Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

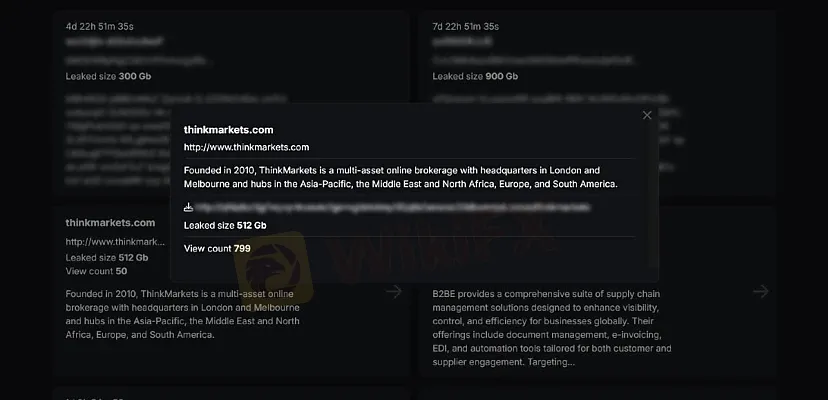

Abstract:Australian broker ThinkMarkets suffers a Chaos ransomware attack; 512GB of sensitive company and client data leaked online.

Australian online brokerage ThinkMarkets has been listed as a victim of a ransomware attack by a group calling itself Chaos, which claims to have stolen and leaked 512 gigabytes of sensitive data.

The group posted ThinkMarkets on its dark web extortion site on 8 December, alongside another unnamed victim. The leaked files appear to include human resources records, client disputes, legal advice, company policies, and trading information. Cyber Daily reporters also observed passport scans of employees and know-your-customer (KYC) documents belonging to clients.

ThinkMarkets has not issued a public statement or responded to requests for comment.

Chaos is a relatively new ransomware group, first detected in February 2025, and has claimed 28 victims to date. Analysts at Talos Intelligence describe the group as active on Russian-language hacking forums, where it promotes its ransomware and recruits affiliates.

The malware is advertised as compatible with Windows, ESXi, Linux, and NAS systems, offering features such as individual file encryption keys, rapid encryption speeds, and network resource scanning. Chaos also provides an automated management panel for affiliates, requiring a paid entry fee that is refunded after the first ransom payment.

The group has stated it avoids targeting BRICS/CIS countries, hospitals, and government entities, focusing instead on corporate victims.

Headquartered in Melbourne, ThinkMarkets operates globally with offices in the Middle East, South Africa, Europe, and the United States. Originally launched as ThinkForex in 2012 under regulation by the Australian Securities and Investments Commission (ASIC), the firm rebranded as ThinkMarkets in 2016.

The company markets itself as a provider of innovative online trading services, offering clients advanced tools, educational resources, and customer support.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.