Basic Information

India

India

Score

India

|

5-10 years

|

India

|

5-10 years

| https://www.bankofindia.co.in

Website

Rating Index

Influence

C

Influence index NO.1

India 6.49

India 6.49 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

India

India

| Bank of India Review Summary | |

| Founded | 1906 |

| Registered Country/Region | India |

| Regulation | Not regulated |

| Market Instruments | Personal/Business Accounts, Forex, Loans, Investments, Agriculture |

| Demo Account | ❌ |

| Trading Platform | BOI Mobile Banking App, UPI, IMT |

| Customer Support | Domestic Phone (India): 1800 103 1906 / 1800 220 229 (Toll-Free) / (022) 40919191 / WhatsApp: +91 7997987601 |

| Email (India): cgro.boi@bankofindia.co.in | |

| NRI Helpline: +91 7969241100 / FEBO.NRI@bankofindia.co.in | |

| Head Office Address: Bank of India, Star House, C - 5, G Block, BKC, Bandra (E), Mumbai 400051 | |

Founded in 1906, Bank of India is a government-owned bank offering personal, business, forex, investment, and agricultural services. While it supports digital tools like BOI Mobile App and UPI, it is not regulated for trading and lacks features such as leverage, spreads, and global market access.

| Pros | Cons |

| Wide range of personal and business services | Not regulated as a trading broker |

| Digital platforms like UPI, BOI Mobile App | No leverage, spread, or CFD support |

| NRI banking and agri-finance options | Limited support for modern trading features and tools |

Bank of India is not regulated as a forex or CFD broker in its country of registration (India), and it is also not licensed by major global regulatory authorities such as the UK‘s FCA (Financial Conduct Authority), Australia’s ASIC (Australian Securities and Investments Commission), or Cypruss CySEC (Cyprus Securities and Exchange Commission).

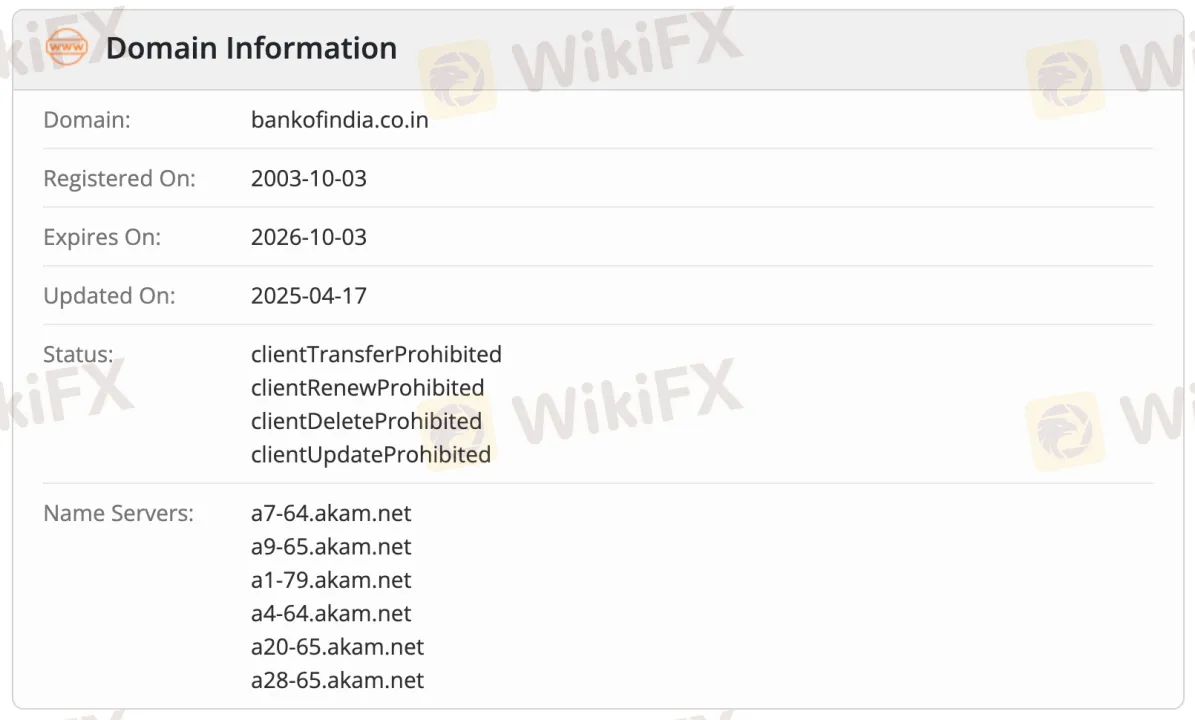

The domain bankofindia.co.in was registered on October 3, 2003, last updated on April 17, 2025, and is set to expire on October 3, 2026. Its status is protected against unauthorized changes, indicating it is securely managed.

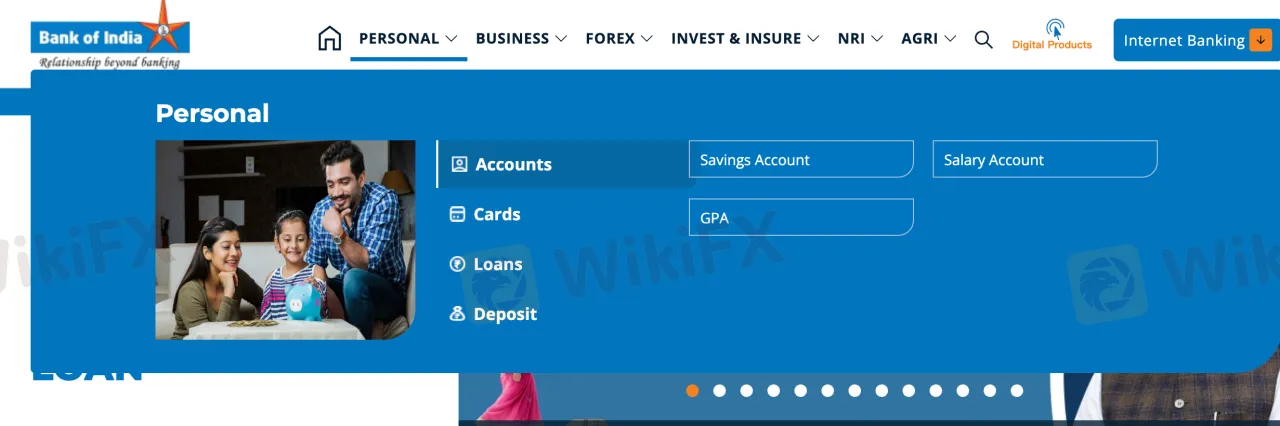

Bank of India offers a wide range of financial products and services across various segments including personal, business, NRI, agricultural, and investment banking. Its offerings span from savings and salary accounts to forex solutions, government deposit schemes, loans, and mutual fund investments.

| Category | Products/Services Offered |

| Personal Accounts | Savings Account, Salary Account, GPA |

| Business Accounts | Current Account, RERA Account |

| Forex | Export Finance, FX Retail, Special Rupee Vostro Account, Authorized Dealer Branches |

| Investment & Insurance | PPF, Sukanya Samriddhi, SCSS, NPS, Sovereign Gold Bonds, Mutual Funds, Insurance |

| NRI Services | NRI Savings Account, Term Deposit, Current Account, Loans, Remittance, KYC, FAQs |

| Agriculture | Kisan Credit Card (KCC), Tractor Loans, Gold Loan, Food & Agro Loans, SHG, Atmanirbhar |

Bank of India offers several types of live accounts tailored to different customer segments, but does not provide demo or Islamic (swap-free) accounts.

| Account Type | Suitable For |

| Savings Account | General individuals and families |

| Salary Account | Working professionals |

| GPA Account | Targeted user groups |

| Current Account | Business owners and corporates |

| RERA Account | Real estate developers |

| NRI Accounts | Non-resident Indians (NRIs) |

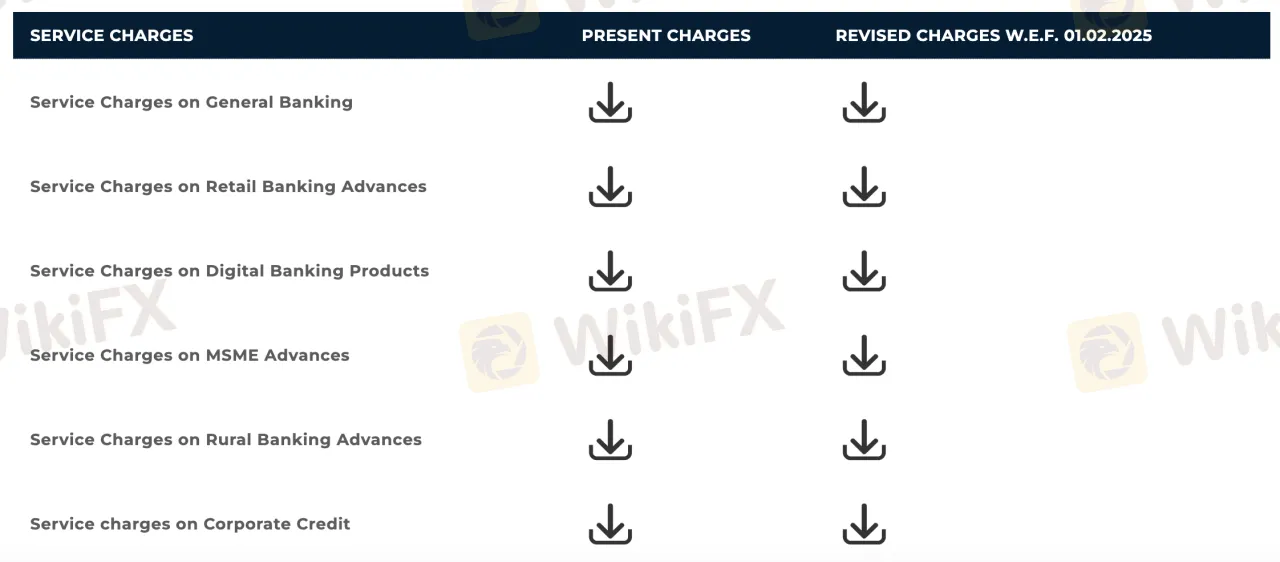

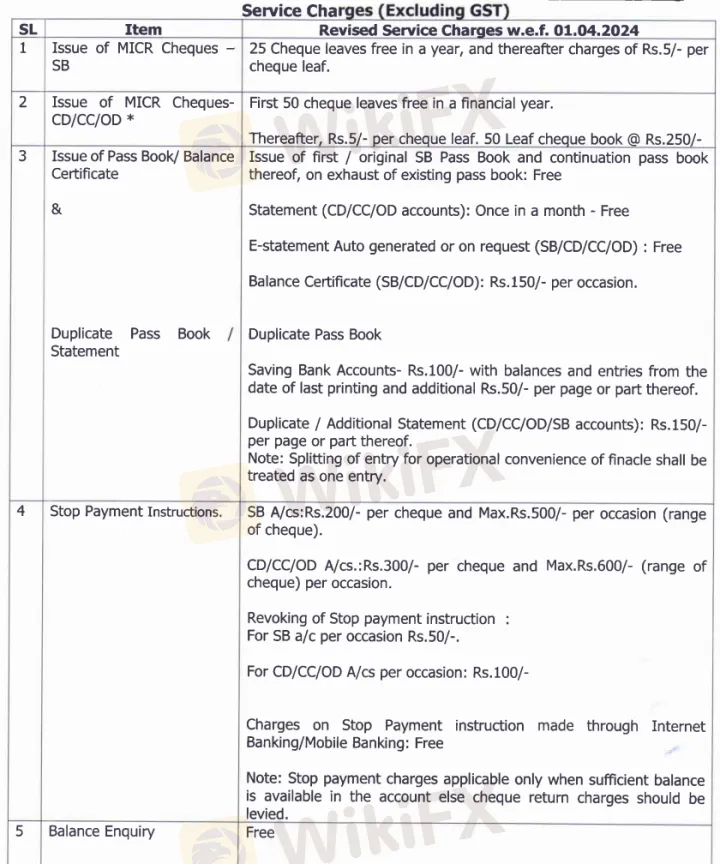

Bank of India's service charges are generally considered moderate compared to industry standards, offering basic banking services with minimal fees. For example, the first 25 cheque leaves annually for savings accounts are free, after which a charge of Rs. 5 per leaf applies.

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| BOI Mobile Banking App | ✔ | iOS, Android | Retail customers needing 24/7 account access, fund transfers, and services |

| UPI Payment System | ✔ | Mobile, Web, Apps | Users preferring quick, VPA-based payments without needing bank details |

| IMT (Instant Money Transfer) | ✔ | Mobile, Internet Banking, ATM | Users sending emergency cash or preferring cardless withdrawals |

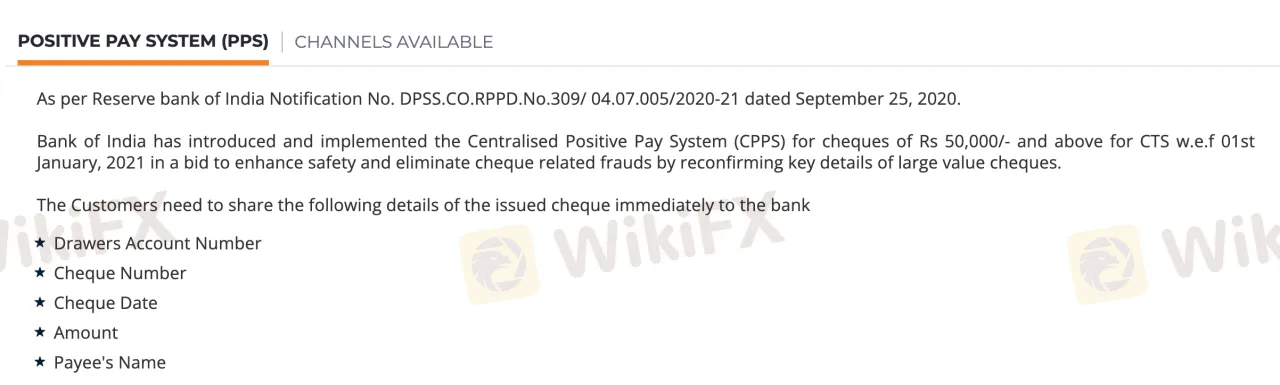

Bank of India does not explicitly list deposit or withdrawal fees for most standard transactions, suggesting that many services such as UPI and internal transfers may be free. However, special transaction types like cheque services and IMT (Instant Money Transfer) might incur nominal charges. The bank has also implemented a Positive Pay System (PPS) to ensure the safety of high-value cheque transactions.

| Deposit Method | Fees | Processing Time |

| UPI Transfer | None | Instant |

| Internet Banking (NEFT/RTGS) | May apply | Same day / 1 working day |

| IMPS | May apply | Instant |

| Cash Deposit at Branch | May apply | Instant to few hours |

| CDM (Cash Deposit Machine) | Usually free | Instant |

If you are thinking of investing with Bank of India, one of the oldest banks in India, it is better to learn about its history first and then decide whether you should invest with it or not.

Bank of India, a major bank in India, was established on September 7, 1906, in Mumbai. Its website, bankofindia.co.in, was registered on October 3, 2003, updated on April 17, 2025, and will expire on October 3, 2026. The domain is securely protected.

Bank of India does not have a trading license. Forex services are only for currency exchange and not for investment transactions.

Bank of India's minimum average monthly balance, if the City Branch may require £5,000–£10,000, the exact amount needs to be confirmed through the branch or customer service.

If the monthly average balance falls below the requirement, a small penalty fee may apply (subject to branch policies).

No, Bank of India does not have a financial regulatory license.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now