简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Solitaire PRIME a Scam? A Complete Solitaire PRIME Review 2026 You Need to Read

Abstract:This Solitaire PRIME review gets right to the point. Our 2026 research has found serious warning signs that show this company is very risky. The biggest problem is that Solitaire PRIME works without proper financial rules and oversight. This is the main sign of a possible scam, and it means your money has no protection. We strongly recommend being very careful. This review will show you the proof behind our warning, helping you protect your money from this and similar dangers.

This Solitaire PRIME review gets right to the point. Our 2026 research has found serious warning signs that show this company is very risky. The biggest problem is that Solitaire PRIME works without proper financial rules and oversight. This is the main sign of a possible scam, and it means your money has no protection. We strongly recommend being very careful. This review will show you the proof behind our warning, helping you protect your money from this and similar dangers, as clearly explained in this Solitaire PRIME Review.

The Biggest Warning Sign

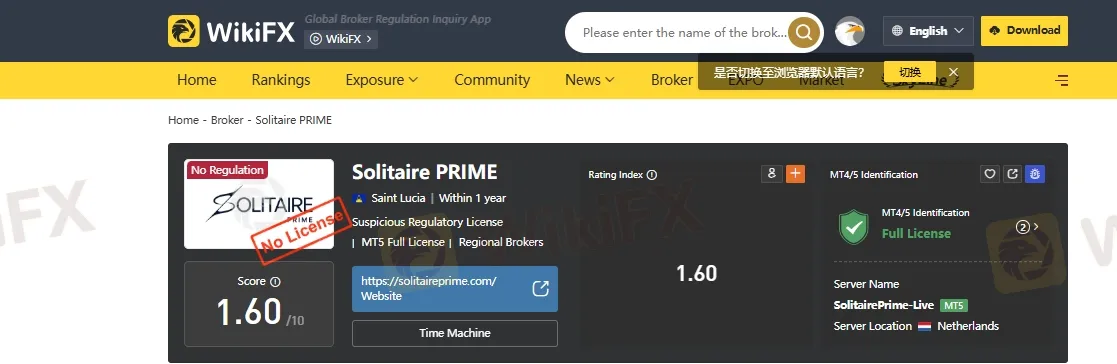

The most important thing for a safe broker is being watched over by a trusted financial authority. Solitaire PRIME completely fails this basic test, which is a central concern highlighted throughout this Solitaire PRIME Review.

How Rules and Oversight Protect You

Top financial watchdogs like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) are not just government offices; they are your financial safety net. They make strict rules to protect people who invest money. Regulated brokers must provide:

• Separated Client Money: Your money is kept in a different bank account from the broker's business money, so it cannot be used to pay their bills.

• Negative Balance Protection: You cannot lose more money than you have in your account.

• Payment Programs: If the broker goes out of business, a special fund may cover your losses up to a certain amount.

Without these protections, you are trading with no safety net. A fact repeatedly emphasized in this Solitaire PRIME Review.

The Missing Rules Problem

We carefully checked the official public lists of major international financial watchdogs. According to Solitaire PRIME Review , The results are clear and worrying. Solitaire PRIME does not appear on any of them.

| Regulatory Body | Solitaire PRIME Authorization Status |

| FCA (United Kingdom) | No Record of Authorization |

| ASIC (Australia) | No Record of Authorization |

| CySEC (European Union) | No Record of Authorization |

| SEC / CFTC (United States) | No Record of Authorization |

This confirmed absence from all major regulatory databases is not a small mistake; it is a choice to operate outside the law. This fact alone is enough reason to completely avoid this broker as concluded in this Solitaire PRIME Review.

Breaking Down Their Methods

This Solitaire PRIME Review informs you how Unregulated brokers like Solitaire PRIME often follow a predictable and harmful pattern. Understanding this pattern is your best defense against becoming a victim. We have studied their methods, which match perfectly with common scam operations.

The First Hook

The process usually starts with unwanted contact. This could be a surprise phone call, an aggressive social media ad, or an email promising financial results that are simply not realistic. They use powerful hooks like “guaranteed daily profits” or “we will double your first deposit.” These are designed to take advantage of the desire for quick money and bypass logical thinking. Please understand, real investment carries risk, and promises of profit are a sign of fraud.

The “Retention Agent” Step-Up

Once you make a small first deposit, the real scam begins. You are passed from the first sales person to a more experienced and manipulative person known as a “retention agent.” Our experience studying these schemes shows that this person's only job is to build false trust and then use high-pressure tactics to convince you to deposit much larger amounts of money. They will be charming, seem knowledgeable, and may even show you some small initial “profits” on your account to build your confidence before pushing for a big investment.

The False Image of Trust

To fight negative information, these operations often work on cleaning up their reputation. Be very careful of overwhelmingly positive Solitaire PRIME review content you may find online. Fraudulent brokers often pay for fake reviews or create their own positive content to cover up the warnings from real victims. They create a carefully planned online illusion of being legitimate to trap new, unsuspecting investors.

Solitaire PRIME Review Uncovers the Scam Process

The entire harmful cycle can be broken down into four clear steps. Recognizing this pattern is crucial.

1. Unwanted Contact: You are approached with promises of unrealistic, guaranteed returns.

2. Minimum Deposit Pressure: You are pushed to make a small initial deposit to “get started.”

3. Retention Agent Handover: A more skilled agent takes over to get larger deposits through aggressive sales tactics.

4. Withdrawal Blocking: When you try to access your money, you face endless delays, excuses, and ultimately, refusal.

Good and Bad Points: A Reality Check

Many users search for a balanced view, looking for the Solitaire PRIME pros and cons. In this case, the analysis is overwhelmingly one-sided.

The So-Called “Good Points”

One might point to a nice-looking website or a simple account opening process as a “good point.” However, these are not real benefits. They are calculated parts of the trap. A professional-looking website is cheap to create and is designed specifically to lower your guard and project a false sense of being legitimate. An easy sign-up process is meant to get your money into their system with as little difficulty as possible. These are features of the scam, not benefits for you.

The Worrying List of Bad Points

The list of downsides is long and serious. Each one represents a significant danger to your money.

• Complete Lack of Rules: This is the most critical danger. Your money has zero protection.

• Misleading and Unrealistic Promises: This is the core of their marketing and a classic sign of a financial scam.

• Systematic Blocking of Withdrawals: Based on typical behavior, getting your money out is designed to be nearly impossible.

• Use of High-Pressure Sales Tactics: The “retention agent” playbook is harmful and designed to manipulate you.

• No Help for Lost Money: Without a regulator, there is no official body to appeal to. Once your money is gone, it is likely gone for good.

The Withdrawal Trap Explained

A key tactic used by such brokers is to deliberately slow down your withdrawal requests. They may ask for endless verification documents or simply ignore your emails. This isn't just poor customer service; it's a strategy. If you deposited by credit card, you typically have a window of up to six months to start a chargeback. By delaying your withdrawal beyond this period, they ensure you lose this vital option. Furthermore, they may pressure you into signing a “Managed Account Agreement” (MAA), which gives them permission to trade on your behalf. They then use this to quickly lose all your money, leaving you with nothing to withdraw.

A Guide for Victims

If you have already put money with Solitaire PRIME, do not panic. You must act systematically and immediately. As part of this Solitaire PRIME Review, we present important steps designed to help you protect yourself and your money from fraudulent schemes.

Step 1: Stop and Document

Based on information presented in the Solitaire PRIME Review, You should Stop all further payments to broker immediately. Do not believe any promises that one more deposit will unlock your money. It is a lie. Your next priority is to gather evidence. Save every email, download all chat logs, and take screenshots of your account balance and transaction history. This documentation is crucial for the next steps.

Step 2: Start a Chargeback

If you made deposits using a credit or debit card, this is your most powerful tool. Contact your bank or card provider's fraud department immediately. State clearly that you have been tricked by an unregulated online trading company that is refusing to return your money. Provide them with the evidence you gathered in Step 1, especially your documented withdrawal requests and their lack of response. Time is critical, so do not delay.

Step 3: Take Action for Wire Transfers

Unfortunately, wire transfers cannot be charged back. Your approach must be different. Send a formal, written communication (email is fine) to broker stating that if your money is not returned within a specified timeframe (e.g., 48 hours), you will be filing official complaints with the financial authorities in your country and reporting them to national and international cybercrime police. It is vital that you follow through on this. The threat of official action can sometimes pressure them into returning money.

Step 4: Always Check Before Investing

The best way to recover from a scam is to never fall for one in the first place. Before you ever deposit a single dollar with any broker, you must do your own research. Check their regulatory claims independently.

We strongly recommend all investors use a comprehensive verification platform. For example, visiting a site like WikiFX allows you to instantly check a broker's regulatory status, license details, and user reviews, which can help you avoid scams like this one.

Conclusion: Final Decision

After a thorough Solitaire PRIME review of the evidence, our conclusion on Solitaire PRIME is clear. The complete lack of regulation, the use of harmful tactics common to scams, and the high probability of withdrawal blocking make it an extremely dangerous entity for any investor.

Critical Warning Signs Summary

• Unregulated Status: Operates outside of any legal financial framework, offering zero investor protection.

• Misleading Tactics: Uses unrealistic promises and high-pressure “retention agents” to take money.

• Withdrawal Blocking: Designed to make it nearly impossible for clients to get back their money.

The Final Word

Based on the findings of this Solitaire PRIME review, engaging with this broker represents an unacceptable financial risk. The brokers structure and practices mirror those commonly associated with scams, and it should be avoided at all costs. Protect your hard-earned money. Always prioritize dealing with properly regulated brokers and verify every claim. A few minutes of research on a platform like WikiFX can save you from significant financial loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Currency Calculator