Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

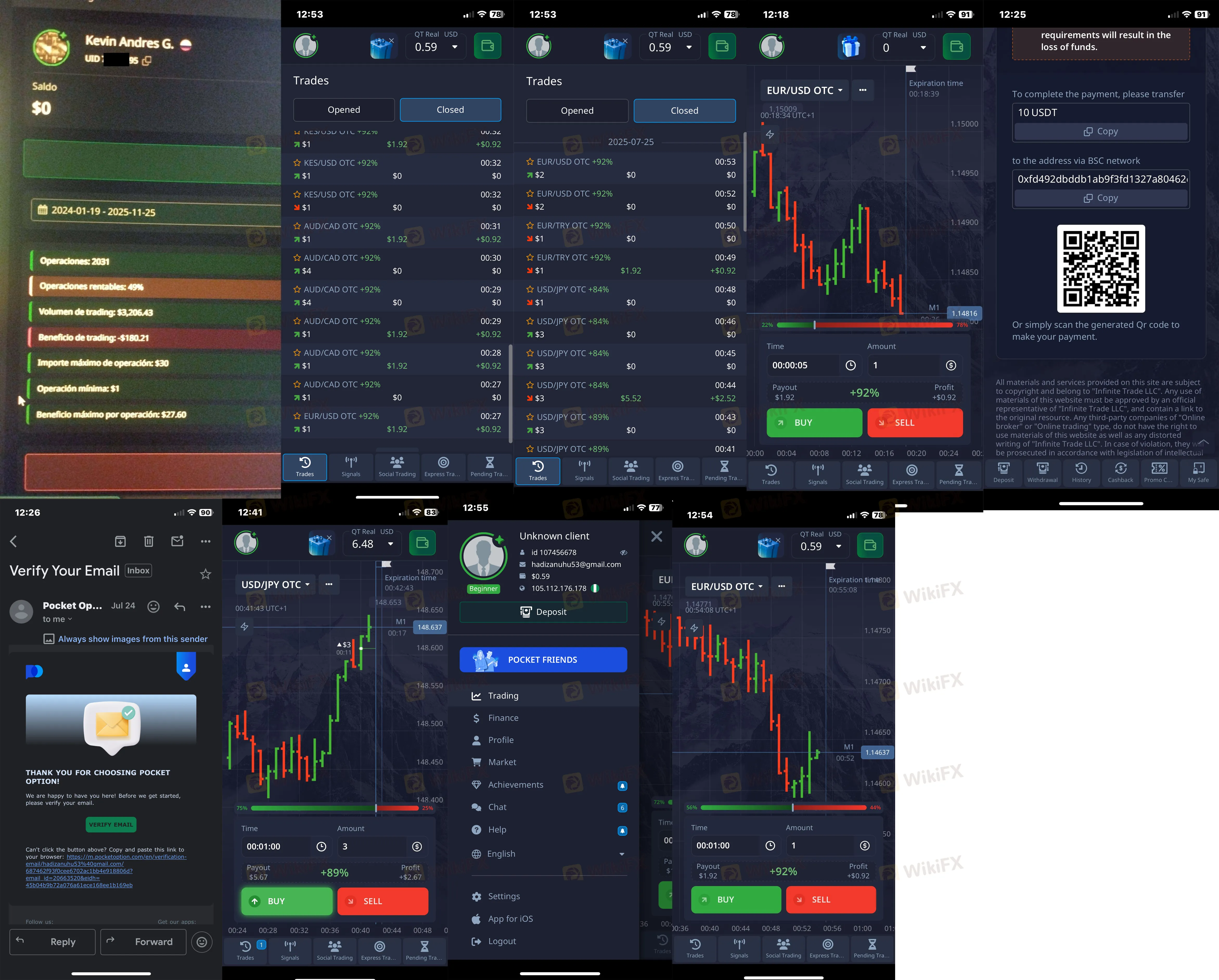

Abstract:Pocket Option is a trading platform headquartered in Costa Rica, established in 2018. While the broker has established a significant market presence with high influence in regions such as the UAE, Australia, Austria, and Argentina, its regulatory status raises serious concerns.

Pocket Option is a trading platform headquartered in Costa Rica, established in 2018. While the broker has established a significant market presence with high influence in regions such as the UAE, Australia, Austria, and Argentina, its regulatory status raises serious concerns.

With a WikiFX Score of just 1.73/10, Pocket Option falls into the high-risk category. Despite its proprietary mobile technology and global reach, the lack of valid regulation creates a dangerous environment for traders.

The primary indicator of a broker's safety is its license. According to our database, Pocket Option does not hold any valid regulation from a Tier-1 financial authority. It operates as an offshore entity based in Costa Rica.

Official data indicates that Pocket Option has been flagged by financial regulators.

| Regulatory Body | Country | Status | Warning Details |

|---|---|---|---|

| Securities Commission Malaysia (SCM) | Malaysia | Unauthorised | Flagged for carrying on unregulated activities (securities/derivatives) without a license. |

The SCM included Pocket Option in its “Investor Alert List” for 2020, citing unauthorized capital market activities. Unlike brokers regulated by the FCA (UK) or ASIC (Australia), Pocket Option does not offer negative balance protection or segregated compensation funds, meaning client funds are at significant risk.

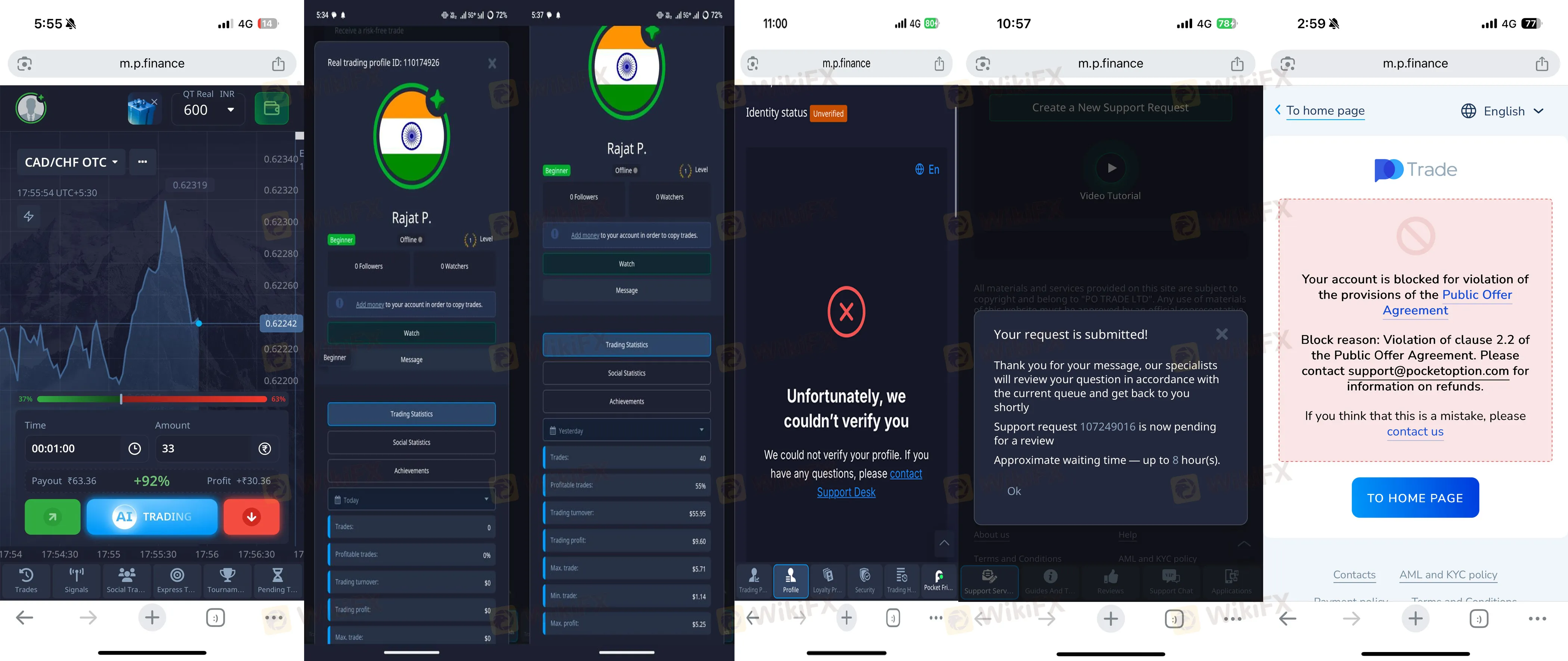

A review of recent user activity reveals a high volume of complaints. In the last three months alone, WikiFX received 24 complaints regarding this broker. Below is a synthesis of the recurring issues reported by users in documented cases:

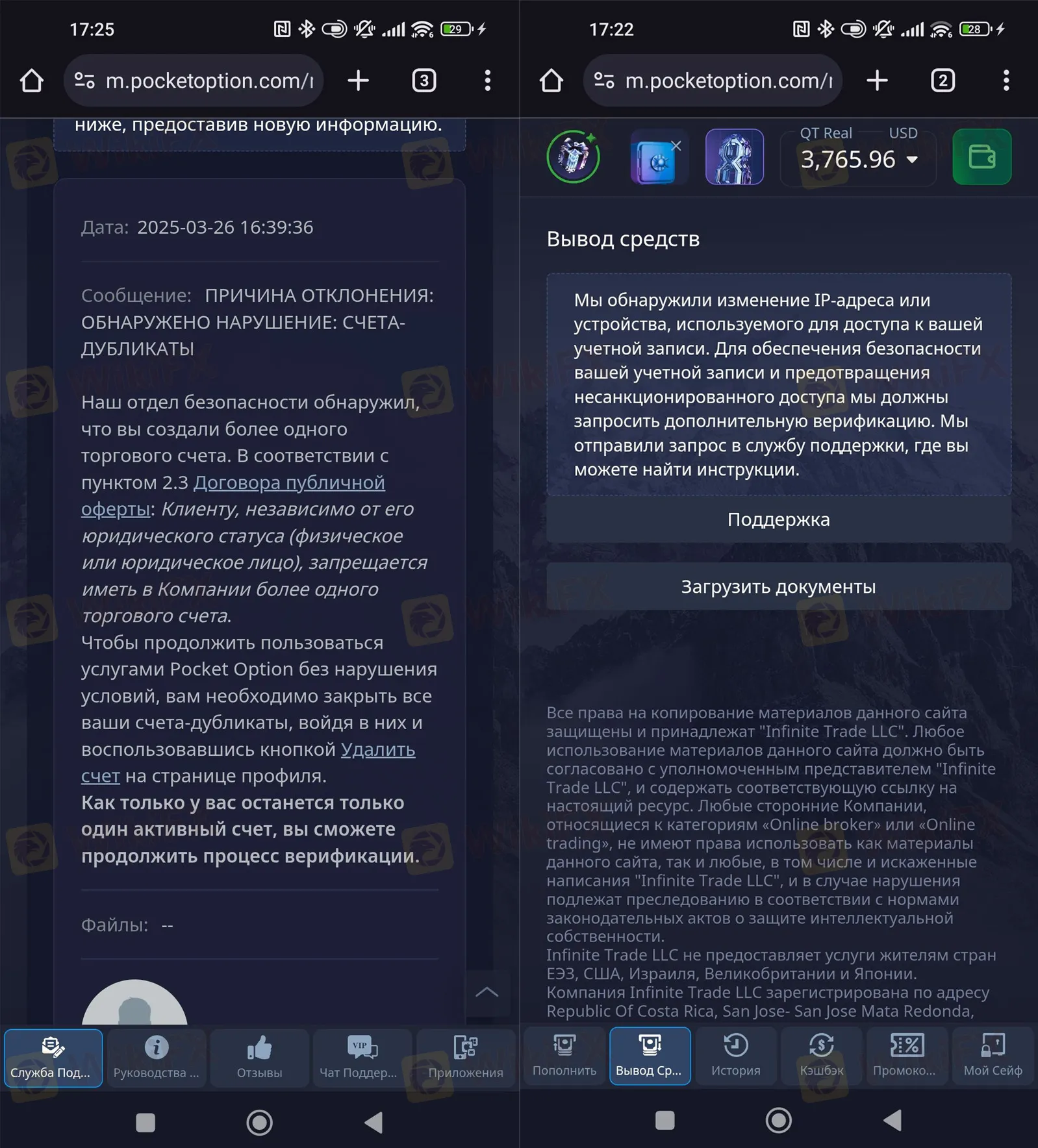

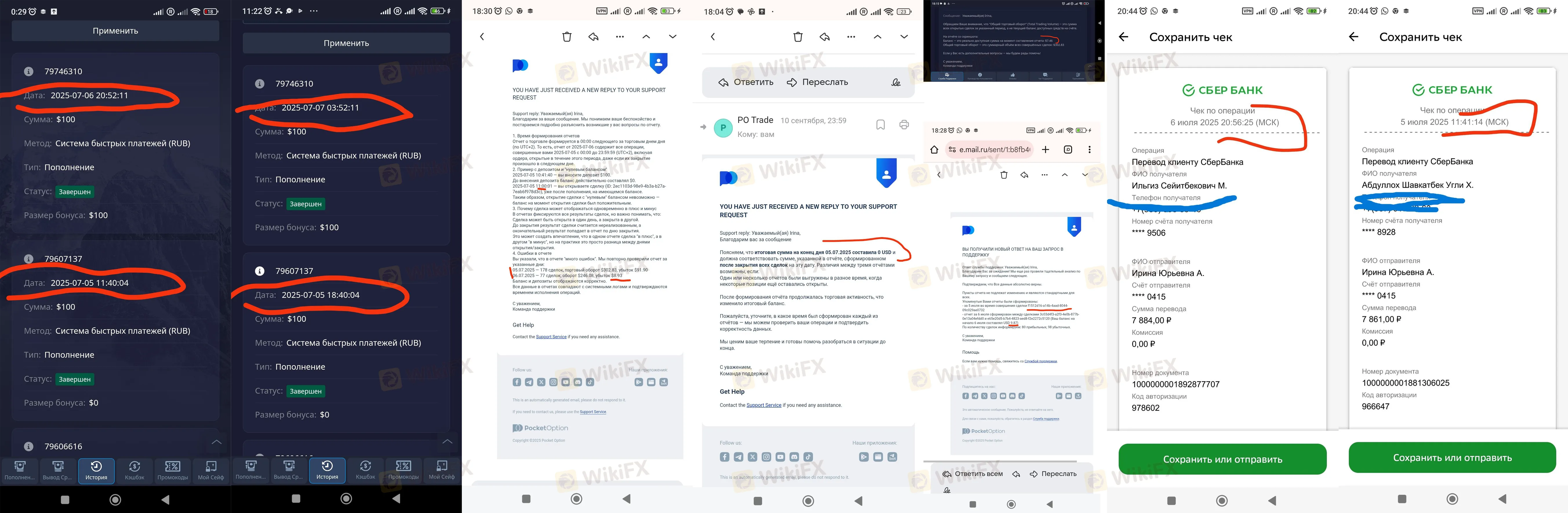

The most frequent complaint involves the inability to withdraw profits.

KYC As a Delay Tactic: A user from Malaysia reported that Pocket Option rejected valid KYC documents repeatedly and blocked the account under “Clause 2.2” of their agreement once a withdrawal was attempted.

Traders have documented technical anomalies that work against the user:

Slippage and Forced Closures: Users from Colombia and Nigeria reported severe slippage and positions closing automatically without their consent, wiping out balances.

In a severe case, a trader claimed that accumulated profits were confiscated, with the broker blaming a “technical glitch” for the winnings. The user alleged that Pocket Option altered transaction history to hide the legitimacy of the trades.

Pocket Option does not utilize standard industry platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Instead, it relies on a Self-Developed (Proprietary) Platform.

Pros

Cons

No, we do not recommend trading with Pocket Option.

Despite its “Perfect” rating for software usability and its popularity in certain regions, the financial risks outweigh the benefits. The broker operates without valid supervision, has been blacklisted by the Malaysian Securities Commission, and faces a barrage of serious complaints regarding stolen funds and banned accounts.

For your financial safety, avoid offshore brokers that use proprietary bans to stop withdrawals. Always check the broker's license validity before depositing.

Protect your capital: Use the WikiFX app to verify licenses and read real-time trader reviews before opening an account. Safety is the most important investment you can make.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.