Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Despite holding a license from the Cyprus Securities and Exchange Commission (CySEC), the broker EZINVEST has become the subject of an alarming 32 formal complaints received by WikiFX in just the last three months. Our editorial team has analyzed a disturbed pattern of behavior involving unauthorized trading, high-pressure demands for deposits, and a near-total blockade on withdrawals. This report dissects how a purportedly regulated entity is exhibiting behavior patterns typically associated with high-risk unregulated platforms.

Abstract:

Despite holding a license from the Cyprus Securities and Exchange Commission (CySEC), the broker EZINVEST has become the subject of an alarming 32 formal complaints received by WikiFX in just the last three months. Our editorial team has analyzed a disturbed pattern of behavior involving unauthorized trading, high-pressure demands for deposits, and a near-total blockade on withdrawals. This report dissects how a purportedly regulated entity is exhibiting behavior patterns typically associated with high-risk unregulated platforms.

Note: All cases cited in this article are based on real user complaints filed with WikiFX. To protect the privacy of the victims, their identities have been anonymized.

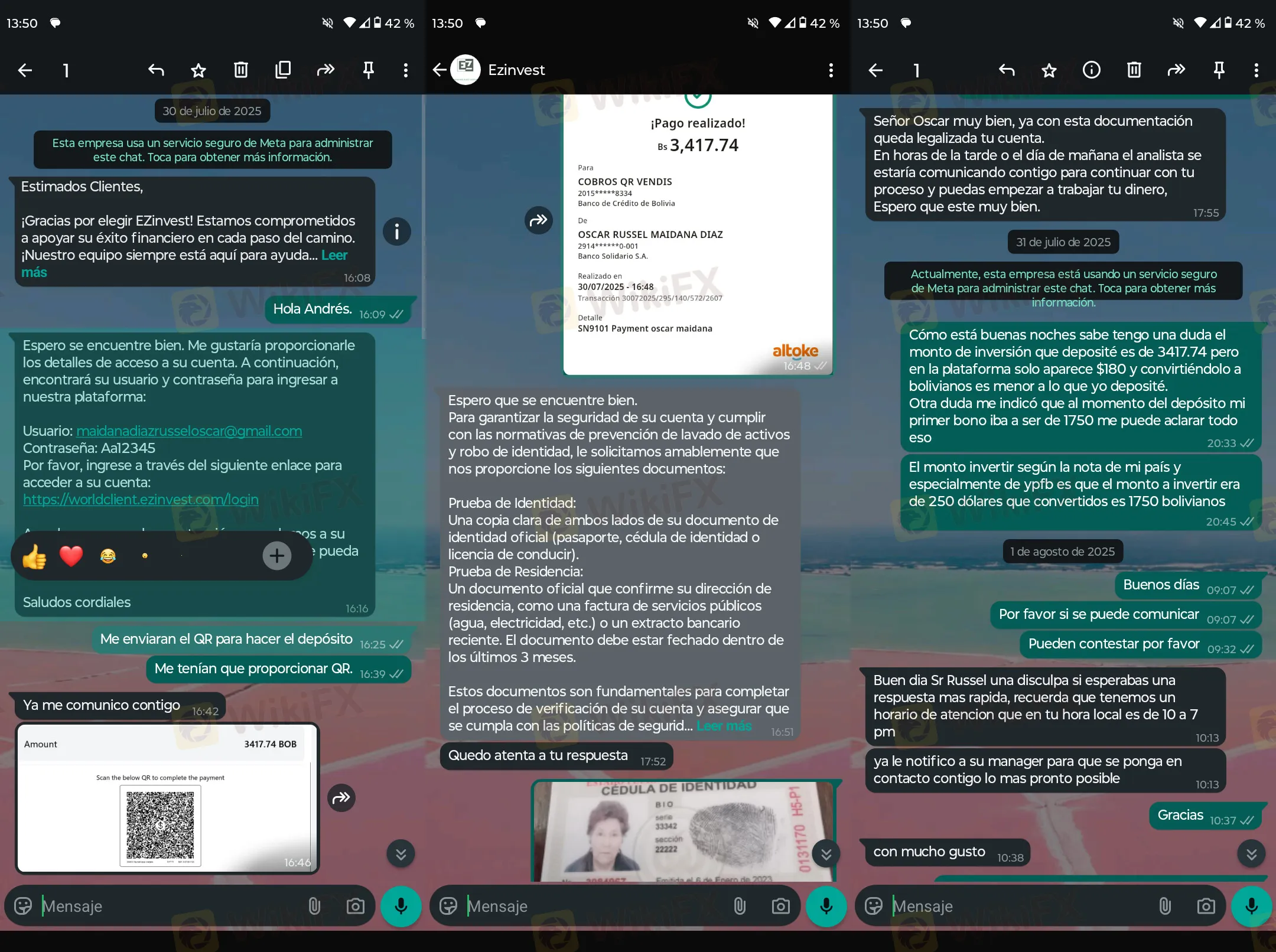

In the world of online trading, a “dedicated account manager” is often sold as a premium benefit. However, for dozens of EZINVEST clients, this feature appears to be the primary mechanism of capital loss. WikiFX has received multiple reports from Latin America and the Middle East where traders claim their assigned advisors effectively hijacked their accounts.

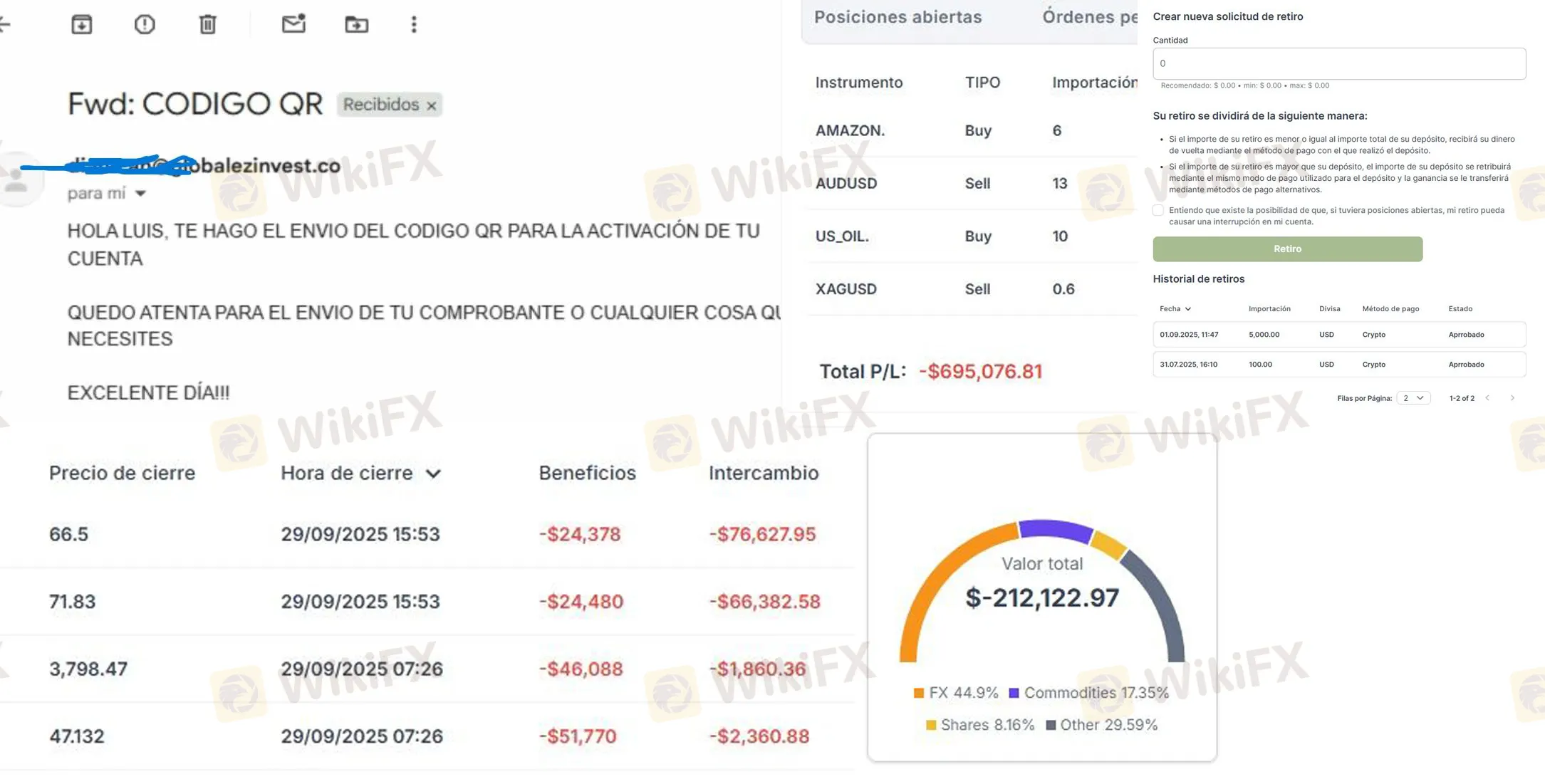

A particularly harrowing case comes from a trader in Bolivia (Case 2), who reported that the entity “opened positions in my account without my authorization.” Instead of assisting with strategy, the advisor allegedly executed trades that drove the account into a “negative float.” When the client attempted to stop the bleeding and withdraw the remaining funds, the account was frozen under the guise of pending open operations—operations the client never requested.

Similarly, a trader from Nicaragua (Case 13) detailed an experience with an agent named “Susana.” After initiating a withdrawal request, the trader returned to find their account empty. The explanation? The advisor had opened reckless positions without permission, wiping out the balance in days. The traders conclusion was heartbreaking: “I requested to close the account... I had $289, then the broker Susana said in 5 business days you will get money back... after 7 days I checked the account out it was empty.”

Our investigation into the complaints reveals a sophisticated psychological trap. The pattern is consistent: clients start with a small deposit (often $200-$250), are shown modest gains, and are then aggressively pressured to drag themselves into debt to “level up” or save a deteriorating account.

A detailed report from a victim in Nicaragua (Case 17) illustrates this predatory cycle perfectly. Starting with a minimum deposit of $250, the trader was convinced to deposit $2,400 to trade heavily on specific tech stocks. When the market turned, rather than hitting a stop-loss, the advisory team demanded more capital to “save” the account. Desperate, the trader took out a bank loan of $3,000.

The demands didn't stop. The broker promised a $10,000 bonus if the trader could hit a $5,000 deposit threshold. This cycle continued until the trader had exhausted credit cards and loans, only to be told that to close the account, they needed to deposit another $9,800.

For those who manage to retain some profit or simply wish to exit, the door appears to be bolted shut. The WikiFX exposure center is flooded with screenshots of cancelled withdrawal requests. The excuses vary from “account inactivity” to “open positions” (which, as noted above, are often opened by the brokers themselves).

A trader from Puerto Rico (Case 19), battling cancer and in need of funds for medical expenses, reported investing over $9,000 but only receiving $300 back. The brokers excuse? They claimed the user's bank card had a “limit” on receiving funds—a claim the user verified with their bank was false. Even after the trader pleaded regarding their health condition, the broker allegedly refused to close operations, keeping the funds locked in market positions until they likely eroded to zero.

Another user from Bolivia (Case 6) summarized the experience of many: “I want to recover my amount... they told me it would take 2 days but time has passed and still no answer, and yet they still call me so that I continue investing.”

Perhaps the most confusing aspect for victims is EZINVEST's regulatory status. As shown in the table below, the broker holds a license with the Cyprus Securities and Exchange Commission (CySEC). Theoretically, this should offer protection against negative balance limits and ban the use of aggressive “bonuses” which are outlawed in the EU/EEA zones.

However, the behaviors described in the complaints—offering 100% deposit bonuses (Case 17), offering leverage up to 1:400 (as seen in WikiFX data), and aggressive cold-calling—are characteristic of non-compliant behavior or the onboarding of clients through offshore subsidiaries that do not share the same protections as the CySEC-regulated entity.

Traders often believe that seeing a “CySEC” logo guarantees safety. However, if a client is registered under a “Global” entity (often implied by high leverage offers like 1:400 which is illegal for retail traders in Europe), the European protections effectively vanish.

WikiFX strictly relies on verified data. Below is the current regulatory status of EZINVEST. While the license is technically valid, traders must weigh this against the overwhelming volume of complaints regarding operational conduct.

| Regulator Name | License Type | Current Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Market Making (MM) | Regulated (License No. 203/13) |

Note: While the license is regulated, the WikiFX Score is a low 2.49 due to the high volume of risk complaints and the “C” grade influence rank.

The disparity between EZINVEST's regulatory paperwork and the reality faced by its clients is stark. The complaints paint a picture of a broker that systematically prevents withdrawals, utilizes advisors to manipulate client trades without consent, and preys on the financial desperation of its users.

While the broker maintains a CySEC license, the operational tactics described by over 30 recent victims suggest a high-risk environment for retail traders, particularly those in Latin America. We strongly advise traders to exercise extreme caution.

WikiFX Risk Warning:

Forex and CFD trading involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment.

Data and specific case details in this review are accurate as of the time of writing based on the WikiFX database.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.