Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

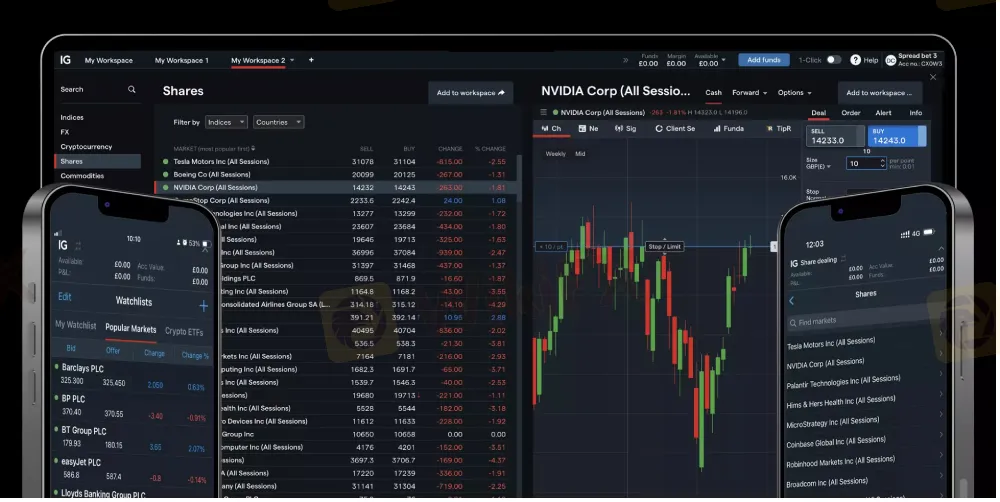

Abstract:IG cashback offer UK 2025 gives investors up to £100 back. Compare the best UK investment platforms with cashback today.

IG's latest initiative targets UK residents seeking entry into markets with tangible rewards. From 21 November to 31 December 2025, new customers opening an ISA, GIA, or SIPP qualify for 5% cashback on average daily invested value, capped at £100. This structure rewards commitment, requiring a first trade of £50 and a £50 minimum portfolio through March 2026, with credits by 30 April.

Such promotions align with rising UK retail participation, where platforms leverage incentives amid economic shifts. IG stands out by tying rewards to sustained activity, fostering habits over one-off gains. Eligibility limits entry to first-time share dealing users aged 18+, excluding prior ISA, GIA or SIPP holders.

Market data underscores appeal: UK stocks and shares ISA investments hit record levels in 2025, per FCA reports, as savers chase returns beyond 4% cash rates. IG's zero-commission UK shares and 4% AER on uninvested cash amplify value.

Among the best UK investment platforms with cashback, IG's 5% rate shines for simplicity and broad account coverage. Competitors like Freetrade offer 2% on pensions or up to £1,000 on ISA transfers, but demand larger commitments. Charles Stanley provides up to £1,500 on transfers, suiting switchers over newcomers.

IG's edge lies in low barriers: no deposit minimum beyond the £50 trade, versus higher thresholds elsewhere. Platforms such as AJ Bell focus on low fees without cashback, while Wealthify ties rewards to £5,000+ ISAs. IG balances accessibility with 12,000+ shares and ETFs.

| Platform | Cashback Rate | Min. Requirement | Account Types | Max Payout |

| IG | 5% | £50 trade + portfolio | ISA, GIA, SIPP | £100 |

| Freetrade | 2% (pension) | Transfer | ISA, SIPP | Varies |

| Charles Stanley | Variable | Transfer | General | £1,500 |

| Wealthify | £50-£1,000 | £5,000 deposit | ISA | £1,000 |

This table highlights why IG tops the best UK investment platforms with cashback for beginners. Tax wrappers enhance long-term efficiency: ISAs shield £20,000 annually from gains tax.

The IG ISA GIA SIPP promotion caters to diverse goals, from tax-free growth to retirement planning. ISAs suit annual savers; GIAs offer unlimited flexibility; SIPPs provide relief on contributions up to £60,000 yearly. All deliver identical 5% cashback under uniform terms.

Experts note SIPPs gain traction as UK pension freedoms expand, with 1.5 million new plans in 2025 per industry stats. IG's intuitive app and educational tools lower entry hurdles for novices. Cashback credits to a GIA, ensuring quick access.

Compared to peers, IG's promotion avoids complexity like random free shares (its prior autumn deal up to £200). Marketing Director Elise Ash calls it a “rewarding nudge” for hesitant starters, emphasizing commission-free trades across global assets.

Broader context: UK platforms face scrutiny on fees, with MSE naming IG among the cheapest for shares. Inflation at 2.1% in late 2025 pushes savers toward equities averaging 7-10% historical returns.

IG's timing capitalizes on year-end reviews, when 40% of UK adults reassess finances per surveys. Zero FX fees on GBP trades and diverse ETFs bolster retention post-promotion.

Risks remain: capital at risk, with markets volatile; past performance no guarantee. FCA regulates IG, ensuring client protections like FSCS up to £85,000.

For switchers, tools like IG's portfolio analyzer aid transitions. Long-tail seekers of “IG cashback offer UK 2025 terms” find clear FAQs: new customers only, no combo with other deals.

This positions IG as a frontrunner among the best UK investment platforms with cashback, blending rewards with robust features. UK investors gain from competitive innovation, driving better terms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.