简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Dollar Extends Four-Day Decline as Markets Brace for BoJ Policy Decision

Zusammenfassung:The Bank of Japan (BoJ) is scheduled to hold its policy meeting this Friday, with growing market expectations that the central bank may proceed with another rate hike. Anticipation of tighter Japanese

The Bank of Japan (BoJ) is scheduled to hold its policy meeting this Friday, with growing market expectations that the central bank may proceed with another rate hike. Anticipation of tighter Japanese monetary policy has begun to ripple through global markets. USD/JPY has fallen below the 155 level, dragging the U.S. Dollar Index beneath the key 98 threshold. Yen appreciation has not only weighed on the dollar but has also triggered spillover pressure across risk assets, including cryptocurrencies.

Why a BoJ Rate Hike Pressures Risk Assets and Crypto Markets

The core transmission mechanism centers on expectations of sustained yen strength tightening global liquidity conditions. As borrowing costs rise, leveraged exposure to high-risk assets becomes more expensive, forcing traders to unwind yen-funded carry trades. During periods of heightened risk aversion, market participants typically reduce leverage and cut overall risk exposure, which in turn suppresses Bitcoin prices.

Historical Context: Bitcoins Performance Following BoJ Rate Hikes

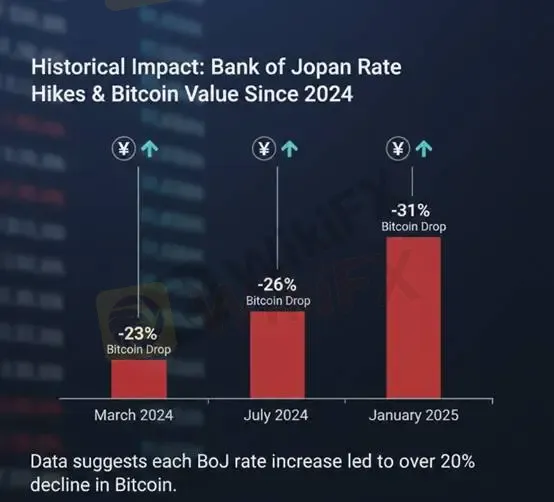

Historical data suggests a clear pattern. Since 2024, every BoJ rate hike has been followed by a Bitcoin correction exceeding 20%.

March 2024: -23%

July 2024: -26%

January 2025: -31%

(Figure 1: Historical data shows sharp Bitcoin sell-offs following BoJ rate hikes)

At present, markets are facing dual sources of uncertainty: the upcoming U.S. Non-Farm Payrolls report and the BoJ policy decision. Amid heightened caution and defensive positioning, most asset classes have come under pressure, pushing markets into a temporary state of impaired price discovery.

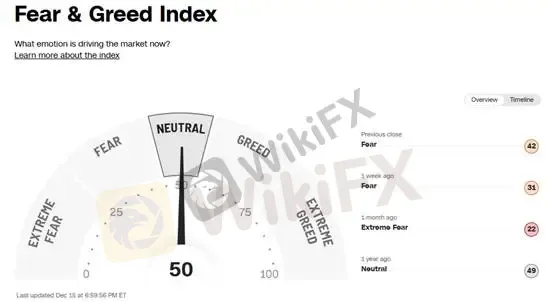

That said, sentiment indicators paint a more balanced picture. The Fear & Greed Index currently stands at a neutral reading of 50. Given that equity indices remain near elevated base levels, this suggests market behavior has not yet shifted into irrational exuberance or panic-driven liquidation.

(Figure 2: Fear & Greed Index; Source: CNN)Broader Central Bank Outlook: Limited Additional Downside Pressure

While the BoJ meeting has fueled risk-off sentiment, attention also turns to policy meetings from the Bank of England (BoE) and the European Central Bank (ECB) this week. According to international media reports, markets believe BoE rate cuts are already fully priced in, driven by signs of easing inflation. Meanwhile, the ECB is widely expected to keep rates unchanged. Given the limited policy surprise potential from these two central banks, we believe their impact on further market downside will be relatively contained.

Macro Outlook

Despite short-term event-driven volatility, we do not expect either December‘s U.S. labor data or a BoJ rate hike to trigger a structural market reversal. Against the backdrop of the Federal Reserve’s broadly accommodative policy bias, the U.S. dollar remains capped by expectations of monetary easing. This environment continues to favor long-term upside potential for risk assets and gold.

Gold Technical Analysis

Gold prices have broken above the blue consolidation box, with the current structure best interpreted as the second major upward leg.

Using Fibonacci retracement analysis, the pullback from the recent high of USD 4,353 per ounce found support at the 50% retracement level around USD 4,257, before reversing higher. However, the attempt to break above the prior high failed, with prices stalling at the USD 4,353 resistance level (Resistance 1) and subsequently pulling back.

Momentum indicators also warrant caution. The MACD histogram has turned from positive to negative, suggesting that near-term price action is more likely to remain range-bound or drift lower. From a trading perspective, a neutral, wait-and-see stance is advisable.

While fundamental drivers continue to support gold over the longer term, this weeks BoJ policy uncertainty has introduced additional noise across asset classes, including precious metals.

Key Levels to Watch (Intraday Focus)

Immediate support at USD 4,279 (Fibonacci 38.2%).

A decisive break below this level would likely push prices back into the prior blue consolidation range, signaling an early end to the second upward leg.

Suggested Stop Loss: USD 30

Support Levels:

SUP1: 4,279

SUP2: 4,257

Resistance Levels:

Resistance 1: 4,353

Resistance 2: 4,381

Risk Disclaimer

The views, analyses, research, price levels, and other information provided above are for general market commentary only and do not represent the position of this platform. All readers bear full responsibility for their own trading decisions. Please exercise caution and manage risk appropriately.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

XRP: Was Ripple dir JETZT nicht offen sagt

Solana vor möglichem Ausbruch: ETF-Zuflüsse stützen Kurs über 131 Dollar

XRP vor Crash? Ripple-Signal warnt: minus 60% möglich

Litecoin unter massivem Verkaufsdruck – Siebter Verlusttag in Folge

BitMine kauft massiv Ethereum und peilt fünf Prozent des Umlaufs an

Cardano stabilisiert sich über 0,40 Dollar – Indikatoren nähren Hoffnungen auf Ausbruch

Wechselkursberechnung