简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ICM Brokers Review: Full Assessment of Trading Terms, Good Points, and Problems

Abstract:Welcome to our complete ICM Brokers review for 2026. If you are thinking about this broker, you probably want to know if it's safe and real. We will answer this clearly. Our detailed research shows that ICM Brokers works without any real financial rules from a trusted authority. This one fact creates a big risk that makes all other parts of its service less important.

Welcome to our complete ICM Brokers review for 2026. If you are thinking about this broker, you probably want to know if it's safe and real. We will answer this clearly. Our detailed research shows that ICM Brokers works without any real financial rules from a trusted authority. This one fact creates a big risk that makes all other parts of its service less important.

This review will explain the broker's trading terms, account types, platforms, and problems that users have reported. However, the main point is the serious risk of putting your money into a company without proper rules. When there are no rules to follow, there is no protection for your money, no required standards for how they operate, and no official way to solve problems. This review gives you the important facts you need to make a smart choice, putting your financial safety first.

Quick Look: Good Points and Bad Points

To give you a fast and easy summary, we have put the main features of ICM Brokers into a clear table of good and bad points in this ICM Brokers Review. It is important to know that the items in the “Bad Points” section, especially the lack of rules, are much more important than any possible benefits.

| Good Points of ICM Brokers | Bad Points of ICM Brokers |

| Full license for the MetaTrader 4 (MT4) platform | No real financial rules |

| Many different trading instruments (CFDs) | Registered in an offshore location (Saint Vincent and the Grenadines) with no forex rule oversight |

| Several account types available (Standard, Prime) | Clear “High potential risk” and “Low score” warnings from independent analysis platforms |

| Low minimum deposit of $50 for the Standard account | High fixed spreads on the Standard account (starting from 2 pips) |

| Negative user reviews claiming problems like “profit removal” | |

| White-label status for MT5, suggesting less control compared to a full license |

The Main Problem: Rules and Safety

For any trader, the most important thing when choosing a broker is keeping their money safe, which depends directly on whether the broker follows proper rules. With ICM Brokers, this is a major worry.

A Broker Without Permission

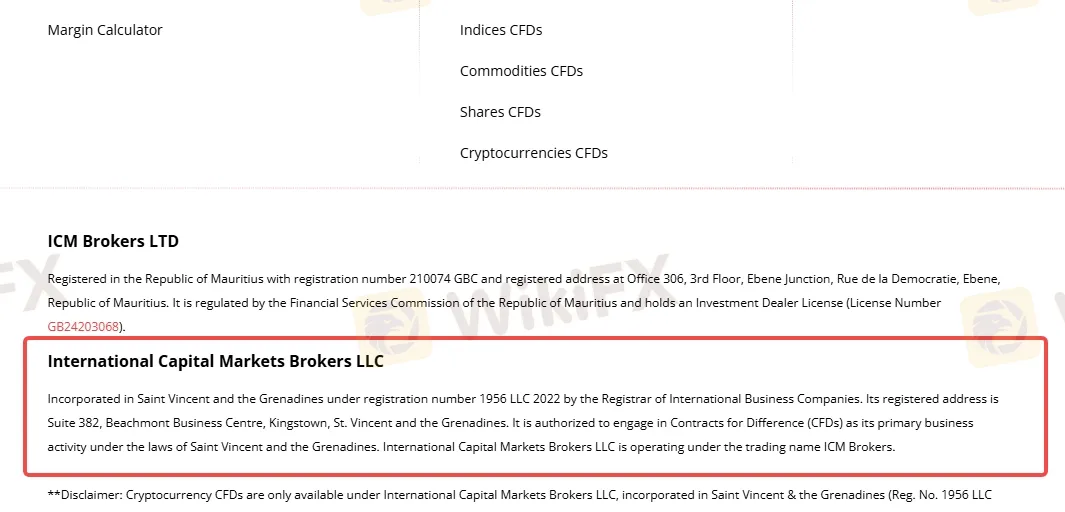

Our research confirms that ICM Brokers has no real license from any respected financial rule-making body. Incorporated in Saint Vincent and the Grenadines under registration number 1956 LLC 2022 by the Registrar of International Business Companies. Traders need to understand that the Financial Services Authority (FSA) of SVG has clearly said that it does not regulate, watch, supervise, or license forex trading or brokerage businesses. So, being registered in this place gives zero rule protection. Therefore This ICM Brokers Review clarify The broker is basically working without oversight.

Understanding the Warning

On checking platforms, ICM Brokers is often marked with a “Suspicious Rule License” warning. This means that any claims of following rules it might make are either unproven, from a non-respected body, or simply a business registration being presented as a financial license. For a trader, this warning is a clear sign that the broker does not work under the strict rules and protections that top-level regulators like the FCA (UK), CySEC (Cyprus), or ASIC (Australia) enforce. It means your money is not kept separate from company funds and you are not covered by any investor protection programs.

Dangers of Unregulated Trading

Working with an unregulated broker like ICM Brokers puts you at several serious risks that can be avoided with a properly licensed company. In this ICM Brokers Review we will tell you about those Dangers:

• No Protection for Client Money: Regulated brokers must keep client money in separate accounts, away from the company's operating money. Unregulated brokers have no such requirement, meaning your money could be at risk if the company faces money problems.

• No Problem-Solving System: If you have a problem about a trade, a withdrawal, or any other issue, there is no independent governing body to appeal to. You are left at the mercy of the broker's internal decisions, with no outside help.

• Potential for Unfair Practices: Without a regulator to enforce fair play, there is a higher risk of manipulative practices such as price manipulation, unjustified stop-outs, or refusal to process withdrawals, with little to no accountability.

• Lack of Openness and Oversight: Regulated brokers must follow strict standards of financial reporting and operational openness. Unregulated companies operate in a black box, with no one to check their liquidity, execution quality, or financial stability.

A broker's rule status cannot be compromised for fund safety. Before considering any broker, we strongly suggest checking their current license and rule details on a trusted platform like WikiFX to avoid potential risks.

Breaking Down Trading Conditions

While the rule status is the main concern, a full review needs an objective look at the trading environment ICM Brokers offers. Here is a breakdown of their accounts, platforms, and related costs, based on the available information.

Account Type

This ICM Brokers review provides detailed information about the platform. According to its website, Broker offers only one account type—the Edge Account. only this account is visible on its website. The minimum deposit required for Edge Account is $50, and the broker provides leverage of up to 1:1000, despite claiming regulatory protection. This raises some concerns, as most regulated and well-established brokers usually offer multiple account types with transparent features. In contrast, the website primarily focuses on promoting a single account, which may cause potential traders to question its overall credibility.

Platforms: MT4 and MT5

Broker gives access to the globally recognized MetaTrader platforms , but with a key difference. It also offers app to traders

• MetaTrader 4 (MT4): The broker holds a full license for the MT4 platform. This generally means a more stable and well-supported trading environment, with full access to the platform's features for Windows, Web, and Mobile. A full license is an investment by the broker and is a positive technical sign.

• MetaTrader 5 (MT5): In contrast, the broker uses a white-label version of MT5. A white-label solution means the broker is basically renting the platform from a primary technology provider. This can sometimes result in less control over the server infrastructure, potentially leading to less reliable performance and slower technical support compared to a full license holder.

While having a fully licensed MT4 is a plus, the benefits of any trading platform become almost meaningless if the funds you trade with are not secure.

Costs: Fees and Spreads

The main cost for traders on ICM Brokers comes from the spreads.

• Standard Account: This account has fixed spreads starting from 2 pips on major pairs like EUR/USD. This is not competitive. Many regulated brokers offer spreads of 1 pip or less on their standard, commission-free accounts.

• Prime Account: This account offers more competitive floating market spreads, starting from 1.2 pips. This is closer to the industry standard, but still not exceptional.

The provided information does not mention any commissions for the Standard or Prime accounts, suggesting the broker's profit is built mainly into the spread. For an unregulated company, wider spreads can be a way to ensure profitability without the competitive pressures and openness requirements of a regulated market.

Leverage: Up to 1:1000

Under this latest ICM Brokers Review , we will discuss leverage of the broker too. maximums reaching up to 1:400 on standard accounts and potentially as high as 1:1000 on some server configurations. While high leverage can attract traders looking to maximize their market exposure with a small amount of money, it is dangerous.

High leverage increases both potential profits and potential losses, and it is especially risky when used with an unregulated broker. Rule-making bodies in major areas have limited leverage for retail traders precisely because of the high risk of rapid, significant losses. Offering such high leverage without rule oversight is a major red flag.

Trust and User Experience

A broker's operating history and the experiences of its clients provide important context. While ICM Brokers has been in business for some time, this longevity does not automatically make it trustworthy Here are the real ICM Brokers Review.

A Trader's Red Flag

Among user reviews, one particular complaint stands out as a significant red flag. A trader reported an incident of “profit removal,” claiming that profitable trades were removed from their account without any reason or prior notice. They described making both profits and losses, only to have the profitable outcomes selectively erased by the broker.

While this is a single user's account, the claim is extremely serious. It points directly to the kind of unfair practice that is possible when a broker operates without oversight. In a regulated environment, a client could file a formal complaint with a financial ombudsman service to investigate such a claim. With an unregulated broker like ICM Brokers, the trader has no such help, and the broker's decision is final.

Does Longevity Equal Trust?

ICM Brokers is listed as having been in business for 5-10 years. Some might interpret this longevity as a sign of stability or reliability. However, this is a dangerous assumption. For an unregulated broker, a long operating history simply means it has managed to operate “under the radar” for an extended period, avoiding the scrutiny, audits, and client protections that come with regulation. It does not prove that the broker has been acting in its clients' best interests. In the absence of rule oversight, longevity is not a substitute for trust and cannot be considered a mark of legitimacy.

User reviews can reveal issues that official websites don't. We recommend checking for a complete list of user feedback and exposure complaints on verification tools like WikiFX to see the full picture of other traders' experiences.

A Critical Risk Analysis

To fully understand the risk profile of ICM Brokers, it is essential to connect the dots between the various red flags we have identified. These issues are not isolated; they form a pattern that points to a high-risk operating model.

1. The Offshore-Unregulated Combination: The choice of Saint Vincent and the Grenadines for registration is not accidental. This area is a well-known hub for high-risk and unregulated brokers precisely because it allows them to operate without the costs and constraints of genuine financial oversight. It is a deliberate strategy to avoid accountability.

2. High Spreads and Lack of Oversight: The uncompetitive fixed spread of 2 pips on the entry-level account is telling. In a regulated, competitive market, such spreads would make it difficult to attract clients. For an unregulated broker, it can serve as a wider profit margin, protected from the competitive pressure that forces regulated brokers to offer tighter pricing.

3. Negative Reviews as a Symptom: The user complaint about “profit removal” should be seen as a direct symptom of the lack of regulation. This type of claimed behavior is a broker's ultimate power play. With a regulated broker, there is a clear, legally-binding process to dispute such an action. With ICM Brokers, the power imbalance is absolute, and the client has no leverage.

4. The Mixed Platform Signal: Offering a full MT4 license shows a degree of financial investment in technology. However, this positive signal is completely overshadowed by the fundamental lack of fund safety. A high-quality platform is of no use if the broker can arbitrarily interfere with your trades or refuse to return your profits and principal. The platform's quality is a secondary concern when your capital is at risk.

Final Decision: An Unnecessary Risk

After a thorough analysis of its operations, rule status, and user feedback in the ICM Brokers Review. Our decision on ICM Brokers is clear. The broker presents an unnecessary and unjustifiable level of risk for any trader.

The main issue is its complete lack of valid financial regulation, made worse by its offshore registration in a place that does not oversee forex brokers. This creates an environment where there is no protection for client funds, no accountability for the broker's actions, and no help for traders in case of disputes. The high spreads on its standard account, mixed platform licensing, and serious claims from users further cement its high-risk profile. While the MT4 platform and range of assets may seem appealing, these features are insignificant when weighed against the fundamental risk to your capital.

Your money is your most important tool in trading. Always put its safety first. Before committing to any broker, make it a mandatory step to do your research. Use a complete verification service like WikiFX to check their rule status, user reviews, and overall score. A few minutes of research can save you from significant potential losses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator