PhillipCapital

India

India

Time Machine

Check whenever you want

Download App for complete information

Exposure

No data

PhillipCapital · Company Summary

| PhillipCapitalReview Summary | |

| Founded | 2012 |

| Registered Country/Region | India |

| Regulation | Unregulated |

| Market Instruments | Equities, Derivatives, Commodities, Currency Futures, Fixed Income, Mutual Funds, Insurance, Securities Lending & Borrowing, Renewable Energy Certificates, Personal Loans |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Phillip9 Trading Application |

| Min Deposit | / |

| Customer Support | Email: contact@phillipcapital.in |

| Phone: +91 22 24831848, 66551234, 66550044 | |

| Live Chat | |

| Social Media: Facebook, YouTube, Instagram, LinkedIn | |

| Company Address: No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013, Maharashtra, India. | |

PhillipCapital Information

PhillipCapital is an unregulated financial services provider offering a broad range of investment and trading solutions to individual and institutional investors. With services spanning equities, derivatives, commodities, forex, and mutual funds, the firm provides access to both domestic and international markets. PhillipCapital India also offers portfolio management, wealth advisory, and lending services. Known for its advanced trading platforms like Phillip9.

Pros & Cons

| Pros | Cons |

| Wide range of tradable products | Unregulated |

| Multiple contact channels | Demo account unavailable |

| Phillip9 supported | Lack of information about fees |

Is PhillipCapital Legit?

No, PhillipCapital is not a licensed broker. In light of this, putting your money on the line would be an inexcusable mistake.

What Can I Trade on PhillipCapital?

PhillipCapital India offers a diverse range of financial instruments for trading:

- Equities

- Derivatives

- Commodities

- Currency Futures

- Fixed Income

- Mutual Funds

- Insurance

- Securities Lending & Borrowing

- Renewable Energy Certificates

- Personal Loans

| Trading Asset | Available |

| Equities: | ✔ |

| Derivatives | ✔ |

| Commodities: | ✔ |

| Currency Futures | ✔ |

| Fixed Income | ✔ |

| Mutual Funds | ✔ |

| Insurance | ✔ |

| Securities Lending & Borrowing | ✔ |

| Renewable Energy Certificates | ✔ |

| Personal Loans | ✔ |

Furthermore, clients on PhillipCapital get access to various types of services:

- Broking

- Portfolio Management Services (PMS)

- Investment Advisory Services

- NRI's

- Loan against Securities

- Financial Planning

- Depository Services

- Clearing Services

- Overseas Exchanges-Commodity Hedging

- Merchant Banking(Related Document)

- Registered Investment Advisor & PAIA Services

Leverage

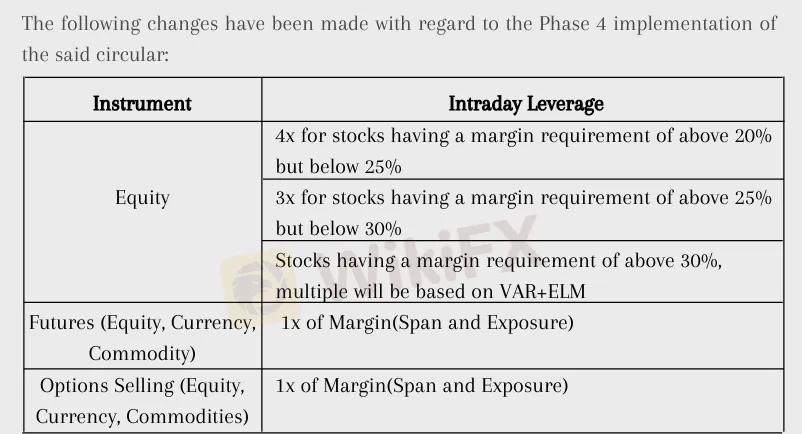

On PhillipCapital, the intraday Leverage for Different Instruments varies depending on the margin requirement of the stock.

Equity (Stocks):

4x leverage: For stocks with a margin requirement of above 20% but below 25%. This means if you need 20% to trade a stock, you can borrow up to 4 times the amount for intraday trading.

3x leverage: For stocks with a margin requirement of above 25% but below 30%. In this case, you can borrow up to 3 times the margin for intraday trading.

Leverage based on VAR+ELM: For stocks with a margin requirement above 30%, the leverage is determined based on a risk model called Value at Risk (VAR) + Expected Loss Margin (ELM). This likely means the leverage varies depending on the stock's volatility and other risk factors.

Futures (Equity, Currency, Commodity):

1x leverage: Futures contracts for equity, currency, or commodities are based on a 1x margin requirement, meaning you'll need to fully fund the margin to hold these positions.

Options Selling (Equity, Currency, Commodities):

1x leverage: You are required to maintain a 1x margin for the positions.

Trading Platform

PhillipCapital provides traders with a trading application named Phillip9, which is said to be loaded with all the latest features and available on multiple devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Phillip9 trading application | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | Desktop, Mobile, Web | Experienced trader |

| MT4 | ❌ | Desktop, Mobile, Web | Beginner |

| Trading View | ❌ | Desktop, Mobile, Tablets, Web | Beginner |

Deposit and Withdrawal

Traders can manage their deposits and withdrawals through the Phillip9 platform.

News

No data