简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MONAXA Review 2026: Comprehensive Safety Assessment

Abstract:MONAXA presents a high-risk profile with a WikiFX score of just 2.24, lacking valid regulatory oversight while facing official warnings from authorities like CySEC. Recent user feedback highlights critical issues with withdrawals and profit cancellations, categorizing the entity as a D-rated trading environment.

Executive Summary

In this in-depth MONAXA review, we analyze the key metrics defining this financial service provider to determine its viability for traders. The broker was established in 2022 and is currently registered in Anguilla, an offshore jurisdiction. despite its short operational history, it has attracted significant volume but maintains a low WikiFX score of 2.24 due to severe deficiencies in compliance and performance. Our internal review protocols classify this entity as high-risk, primarily because it lacks authorization from any Tier-1 supervisory body.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation MONAXA operates under—or crucially, the lack thereof. Currently, the firm is not regulated by any major authority. Instead, it has been flagged by the Cyprus Securities and Exchange Commission (CySEC) and the Japanese FSA for providing unauthorized investment services. Without strict regulation, client funds are not guaranteed segregated protection, leaving traders exposed to significant counterparty risk. The absence of a valid license means that in the event of insolvency or disputes, there is no ombudsman to mediate for the client.

2. Forex Trading Conditions

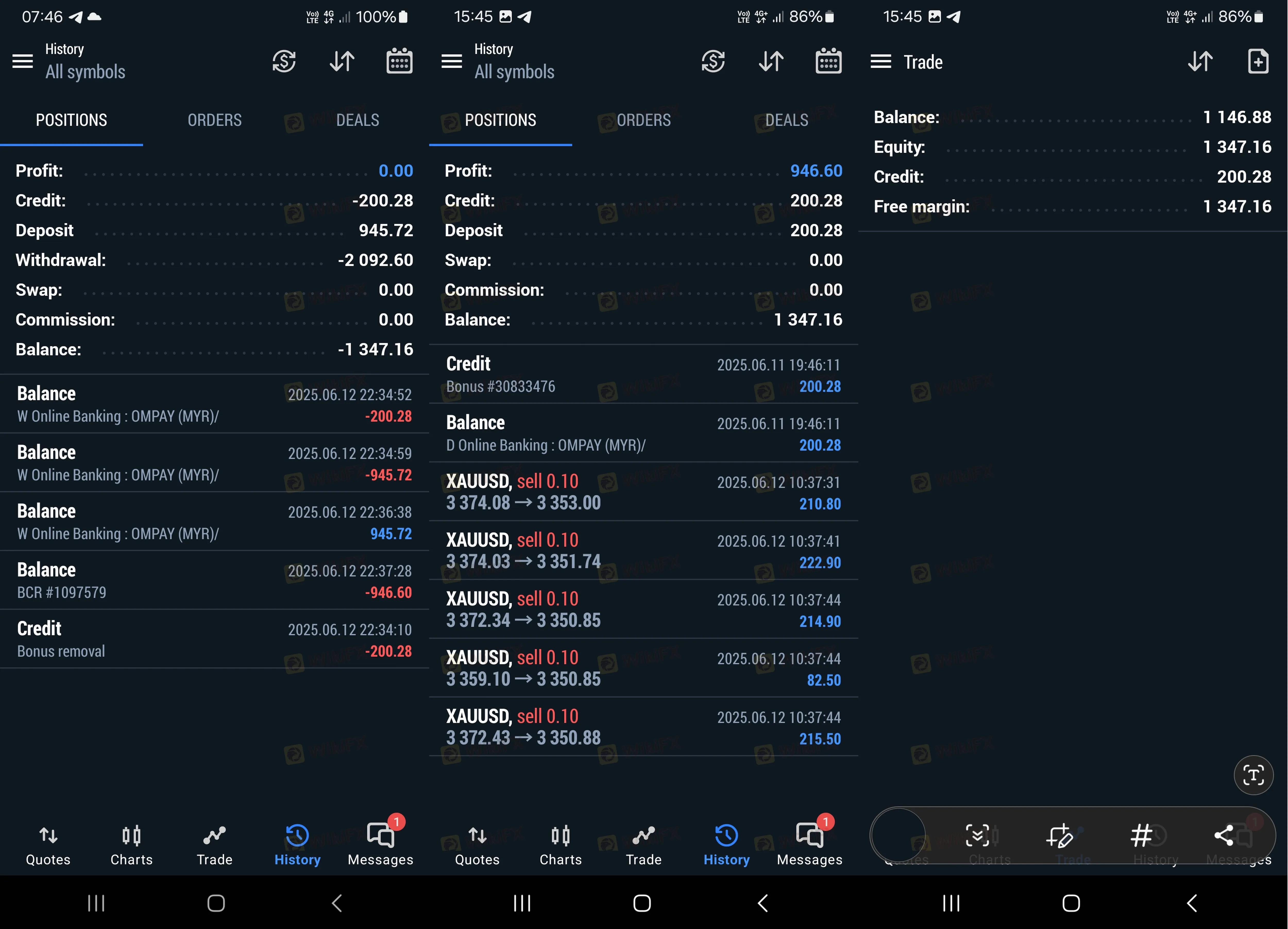

For traders focusing on Forex instruments, MONAXA offers conditions that are typical of offshore entities but dangerous for inexperienced users. The platform provides leverage up to 1:1,000, which drastically increases risk exposure beyond what is permitted in regulated markets. While they advertise spreads starting from 0.0 pips on ECN accounts, the `TradeEnv` audit rates their overall environment as “Poor” (Grade D). Investors must question whether the Forex pricing structure compensates for the high slippage and poor swap rates detected during testing.

3. User Feedback & Complaints

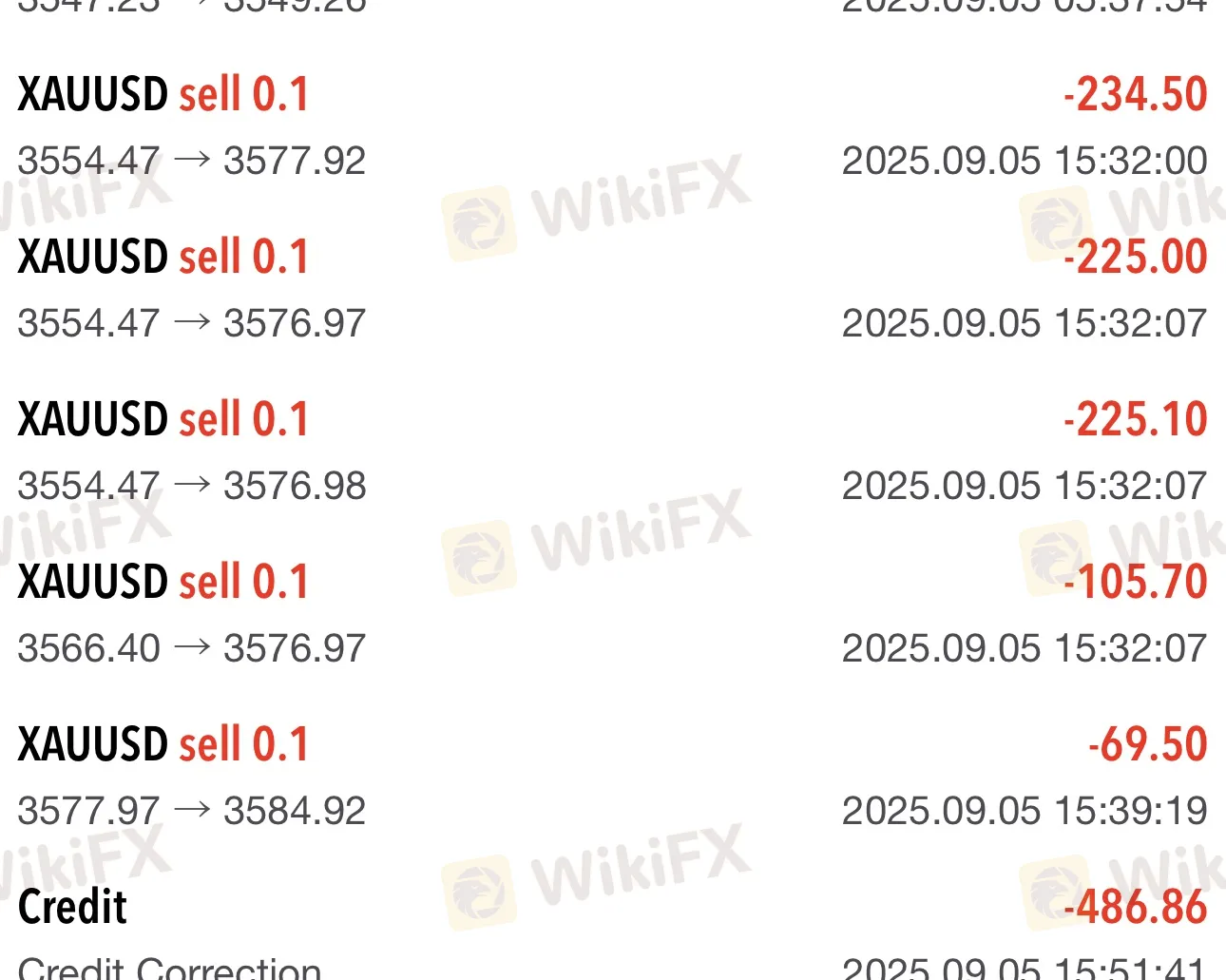

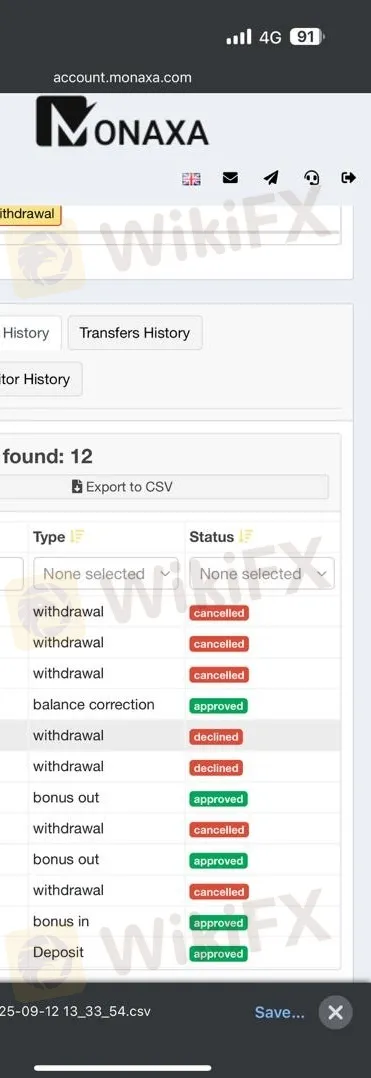

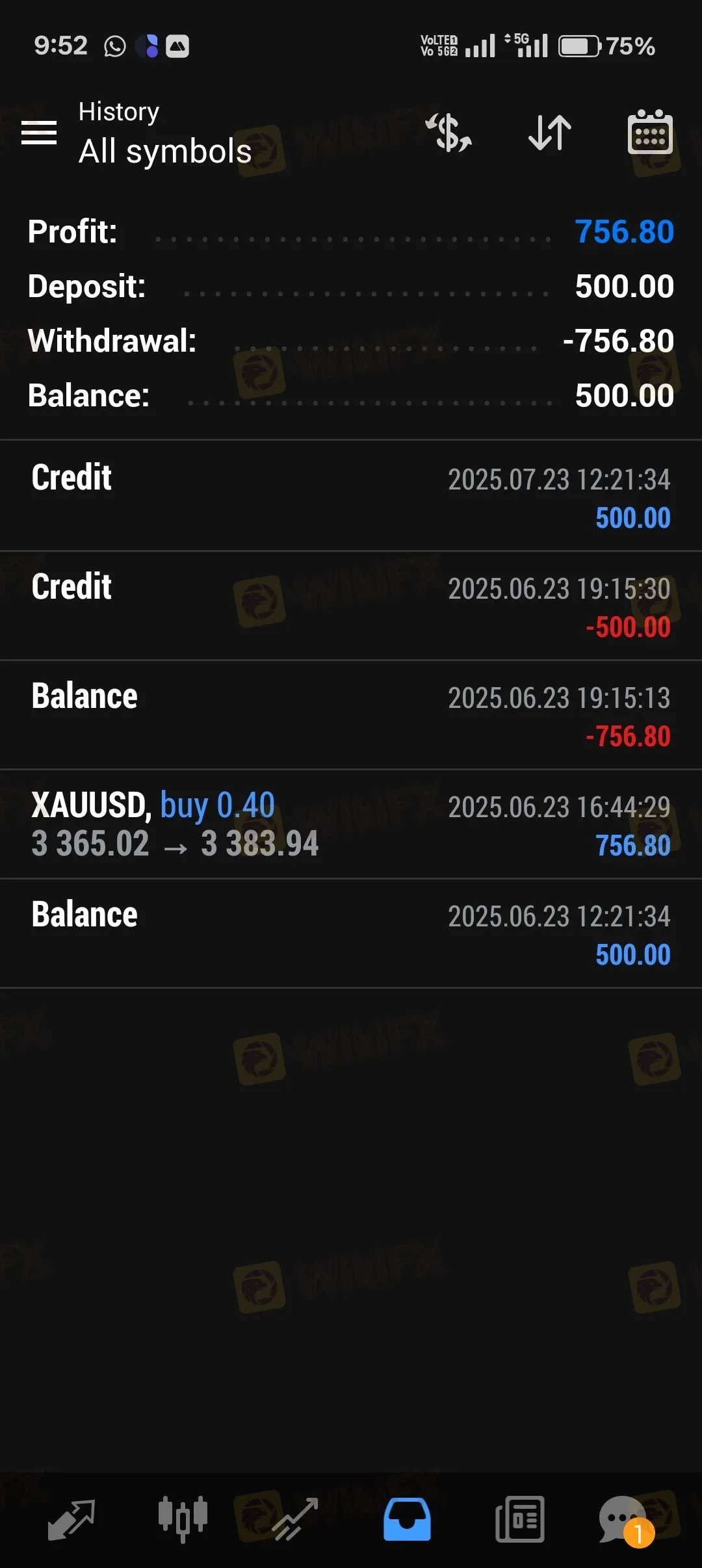

User sentiment is overwhelmingly negative, with numerous complaints alleging scam-like behavior.

A recurring theme in the `casesText` is the arbitrary deduction of profits.

For instance, detailed feedback in Case 7 highlights a scenario where a user had approximately $22,000 deducted. The justification allegedly given by the support team was related to a “multiple login” instance via a VPS service. This suggests that the broker may use technicalities regarding the login process or IP usage to void profitable trades, a practice often observed in unregulated dealing desks.

4. Software & Access

MONAXA utilizes the industry-standard MT4, MT5, and cTrader platforms. To access the platform, traders must complete the login security steps, yet the absence of advanced two-factor authentication (2FA) is a noted weakness in their software suite. While the interfaces are functional, the underlying execution quality remains suspect. We advise traders to verify the official login page URL to avoid phishing, though the primary risk remains the broker's internal execution policies rather than external security threats.

Final Verdict

To summarize, this broker fails to meet basic safety standards, as evidenced by its unauthorized status and severe client complaints regarding fund withdrawals.

For real-time updates on regulation status or to report issues, traders should consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Currency Calculator