Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

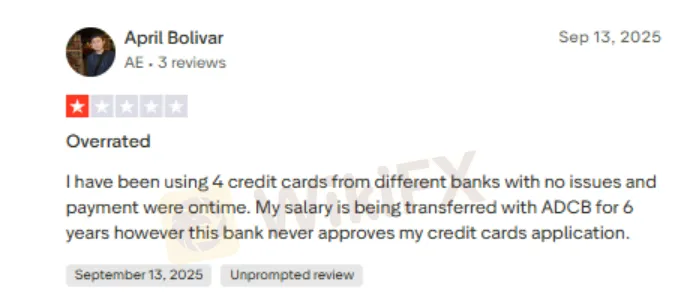

While new customers always face issues, old customers are not behind either. One customer with over six years of banking experience with ADCB has failed to get a credit card approved. Annoyed by a poor response, the customer complained about it online. We have shared the complaint below in a screenshot. Take a look!

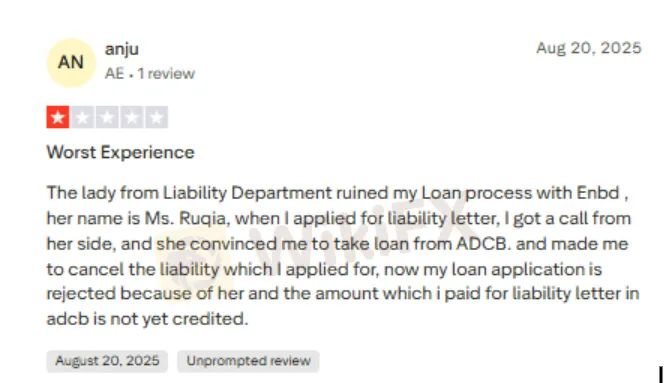

Banks are often found snatching customers from each other, given the intense competition in the banking landscape. In one such case, an ADCB executive called the customer who had initially applied for liability at another bank. Convinced over the call, the customer cancelled the liability of another bank and instead applied for a loan at ADCB. However, ADCB rejected his loan application. Whats more, the amount paid for the liability letter has not yet been credited. Check the screenshot below to know how the incident unfolded as per the ADCB customer review.

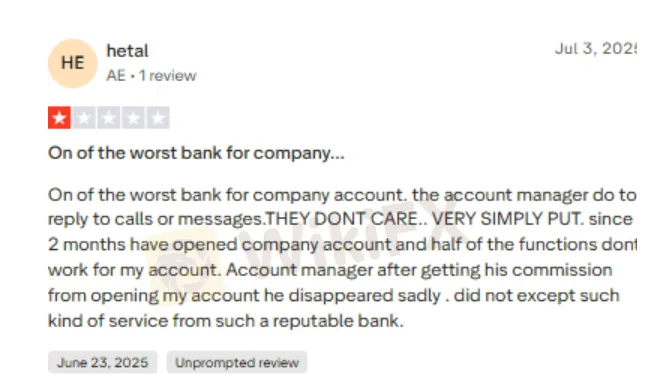

Poor banking services have been affecting many customers. Some of them have complained about the faulty system in place and unresponsive account managers who do not respond to customer queries. The bank appears to have forgotten the principles that help retain customers. The complaint screenshot shared below reaffirms the point made above.

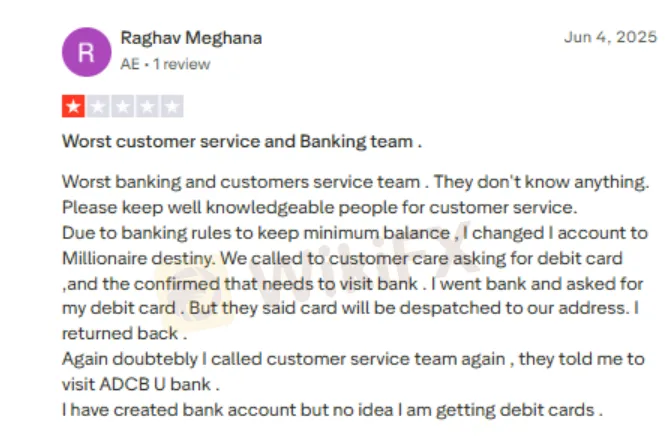

ADCB Bank officials appear to be either unsure or are deliberately making customers frustrated. In one incident, the customer called the customer care for a debit card after changing the account type. The customer care official asked the customer to visit the bank. Upon reaching the bank, the customer asked the official there. The customer was told that the debit card would be delivered to his home. After not receiving the debit card for some days, the customer again called customer care, where officials told him to visit the bank again. The painful cycle created by the banking and customer service teams is totally uncalled for. Here are the painful words from the customer.

WikiFX, a leading broker regulation inquiry app, is concerned about the numerous issues customers face at ADCB regarding products and services. The complaints shared above are serious and have to be looked into by the bank. The score for ADCB is merely 1.54 out of 10.

Watch WikiFX Masterminds to know more about forex scams and other financial news.

Here is how you can dive into this group -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!