Abstract:In the complex world of online trading, name recognition is often confused with security. Our latest investigation into the broker listed as "Kraken" (founded 2018, USA) on WikiFX reveals a disturbing pattern of complaints that starkly contrasts with legitimate institutional standards. With a WikiFX score of just 1.57 and 16 severe complaints logged in the last three months alone, this entity appears to be operating a sophisticated web of "task-based" investment schemes and "advanced fee" traps. While the entity holds a high influence rating in regions like the UAE and Argentina, our analysis suggests this popularity may be driven by aggressive—and potentially predatory—marketing tactics rather than trading excellence.

Executive Summary: In the complex world of online trading, name recognition is often confused with security. Our latest investigation into the broker listed as “Kraken” (founded 2018, USA) on WikiFX reveals a disturbing pattern of complaints that starkly contrasts with legitimate institutional standards. With a WikiFX score of just 1.57 and 16 severe complaints logged in the last three months alone, this entity appears to be operating a sophisticated web of “task-based” investment schemes and “advanced fee” traps. While the entity holds a high influence rating in regions like the UAE and Argentina, our analysis suggests this popularity may be driven by aggressive—and potentially predatory—marketing tactics rather than trading excellence.

Disclaimer: The following report is based on verified complaints and regulatory data submitted to WikiFX. To protect the privacy of the victims, all names have been anonymized. The entity described in this article is the specific broker profile listed on WikiFX with the data provided, which may differ from other entities sharing similar names.

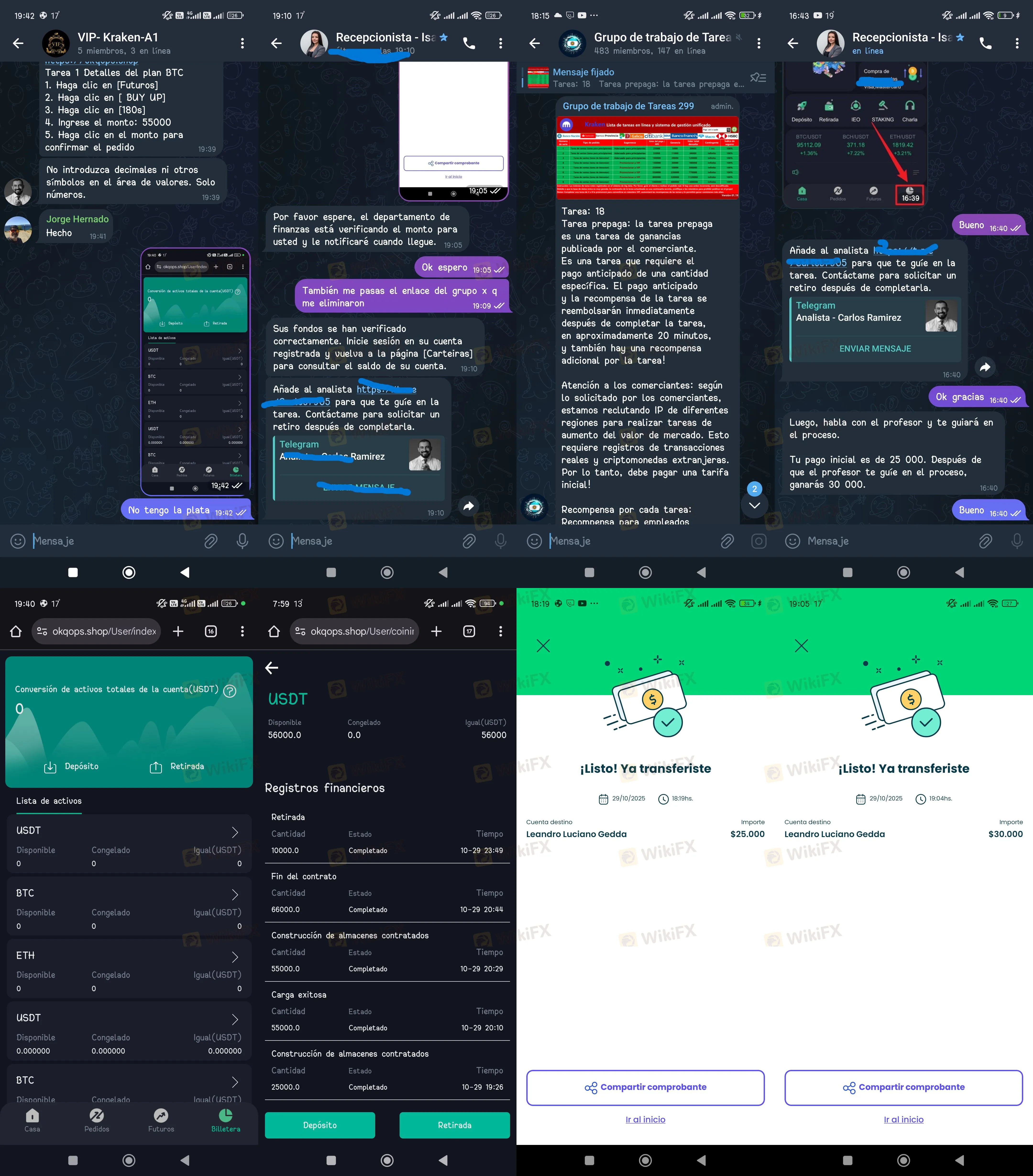

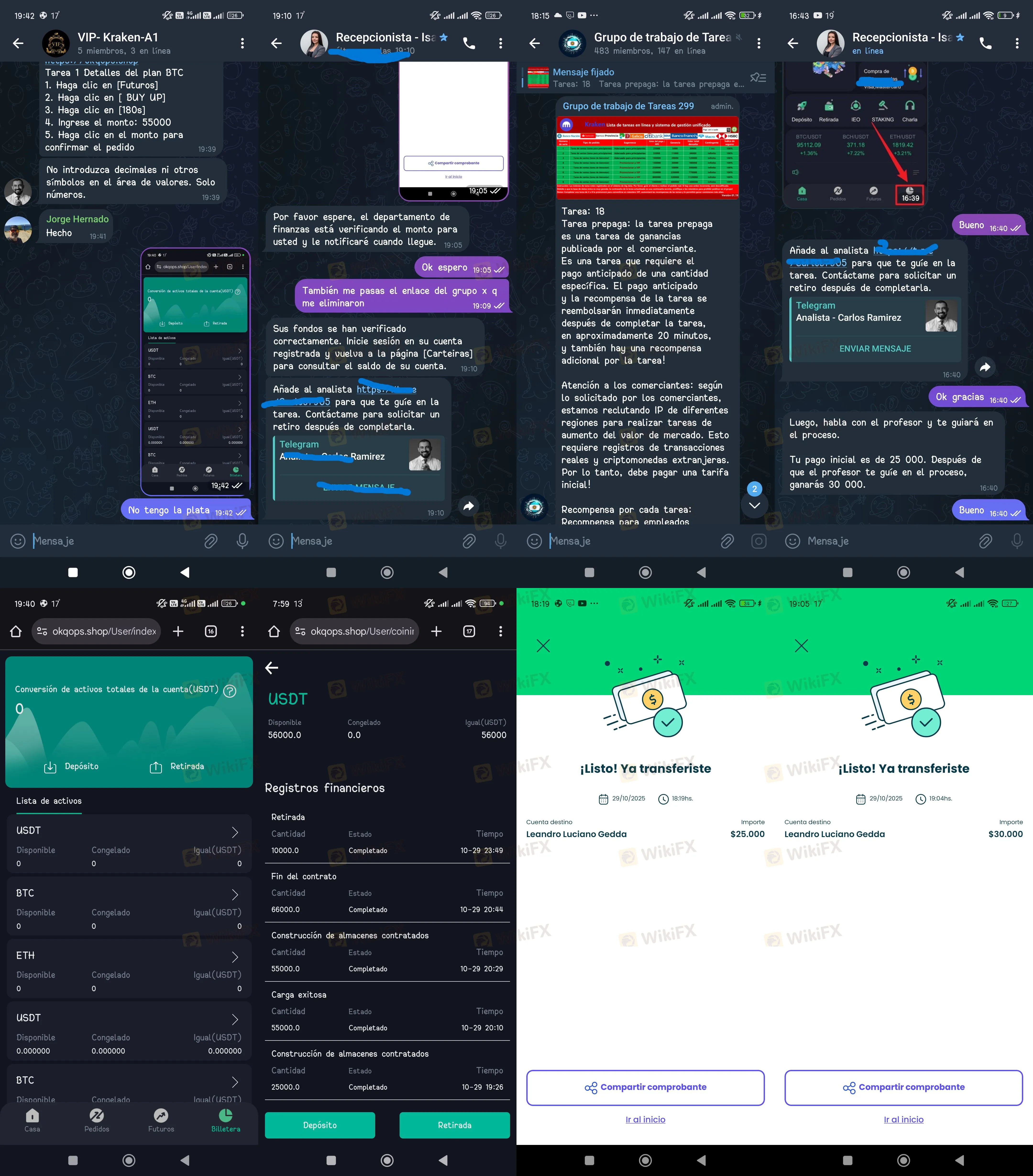

The “VIP” Trap: When Employment Becomes Exploitation

One of the most insidious patterns we have identified in recent months involves the fusion of “employment” and “investment.” Typically, a broker allows a user to trade autonomously. However, recent reports from South America indicate a shift toward a more manipulative model known as the “Task Scam.”

In late 2025, a user from Argentina reported a harrowing experience that began pleasantly enough via the messaging app Telegram. The initial contact wasn't a sales pitch for Forex, but a job offer. The premise was simple: complete basic tasks, such as subscribing to specific channels, to earn a commission. This “grooming” phase is designed to build trust. The user successfully withdrew small amounts, reinforcing the belief that the system was legitimate.

However, the dynamic quickly shifted. The user was moved into a “VIP group,” a common psychological tactic to make the victim feel special and committed. In this group, the “tasks” changed nature entirely. Instead of passive clicking, the user was required to invest their own capital to “unlock” higher-tier tasks.

As seen in similar cases, once the legitimate funds are transferred to the platform, the narrative changes. The user from Argentina described a cycle where the investment required to withdraw “winnings” kept increasing.

A concurrent report from Bolivia, filed in November 2025, mirrors this mechanism with chilling precision. The trader was told they could not withdraw their funds until they completed their “last 2 tasks.” The catch? These tasks required a substantial injection of new capital. The user noted: “It is a total fraud... at first they return it to you because you invest little, then they ask for high amounts and you can no longer continue.”

The “Sunk Cost” Abyss: Why You Can Never Pay Enough

While the “task” narrative exploits users in South America, reports from Asian markets highlight a different, yet equally devastating strategy: the endless accumulation of administrative fees. This method prays on the “Sunk Cost Fallacy”—the human tendency to continue investing in a losing proposition to avoid accepting the loss of the initial principal.

In June 2024, a trader based in China encountered a severe liquidity block. Upon attempting to withdraw their funds, they were informed of a strict and previously undisclosed rule: a requirement to recharge 20% of their total asset value to enable withdrawals. In legitimate financial markets, withdrawal fees are deducted from the existing balance; they never require an external injection of fresh capital.

The complexity of these barriers escalates when the victim shows hesitation. Another case from April 2024 details a highly elaborate “Couple's Activity” lure. The broker allegedly offered a bonus scheme designed for partners. However, the promotional funds were injected into the account before the user fully understood the restrictions.

Once the “bonus” was locked in, the trap sprung. The user and their friend met the trading volume requirements (50% turnover), yet the withdrawal was rejected. The platform's support cited “Anti-Money Laundering (AML)” regulations, claiming that as new users, they needed to undergo “Advanced Certification.” The cost of this certification? A staggering $30,000 USD per person.

This specific tactic—invoking AML laws to demand payments rather than verifying identity through documents—is a hallmark of high-risk platforms.

The Black Wall: When the Platform Goes Dark

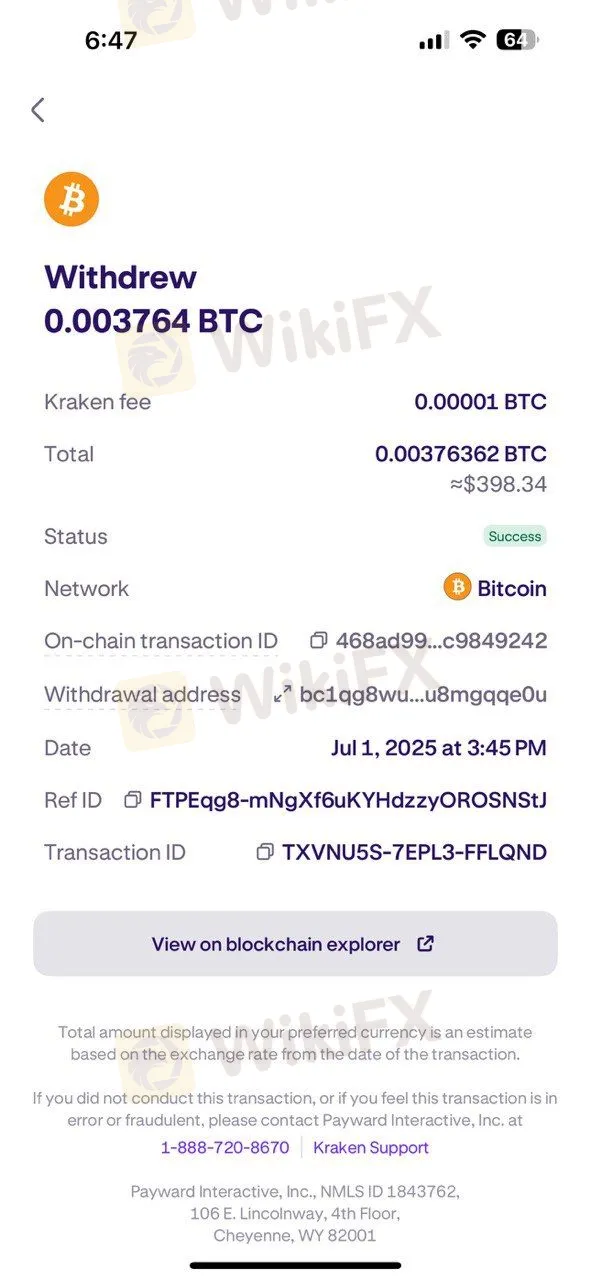

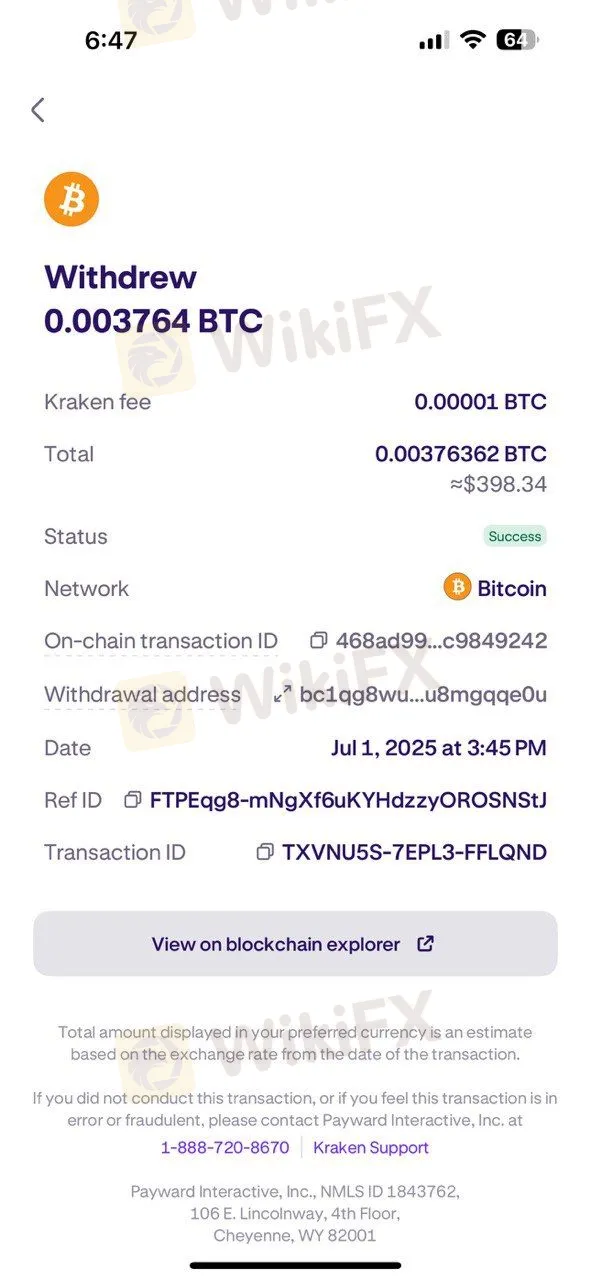

For those who refuse to pay or eventually run out of funds, the final stage is often silence. In July 2024, a user reported that the interface used to access the exchange had simply gone blank. Previously, they had been told to recharge in USDT (Tether) to activate the withdrawal function—a clear warning sign of a “runaway” scenario. The transition from “maintenance” or “activation issues” to a non-functional URL is the digital equivalent of a shop owner clearing out overnight.

Similarly, a user from Nigeria reported in July 2025 that their lifesavings were simply “locked,” with no recourse or response from the platform.

Regulatory Reality Check

Despite claiming to be established in 2018 and holding an “AAA” Influence Rank—likely due to heavy traffic in regions like the UAE and Azerbaijan—the regulatory reality of this “Kraken” entity is alarming. WikiFX data confirms that this broker does not hold a valid license from any major Tier-1 regulator (such as the FCA, ASIC, or NFA).

More damning is the official disclosure from the Indonesian regulatory body, BAPPEBTI. The agency has specifically flagged and blocked entities associated with this profile for operating without authorization. In 2022, BAPPEBTI blocked over 1,000 domains to curb illegal commodity futures trading and gambling masquerading as trading. The inclusion of this entity in such regulatory sweeps suggests it is operating on the fringe of legality, often using domain mirroring to evade bans.

Below is the definitive list of regulatory actions associated with this broker profile:

The discrepancy between the “AAA” influence rank and the 1.57 safety score is a critical reminder for traders: Popularity is not Reliability. A broker can be famous because of aggressive social media campaigns (like the Telegram groups mentioned in the Argentine case) while remaining completely unsafe for capital deposit.

Conclusion

Our investigation into the “Kraken” profile currently listed on WikiFX paints a picture of a high-risk entity employing multiple strategies to entrap user funds. From the “gamification” of trading via tasks in South America to the “regulatory ransom” demanded from users in Asia, the pattern is consistent: money only flows in, never out.

The unauthorized status flagged by Indonesian authorities, combined with zero valid regulatory oversight, makes this platform a severe danger to retail investors. We strongly advise all traders to distinguish carefully between entities, verify licenses independently, and cease depositing funds into platforms that require payments to process withdrawals.