Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

Forex trading has become very popular among Indian traders in recent years. This growing interest is one of the reasons why the Forex market has a bright future in India. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because they make common mistakes. Which are these mistakes? Read below.

1. Overtrading

Overtrading is one of the common mistakes made by Indian Forex traders. Many traders get too excited or impatient and place too many trades without a clear plan. This can lead to losses, especially if the trades are based on emotions and not proper analysis. Trading too often also increases the chances of making mistakes. It's better to take fewer trades with proper research than to trade all the time without a strategy.

2. Trading Through Unregulated or Illegal Brokers

Indian traders choose brokers that are not regulated or are operating illegally in India. Many traders dont check whether the broker is approved by any financial authority or not. Unregulated brokers can shut down without warning, block your withdrawals, or even disappear with your funds. To stay safe, always make sure the broker is authorized by SEBI (in India) or well-known international regulators like the FCA (UK) or ASIC (Australia) etc. If the broker is not regulated by any of these bodies, avoid them completely.

3. Falling for Fake Promotions

Many traders fall prey to fake Forex brokers that promise guaranteed profits, huge bonuses. These are classic scam tactics to steal your money. Always Be skeptical of offers that sound too good to be true. Check platforms like WikiFX to verify broker credibility, ratings, and user reviews before depositing any money.

4. Relying on Telegram Groups or Finfluencers

A growing number of Indian traders follow random tips from Telegram or WhatsApp groups or so called Finfluencers without verifying them. These tips often come from unqualified sources or scam groups looking to manipulate traders. Avoid “get-rich-quick” tips. Build your own trading knowledge, or rely on analysis from licensed financial advisors.

5. Neglecting Education & Strategy

Many Indian Forex traders start trading without first learning the basics. They dont take the time to understand how the market works, how to read charts, or how to use trading tools. Without proper knowledge, They make poor decisions and lose money. To trade successfully, it's important to learn, practice, and build a solid trading plan before putting real money at risk.

6. Ignoring RBI Regulations

Another serious mistake is ignoring the rules set by the Reserve Bank of India (RBI). Many traders use international brokers to trade currency pairs that are not allowed under Indian law. This can lead to legal trouble and financial penalties. RBI only permits trading in a few specific pairs involving the Indian Rupee, and only through SEBI-registered brokers. It's important to follow these rules to stay safe, legal, and protected as a trader.

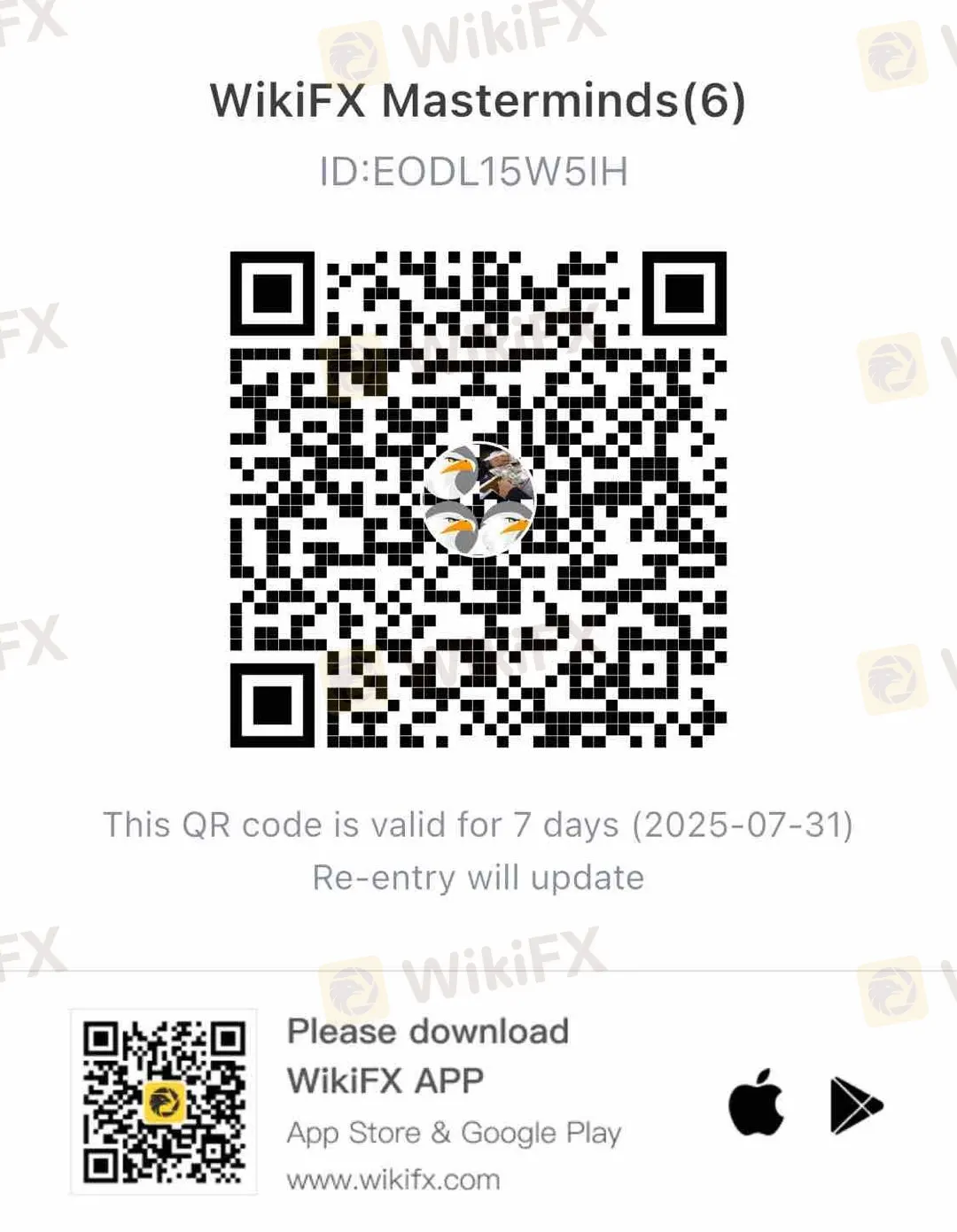

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

WikiFX is launching the "Safe Trade with WikiFX" exclusive interview series, featuring members of the WikiFX Elite Club. This series delivers in-depth industry insights on trading safety, the establishment of industry standards, and regional market dynamics, aiming to foster deeper understanding of local markets and jointly advance transparency across the industry.