Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

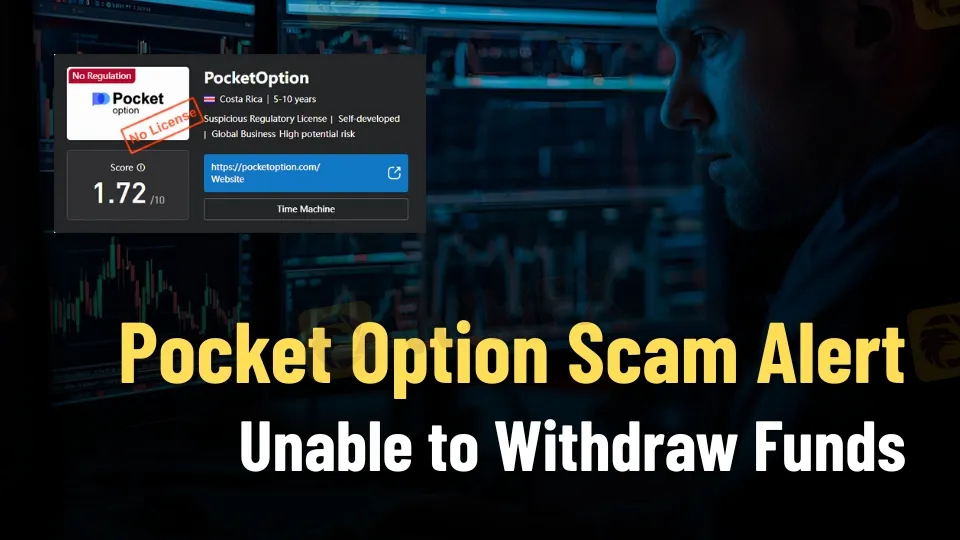

Abstract:Pocket Option Scam Alert: Not regulated claims, suspicious license score, and platform-only trading risks summarized.

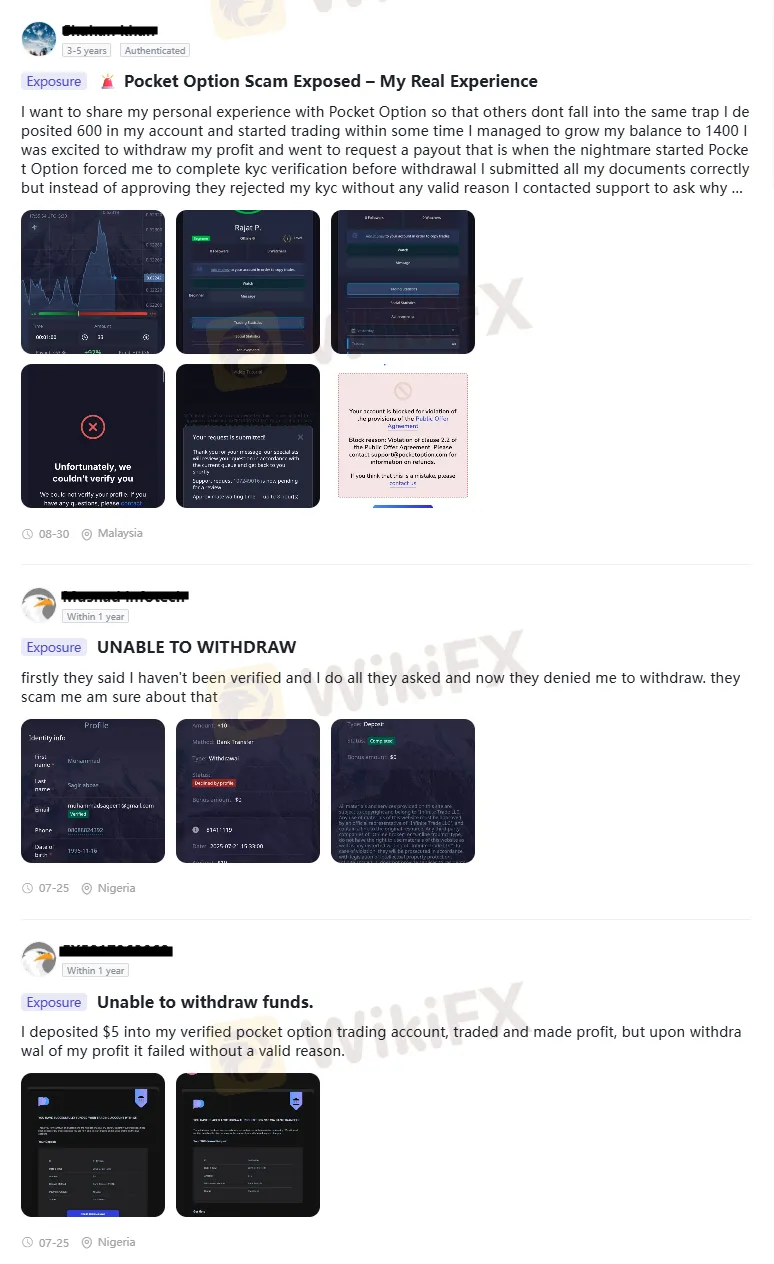

Pocket Option, operated by Infinite Trade LLC, has been the subject of mounting complaints across multiple regions. Traders from Spain, Russia, Malaysia, Nigeria, and Hong Kong have documented cases where withdrawal requests were either delayed for weeks or outright denied.

Several users describe a recurring pattern: once profits accumulate, the platform initiates prolonged verification procedures. These checks often extend beyond 14 days, creating psychological pressure on traders to continue trading rather than cashing out. In multiple instances, accounts were blocked under vague references to the “Public Offer Agreement,” leaving users without access to their funds.

The evidence presented in user testimonies highlights a systemic issue: trades are not routed to interbank markets but remain confined within the platform. This raises serious concerns about transparency and legitimacy.

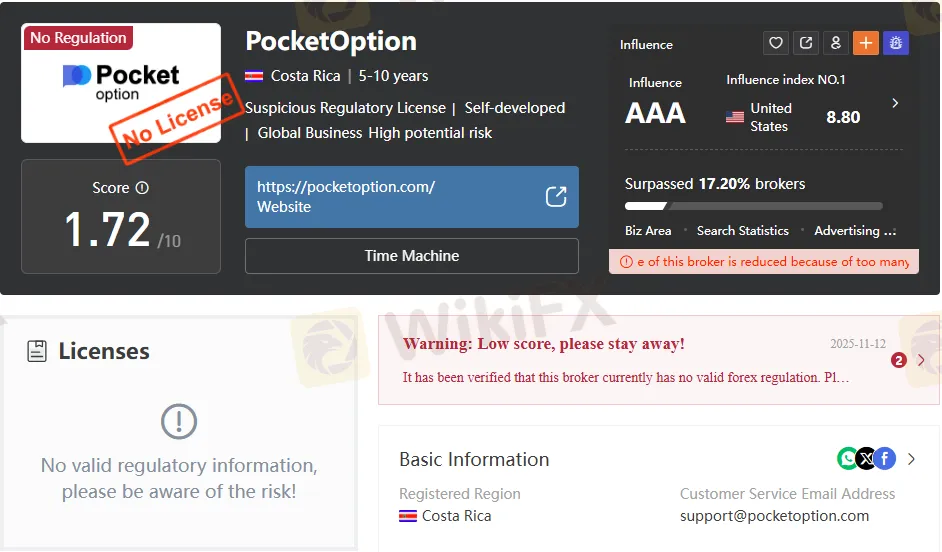

Pocket Option claims to operate under Infinite Trade LLC with a stated history of 5–10 years. However, independent assessments reveal a suspicious regulatory license and a trust score of just 1.72.

This score is far below industry standards for regulated brokers. A legitimate broker typically holds licenses from recognized authorities such as CySEC, FCA, or ASIC. Pocket Options lack of credible oversight means traders face heightened risks, including arbitrary account bans and manipulated trading conditions.

The absence of regulation is not a minor detail—it directly impacts the safety of client funds. Without external audits or compliance checks, users are left vulnerable to internal manipulations, as documented in multiple case studies.

One of the most alarming findings comes from Russian traders who provided detailed evidence of time and balance manipulations. Bank receipts showed timestamps later than those recorded on the Pocket Option platform, with discrepancies ranging from one to four minutes.

After complaints, the platform retroactively altered balances and timestamps. Support staff attributed the issue to “UTC+2 time zone differences,” but this explanation failed to account for the fact that platform times appeared earlier than bank confirmations.

Requests for raw logs and complete trade reports were met with evasive responses. This lack of transparency undermines the credibility of Pocket Options trading environment and suggests deliberate manipulation.

Across multiple countries, traders have shared consistent experiences:

These cases illustrate a consistent pattern: profitable accounts face sudden restrictions, while withdrawal requests remain unprocessed. The recurring references to vague contractual clauses suggest a strategy designed to prevent payouts rather than enforce legitimate compliance.

The cumulative evidence paints a clear picture: Pocket Option operates with no credible regulation, a low trust score, and a history of documented manipulations. Traders face:

For retail traders seeking transparency and security, these risks are unacceptable. The lack of regulatory oversight means there is no external body to hold Pocket Option accountable.

Pocket Option presents itself as a global trading platform, but mounting evidence from multiple regions suggests otherwise. With repeated reports of blocked accounts, withdrawal failures, and suspicious license claims, the platform raises red flags that cannot be ignored.

Traders considering Pocket Option should weigh these risks carefully. The documented experiences show that profitability does not guarantee access to funds, and regulatory gaps leave users exposed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.