Singapore vs Malaysia: Who’s Winning the Scam War?

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Online investment scams have evolved beyond mere phishing attacks impersonating real companies. Now, scammers have started utilizing AI bots to impersonate investment experts, promising high returns and financial advice. Beware if something sounds too good to be true coming your way.

Online investment scams have evolved beyond mere phishing attacks impersonating real companies. Now, scammers fabricate entire entities, including company names, registration details, and promised high returns, all of which are entirely fictitious.

Robert Duncan, vice president of product strategy at Netcraft, highlighted the evolving risks posed by these scams. Unlike traditional phishing schemes, victims willingly part with money, potentially leading to significant financial losses. The jurisdictional nuances further complicate matters, as banks may handle such cases differently.

Collaboration between regulatory bodies and industry partners becomes imperative in combating these threats, Duncan emphasized. Institutions, alongside individual consumers, face varying risks ranging from financial loss to reputational damage.

Netcraft researchers underscored the global scope of online investment scams in a recent blog post. These schemes lure investors with promises of high returns and minimal risks, often touting once-in-a-lifetime opportunities. However, these claims are baseless, and victims end up losing their investments.

Recent data from the Federal Trade Commission (FTC) and the FBI's Internet Crime Report highlight the alarming growth and financial toll of investment scams. The sophistication of these scams, complete with fake trading platforms and manipulated data, makes them highly convincing to unsuspecting investors.

Ted Miracco, CEO at Approov, noted the use of bots to simulate group chats with fake experts, adding an illusion of legitimacy. Mika Aalto, CEO at Hoxhunt, highlighted the psychological manipulation tactics employed by scammers, exploiting our trust in authority figures and desire for easy rewards.

Aalto emphasized the creation of entire fake communities and support systems by these scams, making them exceptionally potent. Moreover, the integration of AI-powered bots further complicates efforts to expose fraudulent activities.

Krishna Vishnubhotla, VP of product strategy at Zimperium, warned of the escalating threat posed by mobile devices, messaging, and social apps. These platforms provide scammers with continuous access to potential victims, facilitating the spread of fraudulent schemes.

The inherent trust in personal devices makes individuals vulnerable to sophisticated social engineering tactics employed by cybercriminals. Vishnubhotla highlighted the ease with which legitimate financial applications can be cloned and distributed, amplifying the efficiency and reach of these scams.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

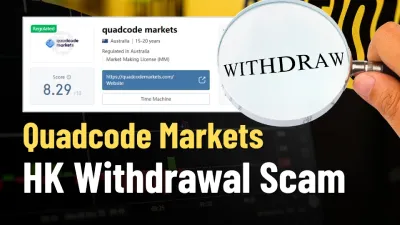

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!