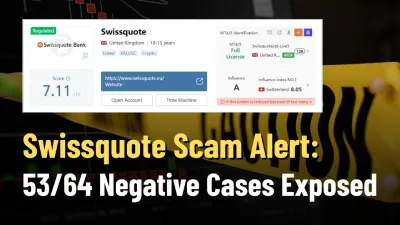

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Coinbase is pleased to announce that we have successfully registered as a Virtual Asset Service Provider with the Central Bank of Ireland, and to welcome Cormac Dinan as our new Country Director for Ireland.

2022 has been a significant year for Coinbase's foreign development, and we are glad to offer some extra excellent news! The Central Bank of Ireland has given Coinbase permission to operate as a Virtual Asset Service Provider (VASP), which means that Coinbase may continue to deliver goods and services to people and institutions in Europe and throughout the world from Ireland. Furthermore, Coinbase's Ireland activities will now be overseen by Cormac Dinan, our new Country Director. Cormac brings over 20 years of expertise in financial services and fintech to the post, and we are thrilled to have him on board.

Coinbase Ireland will be subject to the Criminal Justice Money Laundering and Terrorist Financing Act 2010 (as amended) as a result of our VASP registration, proving our commitment to the highest levels of compliance.

The VASP registration includes two Coinbase firms, both of which are located in Ireland: Coinbase Europe Limited and Coinbase Custody International Limited. Coinbase Europe offers cryptocurrency trading services to users in Europe, while Coinbase Custody International offers cryptocurrency custody services to institutional customers across Europe.

Coinbase has been present in Ireland since 2018, participating in a variety of tasks such as Market Operations, Compliance, Cybersecurity, Legal, and Customer Experience. Cormac will supervise regulated business operations and execute the firm's plan for developing the company via new technology and operational efficiency, all while ensuring clients continue to experience secure and frictionless transactions.

“As the most reputable and secure crypto exchange, Coinbase has improved its technology and regulatory processes with the sector as it evolves. I'm excited to boost Ireland's operations and contribute to the sector's sustained development. ”I am really excited to work on creating an atmosphere that promotes innovation while boosting confidence in cryptocurrency, stated Cormac Dinan.

The VASP registration was implemented in Ireland in 2021, and it requires the Central Bank to examine enterprises to ensure they have an acceptable anti-money laundering and counter-terrorism funding processes. This VASP registration follows Coinbase Ireland Limited's prior authorization to operate as an electronic money institution by the Irish Central Bank (EMI). This enables Coinbase to create electronic money, provide electronic payment services, and process electronic payments on behalf of other parties.

Ireland has been a natural home for Coinbase in Europe, not just because of its talent pool and openness to business, but also because of its EU membership and access. The recent EU political agreement on MiCA is a tremendous step forward, providing one of the most important legal frameworks for cryptocurrency internationally. Our clearance by the Central Bank of Ireland indicates our dedication to and partnership with the Central Bank of Ireland. “Coinbase sees industry regulation as a facilitator for crypto's development, creating an atmosphere that stimulates innovation and improves confidence in the sector,” said Nana Murugesan, Vice President, International, and Business Development at Coinbase.

Coinbase services consumers in around 40 European nations through specific hubs in Ireland, the United Kingdom, and Germany. In order to comply with local rules, further registrations or licensing applications are being processed in a number of important markets.

Stay tuned for more Crypto News.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.