Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

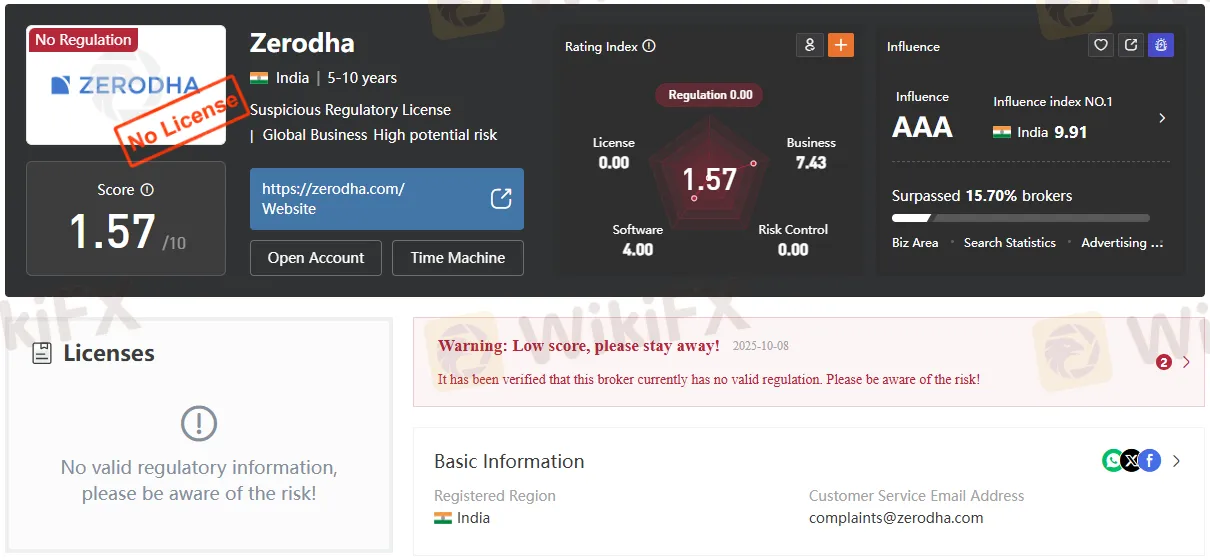

Abstract:Zerodha operates without valid regulation, posing high risks for traders. Learn the implications, risks, and compliance gaps in this in-depth analysis.

Zerodha, one of India's online brokerage firms, currently holds no recognized regulatory license—placing traders at greater risk should disputes or issues arise. As the company continues to attract a vast user base with competitive fees and an innovative platform, its lack of formal oversight calls for a careful, comprehensive risk assessment.

Despite its considerable footprint in the Indian market, Zerodha operates without regulation by any major financial authority—national or international. As of October 2025, the firm has been verified to lack any valid regulatory license, either in India or globally. Regulatory bodies such as the FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), and CySEC (Cyprus Securities and Exchange Commission) do not oversee Zerodha‘s operations. This absence means there’s no official recourse or protection for clients in case of broker misconduct, insolvency, or disputes.

Regulation is crucial in financial services. Agencies like SEBI, FCA, or ASIC set rules to ensure transparency, capital adequacy, segregation of funds, and fair business practices. When a broker is unregulated:

Since its launch in 2010, Zerodha has not secured a license from any recognized securities regulator for its core services. Its website openly shows no official licensing credentials. Platform registration data further confirms this, even though its core domain (zerodha.com) is active and secured.

Potential Risks for Zerodha Traders

Zerodhas platform allows users to trade in:

Notably, forex, global derivatives, commodities, and cryptocurrencies are not offered.

Zerodha offers various account categories: personal, HUF, NRI, minor, and corporate. All accounts provide the same product range, with no options for Islamic (swap-free) accounts or international trading. Demo accounts for strategy testing are available.

Fee Structure: Attractive But Not the Only Factor

While Zerodha is celebrated for its low-cost trading, this affordability—without the protection of regulatory compliance—should be weighed carefully by both new and seasoned traders.

Deposits: Low minimums (as low as ₹1), instant UPI options, and no fees on most deposit methods. Withdrawals are processed through the proprietary platform with no set minimums or fees, arriving usually within 24-48 hours.

Many traders praise Zerodhas user-friendly portal and app ecosystem, including tools like Kite, Console, and Coin. However, industry experts and retail investors frequently raise concerns about the absence of formal regulation, warning that exposure to high risk is the price of convenience.

“A low fee structure shouldnt blind traders to the lack of oversight. If something goes seriously wrong, no one is obliged to intervene on your behalf.” — Independent Financial Analyst.

Industry review sites and compliance databases consistently issue a warning: Zerodhas “no valid regulation” status scores as a high potential risk for individual and institutional clients. Those prioritizing security, compensation in case of disputes, or industry-standard protections should proceed with caution or consider fully regulated alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.