Basic Information

Thailand

Thailand

Score

Thailand

|

5-10 years

|

Thailand

|

5-10 years

| https://www.ylgbullion.co.th/en/

Website

Rating Index

Influence

B

Influence index NO.1

Thailand 7.08

Thailand 7.08 Licenses

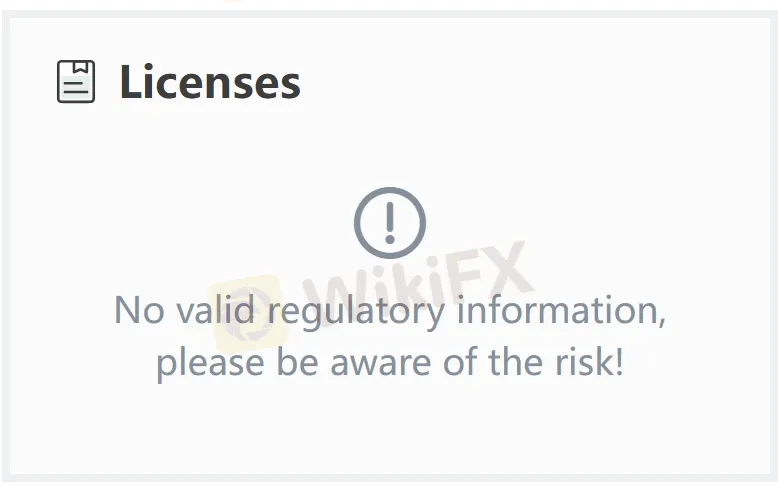

LicensesNo valid regulatory information, please be aware of the risk!

Thailand

Thailand ylgbullion.com.sg

ylgbullion.com.sg ylgcorporation.co.th

ylgcorporation.co.th ylgfutures.co.th

ylgfutures.co.th

| YLG Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Thailand |

| Regulation | No regulation |

| Trading Product | Gold bullion |

| Trading Platform | YLG Gold Trader Online |

| Customer Support | Tel: 02-687-9888, 02-106-5959; |

| Fax: 02-677-5586 | |

| Social platform: Facebook, YouTube, Instagram, LINE | |

| Address: 653/19 (between Soi Narathiwat 7-9), Thung Maha Mek, Sathorn, Bangkok 10120 | |

YLG is a Thailand-based financial services company established in 2022 and offers trading services in gold bullion.

The company currently operates without valid regulation from any financial authorities, degrading its credibility and customer trust.

| Pros | Cons |

| / | No regulation |

| Unclear fee structure |

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. YLG is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose Monix Limited with caution.

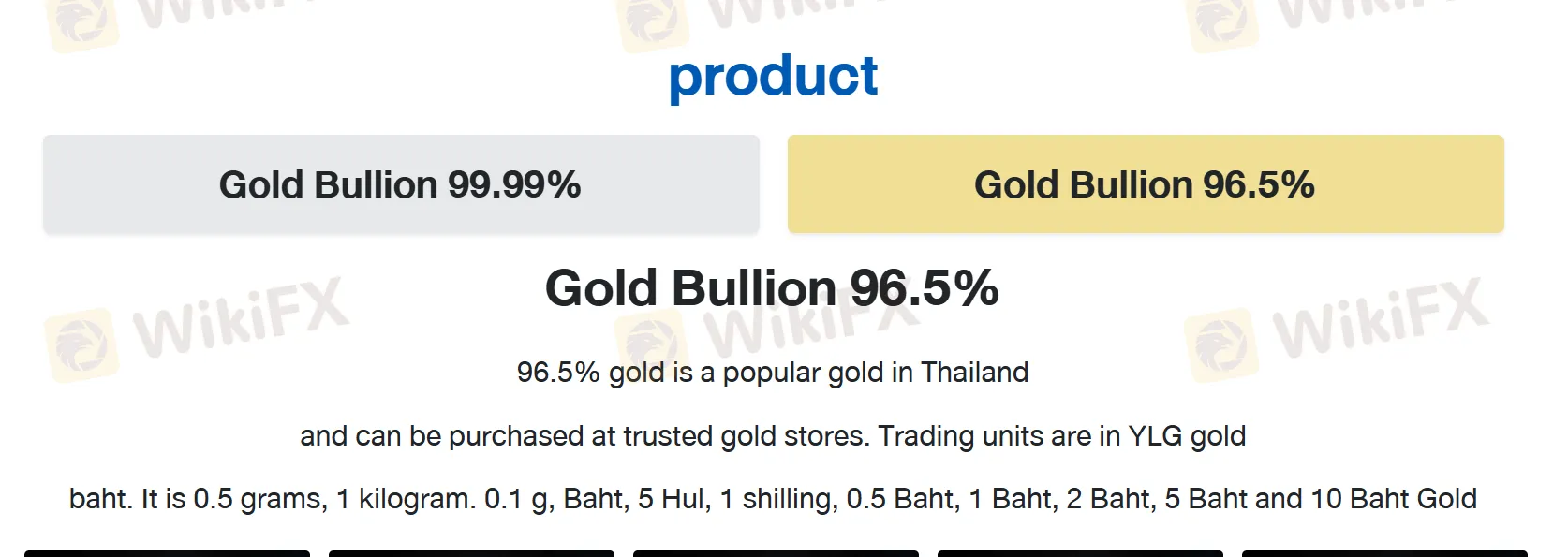

YLG offers both 99.99% and 96.5% gold bullion products in a wide range of sizes, from as small as 0.1 grams up to 1 kilogram.

99.99% gold is internationally recognized for its purity, while 96.5% gold is a popular standard in Thailand, traded in traditional baht units.

Customers can buy, sell, or accumulate gold with YLG, whether for short-term profit or long-term investment.

YLG offers a proprietary trading platform, namely “YLG Gold Trader Online”, which can be accessed via web, iOS and Android platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| YLG Gold Trader Online | ✔ | Web/Mobile phones | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

In my experience as a seasoned forex trader, the first and most significant risk I observed with YLG is its complete lack of regulatory oversight. Trading with an unregulated broker means that, should any issues arise—such as disputes over pricing, withdrawal problems, or platform malfunctions—there is no credible third-party authority to turn to for resolution or protection. This absence of external audit and supervision directly impacts my sense of security regarding both the safety of deposited funds and the integrity of trading conditions. Additionally, I noticed that YLG’s published information makes their fee structure unclear, which is a critical concern for me as costs and spreads can add up significantly over time. If the fee and commission model isn’t transparently disclosed, it becomes harder for me to assess my real trading costs and make informed decisions. Moreover, their core business centers on trading gold bullion products rather than a diverse range of forex or financial instruments. This narrow focus might not suit everyone’s needs, especially if diversification is a priority. YLG uses a self-developed trading platform rather than the widely vetted MT4 or MT5, and this introduces another layer of risk, as some proprietary platforms lack the reliability, speed, or technical support I rely on for more complex strategies. Overall, these factors collectively make me very cautious about using YLG for real-money trading.

As someone who has spent years analyzing brokers with a critical eye, I am always cautious when it comes to evaluating asset offerings and platform stability. With YLG, my experience is that their primary focus is on gold bullion trading, not forex pairs like XAU/USD or commodities such as crude oil. The products available are physical gold in both 99.99% and 96.5% purity, offered in a variety of sizes tailored to the Thai market and those interested in gold accumulation or trading physical gold, rather than contracts for difference (CFDs) on spot metals or energies. It’s also important to note that YLG operates without valid regulation, which adds a significant layer of risk—this impacts not just safety of funds, but also the types of financial instruments they can safely and transparently offer. In my view, the lack of recognized forex assets such as XAU/USD or broader commodities like crude oil makes YLG unsuitable for those seeking standard, liquid trading instruments typical of regulated forex brokers. For me, the absence of MT4 or MT5 support further limits the possibility of trading synthetic products and algorithmic strategies. Ultimately, if your goal is to access leveraged spot trading on pairs like XAU/USD or commodities such as crude oil, YLG, in my experience, does not provide these. Instead, their offering is limited to direct physical gold transactions, which carries a different risk and capital requirement profile. I would approach this broker conservatively, prioritizing platforms with proper oversight and a broader asset list if you are seeking diverse trading instruments.

In my careful evaluation as a trader who prioritizes safety and transparency, I must stress that YLG does not operate under the supervision of any recognized financial regulatory authority. While the firm has an established presence in Thailand and provides gold bullion trading services, there is no valid regulatory oversight or license supporting its activities. This absence of formal regulation means there is no independent body to enforce standards, provide client fund protection, or resolve disputes if issues were to arise. From years of trading experience, I have learned that regulation is not just a formality—it is a cornerstone of client trust and security. Regulated brokers are held accountable by their respective authorities for fair dealing, client fund segregation, and transparent operations. Without such oversight, as is the case with YLG, the risk profile is significantly higher, especially for those accustomed to trading with brokers regulated by tier-one authorities. For me, lack of regulation is a critical red flag and I would exercise heightened caution if considering any relationship with an unregulated entity.

Speaking from my own experience as a trader researching potential brokers, I found that YLG specializes exclusively in gold bullion trading, rather than offering the broader range of instruments you typically see with other brokers—such as forex pairs, stocks, indices, or cryptocurrencies. YLG’s primary focus is providing access to both 99.99% and 96.5% gold bullion in various sizes, catering mainly to those interested either in short-term trading or long-term accumulation of physical gold. While the lure of a focused commodity broker might appeal to some, this specialization limits portfolio diversification. For me, a lack of access to multi-asset classes can be a significant drawback, especially if I’m aiming to hedge positions or balance market exposures. In addition, YLG operates without formal regulation, which raises further concerns over the safety of funds. From a risk management perspective, being limited to only gold trading under these circumstances means I must remain very cautious. Diversification and robust regulatory oversight are both crucial in my approach to safeguarding capital. Therefore, anyone seeking a wide spectrum of trading instruments would likely find YLG’s current model too narrow for comprehensive trading or investing strategies.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now