Abstract:Errante presents itself as a regulated forex broker with multiple platforms and instruments. However, user complaints about withdrawals and account issues raise red flags despite its licenses. Our analysis delves into its compliance, features, and risks to determine whether it’s reliable or shady.

Broker Overview

Errante launched in 2019 and operates from Seychelles with entities in Cyprus. It offers trading in forex, indices, commodities, metals, shares, and cryptocurrencies via MT4, MT5, cTrader, and TradingView. Minimum deposits start at $50, with leverage up to 1:500 on standard accounts.

The broker supports 24/7 customer service through phone, email, and live chat. It accepts deposits via wire transfer, cards, e-wallets, and crypto, though regional restrictions apply in countries such as the US and Canada. Four account types cater to different traders, from Standard to Tailor Made.

Regulatory Status

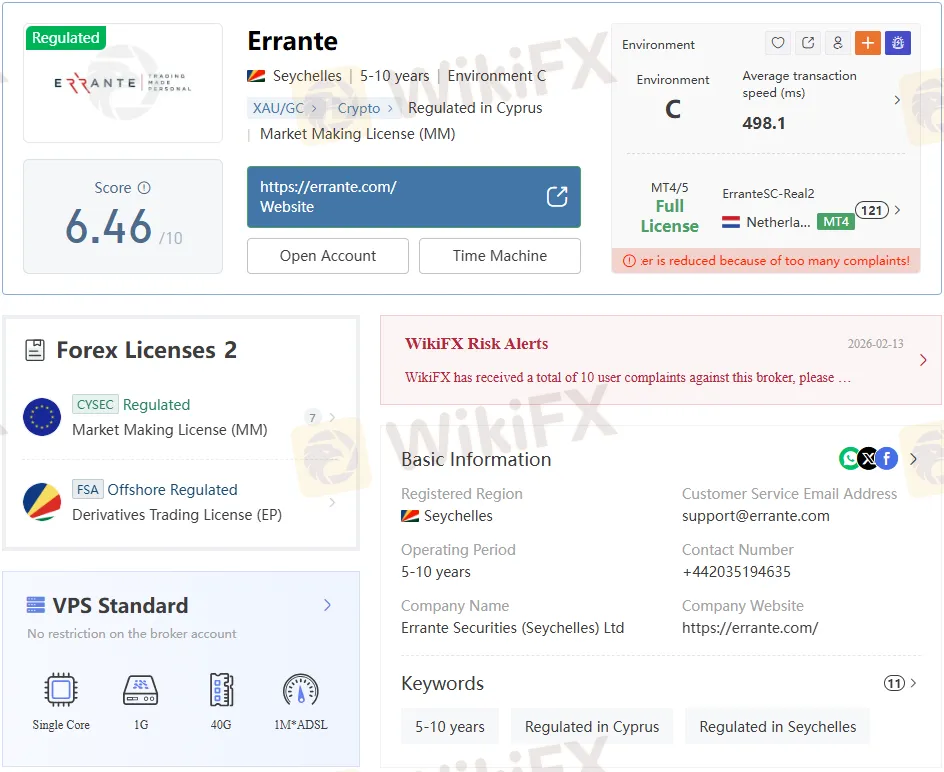

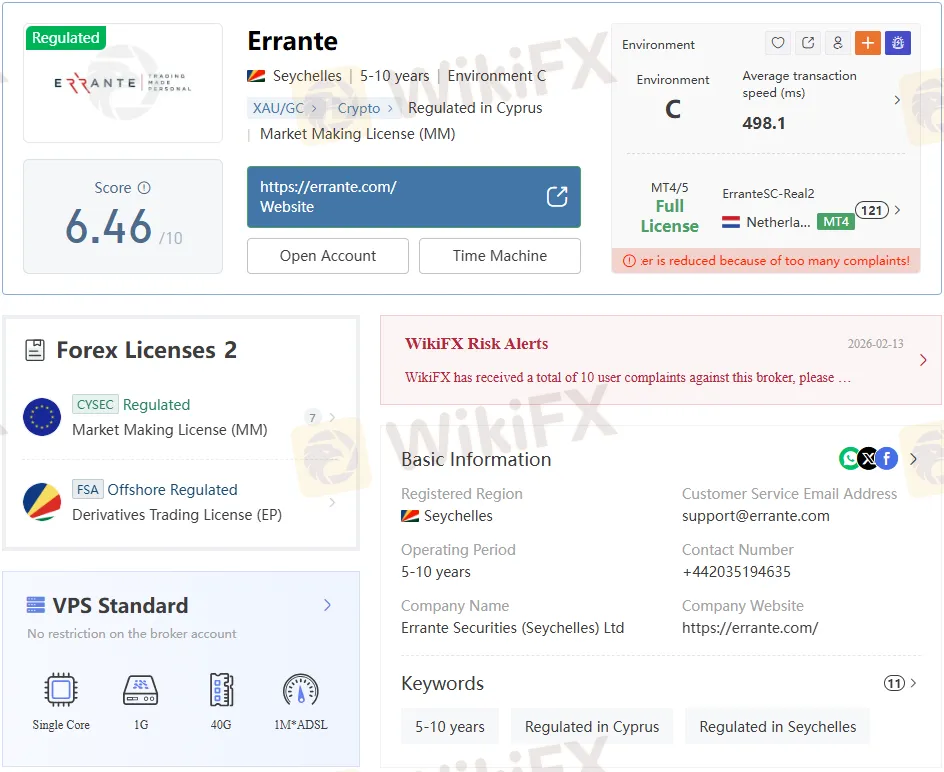

Errante holds a CYSEC regulation under license 383/20 for Notely Trading Ltd as a Market Maker. It also holds an FSA Seychelles license, SD038, for retail forex via Errante Securities (Seychelles) Limited, indicating offshore regulation. While listed as “Regulated” on WikiFX, CYSEC primarily protects EU clients, leaving non-EU traders with limited safeguards.

Concerns arise from CYSECs light penalties, like an €80,000 fine in 2024 for misleading marketing without license revocation. Offshore setups mean funds may sit outside strict oversight, amplifying risks for global users. Download the WikiFX App to verify broker regulation in real-time before trading.

Trading Features

Errante provides spreads from 1.5 pips on Standard accounts, dropping to 0 pips on VIP accounts with commissions. Platforms like MT5 suit experienced traders, while MT4 works for beginners, all available on PC, web, and mobile. Demo accounts help test conditions without risk.

Instruments cover major categories but exclude options, bonds, and ETFs. Leverage reaches 1:500, with a stop-out at 20%, appealing for aggressive strategies. Popular payment options ease funding, though crypto deposits have sparked disputes.

User Complaints Surface

Trustpilot rates Errante “Poor” at 2.2/5 from 38 reviews, citing account blocks, dormant fees, and unresponsive support. Traders report profits wiped out as “abnormal transactions” go unproven, and withdrawals are denied after large gains. One user lost $24,000 due to alleged system errors that blocked their accounts.

Platforms like Forex Peace Army and BrokerHivex highlight frozen accounts demanding settlements, slippage, and server downtimes. Reddit threads echo struggles with “handling fees” or repeated KYC for payouts. WikiFX logs exposure cases of deposit-only scams, urging caution.

Compliance Loopholes

CYSEC regulation sounds strong, but it mainly covers EU clients, routing others to Seychelles entities with weaker protections. MSB registration aids payments but offers no investor safeguards, misleading non-EU traders. WikiFX App users report low risk scores due to withdrawal difficulties.

Fines haven‘t curbed issues; 2024’s €80K penalty ignored compensation. Offshore funds evade full scrutiny; matching scam patterns: small withdrawals are okay, but large ones are frozen. Check the WikiFX App for updated complaints and scores on Errante regulation.

Risk Assessment

Pros include diverse instruments, multiple platforms, and 24/7 support. Cons include offshore risks, regional bans, and persistent withdrawal woes. BrokerHivex scores it 3.2/10 overall, flagging fund security at 2/10.

Non-EU clients face high exposure; profits vanish under vague “violations.” Use the WikiFX App to scan for similar brokers with stronger oversight. Errantes setup prioritizes marketing over reliability for most users.

Final Verdict

Errante is regulated, but concerns persist over enforcement gaps and trader ordeals. Features attract, but complaints suggest shady practices for big withdrawals. Verify via the WikiFX App and proceed slowly if so—better safe than scammed.