Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Is Aron Markets safe? Offshore registration, no valid oversight, 1:1000 leverage. Read pros/cons, account types, and user experiences.

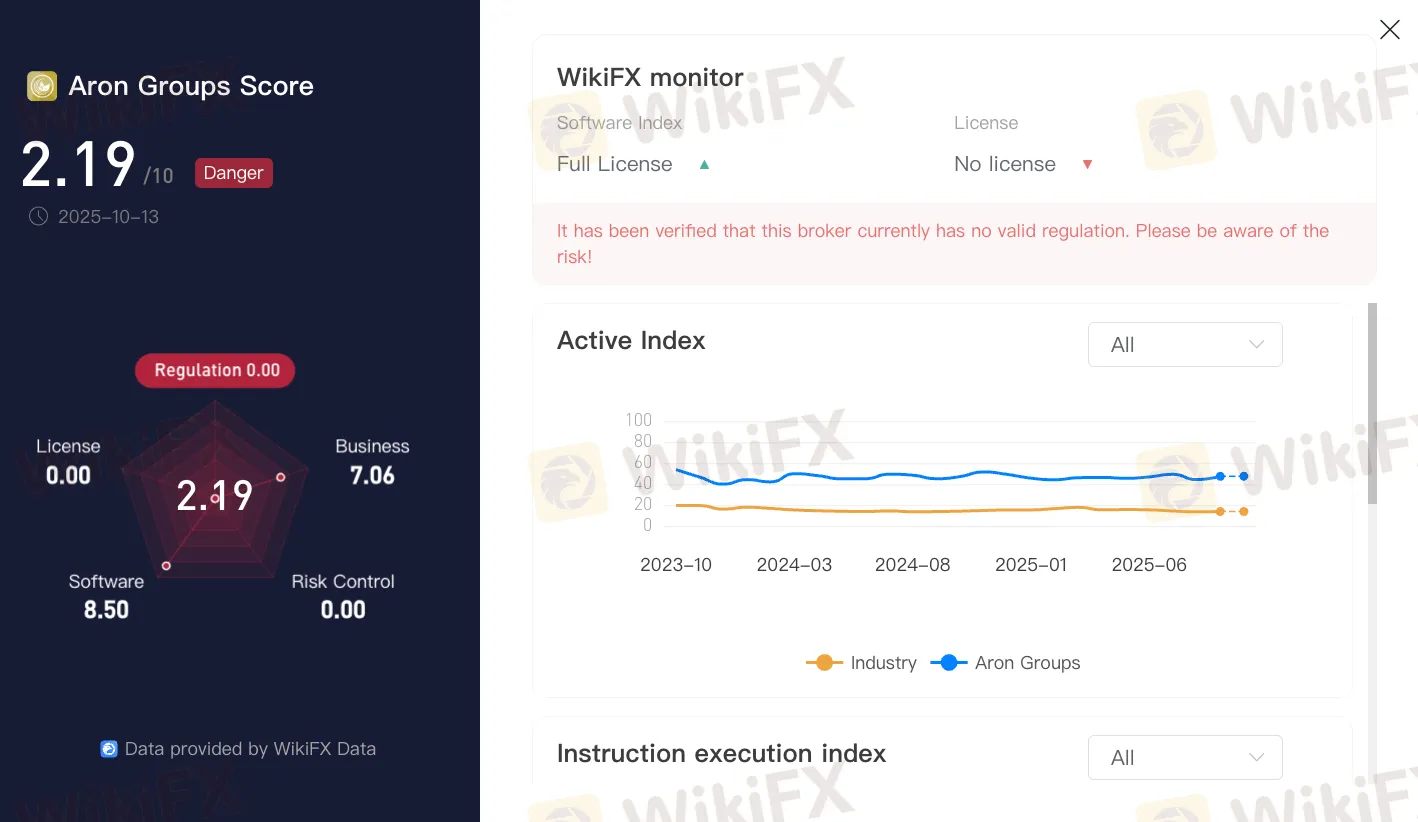

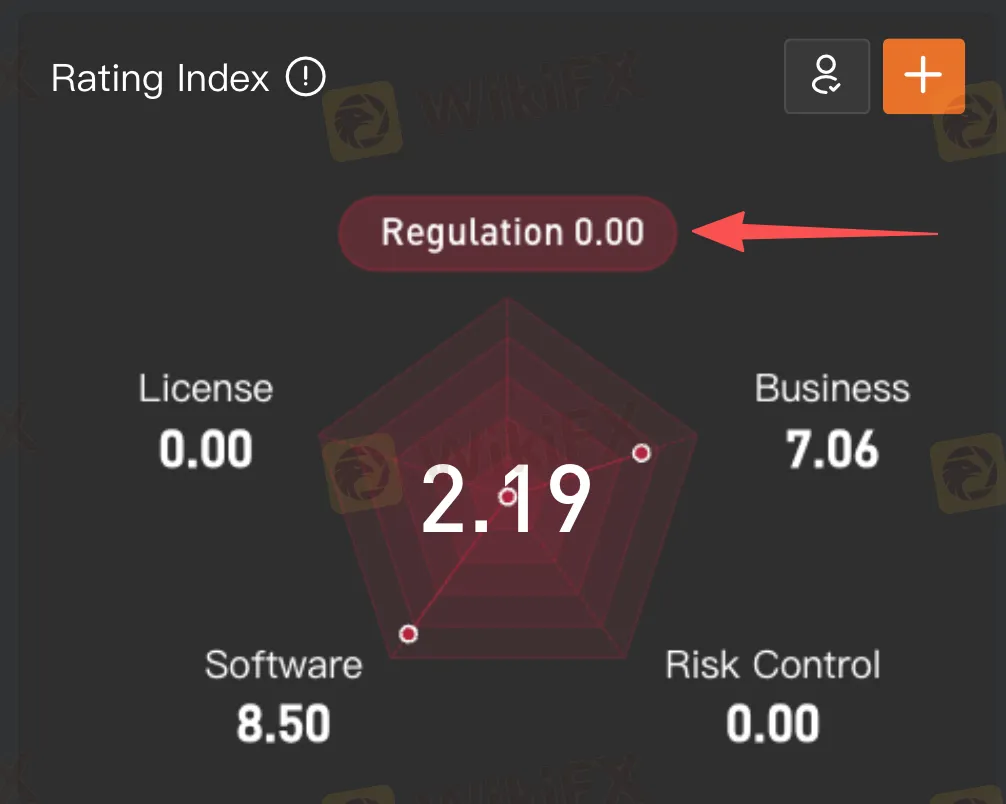

In the fast-paced world of forex trading, where every decision can impact your portfolio, one question stands out for potential users of Aron Markets: Is this broker truly safe, or do its low ratings and lack of regulation hint at underlying concerns? Aron Markets, operated by Aron Markets LTD and registered in the Marshall Islands, positions itself as an accessible platform for CFD trading on assets like Forex pairs, indices, commodities, and cryptocurrencies. Yet, with a WikiFX score of just 2.19/10—driven by zero regulation points and persistent user feedback—this review explores whether it meets the mark for reliability. We'll break down its license status, trading features, and real trader experiences to help you decide if it's worth the risk.

(Rating index displaying regulation at 0.00, overall score 2.19/10, and key metrics like software at 8.50 and risk control at 0.00.)

Aron Markets entered the market in 2020, offering a straightforward entry for traders interested in over 7 Forex pairs, 5 indices, 5 commodities, and 6 cryptocurrencies through CFDs. It includes a demo account for those testing the waters without real capital at stake. While the setup appeals to beginners seeking simplicity, the platform's offshore registration raises questions about long-term stability—especially when paired with its evaluation metrics. Transitioning to core concerns, the absence of strong oversight forms the foundation of many trader doubts.

At the heart of any broker's trustworthiness lies its regulatory framework, and here Aron Markets falls short with no valid licenses from recognized financial bodies. The WikiFX profile flags a “suspicious regulatory license,” assigning a regulation score of 0/10 and highlighting high potential risk due to the complete lack of verified oversight. This means no formal protections for client funds against mismanagement or mechanisms for resolving trade disputes—issues that become all too real in volatile markets. Without these safeguards, even routine operations can feel precarious, prompting traders to weigh the convenience against the exposure.

Aron Markets relies on MetaTrader 5 (MT5) across desktop, mobile, and web versions, complete with full software licensing for seamless access. Execution averages 174 ms, supporting strategies like scalping, while leverage extends up to 1:1000 on entry-level accounts. Spreads are fixed on Nano plans for predictability and floating on others to adapt to market flows. These elements provide a functional trading environment, but users often note the single-platform limitation as a hurdle when compared to multi-tool setups elsewhere.

Catering to varying experience levels, Aron Markets offers four live account types in USD, emphasizing low barriers:

| Type | Min. Deposit | Max Leverage | Spreads | Commission per Lot | Islamic? |

| Nano (Islamic) | $1 | 1:1000 | Fixed | None | Yes |

| Standard (ECN) | $50 | 1:400 | Floating | Varies | No |

| Islamic | $100 | 1:400 | Fixed | None | Yes |

| VIP (ECN) | $2,500 | 1:200 | Floating | 0.04% | No |

The Nano option, with its $1 entry and swap-free feature, draws newcomers, but higher-leverage accounts demand careful position sizing to avoid amplified drawdowns.

Funding is flexible, starting at $1 through over 15 methods. For instance, Tether (TRC20/BEP20) processes instantly at platform rates with a $25 minimum, while Ziraat Bank requires $50 and incurs 3% fees (minimum $2). Withdrawals begin at $20, with crypto options completing in 1 hour to 1 day and bank transfers up to 3 days, alongside fees like 0.5-1% on specific channels. This variety suits diverse preferences, though processing times can vary based on method and volume.

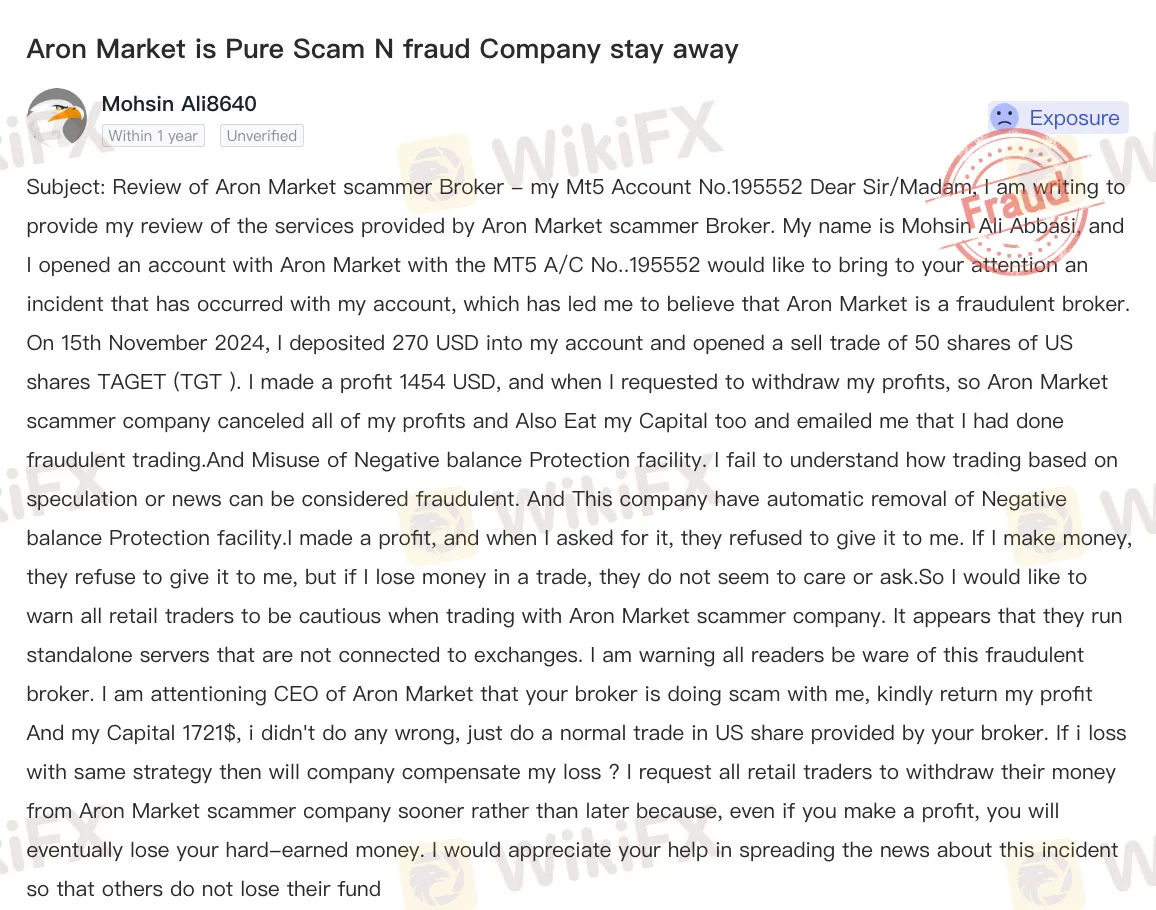

User complaints significantly influence Aron Markets' low WikiFX score, frequently touching on profit handling and withdrawal access. Consider this detailed account: A trader funded an MT5 account with $270 and entered a sell position on 650 TGT shares, yielding $1,454 in profits. When initiating a withdrawal, the gains were reversed, the initial capital deducted, and the broker attributed it to “fraudulent trading” involving negative balance protection—despite the position following standard market speculation. Unable to retrieve MT5 transaction logs or comprehensive statements, the trader expressed frustration over the lack of transparency in server operations and policy application. Such instances underscore recurring themes in feedback, where resolution processes feel opaque and tied to the platform's unregulated structure.

| Pros | Cons |

| $1 minimum deposit | No valid regulation |

| Up to 1:1000 leverage | MT5-only platform |

| Crypto processing speed | Withdrawal fees |

| Islamic accounts | Limited asset selection |

Ultimately, Aron Markets' absent regulatory licenses and the user complaints surrounding profits and withdrawals form the crux of its low WikiFX score, prompting a closer look at whether it aligns with your trading goals. While features like low entries and leverage offer appeal, the evaluation metrics suggest prioritizing platforms with stronger oversight for peace of mind. Forex trading inherently involves risks—always align choices with your strategy and perform thorough due diligence.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.