Chinese Yuan makes new highs marking an historic performance.

Performance like this hasn't been seen since 2021

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

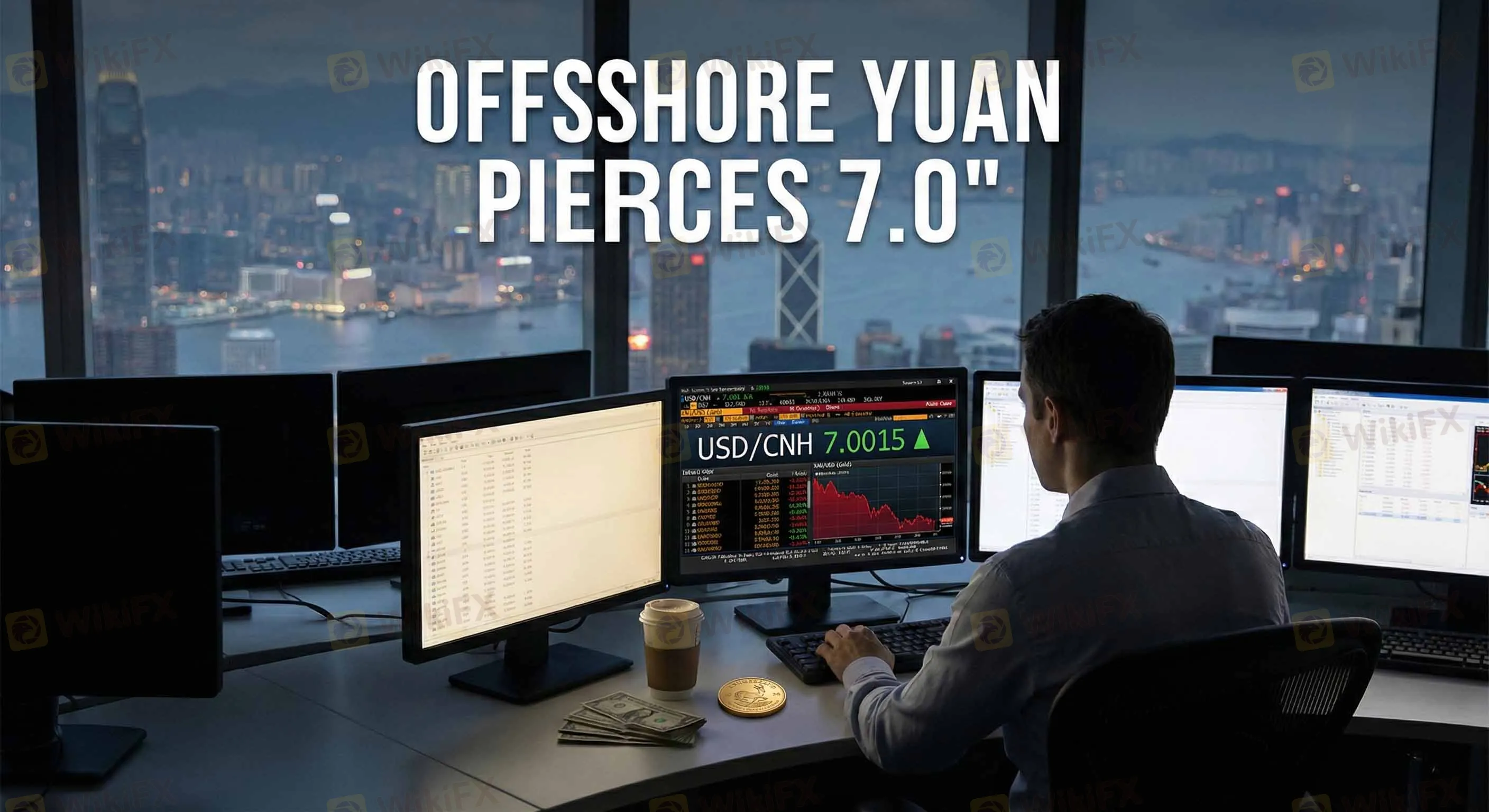

Abstract:Thin holiday liquidity amplified moves in global markets this week, with the Chinese Yuan staging a significant rally against the Dollar, while precious metals retreated from record valuations.

Thin holiday liquidity amplified moves in global markets this week, with the Chinese Yuan staging a significant rally against the Dollar, while precious metals retreated from record valuations.

The offshore Yuan (CNH) strengthened past the 7.0 per Dollar mark for the first time since late 2024, driven by robust export data and a seasonal surge in corporate settlement demand.

Despite looming headwinds—including the US announcement of new Section 301 tariffs on Chinese semiconductor products—market sentiment remains buoyed by China's strong trade surplus. However, analysts caution that the pace of appreciation may be tempered by the People's Bank of China (PBOC), which continues to use the daily fixing and swap market tools to manage volatility. Deutsche Bank forecasts the RMB could appreciate further to 6.7 by late 2026, though short-term fluctuations depend heavily on the evolving liquidity environment and US trade policy implementation.

In the commodities sector, Gold (XAU/USD) underwent a technical correction, slipping below the $4,500/oz handle after touching fresh highs. The pullback is attributed to profit-taking amidst lighter volume. Conversely, Silver maintained its bullish momentum, trading firmly above $71/oz, supported by industrial demand and a massive 149% year-to-date rally that has significantly outperformed the yellow metal.

With major exchanges in the US, Europe, and South Korea closed for Christmas, volatility in open Asian markets highlights the sensitivity of asset prices to order flow. Investors are now positioning for 2026, weighing the resilience of the US “soft landing” narrative against the resurgence of inflation risks in Japan and trade fragmentation in Asia.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Performance like this hasn't been seen since 2021

BEIJING — The People's Bank of China (PBOC) is set to initiate a major overhaul of its central bank digital currency (CBDC) framework, with the "New Generation Digital RMB" system scheduled to go live on January 1, 2026.

The offshore Renminbi (CNH) has surged past the critical 7.0 per Dollar barrier for the first time in 14 months, trading at 6.9977 as of Dec 25. The move marks a significant shift in sentiment, driven by year-end corporate settlement flows and a broadly softer US Dollar.

Amidst a gloomy global trade outlook, China's equity markets are flashing green, potentially offering support to the Chinese Yuan (CNY) and its liquid proxies, the Australian Dollar (AUD) and New Zealand Dollar (NZD).