Italy’s CONSOB Blocks Five Illegal Investment Sites

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Thinking of trading with FXFlat in 2025? Before you invest, read what real traders say. This FXFlat Review 2025 dives into the broker’s regulation, trading platforms, and customer feedback.

Thinking of trading with FXFlat in 2025? Before you invest, read what real traders say. This FXFlat Review 2025 dives into the brokers regulation, trading platforms, and customer feedback.

FXFlat, founded in 1997 by Rafael Neustadt, is a German Forex and stock broker that provides access to global financial markets. The company operates under FXFlat Bank GmbH, offering a wide range of trading services to retail and professional clients.

Headquartered in Ratingen, near Düsseldorf, Germany, FXFlat Bank GmbH has been operating since 1997. According to the company, it has been supervised by the Federal Agency for Financial Services Supervision (BaFin) since 1998. In 2015, FXFlat became a licensed securities trading bank, which allows it to provide expanded financial services under German regulatory oversight.

FXFlat offers a broad selection of financial instruments, enabling clients to trade in:

• Stocks

• Bonds

• Options and Futures

• ETFs (Exchange-Traded Funds)

• Commodities

• Spot Forex and CFDs

The broker provides access to over 100 markets in 33 countries, giving traders a diverse range of global investment opportunities.

FXFlat supports several professional trading platforms, including:

• MetaTrader 4 (MT4)

• MetaTrader 5 (MT5)

• AgenaTrader

• ATAS

• Trader Workstation (TWS)

FXFlat provides customer support 24 hours a day, Monday through Friday, via phone and live chat.

• Telephone: +49 2102 100 494 00

• Email: service@fxflat.com

For any inquiries, assistance, or general information, clients are encouraged to contact the FXFlat Support Team.

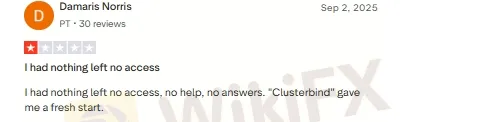

1. Unresponsive Customer Support

Several users have criticized FXFlat for its poor customer support, describing it as unresponsive and unprofessional.

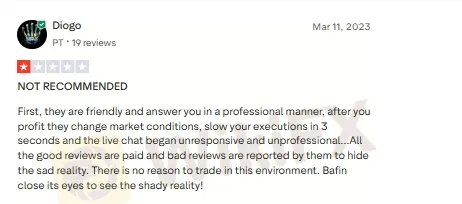

2. Unprofessional Live Chat

Another user mentioned that while the live chat agents initially appear friendly and professional, their service quality quickly deteriorates. Users reported execution delays of up to three seconds and claimed that the live chat later became unhelpful and unprofessional. According to this user, “There is no reason to trade in such an environment.”

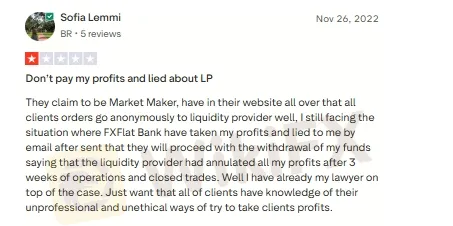

3. Misleading Communication with Customer

One client stated that FXFlat misled him regarding the withdrawal of his profits. After being assured via email that the funds would be processed, the company allegedly failed to deliver on that promise.

4. Allegations of Fraudulent Activity

Another user labeled FXFlat a “scam company,” claiming that the broker refused to release client funds, deleted profits, and banned accounts. The user warned others: “Do not deposit here! Stay away!”

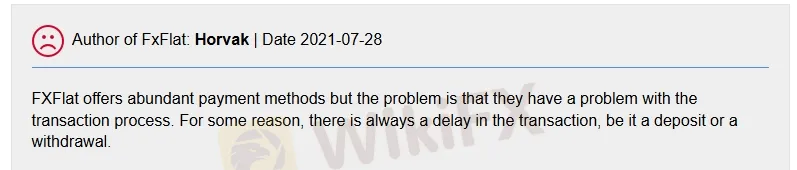

5. Problematic Transaction Process

Although FXFlat offers multiple payment options, some clients reported consistent delays and issues with transaction processing, calling the system unreliable.

Conclusion

Youve read this FXFlat Review 2025 and now understand the broker more clearly. The Trustpilot reviews reveal what traders really think — some even warn of a potential scam alert.

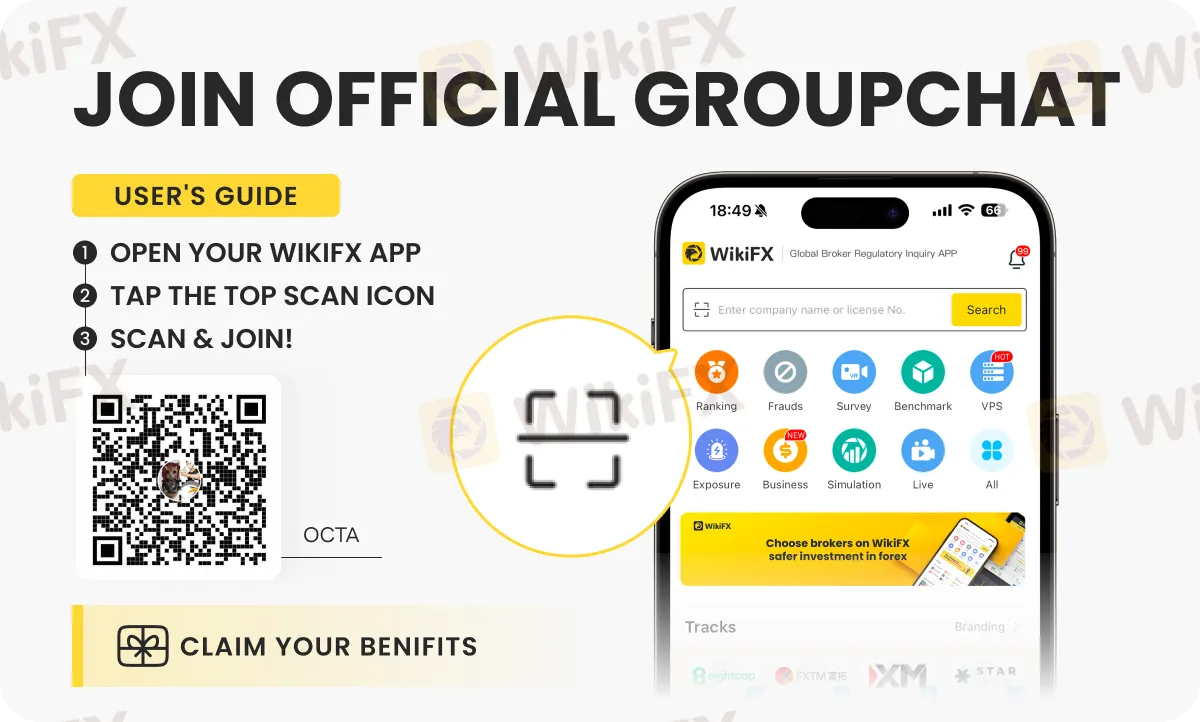

We‘ve created a Octa Broker small community of passionate traders where we share competitions, contests, and the latest daily news, etc. We’d love to have you there!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

Despite holding a recognized license in Hong Kong and maintaining a seemingly high score on some metrics due to its establishment year, the broker JRJR (金荣中国) has become the subject of an alarming volume of trader complaints. In the last three months alone, WikiFX has received over 141 individual complaints. The core risk isn't just market volatility—it is a systematic pattern of behavior that suggests trading conditions may be manipulated to ensure client losses, coupled with a refusal to process withdrawals for profitable accounts.

ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.