Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

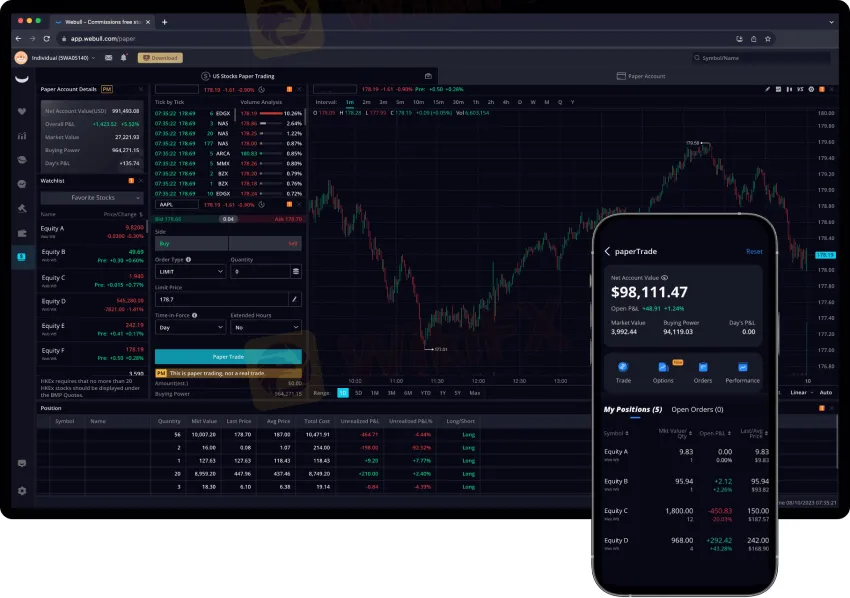

Abstract:Webull debuts corporate bond trading in the U.S. with 0.10% spreads, $10 minimums, and S&P-rated IG and HY access on desktop and mobile platforms.

Webull (NASDAQ: BULL) has launched individual corporate bond trading for U.S. customers, enabling investors to buy and sell corporate bonds directly on its desktop and mobile platforms starting October 16, 2025. The rollout complements Webulls existing access to U.S. Treasuries and advances its fixed income strategy with a retail-friendly pricing model. The company is setting corporate bond transaction spreads at 0.10%, with a $10 minimum per trade, positioning the platform among the lowest-cost options for retail bond investors.

“Corporate bonds are a key part of a diversified portfolio, and we‘re proud to make them more accessible,” said Anthony Denier, Group President and U.S. CEO of Webull, noting the firm’s 2025 expansions into Treasuries and fractional bond trading to serve demand for diversification, income, and capital preservation across devices. Denier emphasized that retail participation in credit markets remains early, and platforms can streamline a more intuitive bond trading experience for individual investors.

Corporate bonds can offer predictable coupon income and return of principal at maturity, appealing to long-term investors seeking stability and steady cash flows alongside equity holdings. Webulls low-friction access and competitive pricing could lower barriers for retail investors to build laddered portfolios or target duration and credit exposures directly, rather than relying solely on bond funds. Expanded fixed income access on mainstream retail platforms may also help investors manage interest-rate risk and diversify their overall asset allocation.

By anchoring pricing to a 0.10% spread with a $10 minimum, Webull is signaling a cost-effective alternative for direct bond access versus traditional channels where retail investors often face wider spreads or opaque markups. The move follows early-2025 enhancements, including Treasuries and fractional bond trading, broadening the fixed income toolkit available to retail traders within a single app ecosystem. This trajectory aligns with Webulls broader strategy to combine low costs, robust tooling, and 24/7 multi-asset market access for its global user base.

Webull Financial LLC is registered with the SEC as a broker-dealer and with the CFTC as a futures commission merchant, and is a member of FINRA, NFA, and SIPC, while advisory services are offered by SEC-registered Webull Advisors LLC; registration does not imply any specific level of skill or training, and investing involves risk, including loss of principal. The company operates across multiple markets under Webull Corporation (NASDAQ: BULL), serving more than 24 million registered users globally with multi-asset trading and investor education resources integrated into its platform.

Webull indicates the corporate bond feature will expand geographically after the U.S. launch, with ongoing development in fixed income, including fractional access and potential additions such as municipal bonds referenced on its fixed income hub as “coming soon”. As retail investors continue to seek diversified income and risk management tools, streamlined bond access within retail-first platforms could accelerate the adoption of direct credit exposure in individual portfolios.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.