Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

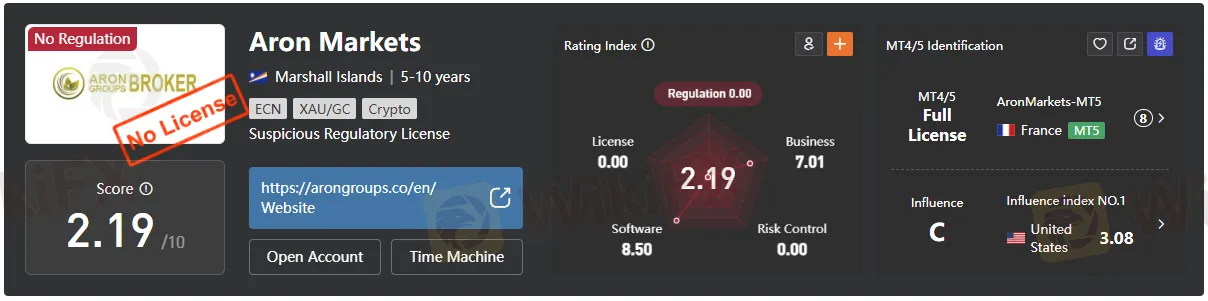

Abstract:Aron Markets is an unregulated offshore broker with high leverage and mounting risk warnings—read this 2025 review before depositing funds.

In 2025, choosing a forex and CFD broker demands extreme vigilance: regulation, fund safety, and transparency are no longer optional. Offshore firms can expose traders to grave withdrawal delays, platform manipulation, and almost no legal recourse. Aron Markets (often linked with Aron Groups) stands out for its Marshall Islands registration, total lack of credible oversight, and a mounting chorus of industry alerts that flag it as high risk. This review assembles evidence—licensing gaps, offshore location, products, platforms, leveraged risk, and red flags—to decisively signal whether Aron Markets poses a threat to your capital.

Aron Markets/Aron Groups presents itself as a multi‑asset brokerage brand, with corporate disclosures stating incorporation in the Marshall Islands via “Aron Markets LTD” and listing a Trust Company Complex address and registry number in the site's legal pages. The Marshall Islands does not operate a dedicated forex regulatory framework, meaning such incorporation does not equate to client‑fund protections, prudential audits, or dispute‑resolution mechanisms associated with top‑tier regulators. Independent broker intelligence services repeatedly note that Aron Markets/Aron Groups is not authorized by any recognized financial authority and warn that investor protection is absent. These findings are echoed in broader risk analyses that advise avoiding unregulated or low‑tier jurisdictions when real funds are at stake.

Aron Markets promotes multi‑asset CFD trading that includes forex pairs, commodities, indices, cryptocurrencies, and shares, positioned through the MetaTrader 5 platform. WikiFXs broker summary cites flexible account structures with variable or fixed spreads and leverage extending to 1:1000 on “Nano” accounts, with floating spreads on standard and VIP tiers. While MT5 is a robust, widely used platform, platform quality does not substitute for licensing safeguards such as segregated client funds under strict supervision or access to recognized compensation schemes.

The brand runs time‑bound promotions and bonuses, including a 2025 “comeback bonus” aimed at clients who experienced losses during a defined period, which signals ongoing marketing activity but does not change the regulatory picture. Bonus schemes at unregulated brokers often include restrictive terms on withdrawals or trading volume, so traders should scrutinize conditions carefully before accepting incentives.

Industry trackers and forum‑style journals have discussed Aron Groups operational terms—such as the ability to alter spreads in abnormal market conditions and policies around negative balance—details that can materially affect trading outcomes at an unregulated venue. Separate monitoring sites have also published investor complaints and accusations related to licensing and withdrawals, which, while anecdotal, align with the structural risks of operating without recognized supervision.

Top‑tier regulators like the FCA, ASIC, and others enforce stringent capital requirements, client‑money segregation, transparency in pricing/execution, robust complaint handling, and access to formal dispute resolution—protections that Aron Markets lacks due to its unregulated status. Reputable comparison resources therefore recommend prioritizing brokers supervised by top‑tier authorities and caution against depositing with offshore entities where remedies are limited.

Given the absence of recognized regulation, offshore registration, and repeated warnings from multiple independent broker‑review sources, Aron Markets is best categorized as a high‑risk option in 2025. While MT5 access and broad market coverage may appear attractive, these features do not offset the critical deficiency of investor protections and the heightened probability of unfavorable outcomes at unregulated firms.

Aron Markets combines offshore registration, no recognized license, very high leverage, and persistent third‑party warnings—factors that collectively elevate risk far beyond acceptable levels for most retail traders in 2025. Those seeking forex and CFD exposure should favor brokers licensed by top‑tier regulators, where client funds, dispute processes, and operational standards are enforceable under law.

Dont get swayed by flashy marketing. Simply scan the QR code below to download the WikiFX app and quickly verify brokers right from your phone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.