Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Plus500 allegations revealed: trader complaints, withdrawal delays, and regulatory oversight explained in detail.

Plus500 allegations center on persistent trader complaints about withdrawal delays, deposit discrepancies, and evasive customer support, as documented in multiple real-user accounts. Despite its regulated status across several jurisdictions, these issues raise serious questions about operational reliability for everyday traders. This exposure draws directly from verified trader reports and regulatory filings to uncover patterns that demand scrutiny.

Traders report endless hurdles pulling funds from Plus500 accounts, often stretching over months with shifting document demands. One user detailed submitting salary statements and address proofs, only to face an indefinite “under review” status without timelines. Such Plus500 allegations highlight a pattern where verification checks pass, but payouts stall, eroding trust.

These stories fuel broader Plus500 Exposed discussions on forums, pointing to systemic delays.

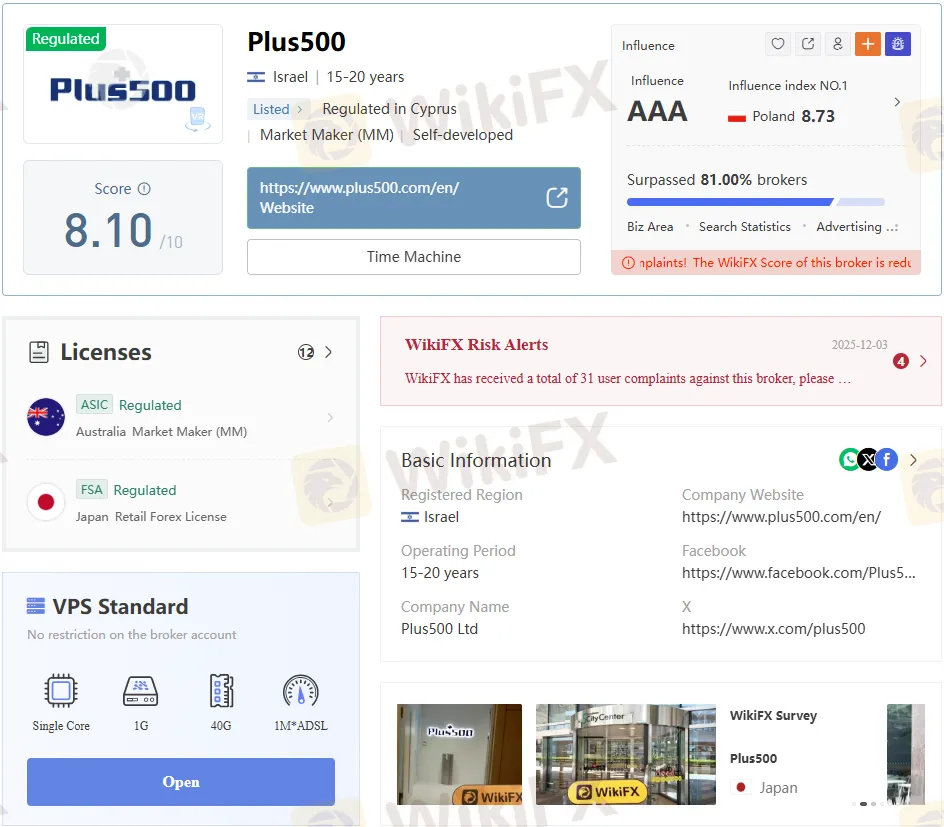

Plus500 holds licenses from top bodies like FCA (UK, #509909), ASIC (Australia, #417727), and CySEC (Cyprus, #25014), yet offshore entities in Seychelles (#SD039) and the Bahamas draw warnings for weaker oversight. Israeli origins via PLUS500IL LTD add scrutiny, with traders citing “sketchy” bonus tactics tied to its roots. Client funds stay segregated under FCA rules, but complaint volumes question enforcement.

| Regulator | License # | Type | Key Risk |

| FCA (UK) | 509909 | STP | Strong, but complaints persist |

| ASIC (AU) | 417727 | MM | Solid; bonus issues flagged |

| CySEC (CY) | 25014 | MM | Multi-country; delays reported |

| FSA (Seychelles) | SD039 | Offshore | High risk, limited recourse |

Offshore arms amplify Plus500's allegations of inadequate protection.

Plus500 offers 1000+ CFDs on forex, shares, indices, plus futures and share dealing via its proprietary platform. No traditional commissions, but spreads on majors like EUR/USD can widen during volatility, squeezing profits. Leverage hits 1:30 under EU rules, dropping lower elsewhere—risky for novices amid reported platform glitches.

Account types include standard retail with $100 minimum, premium perks for high-volume traders, and demo modes. Fees hit on inactivity ($10/month after 3 months) and overnight financing, often undisclosed upfront. Mobile apps rate high on stores, yet traders blast lag during key sessions.

Pros:

Cons:

Risks dominate, especially for withdrawals.

Opt for IG Group (FCA-regulated, transparent withdrawals) or CMC Markets (ASIC/FCA, fixed spreads) over Plus500 exposed to pitfalls. eToro adds social copying with stronger US oversight, dodging offshore woes. These peers boast faster payouts and fewer complaints, per recent reviews.

| Broker | Regulation | Withdrawal Speed | Spreads |

| IG | FCA/ASIC | 1-2 days | Tight |

| CMC | FCA/ASIC | Same day | Fixed |

| eToro | FCA/CySEC | 1-3 days | Variable |

| Plus500 | Mixed | Weeks+ |

Switching cuts Plus500 allegations risks.

Plus500 maintains legitimacy through major licenses, but trader cases expose withdrawal chaos and bonus tricks that undermine it. Regulatory standing shines in the UK/Australia yet falters offshore, amplifying exposure risks for global users. Approach with caution—prioritize brokers providing payout reliability over app hype.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.