Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Traders flock to OneRoyal drawn by the allure of "AI-driven" returns and a prestigious name backed by global licenses. However, a disturbing pattern has emerged from the chaotic data streams: accounts are being drained not just by market forces, but by "artificial" spread widening, erratic price data that defies global benchmarks, and—most alarmingly—arbitrary demands for "tax clearance certificates" to release funds.

Traders flock to OneRoyal drawn by the allure of “AI-driven” returns and a prestigious name backed by global licenses. However, a disturbing pattern has emerged from the chaotic data streams: accounts are being drained not just by market forces, but by “artificial” spread widening, erratic price data that defies global benchmarks, and—most alarmingly—arbitrary demands for “tax clearance certificates” to release funds.

Anonymity Disclaimer: All cases detailed below are based on real user records submitted to the WikiFX support center. Consumer identities have been anonymized for their protection.

OneRoyal presents a complex picture. On paper, they appear to be a fortress of compliance, holding licenses in top-tier jurisdictions. However, having a license in one region does not automatically protect traders in another. Our regulatory audit reveals a critical “red flag” hidden amidst the approvals: while they are regulated in Europe and Australia, they have been explicitly flagged by the Securities Commission Malaysia (SCM) for unauthorized activities—a warning signal that African traders should take seriously.

| Regulator Name | License Type | Current Status |

|---|---|---|

| Australia Securities & Investment Commission (ASIC) | MM (Market Maker) | Regulated |

| Cyprus Securities and Exchange Commission (CySEC) | MM (Market Maker) | Regulated |

| Vanuatu Financial Services Commission (VFSC) | Retail FX | Offshore Regulation |

| France Autorité des Marchés Financiers (AMF) | Retail FX | Regulated |

| Securities Commission Malaysia (SCM) | Investor Alert | Unauthorized / Warning List |

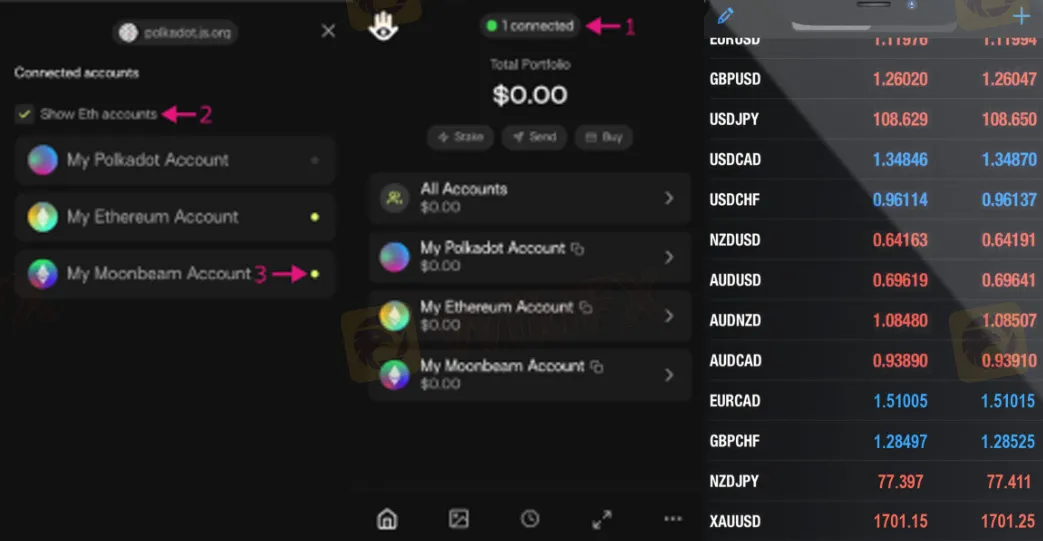

One of the most dangerous trends identified in recent complaints is the promotion of “AI Intelligent Trading Systems.” Traders are being seduced by marketing claims of “92% historical win rates” and “monthly returns of 20%.”

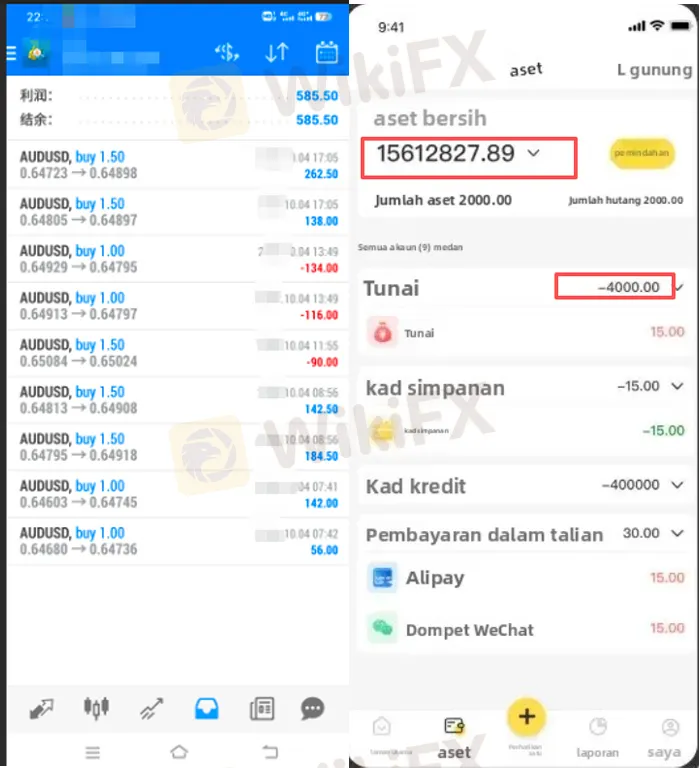

The reality reported by users is devastatingly different. In one documented instance, a trader deposited a significant sum based on these promises. Instead of the advertised low drawdown, the system executed dozens of trades with an 89% loss rate. When the trader compared the platform's historical backtest data (which showed massive wins) with actual market records, they discovered the backtest data had been inflated by thousands of points. The “AI” wasn't missing the market; it was seemingly designed to drain the account.

Another user reported that after depositing funds to follow a “trading guru,” their account accumulated profit until—suddenly and without warning—the system executed seven massive hedging trades that wiped out the entire balance.

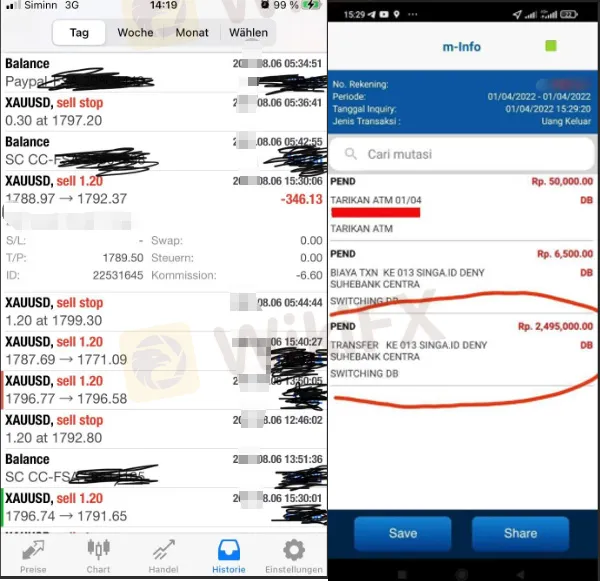

A standard hallmark of a reliable broker is price consistency. If the global price of EUR/USD is 1.0850, it should be roughly 1.0850 on your screen. OneRoyal users, however, are reporting severe data distortions.

One trader attempting to hedge currency risk noted that while the international market price was stable at 4.68, the OneRoyal platform displayed a rate of 4.75. This artificial discrepancy forced the trader to cancel hedges, exposing them to massive risk. When they attempted to close positions, the data reportedly “skyrocketed,” fluctuating over 100 pips in minutes—volatility that was not reflected on verified global charts.

Furthermore, complaints of “sticky” platforms are common. During critical profit-taking moments, the “sell” buttons allegedly become unresponsive. When traders demand answers, support teams cite “abnormal market fluctuations” or claim the system “temporarily disabled profit-taking functions” to protect users—a paradox where “protection” results in total loss of profit.

Perhaps the most distressing feedback concerns the hurdles erected when traders attempt to leave. The withdrawal process at OneRoyal appears to be a moving target of excuses.

WikiFX records show a progression of efficient stalling tactics:

Other traders report simply being ghosted. One user waited over 15 days for a withdrawal, only to be told their banking information “contained an error” after checking it ten times. These “layers of obstacles” effectively hold client funds hostage under the guise of bureaucracy.

WikiFX Risk Warning

The behavior exhibited in these reports—specifically the discrepancy between advertised spreads and execution, and the imposition of undisclosed fees during withdrawal—are classic indicators of high risk. While OneRoyal holds valid licenses in reputable jurisdictions, the complaints suggest that clients may be funneled into offshore entities where these protections do not apply.

WikiFX urges African traders to exercise extreme caution. Score: 6.42 (Declining).

WikiFX reminds you: Forex trading involves significant risk. Always verify the specific entity you are contracting with, not just the brand name.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.