FINRA Fines Mundial Financial $100K for Violations

FINRA fines Mundial Financial Group $100K for compliance failures, AML violations, and unregistered principal activity.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

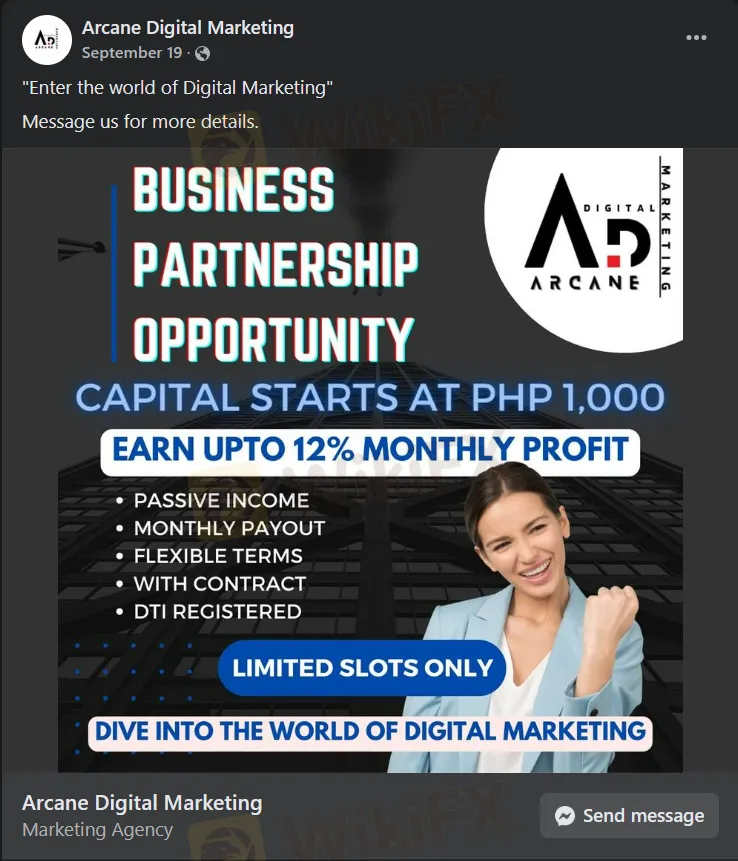

Abstract:The Philippine Securities Commission has warned against ARCANE DIGITAL MARKETING for conducting unauthorized investment activities. The company, which operates online, entices public investments with promises of 12% to 45% profits in 45 days on a minimum investment of Php1,000.00. These activities, resembling securities under the Howey Test, are unregistered and illegal. ARCANE DIGITAL MARKETING is not a registered corporation or partnership and lacks legal authorization for such activities, violating the Securities Regulation Code. The public is advised against investing and to report suspicious activities.

The Securities Commission of the Philippines has issued a critical warning against ARCANE DIGITAL MARKETING, an online entity found to be conducting investment activities without the necessary legal authorization.

Investigations reveal that ARCANE DIGITAL MARKETING, an emerging social media platform, is luring the public into investing a minimum of Php1,000.00. They promise high returns between 12% to 45% profit in just 45 days. However, this enticing offer is not legally sanctioned.

The investment packages proposed by ARCANE DIGITAL MARKETING resemble securities, as defined by the Howey Test. They require no effort from investors other than the initial financial contribution, expecting a profit in return. Such activities involving securities must be registered with the Commission, which ARCANE DIGITAL MARKETING has failed to do.

The company is neither registered as a corporation nor a partnership with the Commission. Moreover, they lack the authorization to solicit investments from the public or issue any investment contracts and securities. This is a clear violation of the Securities Regulation Code, specifically Sections 8 and 12.

The public is strongly urged NOT to invest or continue investing in any scheme offered by ARCANE DIGITAL MARKETING. Investments in unregulated entities carry significant risks, as they do not adhere to the necessary investor protection standards and market conduct requirements.

The Commission is also issuing a stern warning to individuals and entities involved in the promotion, sale, or recruitment of ARCANE DIGITAL MARKETING. Participation in these unauthorized activities could result in severe legal consequences, including penalties and imprisonment, as stated in the Securities Regulation Code and the Financial Products and Services Consumer Protection Act (FCPA).

Additionally, the Commission will report the names of all involved parties to the Bureau of Internal Revenue (BIR) for appropriate penalization and tax assessment.

The public is encouraged to report any suspicious investment solicitation activities related to ARCANE DIGITAL MARKETING to the Commission's Enforcement and Investor Protection Department at epd@sec.gov.ph.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

FINRA fines Mundial Financial Group $100K for compliance failures, AML violations, and unregistered principal activity.

ASIC warns of rising pump-and-dump scams after four Australians were convicted for manipulating penny stocks via Telegram.

In the world of online trading, trust is the currency that matters most. However, recent data aggregation by WikiFX has signaled a "level red" alert regarding Tradeview Markets. Between July and November 2025, our support center was flooded with complaints alleging that the broker unilaterally wiped out account balances under the guise of "negative balance reversal," while simultaneously employing "account deletion" tactics in Asian markets. This report investigates the alarming patterns behind these complaints and analyzes why existing regulations failed to protect these traders.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.