WikiFX Deep Dive Review: ExpertOption

Reference to WikiFX records shows that **ExpertOption is a high-risk broker.** While the company has been operating since 2017 and has a popular trading app, the safety foundations are weak.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract: Artificial intelligence is reshaping industries, but its rapid adoption has also opened new avenues for fraudsters. In 2025, platforms like Facebook, X, and Telegram are emerging as hotbeds for scams targeting investors. Regulators, including NASAA, have raised alarms about the growing use of AI to deceive and defraud unsuspecting victims.

Artificial intelligence is reshaping industries, but its rapid adoption has also opened new avenues for fraudsters. In 2025, platforms like Facebook, X, and Telegram are emerging as hotbeds for scams targeting investors. Regulators, including NASAA, have raised alarms about the growing use of AI to deceive and defraud unsuspecting victims.

The New Face of Investment Scams

According to NASAA, 38.9 percent of regulators anticipate a surge in scams involving AI-generated content. Fraudsters are now using sophisticated tools to produce professional-quality graphics and videos that lend an air of legitimacy to fraudulent schemes. These scams prey on investors fears of missing out or the allure of quick riches, often masking their true intentions behind a veneer of cutting-edge technology.

Deepfakes: When Reality Is Faked

A concerning trend noted by 22.2 percent of regulators is the use of AI to create deepfake images, videos, and even voices of well-known figures. These highly realistic fabrications are designed to trick victims into believing that influential personalities endorse certain investments or strategies. By mimicking the appearance and sound of trusted figures, criminals can mislead investors and manipulate decision-making.

“AI investing is the latest technology to make waves in the investing landscape and fraudsters are pitching new investments that often have nothing to do with the latest tech developments and instead play on fear of missing out or get rich quick schemes along with other heightened emotions,” said Leslie Van Buskirk, NASAA President and Wisconsin Securities Administrator.

How Fraudsters Are Exploiting AI

Bad actors are already capitalizing on AIs capabilities in several alarming ways:

What Investors Can Do

With the rise of AI-driven scams, its essential to stay informed and vigilant:

Conclusion

As AI continues to revolutionize the investment landscape, it also arms fraudsters with new methods to deceive. Regulators warnings serve as an important reminder: remain cautious and always conduct thorough research before making any investment decisions. By staying informed and vigilant, investors can protect themselves against the sophisticated, AI-driven scams that are set to rise in 2025.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Reference to WikiFX records shows that **ExpertOption is a high-risk broker.** While the company has been operating since 2017 and has a popular trading app, the safety foundations are weak.

If you are looking into ICM Capital (also known simply as ICM), you might be attracted by their established history since 2017 or their access to the MetaTrader platforms. However, glancing at the surface isn't enough when your capital is at risk. With a concerning WikiFX Score of 2.46 out of 10, this broker is currently flashing warning signals that every potential client needs to understand before hitting the "Deposit" button.

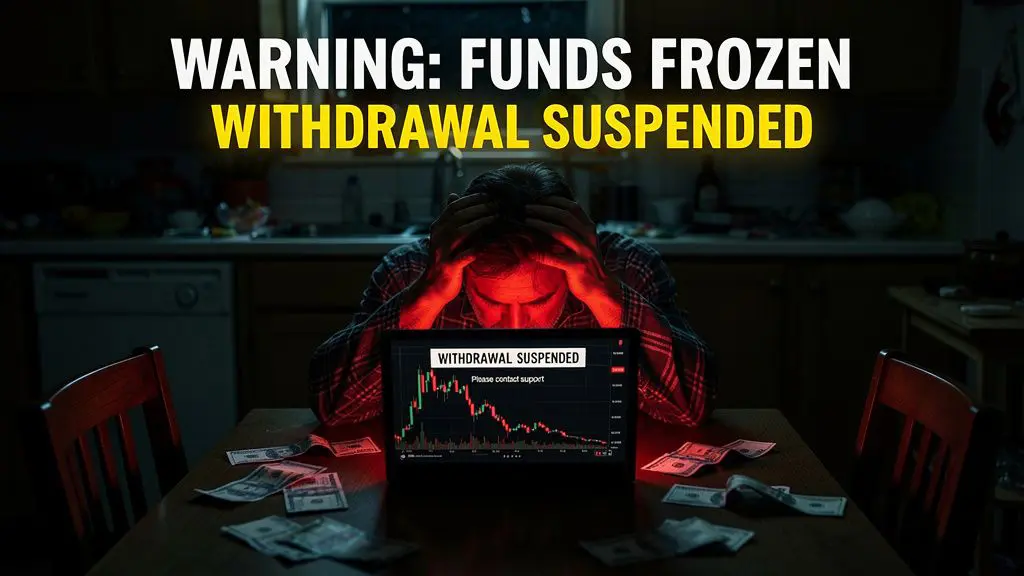

In the world of online trading, trust is the currency that matters most. However, recent data aggregation by WikiFX has signaled a "level red" alert regarding Tradeview Markets. Between July and November 2025, our support center was flooded with complaints alleging that the broker unilaterally wiped out account balances under the guise of "negative balance reversal," while simultaneously employing "account deletion" tactics in Asian markets. This report investigates the alarming patterns behind these complaints and analyzes why existing regulations failed to protect these traders.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.