简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Multifamily Delinquencies Rise Again, Hit New Post-Great Recession High

Abstract:Fannie Mae and Freddie Mac (also known as “GSEs”) have released their November reports on their mort

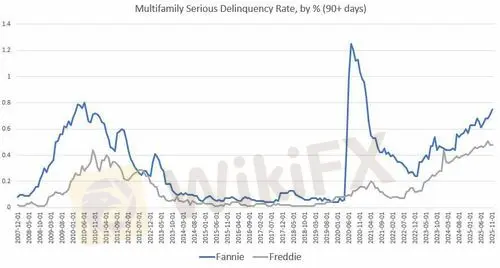

Fannie Mae and Freddie Mac (also known as “GSEs”) have released their November reports on their mortgage portfolios and mortgage delinquencies.Both Fannie and Freddie report that serious delinquencies in multifamily are rising to multiyear highs.

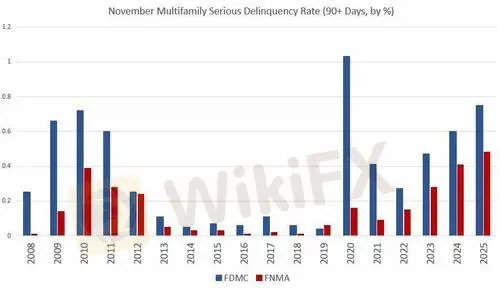

For November, seriously delinquent multifamily mortgages (90+ days delinquent) at Fannie Mae rose to 0.75 percent.That‘s up from October’s total of 0.71 percent, and it was up from November 2024‘s total of 0.60 percent. Fannie’s delinquency rate has risen quickly since December 2022 when the rate was 0.24 percent. Excluding the covid panic, Fannies delinquency rate is now the highest since 2010, but remains below the Great-Recession high of 0.80 percent.

Freddie Mac‘s delinquency report, on the other hand, shows delinquencies the Great-Recession peak. During November, Freddie reported multifamily serious delinquency rate was 0.48 percent. That’s unchanged from October 2025, but up from November 2024s level of 0.41 percent.

Comparing for November of each year, November 2025‘s delinquency rate at Fannie exceeds that of November 2011, the previous peak year for delinquencies (ex covid), when November delinquencies reached 0.72 percent. At Freddie, November 2025’s delinquency rate of .48 percent is the highest in decades, and above the previous peak of 0.39 percent.

This trend likely reflects slowing rent growth and waning demand for rentals as employment stagnates and wage growth slows. CNBC reported on Dec 26:

The phrase “renter friendly” is anything but friendly for owners of multifamily rentals. Moreover, landlords must continue to contend with rising prices in services and materials necessary for regular maintenance of multifamily units. In other words, we must consider inflation, so real, inflation-adjusted rent growth is even worse than the nominal declines now reported in a number of metro areas. In Denver metro, for example, the median asking rent in November was down 4.8 percent, year over year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Currency Calculator