Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Don’t fall for the trap- stay alert and read on to protect yourself from being looted.

SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Dont fall for the trap- stay alert and read on to protect yourself from being looted.

1. Lack of Strong Regulatory Supervision

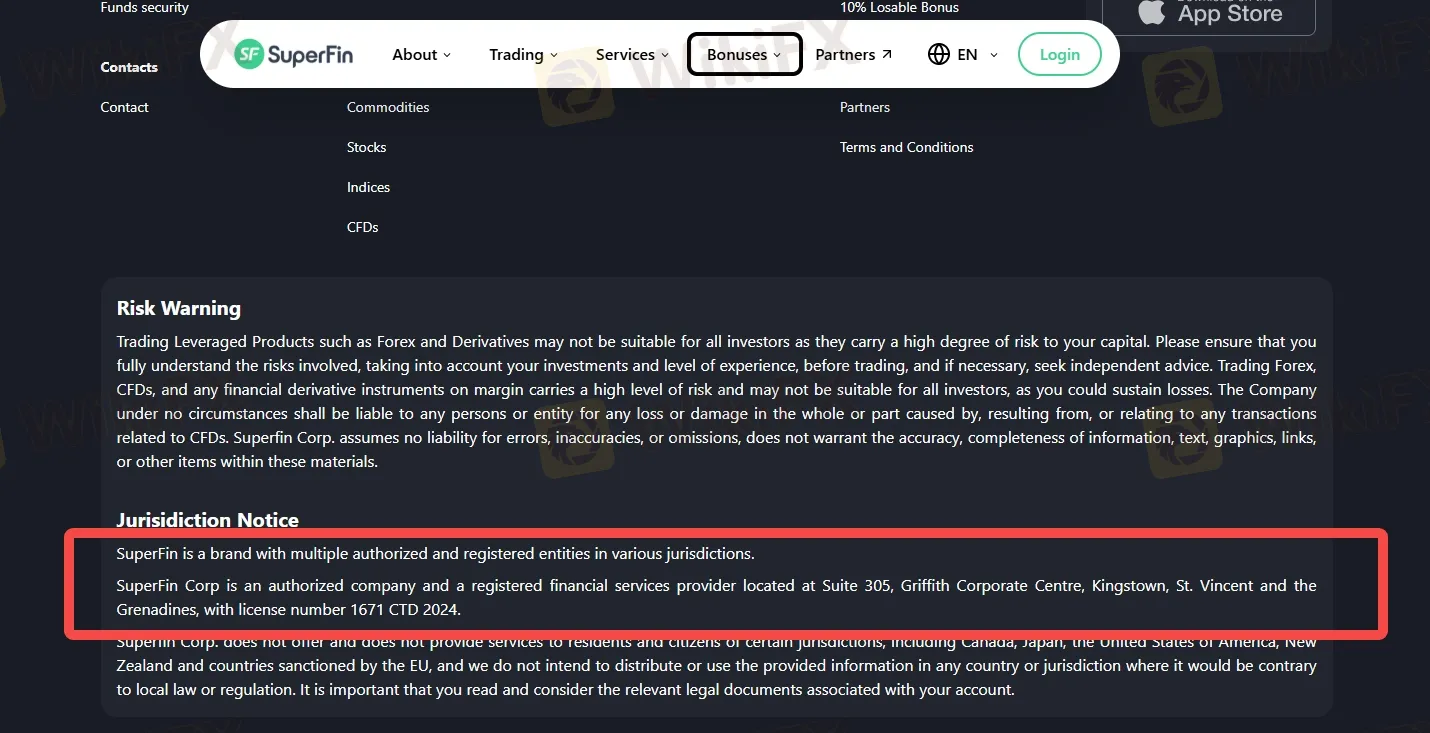

SuperFin Corp is registered in St. Vincent and the Grenadines and operates under license number 1671 CTD 2024. While this registration gives the company a legal business identity, it's important to note that this offshore jurisdiction is known for its limited investor protection. Unlike brokers regulated by tier-one authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), entities licensed in St. Vincent and the Grenadines are not held to the same rigorous standards of transparency, capital adequacy, or client fund segregation.

2. Attractive Yet Flashy Promotions

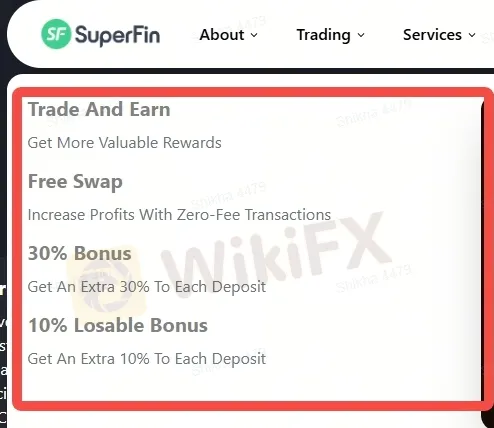

SuperFin aggressively markets itself with bold and flashy promotions designed to attract new traders and retain existing ones. Campaigns like “Trade and Earn” promise valuable rewards, while financial incentives such as a 30% deposit bonus and a 10% losable bonus aim to boost traders capital. SuperFin offers a free swap feature, which allows traders to hold positions overnight without paying swap fees, potentially increasing profitability. However, while these offers may look appealing on the surface, traders should be cautious.

3. Limited Platform Availability

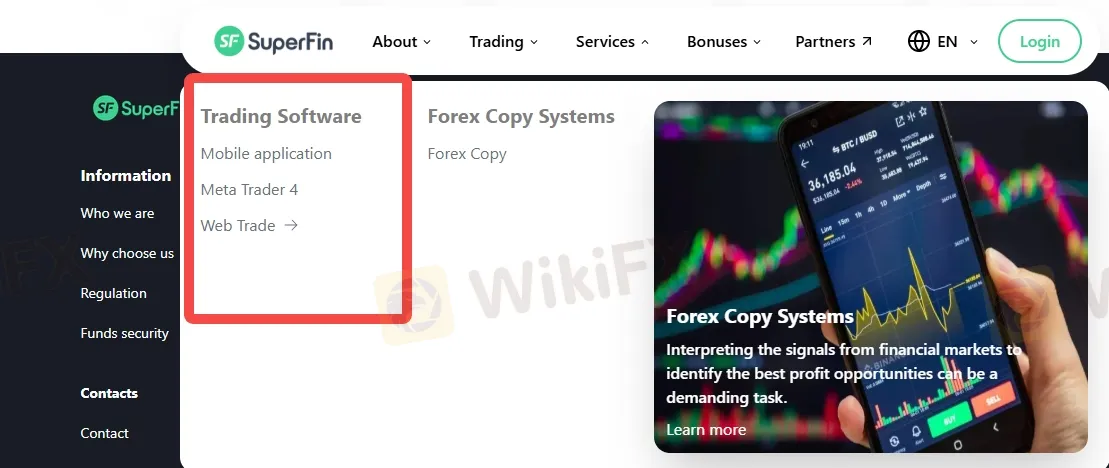

SuperFin currently offers trading exclusively through the MetaTrader 4 (MT4) platform. While MT4 is one of the most widely used platforms in the forex industry, known for its user-friendly interface, advanced charting tools, and automated trading capabilities via Expert Advisors (EAs), it is also somewhat outdated compared to newer platforms like MetaTrader 5 (MT5) or cTrader.

The absence of platform diversity could be a disadvantage for professional or multi-asset traders who expect broader functionality and integration across different devices and asset classes.

What WikiFX Reveals about SuperFin?

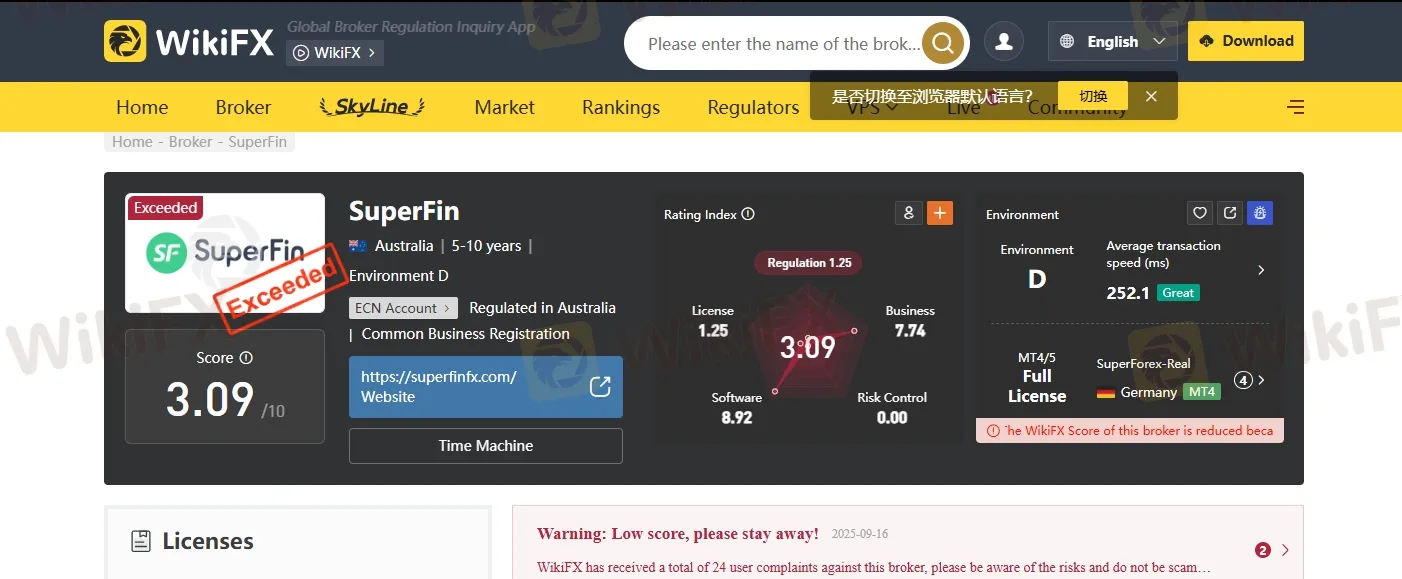

According to WikiFX, SuperFin has received a poor trust score of just 3.09 out of 10, indicating serious concerns about the brokers credibility and overall reliability. WikiFX has also issued an explicit warning against using the platform, stating: “Warning: Low score, please stay away!”

This low rating reflects multiple risk factors, including weak regulatory oversight, questionable transparency, and potentially unsafe trading conditions. For traders seeking a secure and trustworthy trading environment, such a low score should serve as a major red flag and a strong reason to reconsider opening an account with SuperFin.

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.