Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

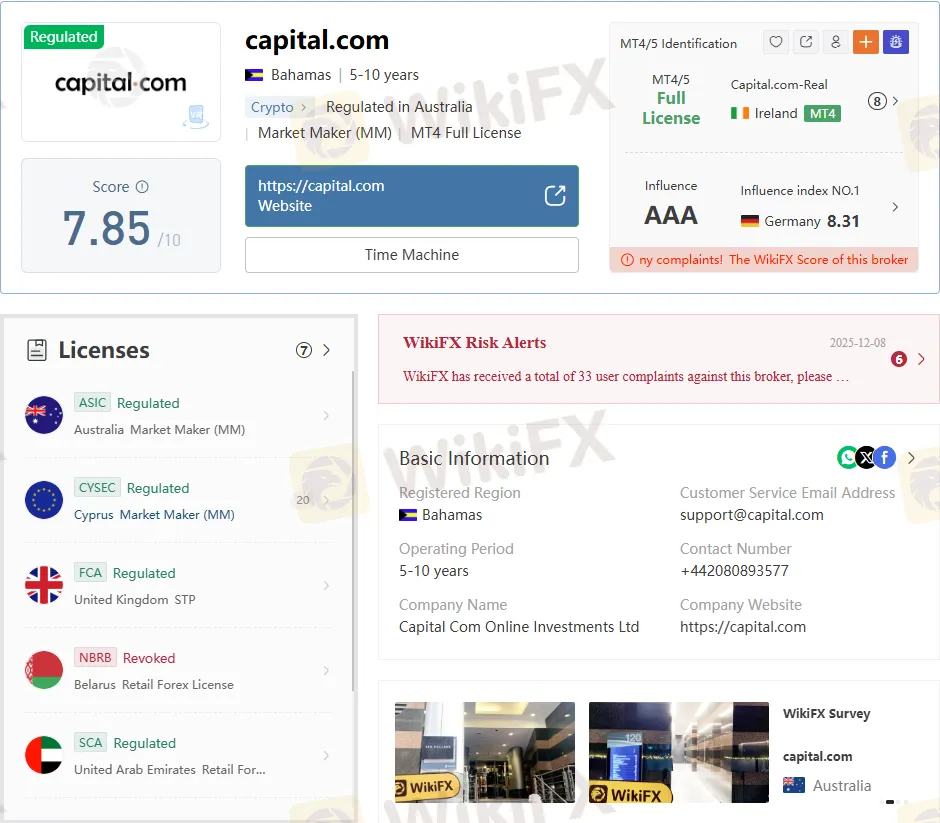

Abstract:Capital.com is regulated by ASIC, FCA, CYSEC, UAE SCA Bahamas SCB. Explore its licenses and broker trustworthiness.

Capital.com stands out as a CFD broker with multi-jurisdictional oversight, serving over 787,000 traders who have executed more than 1 trillion in volume. Regulators like ASIC and FCA enforce strict client protections, making Capital.com Regulation a key draw for risk-conscious traders. This review digs into licenses, platforms, and costs drawn directly from verified records.

Capital.com Regulation spans top-tier bodies, starting with ASIC in Australia (license 513393, CAPITAL COM AUSTRALIA PTY LTD, active since 2021). CYSEC in Cyprus (license 319/17, Capital Com SV Investments Ltd) covers 19 European countries, while FCA in the UK (793714, STP model) adds credibility for retail traders.

UAE's SCA (20200000176) and Bahamas SCB (SIA-F245, offshore) round out the list, with physical offices verified in London, Melbourne, and Limassol. No license sharing detected; all entities maintain independent compliance contacts like compliance@capital.com.

Domain ties to Cyprus registration since 2016 align with operational history, though some addresses lack on-site verification. Traders gain negative balance protection under these rules, unlike unregulated peers.

Access 3,000+ CFDs on forex majors (EUR/USD at 0.6 pips), indices (US 500, UK 100), commodities (gold, oil), shares (Apple, Tesla), cryptocurrencies (Bitcoin, Ethereum), and ESG assets. No bonds, options, or ETFs, narrowing focus to high-liquidity markets versus eToro's broader ETF lineup.

| Asset Classes | Examples | Key Notes |

| Forex | EUR/USD, GBP/USD | Majors/minors/exotics; variable spreads |

| Indices | US Tech 100, DE40 | Global coverage, tight pricing |

| Commodities | Crude Oil, Gold | Energy, metals, agriculture |

| Shares | Amazon, Google | Popular globals via CFDs |

| Crypto | BTC, ETH | Volatile pairs, no direct ownership |

Execution averages 175ms on MT4 servers, outperforming many market makers.

Minimum deposit hits just $10 (USD/EUR/GBP), beating competitors like IG's $250 threshold. Demo accounts offer $100,000 virtual funds indefinitely—ideal for testing. Live accounts lack tiered details, but pros access 1:3000 leverage (retail capped lower by rules).

Islamic swaps-free options are likely available per regional norms, though unconfirmed. Inactivity fee: $10 after 12 months. No multi-account tiers are publicized, unlike XM's standard/pro/vip spread.

Proprietary web/desktop/mobile apps lead with 75+ indicators, risk tools, and seamless execution—named best for new investors. MT4 supports EAs, signals, and up to 1:200 leverage; TradingView integrates charts. No MT5, lagging Plus500's dual support.

| Platform | Devices | Best For |

| Web/Desktop | PC, Mobile | Beginners: Intuitive UI |

| MT4 | Desktop/Mobile/Web | EAs, signals |

| TradingView | All | Advanced charting |

| App | iOS/Android | On-the-go trades |

TradingView ratings hit 4.6/5; app downloads exceed 8 million.

Zero commissions, deposit/withdrawal fees—earns via spreads (EUR/USD 0.6 pips average). Overnight funding applies (long/short dependent); guaranteed stops add premiums. Currency conversion possible; no opening/closing fees.

Compares favorably to Pepperstone (0.0 pips + commission), but watch swaps on holds. Transparent via real-time tools.

| Fee Type | Capital.com | Competor Avg. |

| Min Deposit | $10 | $250 |

| Spread (EUR/USD) | 0.6 pips | 0.8 pips |

| Inactivity | $10/year | $12/month |

| Withdrawal | Free | $15+ |

Pros:

Cons:

Fund via Visa, Apple Pay, wire, Trustly—no fees, instant cards. Withdrawals match, processed promptly per reviews. Support shines: live chat, +44 20 8089 7893, support@capital.com, social channels.

Capital.com delivers legit value through Capital.com Regulation across ASIC, FCA, CySEC, SCA, SCB—backstopped by low barriers and vast CFDs. Suits beginners with demos/education, pros with high leverage/tools, but monitor extras like swaps. Outweighs risks for regulated access; 81-85% loss disclaimers underscore CFD hazards.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.