简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBInvesting Review: Is Your Capital Safe with this Forex Broker?

Abstract:Our 2025 investigation into dbinvesting reveals a critical pattern of profit erasure and withdrawal denials, with traders reporting over $16,000 in withheld funds under vague "violation" clauses. Operating with a low WikiFX score of 2.14 and offshore regulation, this platform presents a severe risk of capital loss for mobile and retail investors.

By WikiFX Special Investigator

Last Updated: 2025 Investigation

Our investigation reveals a disturbing trend for traders using dbinvesting. While the platform markets itself as a seamless gateway to the Forex markets, a surge of user complaints in 2025 paints a different picture. Traders from Hong Kong, Jordan, and India are reporting an identical trap: successful trading followed by sudden accusations of “abuse,” leading to the total erasure of profits and the freezing of principal funds.

The Trap: “Profit Erasure” Tactics Exposed

The most alarming signal comes from a damning dbinvesting review submitted by a trader in Hong Kong on January 23, 2025.

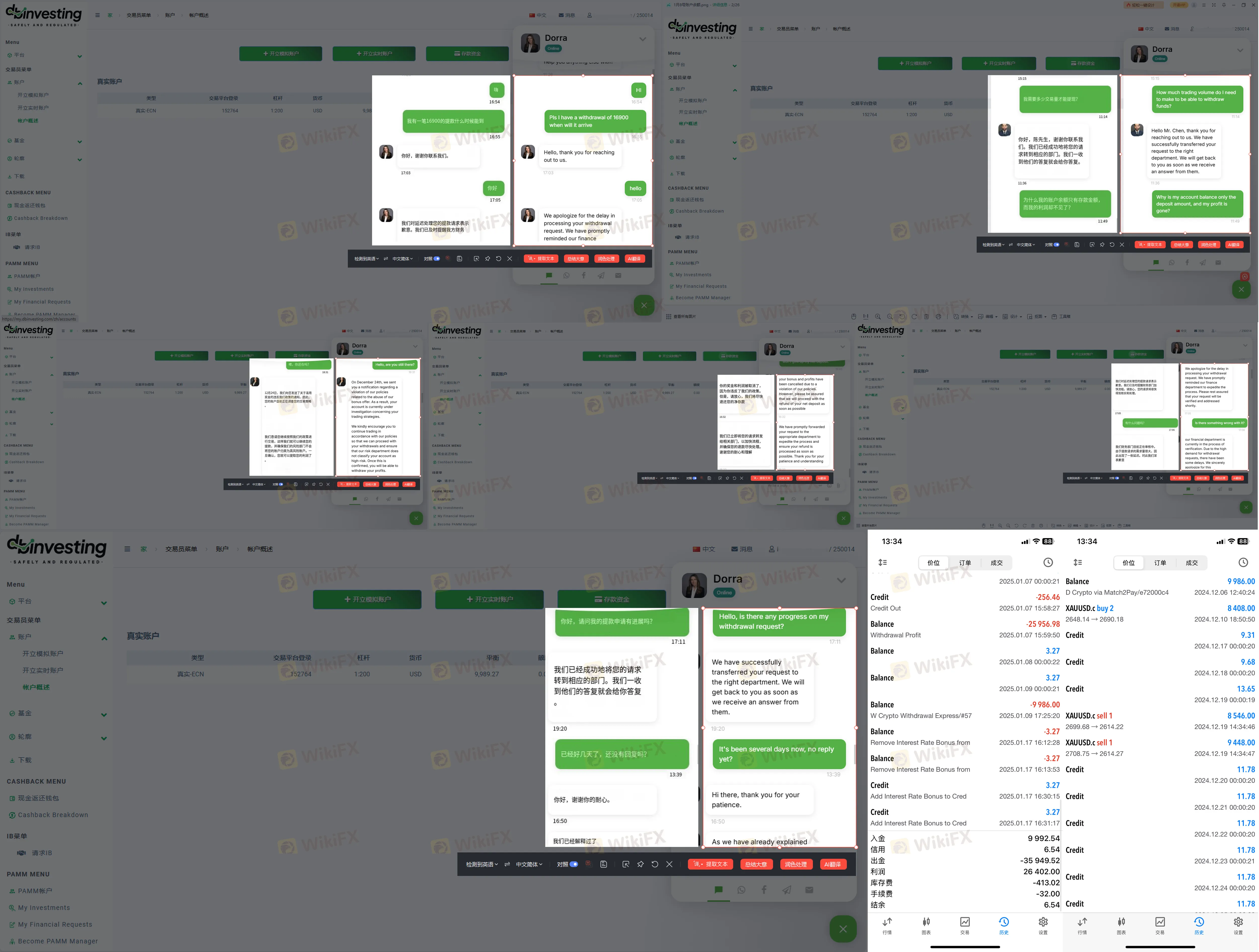

The user deposited $9,986 and generated significant profits. However, when they attempted to withdraw $16,900, the dbinvesting broker system stalled. Days later, the user received an email accusing them of “bonus abuse” despite claiming normal trading activity. The platform offered a coercive ultimatum: forfeit all bonuses and profits to get the initial deposit back, or risk everything. Even after the user agreed to the unfair terms, the platform reportedly seized the profits and delayed the capital return.

Visual Evidence of User Complaints:

This is not an isolated incident. In July 2025, a trader from Jordan reported that after recouping losses and becoming profitable, their larger withdrawal requests were rejected. The broker cited shifting justifications—ranging from AML reviews to “scalping” and “swap abuse”—before restricting the account entirely.

DBInvesting Regulation: An Offshore Reality Check

Why can dbinvesting enforce these arbitrary penalties? The answer lies in their regulatory status. Our audit of the dbinvesting regulation framework shows that while they hold a license, it lacks the protective power of top-tier authorities.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| Seychelles FSA | Retail Forex License | Offshore Regulation (High Risk) |

The Risk: The Seychelles Financial Services Authority (FSA) is an offshore regulator. Unlike FCA or ASIC regulated brokers, offshore entities often lack mandatory compensation schemes or strict conduct regularities. This allows the broker to define “abusive trading” (like scalping or using bonuses) in their Terms & Conditions loosely, often using it as a tool to void profitable trades without external oversight.

DBInvesting Login and Access Issues

Vital to any trader is the ability to access their funds. However, dbinvesting login complaints suggest that account access acts as a choke point during disputes.

Multiple users have reported that once a withdrawal dispute begins, their access to the trading portal becomes compromised.

- Case #16 (Italy): A user reported their “client portal was disabled” while $7,502 remained inside.

- Case #2 (Jordan): The account was “restricted and then closed” without processing the remaining balance.

If you cannot perform a dbinvesting login, you cannot close positions or prove your balance, leaving you powerless.

The Verdict: High-Risk Warning

Based on the 2025 data, dbinvesting exhibits severe anomalies consistent with high-risk platforms. The pattern is clear: aggressively recruit traders, allow deposits, but strictly penalize profitability under the guise of policy violations.

Key Red Flags

- Severe Withdrawal Blockades: Multiple reports of denied withdrawals for profitable accounts ($16,000+ disputes).

- Policy Weaponization: “Bonus abuse” and “Scalping” accusations used to void profits.

- Offshore Limitation: Seychelles regulation offers minimal recourse for international clients.

- Low Trust Score: A WikiFX score of 2.14/10 indicates a “Stay Away” status.

WikiFX Recommendation: We strongly advise traders to avoid depositing funds with dbinvesting. The combination of offshore regulation and verified reports of profit seizure creates an unacceptable risk to your capital. Prioritize brokers with Tier-1 regulation (FCA, ASIC, NFA) to ensure your trading success is paid out, not penalized.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

STARTRADER

FOREX.com

D prime

IC Markets Global

GO Markets

OANDA

STARTRADER

FOREX.com

D prime

IC Markets Global

GO Markets

OANDA

WikiFX Broker

STARTRADER

FOREX.com

D prime

IC Markets Global

GO Markets

OANDA

STARTRADER

FOREX.com

D prime

IC Markets Global

GO Markets

OANDA

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator