Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:TastyTrade is an unregulated broker with a low trust score, and high-risk warnings. Get the facts before you trade.

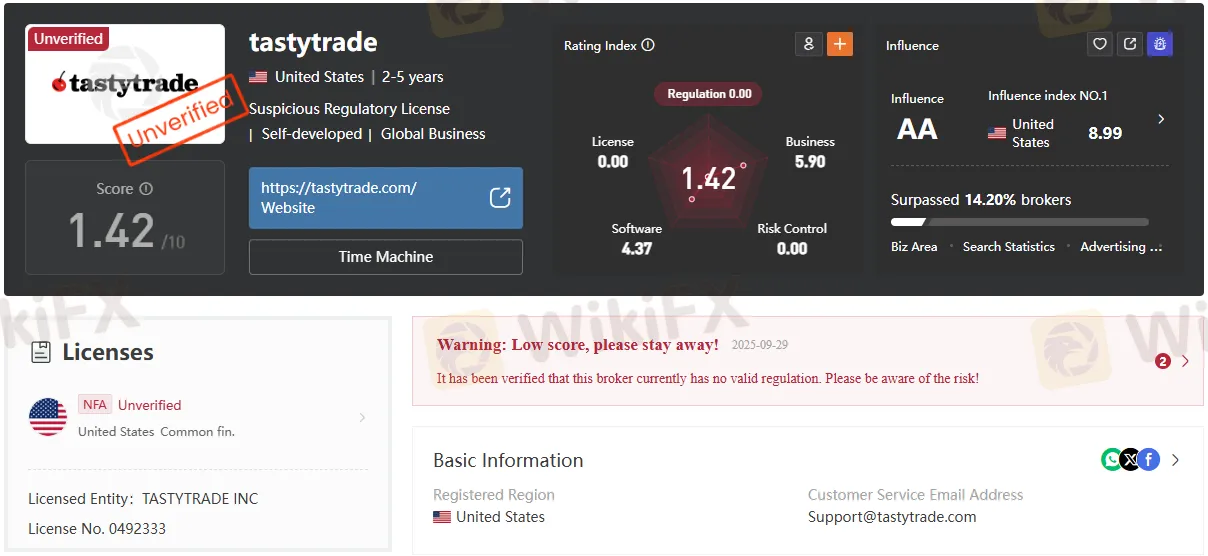

tastytrade is presented as operating without a currently valid regulatory license, with an “Unverified” status tied to an NFA reference, signaling elevated counterparty and compliance risk for prospective clients seeking a regulated brokerage relationship. The profile flags a low trust score and an explicit warning to “stay away,” indicating users should proceed with heightened caution and independent verification before opening or funding accounts.

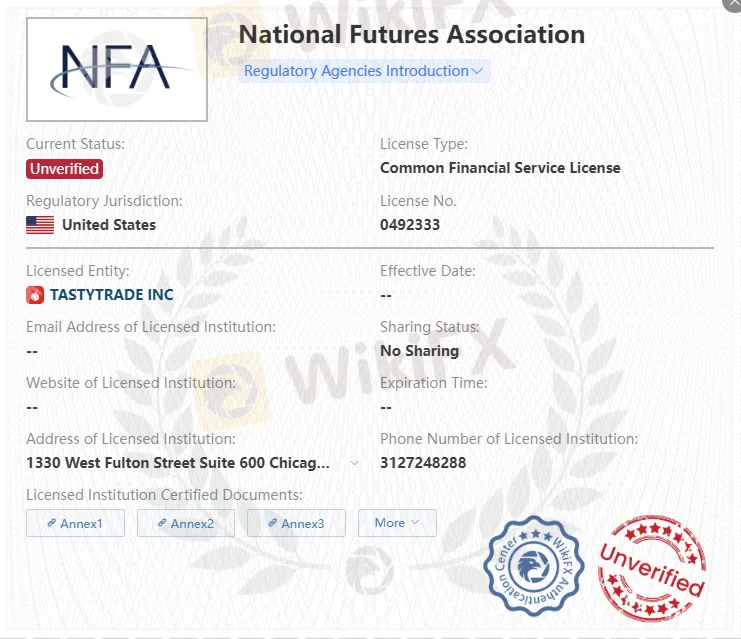

The document lists tastytrades jurisdiction as the United States with an NFA-related entry marked “Unverified,” accompanied by a claim that the broker “currently has no valid regulation” and a low score of 1.42/10 on the referenced ratings page. It also displays a license number “0492333” next to TASTYTRADE INC, but simultaneously labels the NFA line as “Unverified,” which underscores the need to cross-check with primary regulators.

The page issues a conspicuous warning—“Low score, please stay away!”—and states it has been verified that there is no valid regulation at present, which, if accurate, suggests limited recourse mechanisms and a higher risk of operational or compliance lapses for clients. A low composite score, zero in “Regulation,” and the “Unverified” badges collectively indicate significant uncertainty around oversight and consumer protections.

Despite the regulatory concern, the profile describes a broad product suite: stocks, options, futures, crypto, options on futures, ETFs, commodities, and indices, alongside multiple account types spanning individual, joint, retirement, entity, trust, and international accounts. It notes commissions “from $0” and availability across desktop, browser, mobile, and iPad, with funding by bank or wire transfer and check, highlighting a retail-friendly commercial offering.

The summary dates the firm‘s founding to 2006 in the United States and reports roughly “2–5 years” in the specific listing’s age designation while asserting nearly 20 years of operations—an internal inconsistency that reinforces the need for direct regulator lookups. The listing provides an address on West Fulton Street in Chicago and a phone number, details that can be used for independent validation against regulator records and corporate registries.

Given the “Unverified” status and “no valid regulation” claim, traders should independently query primary databases such as official NFA registrant search or state-level corporate records to confirm current authorization before engaging services or wiring funds. Where verification fails or remains unclear, risk management best practice is to avoid funding, seek alternative regulated brokers, and document any communications for potential dispute resolution needs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.