Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When it comes to online trading, the broker you choose can make or break your trading journey. A reputable and regulated broker offers a sense of security and accountability, while unregulated brokers often pose significant risks to traders. Aron Markets is one such broker that raises multiple concerns due to its lack of valid regulation and its registration in a high-risk offshore location.

When it comes to online trading, the broker you choose can make or break your trading journey. A reputable and regulated broker offers a sense of security and accountability, while unregulated brokers often pose significant risks to traders. Aron Markets is one such broker that raises multiple concerns due to its lack of valid regulation and its registration in a high-risk offshore location.

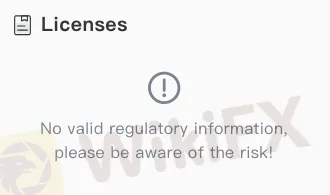

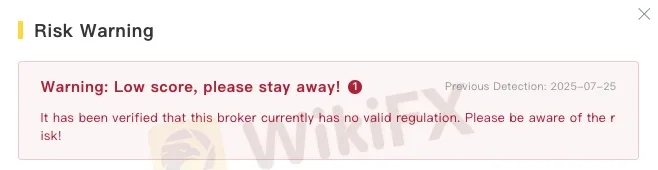

According to WikiFX, a leading global broker regulatory query platform, Aron Markets currently has no valid regulation. This means the broker operates without oversight from any recognized financial authority, leaving traders vulnerable in the event of disputes, withdrawal issues, or fraudulent activities.

Unregulated brokers are often associated with various scams in the trading industry. Without a regulatory framework to ensure fair operations, brokers like Aron Markets can potentially manipulate trading platforms, delay withdrawals, or impose unfair terms without facing consequences.

Another red flag is that Aron Markets is registered in the Marshall Islands, a jurisdiction notorious for its lack of clear financial regulation for forex or trading brokers. While setting up a business in such locations is legal, it is often a tactic used by brokers to avoid strict regulatory requirements.

The absence of rigorous oversight in offshore jurisdictions means traders have limited or no legal recourse if issues arise. In many cases, offshore brokers have been linked to trading scams, exploiting the lack of accountability to engage in unethical practices.

Aron Markets has a WikiScore of just 2.17/10, a rating derived from evaluating various factors such as regulatory status, licenses, trading environment, risk control measures, and overall business operations. This extremely low score highlights the potential dangers of trusting this broker with your capital.

Traders should take such warnings seriously. A low trust score, combined with the lack of regulation and offshore registration, is a classic combination of red flags that experienced traders associate with high-risk operations or possible scams.

With so many scams and fraudulent schemes targeting online traders, due diligence is non-negotiable. Aron Markets lack of regulation, coupled with its Marshall Islands registration, places it firmly in the high-risk category. Traders must exercise extreme caution and consider whether the potential rewards of trading with this broker outweigh the risks.

Choosing a regulated broker with a proven track record is always safer than entrusting your funds to a company that operates in a grey zone.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!