Basic Information

United States

United States

Score

United States

|

2-5 years

|

United States

|

2-5 years

| https://liotrade.com/

Website

Rating Index

Licenses

LicensesNo valid regulatory information, please be aware of the risk!

United States

United States liotrade.com

liotrade.com United States

United States

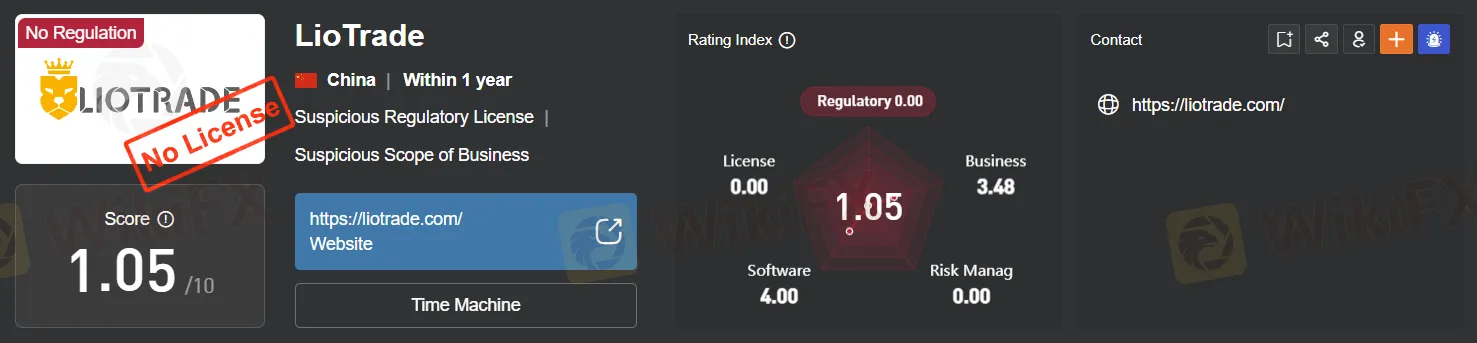

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2023 |

| Company Name | LioTrade |

| Regulation | Not regulated |

| Minimum Deposit | $250 (Trial Account) |

| Maximum Leverage | Up to 1:400 |

| Spreads | Vary by account type (e.g., starting from 2.5 pips for Trial Account) |

| Trading Platforms | Not specified |

| Tradable Assets | Not specified |

| Account Types | Trial, Bronze, Silver, Gold, Platinum, Diamond |

| Customer Support | Issues with response times and quality reported |

| Reputation (Scam or Not) | Some users have labeled it as a potential scam |

LioTrade, established in 2023 and based in China, raises considerable concerns within the trading community. This brokerage operates without regulatory oversight, making it a risky proposition for investors. While it offers a range of account types and high leverage, the lack of transparency regarding trading costs, unavailable demo and Islamic accounts, and reported issues with customer support response times and quality all contribute to a sense of apprehension. Furthermore, the presence of allegations dubbing LioTrade as a potential scam further diminishes its reputation and reliability, emphasizing the importance of cautious consideration before engaging with this company.

LioTrade is not subject to regulatory oversight. This lack of regulation means that the company may not adhere to the same strict standards and guidelines that regulated financial institutions do. As a result, investors and traders engaging with LioTrade should exercise caution and conduct thorough due diligence before participating in any financial activities with the platform. The absence of regulatory oversight can potentially expose individuals to higher levels of risk, as there may be fewer safeguards in place to mitigate fraudulent or unethical practices within the organization. Therefore, it's essential for anyone considering involvement with LioTrade to be well-informed about the associated risks and carefully consider their options when seeking investment or trading opportunities.

LioTrade presents a mixed picture of advantages and drawbacks. While it offers a variety of account types to cater to different trader needs and competitive leverage options, it also raises concerns due to the absence of regulatory oversight and limited transparency regarding trading costs. The customer support experience seems lacking, and there are allegations of it being labeled a potential scam. Prospective traders should carefully weigh these factors before considering involvement with LioTrade.

| Pros | Cons |

|

|

|

|

|

|

|

|

Please note that while LioTrade offers certain advantages such as account variety and leverage options, the absence of regulatory oversight and unclear trading costs should be approached with caution. Additionally, concerns about customer support and its reputation should be considered by potential users.

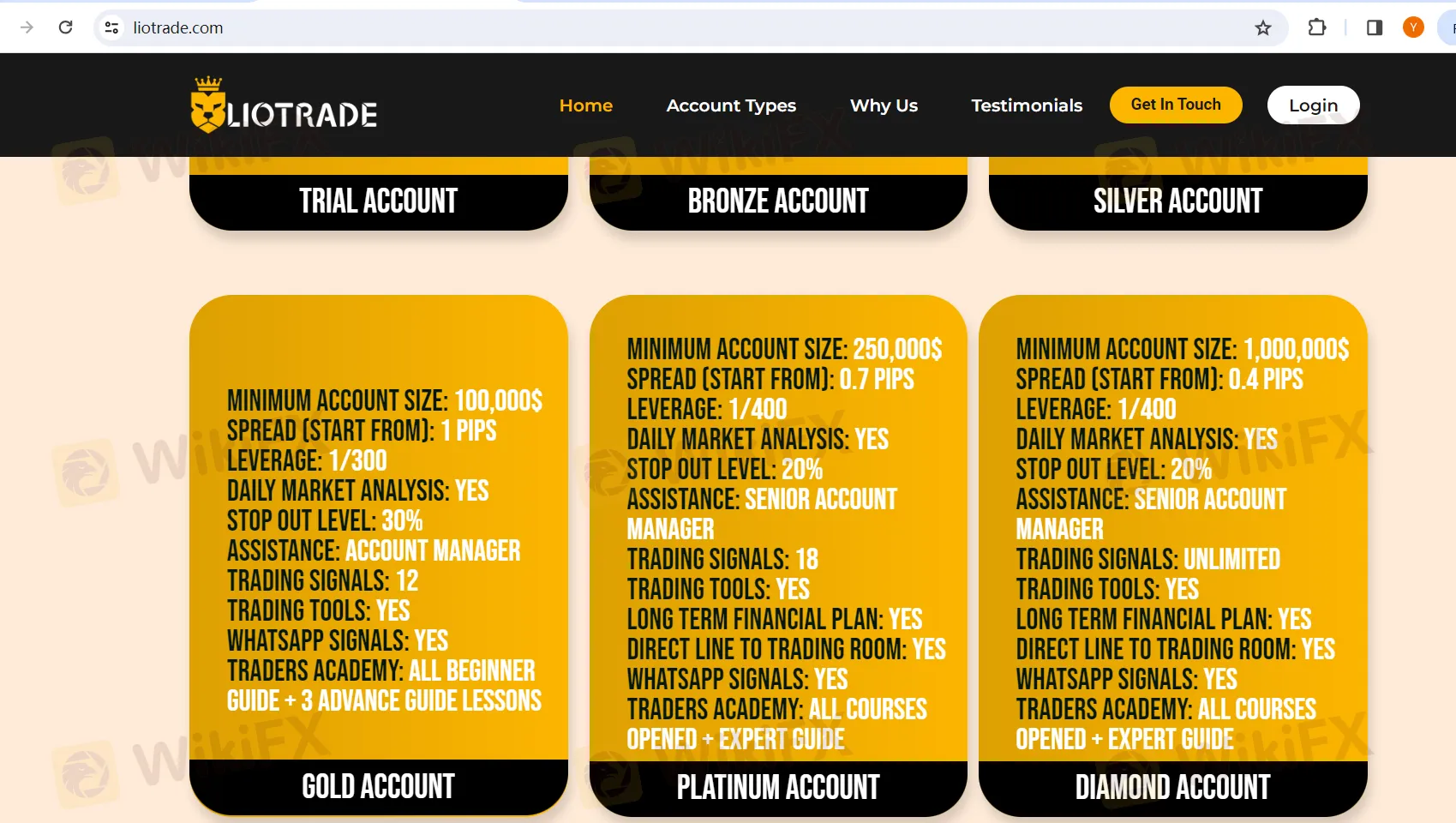

LioTrade offers a diverse range of account types to accommodate the diverse needs and preferences of traders. These accounts are tailored to suit varying levels of trading experience, capital availability, and desired features.

The Trial Account is an entry-level option with a minimum account size of $250. It provides a starting spread of 2.5 pips and a leverage of 1/100. However, daily market analysis is not included in this account, and the stop-out level is set at 40%. Traders opting for this account will have access to an account manager who can provide assistance and guidance.

Moving up the ladder, the Bronze Account requires a minimum account size of $5,000 and offers a slightly improved starting spread of 2.0 pips. It maintains a leverage of 1/100 and also includes an account manager for support. Like the Trial Account, it does not provide daily market analysis and maintains a stop-out level of 40%.

The Silver Account steps up the offerings with a minimum account size of $25,000. Traders in this category benefit from a starting spread of 1.8 pips and increased leverage at 1/200. Daily market analysis is included, and the stop-out level remains at 40%. Additionally, traders receive assistance from an account manager and access to trading tools. The Traders Academy offers three lessons of the Beginner Guide.

For those with a more substantial capital base, the Gold Account requires a minimum account size of $100,000. It offers a competitive starting spread of just 1 pip, a leverage of 1/300, and daily market analysis. The stop-out level is slightly lower at 30%, and traders are supported by an account manager. This account also provides 12 trading signals, various trading tools, and access to Whatsapp signals. Traders can access the Traders Academy, which includes all lessons from the Beginner Guide and three Advance Guide lessons.

The Platinum Account targets traders with a minimum account size of $250,000. It boasts a highly competitive starting spread of 0.7 pips and a leverage of 1/400. Daily market analysis is included, and the stop-out level is set at 20%. Traders receive support from a senior account manager, 18 trading signals, trading tools, a Long Term Financial Plan, and a direct line to the trading room. Additionally, Whatsapp signals are available, and the Traders Academy offers all opened courses along with an Expert Guide.

For elite traders, the Diamond Account sets the bar higher with a minimum account size of $1,000,000. It offers an exceptionally tight starting spread of 0.4 pips and maintains a leverage of 1/400. Daily market analysis is part of the package, and the stop-out level is set at 20%. A senior account manager provides personalized assistance, and traders receive unlimited trading signals, a comprehensive set of trading tools, a Long Term Financial Plan, a direct line to the trading room, Whatsapp signals, and access to all opened courses in the Traders Academy, along with an Expert Guide.

LioTrade offers a maximum trading leverage of up to 1:400. Leverage in trading is essentially a borrowed capital that allows traders to control a larger position size than their initial investment. In this case, a leverage of 1:400 means that for every $1 of your own capital, you can control a trading position worth up to $400.

While higher leverage can amplify potential profits, it also significantly increases the level of risk. Traders should be aware that with such high leverage, even small price movements in the market can lead to substantial gains or losses. Therefore, it's crucial for traders to use leverage wisely, have a solid risk management strategy in place, and be aware of the potential for significant losses when trading with high leverage. It's generally recommended for traders to only use leverage that they are comfortable with and can afford to lose.

LioTrade offers spreads and commissions that vary depending on the type of trading account selected. The spreads, which represent the difference between the buying (ask) and selling (bid) prices of a financial instrument, can have a significant impact on trading costs and potential profitability.

For the Trial Account, the spread starts from 2.5 pips. This means that traders using this account may encounter spreads of 2.5 pips or higher on the instruments they trade. This account type does not mention any specific commission charges.

Moving up the account tiers, the Bronze Account offers a slightly more competitive spread, starting from 2.0 pips. While it provides a better spread compared to the Trial Account, it also does not specify any commission charges.

The Silver Account, with a minimum account size of $25,000, provides traders with an improved starting spread of 1.8 pips. Additionally, it introduces the concept of daily market analysis. However, it does not mention any commission fees, suggesting that the costs are primarily built into the spread.

As we progress to higher-tier accounts, the Gold Account offers traders a starting spread of just 1 pip, which is quite competitive. This account, similar to the Silver Account, does not detail any commission charges. Instead, traders pay the costs associated with trading through the spread.

The Platinum and Diamond Accounts are the most advanced account types, targeting traders with substantial capital. They offer even tighter spreads, starting from 0.7 pips and 0.4 pips, respectively. These accounts provide an array of additional features and services, including daily market analysis, trading signals, trading tools, Whatsapp signals, and access to comprehensive educational resources. However, similar to the other account types, no specific commission fees are mentioned, indicating that traders' costs are primarily absorbed within the spreads.

In summary, LioTrade's spreads and commissions structure appears to be primarily spread-based, where the cost of trading is embedded in the difference between the bid and ask prices. The spread varies depending on the chosen account type, with more advanced accounts offering tighter spreads. While the brokerage may not explicitly mention commission charges for these accounts, it's essential for traders to understand how spreads and any potential hidden costs may impact their overall trading expenses and profitability.

The customer support offered by LioTrade leaves much to be desired. Despite their claim of being available around the clock, the quality of assistance provided falls short of expectations. Contacting them through their online form feels like a futile exercise, as their responses often lack the promptness and depth required to address customer concerns.

Furthermore, the lack of clarity in their communication is evident from the repetition of fields for both name and email, making it seem like a careless oversight. It raises questions about their attention to detail and professionalism. Customers who reach out with questions, feedback, or concerns may find themselves frustrated with the level of service they receive, as it may not meet the standards one would expect from a reputable financial institution. Overall, the customer support experience at LioTrade appears to be subpar and potentially a source of frustration for clients seeking timely and meaningful assistance.

LioTrade's website raises several concerns for potential users, as critical information about market instruments, deposit and withdrawal processes, and the trading platform is notably limited and unclear. This lack of transparency can leave prospective traders feeling uncertain about the services and offerings provided by the company. Furthermore, the fact that some users have labeled LioTrade as a potential scam adds to the apprehension surrounding the platform. Such allegations can erode trust and confidence in the company's operations, highlighting the importance of robust and transparent communication to address these concerns. To establish credibility and attract a discerning clientele, it is crucial for LioTrade to improve the clarity and accessibility of essential information while addressing any negative reputation issues head-on.

LioTrade presents a concerning picture with its lack of regulatory oversight, limited transparency regarding market instruments, deposit and withdrawal procedures, and unclear information about spreads and commissions. The allegations of being labeled a potential scam by some users only further intensify the doubts and reservations surrounding this platform. Additionally, the subpar customer support experience, marked by slow responses and an apparent lack of attention to detail, doesn't instill confidence in the company's ability to provide adequate assistance to its clients. Prospective traders and investors would be wise to exercise caution and conduct thorough due diligence before considering involvement with LioTrade, as it currently fails to provide the transparency and clarity expected from a reputable financial institution.

Q1: Is LioTrade regulated?

A1: No, LioTrade is not subject to regulatory oversight, which means it may not adhere to the strict standards and guidelines followed by regulated financial institutions.

Q2: What is the minimum account size for the Trial Account?

A2: The minimum account size for the Trial Account at LioTrade is $250.

Q3: Can I access daily market analysis with the Silver Account?

A3: Yes, the Silver Account provides daily market analysis as part of its features.

Q4: Does LioTrade charge specific commission fees?

A4: LioTrade's accounts appear to primarily use spread-based pricing, and the website does not specify any commission charges.

Q5: How much leverage does LioTrade offer?

A5: LioTrade offers a maximum trading leverage of up to 1:400, allowing traders to control larger positions with their initial capital.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now