简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Capital.com Exposed: When 'Regulatory Safety' Becomes a Withdrawal Trap

Abstract:Our investigation exposes a critical 'pay-to-withdraw' spiral where traders are forced to pay exorbitant 'margin' fees to access their own funds. Despite holding top-tier licenses, Capital.com displays severe red flags including revoked regulatory statuses and 32 urgent complaints alleging withdrawal blockades in the last three months.

The promise of a global, multi-regulated broker usually brings peace of mind. But for dozens of traders reporting to WikiFX in late 2025, that peace has turned into panic.

Our investigation into Capital.com uncovers a disturbing disconnect between its polished reputation and the gritty reality faced by its users. While the brand flaunts an “AA” ranking, the ground-level data tells a story of frozen accounts, demands for “security deposits,” and revoked licenses.

The Trap: “Pay More to Get Your Money Back”

It starts simply: You hit withdraw. The money doesn't move.

Then comes the demand.

According to a harrowing report from November 13, 2025 (Case #2), a trader with a balance of over $13,000 was blocked from withdrawing due to “insufficient turnover.” The platform's solution? Deposit another $13,000.

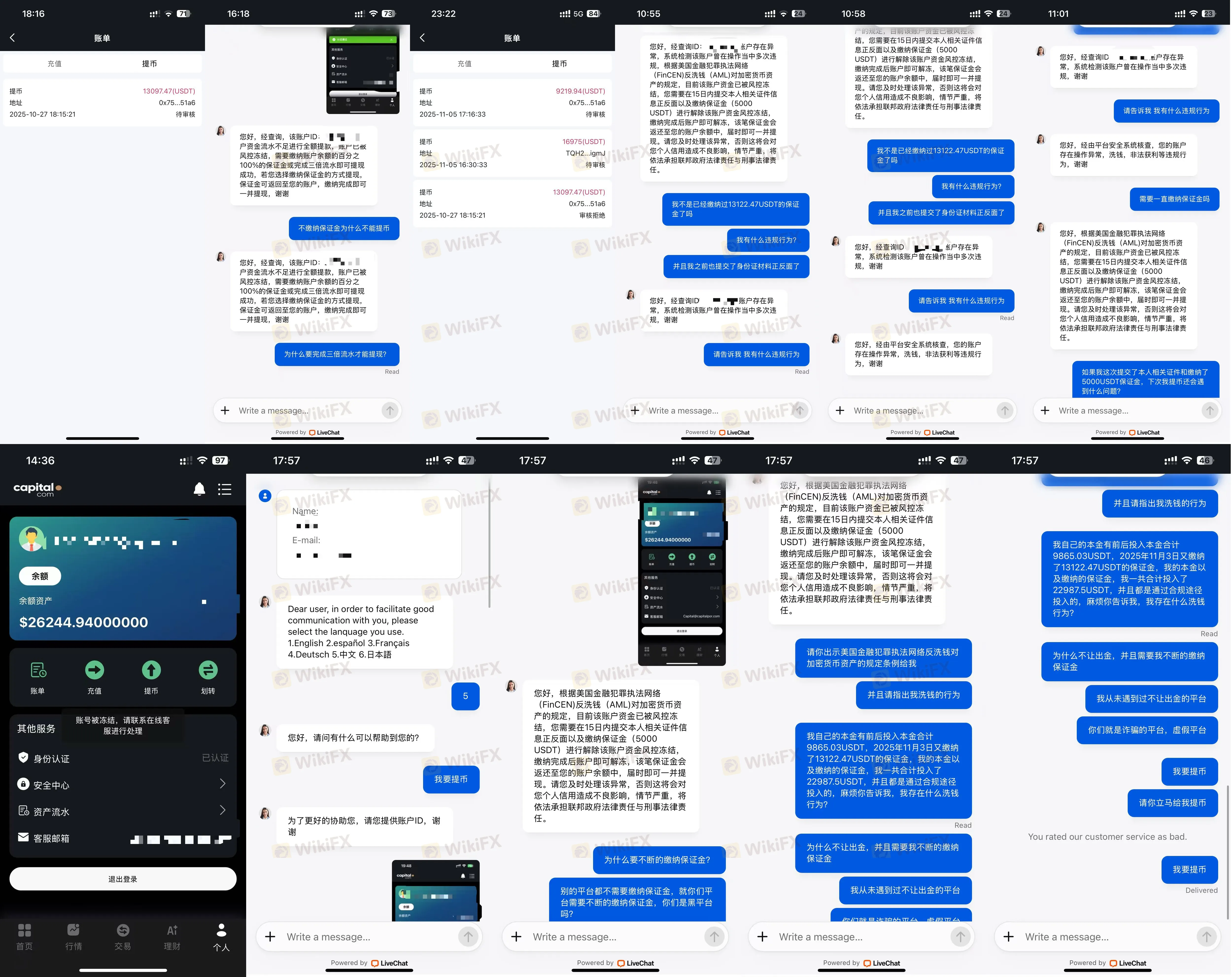

> “I paid the 100% margin as requested within the time limit... Then I tried to withdraw the total $26,244. Now they are asking for another $5,000 within 15 days or my account will be permanently frozen.” — WikiFX User Complaint (ID: Case 2)

This is not standard industry practice. This is a classic extortion tactic known as a “recovery trap.” And it is not an isolated incident. Another user (Case #1) reported similar coercion on November 14, 2025, being asked to pay 5,000 USDT to clear a “money laundering” flag after already investing over 22,000 USDT.

Visual Evidence: The Withdrawal Blockade

Below are snapshots provided by users showing the paralysis of their funds.

Regulatory Reality Audit

Capital.com relies heavily on its image as a safe, regulated entity. However, our audit of the regulatory data reveals significant cracks in this shield. While they hold valid licenses in the UK and Australia, other jurisdictions show severe instability.

| Regulator | Region | License Status |

|---|---|---|

| NBRB (National Bank of Republic of Belarus) | Belarus | 已撤销 (Revoked) |

| FSA (Financial Services Authority) | Seychelles | 已撤销 (Revoked) |

| SCM (Securities Commission) | Malaysia | Unauthorized (Investor Alert) |

| CySEC | Cyprus | 监管中 (Regulated) |

| FCA | UK | 监管中 (Regulated) |

| ASIC | Australia | 监管中 (Regulated) |

Critical Warning: The Malaysia Securities Commission (SCM) explicitly listed Capital.com on its Investor Alert List for “carrying on capital market activities of dealing in securities without a license.” Furthermore, the revocation of licenses in Belarus and Seychelles suggests a retreat from certain regulatory frameworks or a failure to maintain compliance standards in those regions.

Anatomy of the Complaints

In the last 90 days alone, WikiFX has received 32 complaints. They follow three distinct patterns of failure:

- The “Turnover” Loophole: Users are told they haven't traded enough volume to withdraw their own principal (Cases 1 & 2). Legitimate brokers rarely lock principal deposits behind turnover walls; this is usually reserved for bonus credits.

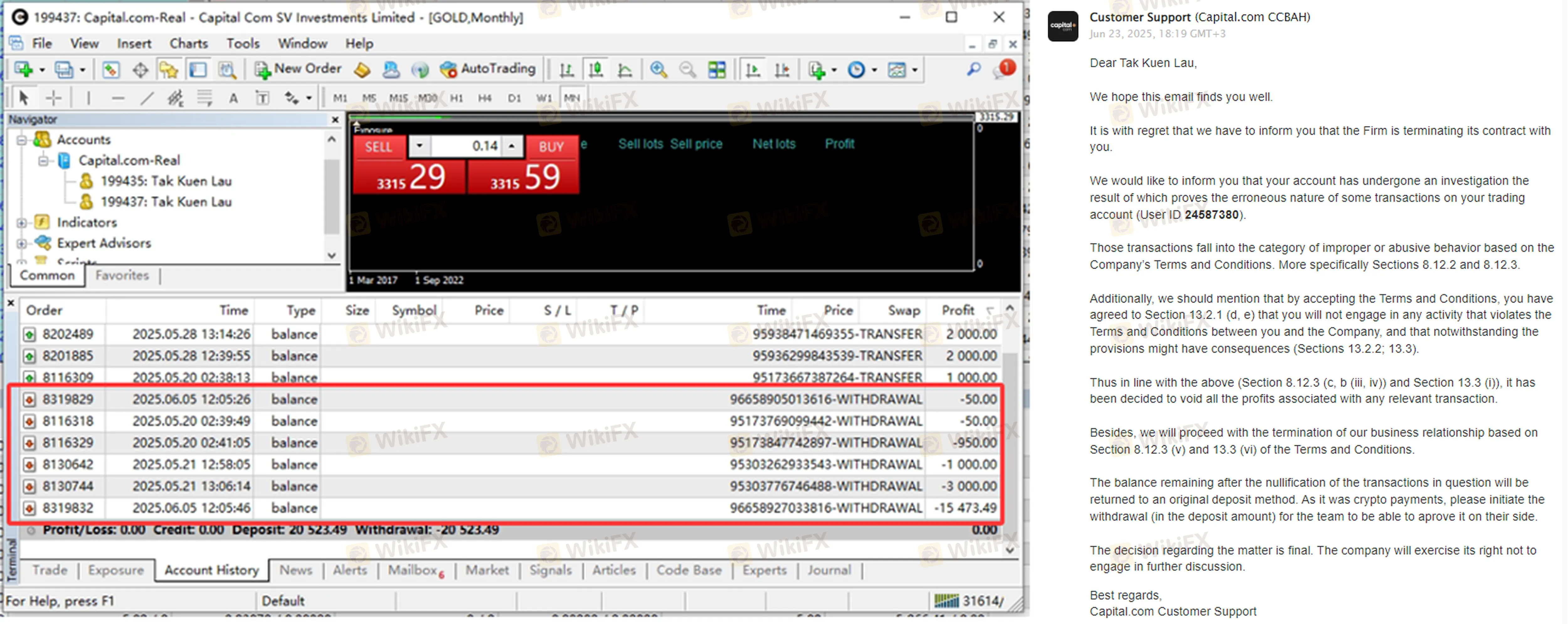

- The “Profit Cancellation” Clause: A user from Hong Kong (Case #8) reported that losses were treated as normal, but profitable trades were flagged as “abnormal,” leading to a rejection of an $18,523 withdrawal.

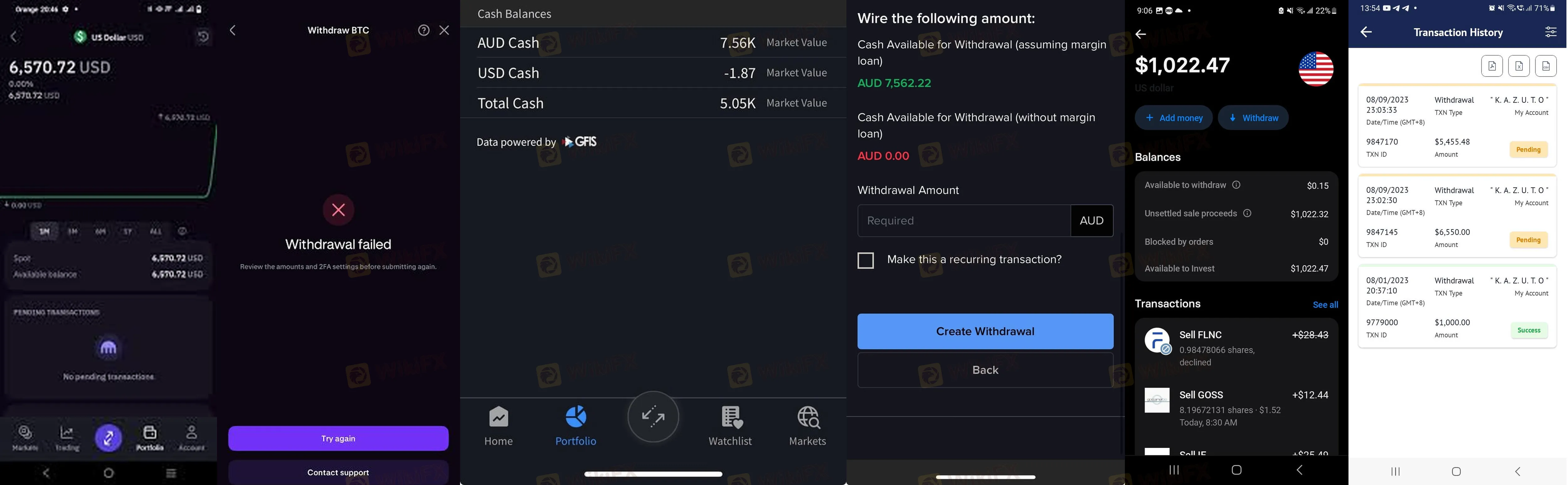

- Technical Stonewalling: U.S. traders (Cases 3, 4, 5, 6) report a wave of system errors—invalid name errors, pending statuses lasting 15+ days, and an inability to withdraw even with positive cash balances.

Verdict: High-Risk Anomalies Detected

While Capital.com possesses high-level regulatory paper in the UK and Australia, the user experience reported to WikiFX directly contradicts the safety implied by these licenses.

The presence of “pay-to-withdraw” demands (Case 1, Case 2) is the single biggest red flag in online trading. Whether these users have fallen victim to a clone site or are experiencing severe malpractice from the main entity, the risk to your capital is currently critical.

WikiFX Recommendation:

1. Do NOT Pay Margin to Withdraw: If a broker asks for a deposit to release funds, stop immediately. You will not get that money back.

2. Verify the URL: Ensure you are not on a phishing site, as the “Margin Trap” is a hallmark of clone firms.

3. Halt Trading: Given the 32 recent complaints and the Malaysia warning, we advise suspending all deposits until these withdrawal hurdles are publicly resolved.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Currency Calculator