简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Dec 15, 2025

Zusammenfassung:The Final “Super Week” of 2025; U.S. Data to Set the Tone into 2026Global markets experienced heightened volatility last Friday as investors booked profits following the Federal Reserves rate decision

The Final “Super Week” of 2025; U.S. Data to Set the Tone into 2026

Global markets experienced heightened volatility last Friday as investors booked profits following the Federal Reserves rate decision.

The U.S. Dollar Index (DXY) staged a modest intraday rebound but gave back most gains, closing at 97.97—marking a third consecutive weekly decline and reflecting persistent post-FOMC bearish pressure. Gold briefly surged toward 4,350, testing record highs, before facing heavy selling during the U.S. session.

Equities showed clear sector rotation. The Nasdaq 100 and S&P 500 fell 2.23% and 1.02%, respectively, as high-valuation tech stocks remained under pressure. The Dow Jones slipped just 0.43% yet secured a positive weekly close, signaling continued capital flow into value and cyclical sectors.

The NFP & CPI Double Header

Markets now enter the final full trading week of the year. Liquidity may thin ahead of the holidays, but volatility could remain elevated due to two major U.S. data releases compressed into one week:

· Tuesday, December 16: U.S. Non-Farm Payrolls for October and November

· Thursday, December 18: U.S. Consumer Price Index (CPI)

Last weeks FOMC delivered a hawkish cut, yet the broader tone leaned dovish, reinforcing expectations of a continued easing cycle into 2026 and contributing to renewed dollar weakness.

The dual NFP and CPI releases are likely to drive near-term volatility and shape market positioning into early 2026. Simply put, if both job reports and inflation data confirm a slowdown, market expectations for the Feds 2026 policy path may be recalibrated.

US Dollar Outlook

USD Index, Daily Chart

The US Dollar Index‘s breakout below 99 signals a continuation of the downtrend, despite the potential for a short-term rebound near 98.00. However, the next decisive move will likely depend on this week’s dual data releases.

Outlook: At this stage, any move below 99.00 maintains a bearish bias for the dollar. Only a stronger-than-expected CPI or Non-Farm Payroll report could force the market to reassess Fed rate-cut expectations and trigger a reversal.

Gold Benefit on Weaker Dollar

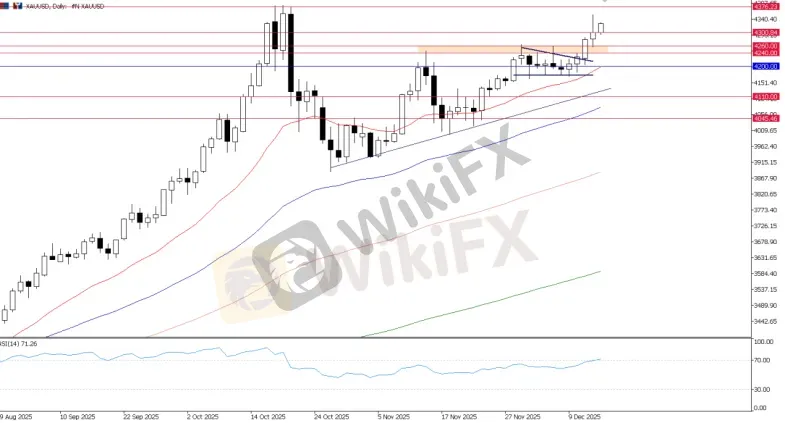

XAU/USD, Daily Chart

Gold continues to benefit from U.S. dollar weakness. With the breakout of the 4,240–4,260 zone, the bullish trend remains intact. Any dip above this zone still presents a buying opportunity. Only a significant dollar rebound would threaten the uptrend.

XAU/USD, H1 Chart

Near-term support lies at 4,300, with the key zone at 4,240–4,260. Pullbacks that hold above this area validate the ongoing uptrend. Gold is likely to maintain a bullish-to-consolidation outlook near record highs.

US Equities: Profit-Taking Move?

Following a post-FOMC record-high rally, U.S. major indices saw a notable pullback last Friday, likely reflecting profit-taking ahead of the holiday session.

US500, Daily Chart

The pullback is significant but far from undermining overall market resilience. On the upside, caution is warranted, but the broader trend remains bullish unless US500 breaks the 6,780-support level, which could trigger a consolidation phase rather than a fresh bull run.

UT100, Daily Chart

For the UT100, key support lies at 25,250. A break below this level could signal broader consolidation across U.S. equities, particularly as the market enters a two-week holiday session, which may prompt further profit-taking.

Key Focus This Week: Data & Central Banks

1. The U.S. Double-Header: NFP & CPI This week features a rare compression of major data releases that will serve as the final “reality check” for 2025.

· Tuesday (Dec 16) – Non-Farm Payrolls (NFP): Due to reporting delays, markets will see a critical update on the labor market. A weak print (below consensus) would validate the “dovish” market narrative, potentially crushing the Dollar and launching Gold toward new highs. A strong beat, however, would force traders to align with the Feds “slower easing” forecast.

· Thursday (Dec 18) – CPI Inflation: Following the soft PCE data, this report is the final hurdle. If CPI confirms disinflation is entrenched, it paves the way for a continued rally in risk assets into 2026.

2. Central Bank “Super Thursday”: BoJ & BoE While the U.S. data dominates the first half of the week, Thursday brings pivotal decisions from Japan and the UK.

· Bank of Japan (BoJ): The Hike Risk. Markets are pricing in a high probability (~90%) of a rate hike. If delivered, this hawkish move—contrasting with the Fed's recent cut—could trigger a massive unwinding of carry trades, sending USD/JPY sharply lower toward 150.00.

· Bank of England (BoE): The Dovish Pivot. Conversely, the BoE is expected to cut rates to 3.75% amid cooling UK inflation. This divergence (BoJ hiking vs. BoE cutting) makes GBP/JPY a key pair to watch for potential volatility.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

XRP: Was Ripple dir JETZT nicht offen sagt

Solana vor möglichem Ausbruch: ETF-Zuflüsse stützen Kurs über 131 Dollar

XRP vor Crash? Ripple-Signal warnt: minus 60% möglich

Litecoin unter massivem Verkaufsdruck – Siebter Verlusttag in Folge

BitMine kauft massiv Ethereum und peilt fünf Prozent des Umlaufs an

Cardano stabilisiert sich über 0,40 Dollar – Indikatoren nähren Hoffnungen auf Ausbruch

Wechselkursberechnung