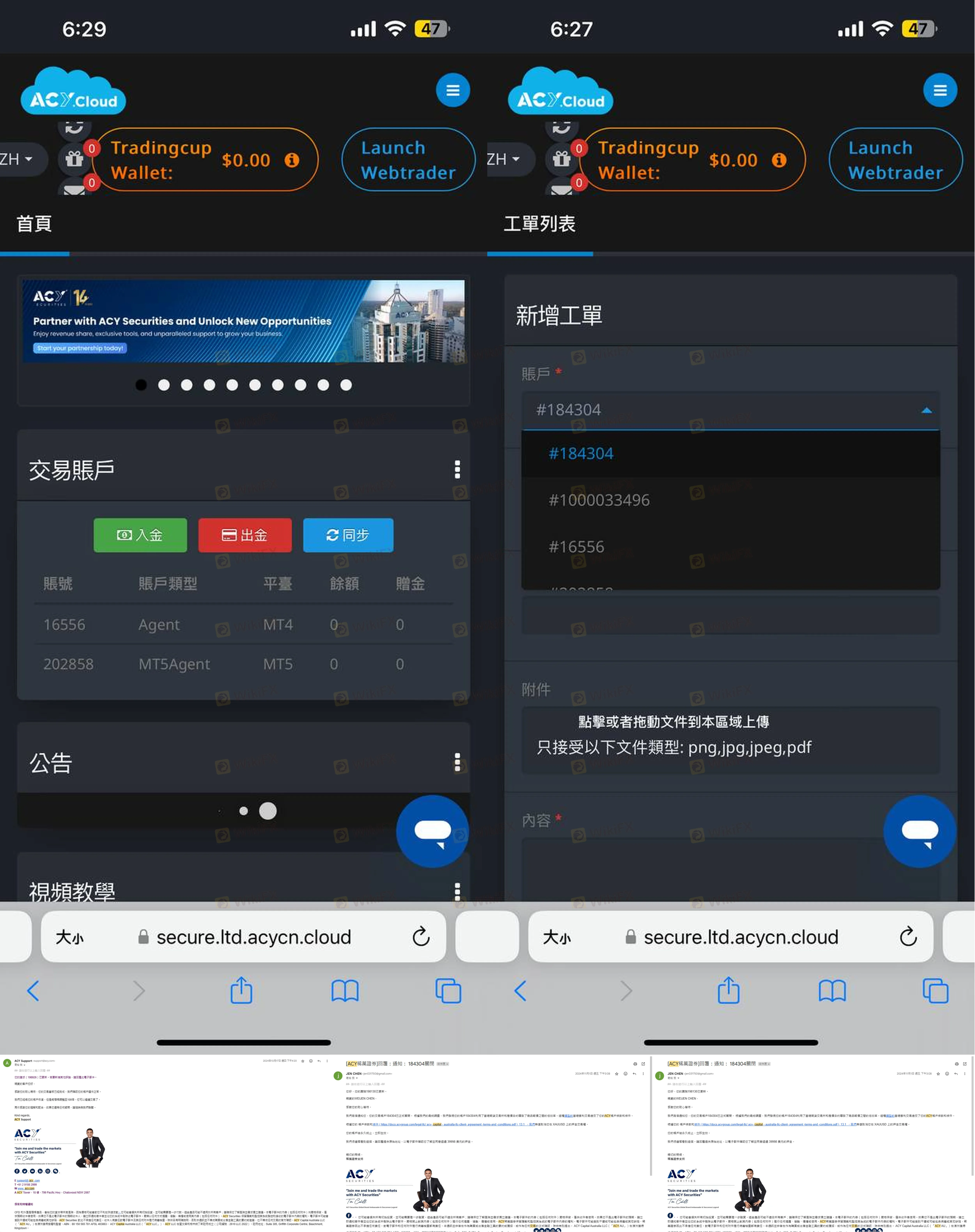

ACY Securities uses the industry-standard MT4 (MetaTrader 4) and MT5 platforms. These are the gold standard for authorized trading software.

Security Warning:

When using these popular platforms, you must be vigilant about security. Always ensure you are on the official ACY website before entering your client portal login details. Phishing sites often clone these login pages to steal your credentials. Additionally, one user noted that the platform lacks Two-Factor Authentication (2FA), so you must use a strong, unique password to protect your funds.

Final Verdict: Should I open an account?

ACY Securities is a “High Risk, High Reward” environment.

They are not a scam in the traditional sense, thanks to their valid ASIC license and long operating history (since 2011). However, the extreme leverage (1:5000) and recent confirmed complaints about price spikes and profit deletions make them less suitable for beginners or scalpers.

- Safe for: Long-term traders using low leverage who want ASIC protection.

- Risky for: News traders, scalpers, and anyone using maximum leverage.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and server status.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator