简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Moneta Markets Review: Regulation, Licences and WikiScore Analysis

Abstract:This article provides a factual Moneta Markets review, focusing on the broker's regulatory licences in the United Kingdom, South Africa, and Seychelles, and analysing its WikiFX Score to inform traders about its compliance and oversight status.

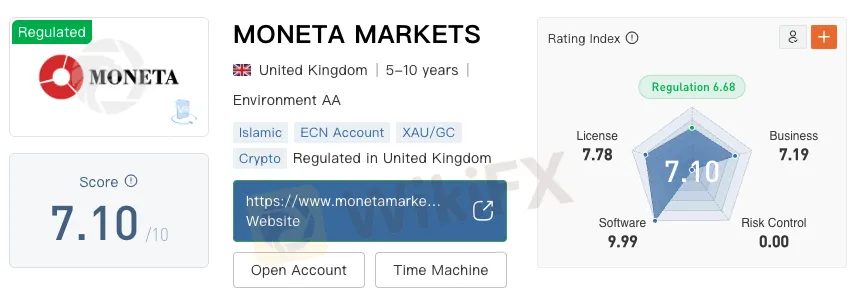

Moneta Markets is an online forex and derivatives broker that serves clients across multiple regions. On WikiFX, the broker is assigned a WikiScore of 7.10 out of 10. This score places the moneta markets broker above average compared with many global counterparts, although it does not rank among the highest rated brokers on the platform.

The WikiFX scoring system evaluates brokers using a combination of regulatory status, licence quality, business stability, software quality, and exposure to complaints or risks. The score is intended as a reference tool rather than a recommendation, helping traders understand how a broker compares within the wider market.

In the case of broker Moneta Markets, the score is influenced mainly by its multi jurisdictional regulatory coverage and the presence of both onshore and offshore licences.

Moneta Markets Regulation Framework

Moneta Markets regulation consists of three primary licences issued by different financial authorities. These licences allow the broker to offer trading services in specific jurisdictions and are a central component of its WikiFX profile.

Financial Conduct Authority of the United Kingdom

Moneta Markets holds a Forex Execution Licence issued by the Financial Conduct Authority of the United Kingdom, under licence number 613381. The FCA is widely regarded as one of the most established and stringent financial regulators globally.

The FCA oversees financial firms operating in the United Kingdom and enforces rules related to client fund segregation, transparency, capital adequacy, and conduct of business. Brokers authorised by the FCA are required to keep client funds separate from company funds and are subject to regular reporting and compliance checks.

The presence of an FCA licence is considered a significant regulatory credential. Within the context of this Moneta Markets review, the FCA authorisation represents the strongest regulatory element in the brokers licensing structure.

Financial Sector Conduct Authority of South Africa

In addition to its UK licence, Moneta Markets is authorised by the Financial Sector Conduct Authority of South Africa. The broker holds a Derivatives Trading Licence, classified as an EP licence, under licence number 47490.

The FSCA is the primary regulator of financial markets in South Africa and is responsible for supervising market conduct and protecting financial customers. While its regulatory framework differs from that of the FCA, the FSCA requires licensed entities to meet compliance standards related to disclosure, operational conduct and risk management.

For the moneta markets broker, the FSCA licence extends its regulatory reach into the African region and adds another recognised supervisory authority to its profile.

Seychelles Financial Services Authority

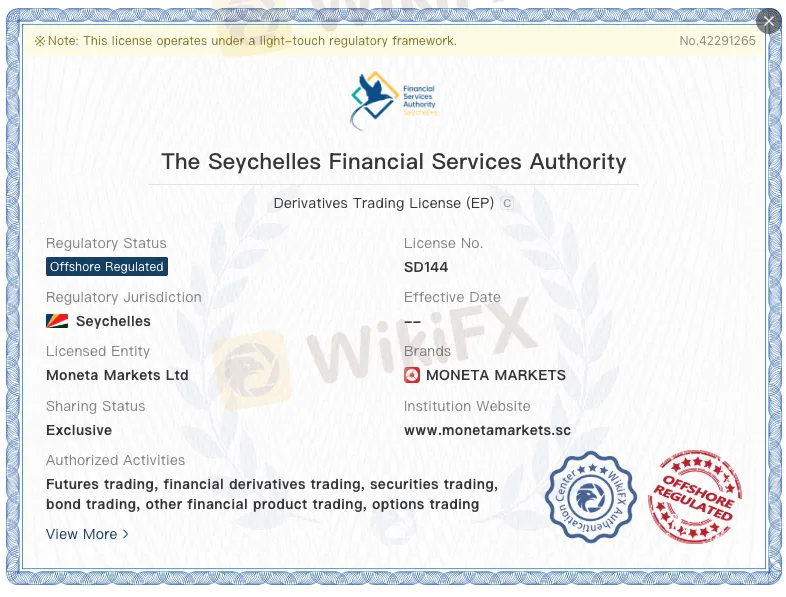

Moneta Markets also holds a Derivatives Trading Licence issued by the Seychelles Financial Services Authority, with licence number SD144. This licence is classified as offshore regulation on WikiFX.

The Seychelles FSA regulates non-bank financial services entities operating within its jurisdiction. Offshore regulators generally have lighter regulatory requirements compared with top tier authorities such as the FCA. Investor protection mechanisms and enforcement powers may vary significantly depending on the jurisdiction.

In the context of Moneta Markets regulation, the Seychelles licence allows the broker to serve a broader international client base, although it is typically considered lower in regulatory strength compared with onshore licences.

WikiScore and Regulatory Impact

The WikiScore of 7.10 reflects a combination of the above regulatory factors. WikiFX assigns higher credibility weight to licences issued by well established regulators such as the FCA, while offshore licences have a more limited impact on overall scores.

WikiFX also incorporates exposure data, including user complaints and risk alerts, when calculating a broker‘s score. These elements do not invalidate a broker’s regulatory status but may influence how the platform evaluates overall risk. For Moneta Markets, the balance between strong onshore regulation and offshore licensing contributes to its mid to upper range score.

Conclusion

This Moneta Markets review highlights a broker with a diversified regulatory structure spanning multiple jurisdictions. Broker Moneta Markets is authorised by the Financial Conduct Authority in the United Kingdom, the Financial Sector Conduct Authority in South Africa, and the Seychelles Financial Services Authority. Each licence serves a different regulatory purpose and geographic market.

From a factual standpoint, Moneta Markets regulation includes both high standard onshore oversight and offshore authorisation. This combination is not uncommon among global brokers and allows operational flexibility while maintaining regulatory presence in major markets.

As with any broker evaluation, regulatory status should be considered alongside other factors such as trading conditions, platform reliability, and individual risk tolerance. WikiFX provides the WikiScore and licence information as reference tools to support informed decision making, rather than as an endorsement or warning.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

AI in Medicine: Diagnostics, Privacy, and Ethical Challenges

TSMC Earnings Confirm AI "Supercycle," But Capacity Wall Looms

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Currency Calculator