简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Quotex Review 2026: Comprehensive Safety Assessment

Abstract:Quotex receives a low safety score of 1.52/10 due to its unregulated status and multiple investor warnings from authorities like BAPPEBTI and CMVM. User feedback highlights severe issues including deposit failures, account suspensions upon profit generation, and withdrawal obstructions.

Executive Summary

In this in-depth review, we analyze the key metrics, safety protocols, and user feedback surrounding Quotex, an online trading provider headquartered in St. Vincent and the Grenadines. The broker was established in 2020 and has quickly garnered attention, though not entirely for positive reasons. With a remarkably low WikiFX score of 1.52, the entity is flagged for high potential risk. This review aims to dissect the regulatory voids and operational red flags that traders must consider before committing funds. Currently, Quotex holds no valid regulatory license, and its influence rank remains at a 'C' level, despite average popularity in regions like Canada and Ecuador.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under, or in this case, the lack thereof. Quotex is registered in St. Vincent and the Grenadines, a jurisdiction known for loose oversight that does not police forex or binary options brokers. Consequently, the firm is officially classified as “Unregulated” on WikiFX.

More concerning are the specific warnings issued by tier-1 and tier-2 financial authorities. The Indonesian regulator, BAPPEBTI, has flagged the platform, blocking its domains and categorizing its operations as gambling under the guise of trading. Similarly, the Portuguese CMVM and the Malaysian SCM have issued warnings stating that Quotex is not authorized to provide financial services. Without regulation oversight, client funds are not segregated, and there is no compensation scheme in the event of insolvency. This lack of legal accountability significantly elevates the risk profile for any prospective client.

2. Forex Trading Conditions

For traders focusing on Forex instruments, the trading environment at Quotex appears opaque. The broker does not publicly disclose detailed specifications regarding spreads or maximum leverage on its main summary pages, a common trait among low-transparency offshore entities. However, user feedback suggests inconsistencies in the trading conditions provided.

Specifically, one user (Case 5) reported that their leverage was unexpectedly decreased after they began trading, which directly impacts risk management strategies. This raises a pivotal question: Does Forex pricing compete with top-tier providers? Without transparent, verifiable data on spreads and commissions, it is difficult to validate the cost-efficiency of the platform. Furthermore, BAPPEBTI‘s classification of the platform’s operations suggests a model closer to binary options—often termed “fixed time trades”—rather than the standard spot Forex market structure used by regulated brokers.

3. User Feedback & Complaints

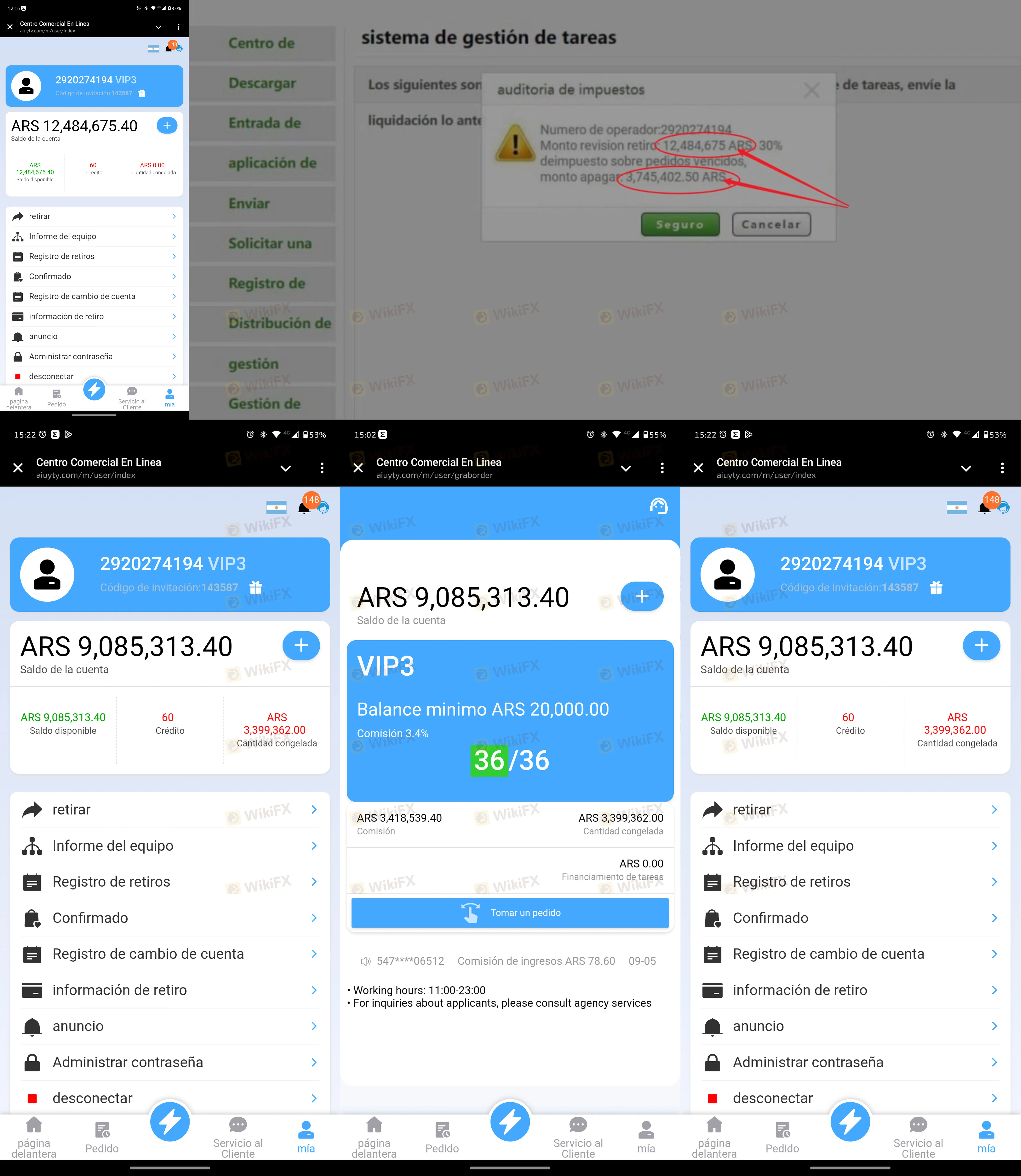

Evaluating the `casesText` data reveals a disturbing pattern of financial disputes. Over the last three months alone, WikiFX has received 9 formal complaints. The grievances generally fall into two categories: deposit failures and withdrawal denials.

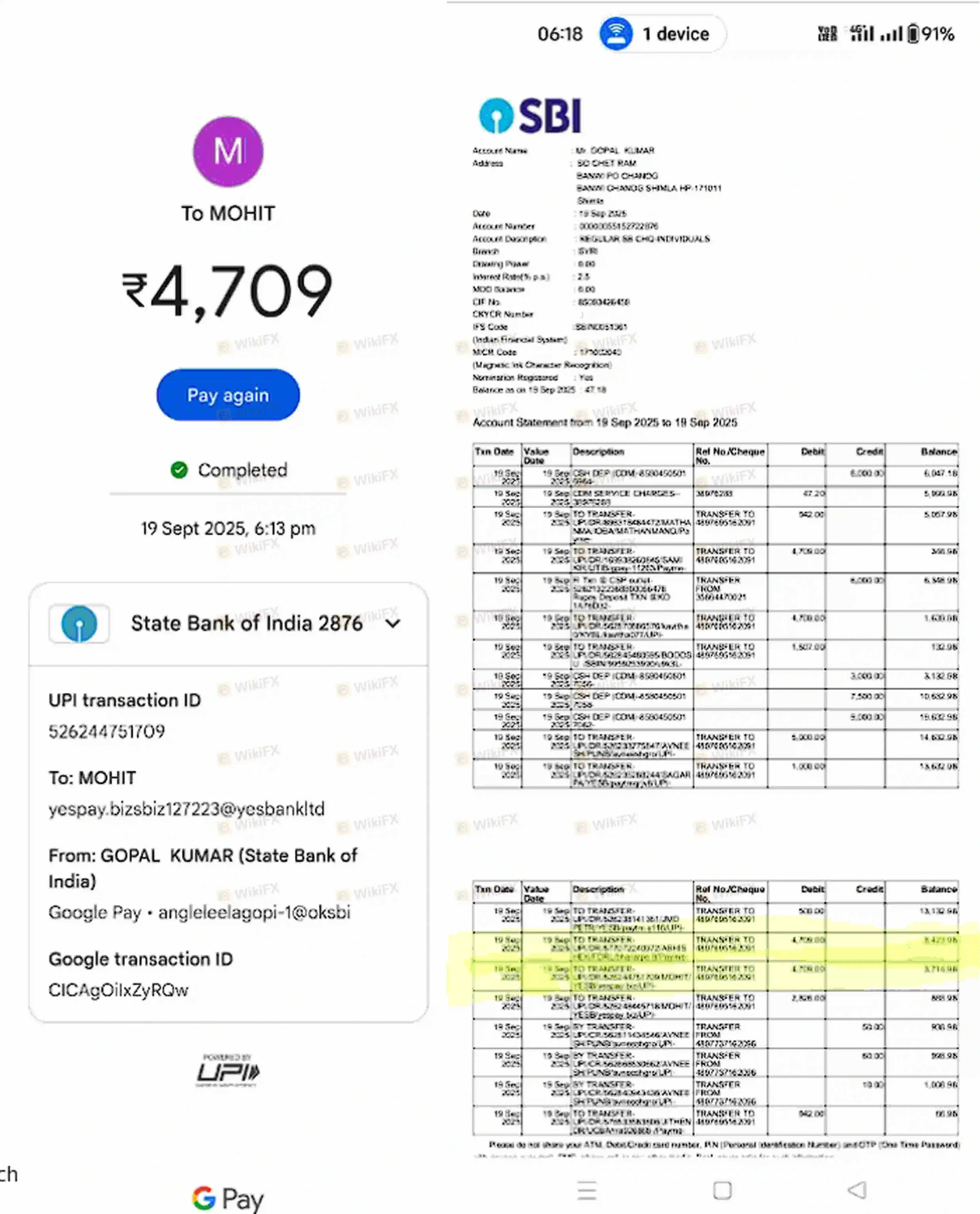

- Deposit Issues: Multiple users (Case 1 from India, Case 4 from Vietnam) reported that funds were debited from their bank accounts but never credited to their trading balance. Despite providing transaction receipts, these users claimed the support team was unresponsive.

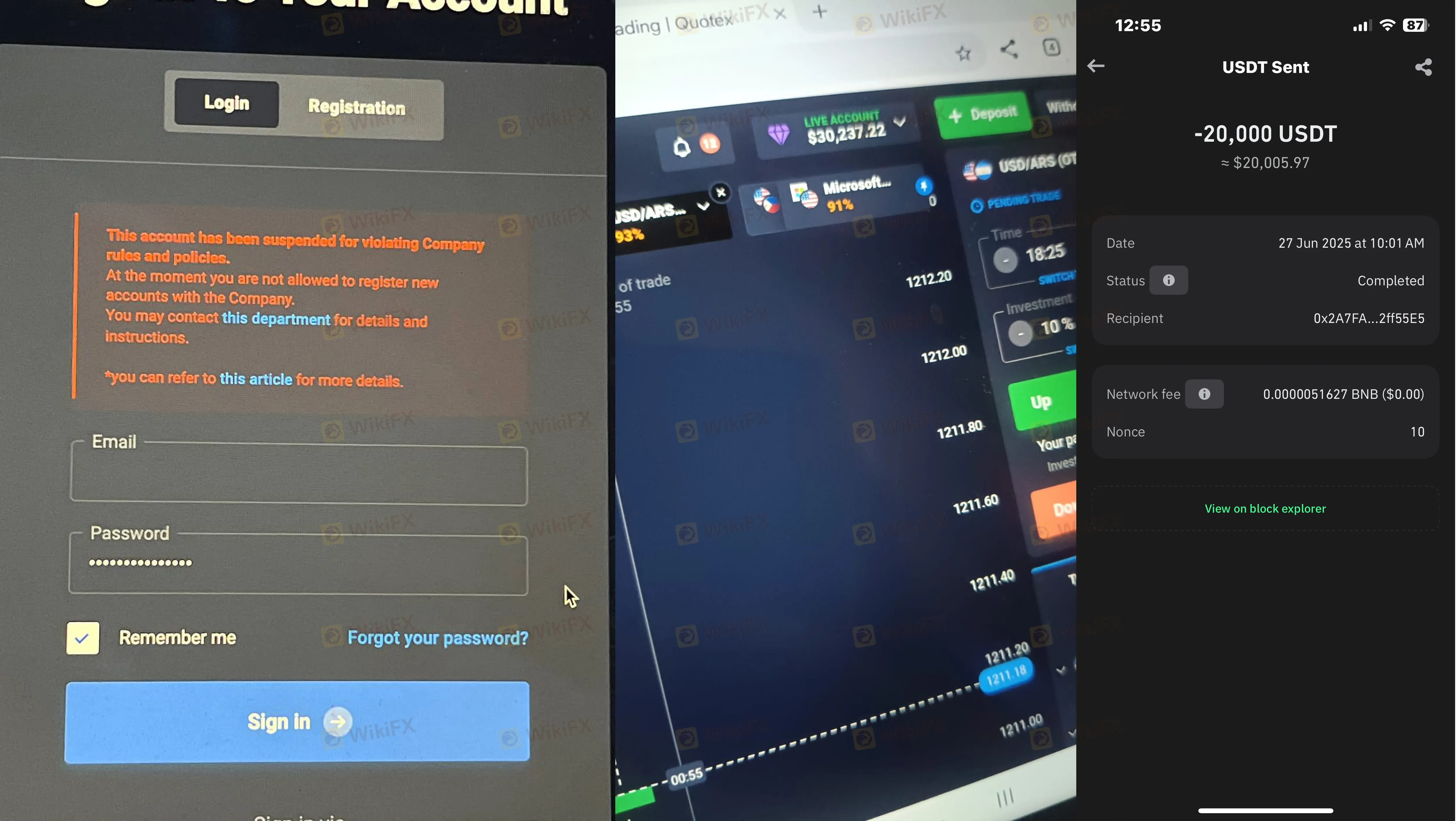

- Withdrawal & Account Blocking: Case 3 describes a scenario where a trader grew their account to $43,000, only to have the account suspended during the withdrawal attempt. In such instances, the suspension effectively disables their login access, leaving them unable to retrieve funds or contact support from within the platform.

- Tax Scams: Case 2 identifies a classic withdrawal obstruction tactic where the platform allegedly requested additional tax payments before releasing funds.

4. Software & Access

Quotex utilizes a proprietary web-based trading platform and mobile application. While proprietary platforms can offer unique features, they lack the third-party auditing and transparency of standard software like MetaTrader 4 or 5.

Security regarding account access is also a concern. To access the platform, traders must complete the login security steps, but as noted in the user complaints, the stability of this access is not guaranteed if the broker decides to freeze an account. As a broker entity operating without oversight, Quotex retains full control over the software backend, meaning they can potentially manipulate pricing or access rights without external accountability. This “black box” environment is a significant disadvantage compared to regulated platforms where trade execution is audited.

Final Verdict

Quotex presents a high-risk environment for traders. With a score of 1.52, no regulatory license, and confirmed warnings from financial authorities in Indonesia, Portugal, and Malaysia, the platform fails to meet basic safety standards. The numerous complaints regarding missing deposits and frozen withdrawals further corroborate the regulatory warnings.

Recommendation: We strongly advise traders to avoid unregulated entities. For real-time updates on regulation status or to verify the official login page of safer alternatives, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Dollar Under Siege: Fiscal Gridlock and Foreign Divestment Weigh on Greenback

Commodities Brief: Gold Pierces $5,000 as 'Debasement Trade' Accelerates

Currency Calculator