简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stonefort No Deposit Bonus: What Traders Must Know Before Signing Up

Abstract:Many traders start their journey by looking for low-risk ways to begin trading, and a stonefort broker no deposit bonus is something they often search for. This represents a wish to try out a broker's platform and conditions without putting up any money first. Let's be direct about this: based on our complete review of all publicly available information for 2025, there is no confirmed or currently advertised no deposit bonus offered by Stonefort Securities.

Many traders start their journey by looking for low-risk ways to begin trading, and a stonefort broker no deposit bonus is something they often search for. This represents a wish to try out a broker's platform and conditions without putting up any money first. Let's be direct about this: based on our complete review of all publicly available information for 2025, there is no confirmed or currently advertised no deposit bonus offered by Stonefort Securities.

The fact that this specific promotion doesn't exist should not stop a trader from doing their research. Instead, it moves the focus to more important questions about whether the broker is legitimate, safe, and provides a good trading environment. This article gives an objective, detailed analysis of Stonefort's services, regulatory standing, and operating conditions to help you make a fully informed and secure decision, going beyond just looking for a free bonus.

Stonefort at a Glance

To properly evaluate any brokerage, we must first understand its basic operational details. This gives a foundation for any trader doing their research. Stonefort Securities Limited is a relatively new company in the brokerage space, having been in operation for one to two years. For a complete and detailed profile of Stonefort's corporate structure and history, you can explore their full information page. The main details are presented below for a quick summary.

| Feature | Detail |

| Company Name | Stonefort Securities Limited |

| Registered Region | Saint Lucia |

| Operating Period | 1-2 years |

| Contact Number | +971 43656600 |

| Customer Service | support@stonefortsecurities.com |

| Website | https://stonefortsecurities.com/ |

These facts provide a starting point, but the most important element for any trader's consideration lies in the broker's regulatory status and the safety of client funds.

Regulation and Safety Analysis

Regulation is the single most important factor when choosing a broker. It is the framework that protects traders from bad practices and ensures a firm operates within legal boundaries. Our examination of Stonefort Securities reveals several important points that demand careful attention.

The broker's related entity, Stonefort Securities LLC, holds an Investment Advisory License from the United Arab Emirates Securities and Commodities Authority (SCA), with license number 20200000226. However, this license is officially marked as “Exceeded.” In simple terms, this means the broker is conducting business activities that fall outside the scope of what this specific license allows.

This is a major red flag for potential clients. Furthermore, the license is classified as a “Non-Forex License.” For a trader looking to engage in forex markets, using a broker whose license does not specifically cover forex trading activities introduces a significant layer of risk. The regulatory framework intended to protect forex traders may not apply.

Adding to these concerns is a direct and clear warning associated with the broker's profile:

> Warning: Low score, please stay away!

This alert, coupled with a low overall rating from regulatory review tools, paints a concerning picture of the broker's compliance and safety profile. The license itself is listed with a validity date through November 3, 2025, but its exceeded status and non-forex classification overshadow its active period.

This information is based on data available as of early 2025. Regulatory statuses can change, and brokers can update their licensing. Therefore, traders should always perform their own up-to-the-minute research directly with regulatory bodies. Given these serious concerns, we strongly encourage traders to check the latest, real-time regulatory details and any new warnings for Stonefort on the WikiFX platform before proceeding.

Do not miss this Imp. article - Stonefort Broker Review 2025: A Complete Look at Rules, Costs, and What Users Say-www.wikifx.com/en/newsdetail/202511047824827316.html

Accounts and Trading Conditions

Beyond regulation, the practical trading conditions offered by a broker determine if it aligns with a trader's strategy, capital, and risk tolerance. Stonefort offers three primary account tiers: Starter, Advanced, and Elite. While details for the higher tiers are not fully specified, the baseline Starter Account provides significant insight into the broker's target clientele.

To compare the full features of the Advanced and Elite accounts, traders can view the detailed account comparison on the broker's page. Below are the key conditions for the entry-level Starter Account:

• Minimum Deposit: $10,000

• Maximum Leverage: 1:200

• Minimum Spread: From 0.1

• Commission: $7 per lot

• Supported EA: Yes

• Products, Deposit/Withdrawal Methods: Information not specified.

The most striking feature here is the minimum deposit of $10,000. This is extremely high for a “starter” account in the retail brokerage industry. It suggests that Stonefort is not targeting beginner or small-volume traders but is instead focused on attracting high-net-worth individuals or institutional clients. The 1:200 leverage is fairly standard, while a spread from 0.1 pips combined with a $7 commission is a competitive pricing structure, often seen in ECN-style accounts. The lack of clarity on tradable products and, more importantly, deposit and withdrawal methods is a notable omission that requires direct inquiry.

Platforms and Technology

A broker's technology stack is the trader's primary toolkit. A reliable and familiar platform is essential for effective market analysis and trade execution. Stonefort provides its clients with the globally recognized MetaTrader 5 (MT5) platform.

Importantly, the broker holds a “Full License” for MT5. This is a positive indicator, as a full license generally implies a more robust and stable service with better technical support compared to a white-label solution. It suggests a more significant investment in their trading infrastructure. Analysis of their server infrastructure shows a presence in both Singapore and Mauritius, which can influence execution speed depending on the trader's geographic location.

In addition to MT5, Stonefort offers its own proprietary mobile application, the “Stonefort Trader.” This app is marketed as a tool designed to simplify the trading experience, likely offering account management and trading functionalities in a user-friendly mobile interface.

• Primary Platform: MetaTrader 5 (MT5)

• License Type: Full License

• Proprietary App: Stonefort Trader

• Server Locations: Singapore, Mauritius

Reviews vs. Official Rating

One of the most puzzling aspects of evaluating Stonefort is the stark contradiction between its low official rating and severe regulatory warnings on one side, and a collection of glowing user reviews on the other. This discrepancy requires a critical and balanced perspective.

As of our latest review, there are 12 user reviews available, all of which are positive. These reviews come from traders in India, Indonesia, and the United Arab Emirates. It is important to note that these reviews are marked as “Unverified,” meaning they have not been independently authenticated to confirm the user is a genuine client.

Despite their unverified status, the reviews highlight several consistent themes that paint a picture of a highly functional and supportive brokerage. Key points of praise include:

• Smooth and Fast Withdrawals: This is a recurring comment, with multiple users stating that withdrawals are hassle-free, a common pain point with other brokers.

• Responsive and Helpful Support: Specific support agents, such as “Hassan Abdulla” and “Jack,” are named and praised for their professionalism, knowledge, and responsiveness.

• User-Friendly Platform: Users describe both the main platform and the proprietary mobile app as easy to use and stable.

• Competitive Trading Conditions: Fast execution and competitive spreads are mentioned as positive attributes.

• Transparent IB Program: One review specifically praises the Introducing Broker (IB) program for its transparent reporting and reliable, fast payouts.

Traders interested in what actual users are saying can read through these reviews in their entirety on the broker's profile to get a feel for the client experience. However, these positive anecdotes must be weighed heavily against the objective and serious regulatory red flags. It is not our place to resolve this contradiction, but to present it as a critical point of consideration for any potential client.

Conclusion: The Right Choice?

Our investigation began with a search for a stonefort broker no deposit bonus, a promotion that does not appear to be available in 2025. This led to a deeper dive into the broker's core offerings and, more importantly, its safety profile. The findings present a deeply conflicting picture.

On the one hand, Stonefort offers the powerful, fully-licensed MT5 platform and has accumulated a stream of positive, albeit unverified, user reviews. These reviews consistently praise the broker's customer support, platform stability, and, most notably, the efficiency of its withdrawal process.

On the other hand, the negatives are severe and cannot be overlooked. The broker faces serious regulatory concerns, including an official “Exceeded” status on its UAE license, the fact that it's a “Non-Forex License,” and an explicit “stay away” warning from review bodies. Furthermore, the extremely high minimum deposit of $10,000 for its most basic account makes it inaccessible and unsuitable for the vast majority of retail traders, especially beginners.

We do not issue a direct “yes” or “no” verdict. The decision to engage with any broker is a personal one, based on an individual's risk tolerance and research.

Ultimately, the decision rests with the individual trader. Given the conflicting information, it is absolutely essential to conduct thorough personal research and continuously monitor the broker's profile and user feedback on WikiFX before committing any funds.

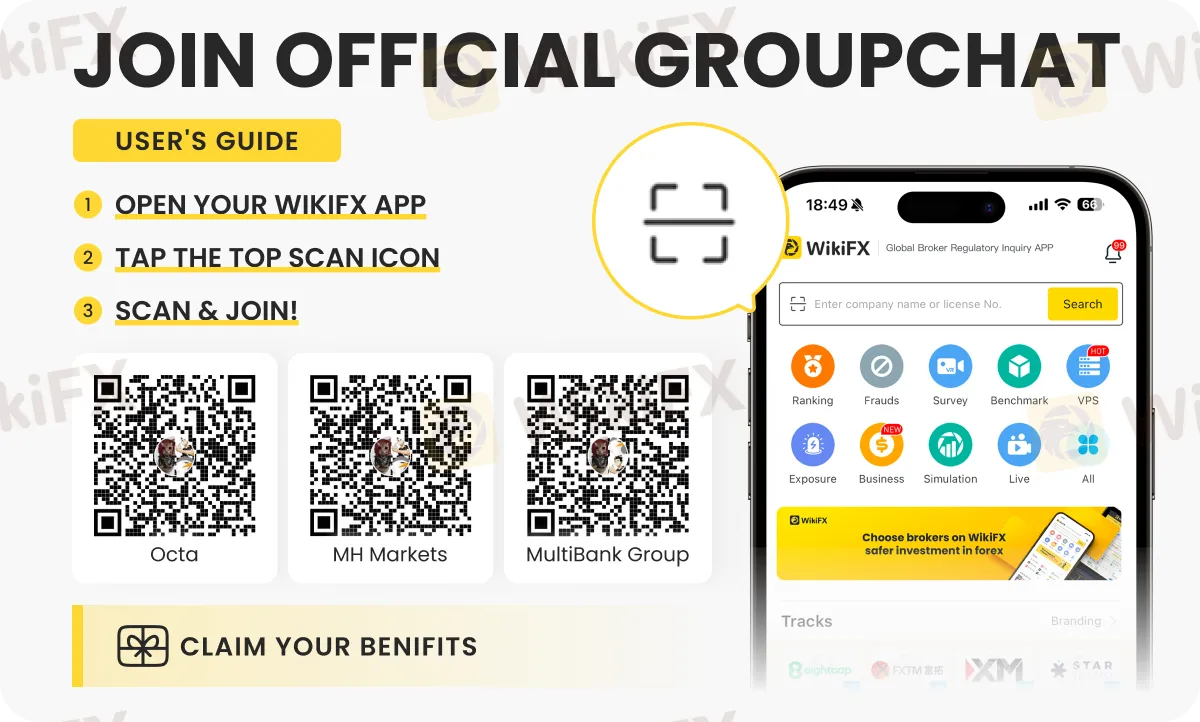

We have created an official Brokers community! Join it Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Oil War Shock: Diesel Futures Surge 34% as White House Pledges Military Escort for Tankers

Energy Crisis Deepens: Hormuz Blockade Risks Physical Supply Shock

Middle East conflict poses fresh test to central banks as oil shock fuels inflation

Nigeria: Tinubu Overhauls Fiscal Team Amid Fuel Price Hike and Inflationary Pressures

WikiFX Invitation Rewards Program

Mentari Mulia Review : Is This BAPPEBTI-Regulated Indonesian Forex Broker Right for You?

OANDA to Transfer Prop Trading Business to FTMO Platform

Global Divergence: Eurozone Inflation Fears vs. China's "Value" Play

ECB Watch: Energy Shock Won't Derail Policy Path, Says Nomura

Geopolitical Shock: Reports of Iranian Drone Strike on U.S. Embassy in Riyadh

Currency Calculator