KKM Ends, Gold Volatility, and the Fate of the Turkish Lira

Turkey’s FX market is entering a new phase as KKM ends, inflation pressures persist, and global gold price volatility impacts the lira.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Turkey’s FX market is entering a new phase as KKM ends, inflation pressures persist, and global gold price volatility impacts the lira.

The Bank of England's dovish hold and lowered inflation forecasts have pressured Sterling, highlighting a widening global policy divergence. While the Fed and BoE lean toward easing, improving liquidity metrics signal complex cross-currents for FX traders.

Bitcoin bounces 13% to reclaim $71,000 after a massive leverage flush, highlighting its role as a high-beta proxy for global risk sentiment.

Despite a spike in US jobless claims and layoff headlines, JPMorgan analysis suggests the labor market remains resilient, attributing anomalies to weather and statistical noise. Meanwhile, long-term concerns mount over the Trump administration's aggressive trade agenda for 2026.

As Japan approaches pivotal snap elections, the Yen weakens against major peers, with EUR/JPY reclaiming 185.00. Analysts signal potential FX intervention risks if USD/JPY breaches the critical 160.00 threshold, despite expectations of an LDP victory stabilizing the political landscape.

Structural strength in gold prices is driving record profitability projections for major producers, serving as a bullish proxy for continued demand in the precious metals market.

OW Markets is a Seychelles-regulated entity offering high leverage on MT5, but its low safety score and unresolved complaints about profit deletion raise significant risks. This 2026 assessment highlights critical concerns regarding fund safety and offshore regulatory standards.

The study explores the integration of renewable energy sources into existing power grids, focusing on the technological challenges and economic benefits.

The Nigerian Naira (NGN) strengthened against the Euro to close at N1,606 amid renewed economic optimism, bolstered by a $1.6 billion investment pledge from Dubai-based Maser Group targeting key African markets.

The United States extends trade privileges for African nations through 2026 while China secures a duty-free export deal with South Africa, signaling intensified geopolitical competition and potential support for the South African Rand.

Urgent warning: The **QUOTEX broker** faces multiple regulatory blacklists and a surge of 2025 complaints alleging blocked withdrawals and emptied accounts. Investors are advised that this entity is operating without valid authorization in several jurisdictions.

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

The Hong Kong Monetary Authority has uncovered fraudulent websites using fake domains and counterfeit login pages to deceive users and steal their information.

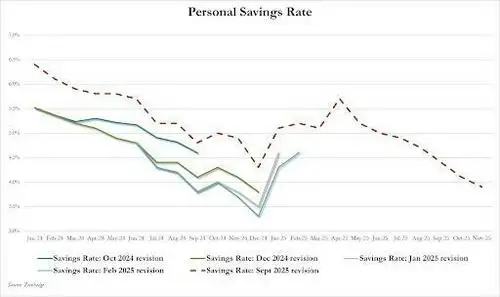

2025 closed with a surprising surge in consumer spending and retail sales, one which was unexpected

This review isn't based on personal opinions or company advertisements. Instead, it's a detailed look at real facts, complaints from users, and information about regulations that WikiFX has collected. We believe the best way to judge a broker is by looking at what its clients actually experienced and how well it follows regulations.

If you're looking for a " TransXmarket Review" you probably want to answer one important question: is this broker safe for my money? As industry experts, we have looked at the available information, and our results are clear. This review will get straight to the point. Our research, based on public records and third-party checking platforms, shows serious concerns about this broker's trustworthiness. TransXmarket operates without any valid financial regulation and has an extremely low trust score, which is a major warning sign for any trader. This article will carefully break down the information, from its regulatory status and user experiences to its stated trading conditions. Our goal is to give you a clear, fact-based assessment to explain why extreme caution is not just recommended, but necessary.

This Jetafx Review gives a complete analysis for traders thinking about this broker in 2025. Our goal is to look past the marketing claims and give you a fact-based review of how safe and legitimate it is. This investigation uses reliable data from independent tracking platforms like WikiFX, which are important tools for any trader's research process. The main finding of our review is immediate and serious: Jetafx operates with a "Suspicious Regulatory License" and is marked as a high-risk company with an extremely low trust score. The information we present here is not just an opinion but an analysis of real facts, designed to help you understand the major risks involved. Our main goal is to give you the information you need to protect your money from potentially dangerous trading environments.

An experienced investor lost RM47,000 to a WhatsApp investment scam over the course of one week.

Japan’s sudden bond market turmoil, driven by fiscal strain and a historic shift in central bank policy, is believed to be quietly reshaping global liquidity flows and could have far reaching consequences for investors worldwide.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.