Italy’s CONSOB Blocks Five Illegal Investment Sites

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The opportunities for Muslim traders to engage in forex trading during Ramadan 2023, providing tips for successful trading. It recommends choosing regulated brokers, planning trading activities in advance, setting realistic goals, using a trading plan, managing risk, and staying informed. By following these guidelines, Muslim traders can increase their income while also focusing on spiritual growth during the holy month.

The month of Ramadan is the holy for Muslims around the globe, during which they observe fasting, partake in devotional activities, and exercise self-control. The chance to engage in currency trading, one of the most profitable marketplaces in the world, offers Muslims a special way to make the most of their time.

The dealing of currencies known as forex involves dealers speculating on the price changes of various currency combinations in an effort to increase their earnings. The currency market is accessible to dealers from all over the globe because it is open twenty-four hours a day, five days a week. For Muslim merchants, currency dealing during Ramadan can offer a second source of revenue if they have the necessary skills and information.

Islamic accounts must take certain specific precautions when dealing currency during Ramadan because Islamic finance is governed by Shariah law, which forbids all deals involving interest.

As a sign of regard for the sacred month of Ramadan, some firms may provide unique discounts or lower trading costs for Islamic accounts during this time. As a gesture of gratitude and to devote more time to their spiritual routines, some merchants may also decide to scale back their business activity during Ramadan.

For any trading endeavor to be successful, selecting the ideal forex dealer is crucial. The best choice is to use a regulated forex broker because they have a license and are allowed to offer trading services to users by the appropriate regulating bodies. They provide a secure dealing atmosphere, guaranteeing the safety of dealers' money and the protection of their interests.

Trading Mechanics:

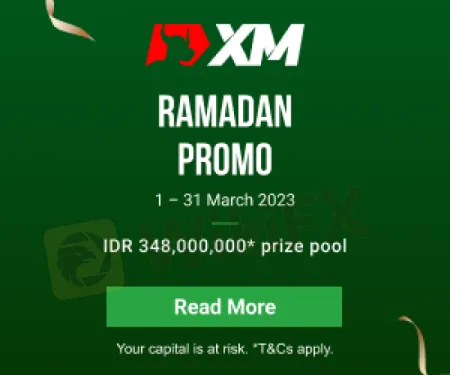

- Register for the promo with a verified XM real trading account and have a minimum balance of $200 (or currency equivalent).

- Start trading in forex, gold, or silver from 1 to 31 March 2023.

- Trade at least 2 standard lots to qualify for the lucky draw.

- For every additional 1 lot, you will receive 1 extra lucky draw ticket. There is no limit to the number of tickets that can be collected.

Broker's link: https://www.wikifx.com/en/dealer/0001461138.html?source=fma3

HFM Markets

Trading Mechanics:

- Register with HFM Broker

- Complete KYC verification

- Deposit at least $300

- Trade at lease 2 standard lot on Forex or Gold

- Promotion duration – 1st March 2023 to 28th April 2023

- Win a trip to Mecca and exclusive cash prizes

- Other 50 Clients will win $1000 each

Broker's link: https://www.wikifx.com/en/dealer/7391713958.html?source=fma3

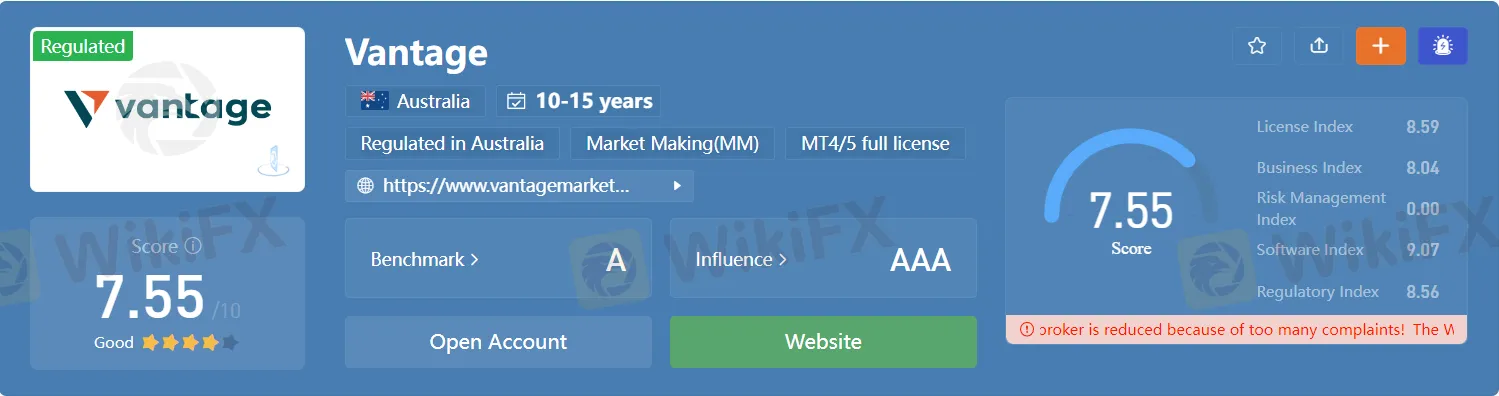

Vantage

Trading Mechanics:

Claim 100% Trading Bonus from Vantage. You can earn 100% trading bonus on your deposits, up to a total of USD$30,000, from now until 30 April 2023. If you are a new customers, you will need to create a new account first. Simply deposit a minimum of USD$2,000 and start earning cashback as you trade.

- Opt-in to the promotion via Client Portal.

- Fund a minimum of USD$2,000 to the qualify.

- Receive 100% trading bonus on all your deposits, capped at USD$30,000.

- Start earning cashback from your accumulated trading bonus as you trade.

Broker's link: https://www.wikifx.com/en/dealer/0361345333.html?source=fma3

Muslim merchants have a special chance during Ramadan to concentrate on their spiritual development while also conducting business. Ramadan investing calls for self-control, endurance, and a solid trading plan.

Plan Your Trading Activities in Advance

Planning is important for any dealing activity, but it's especially important during Ramadan. It's crucial to arrange your buying activities in preparation, keeping in mind your fasting timetable and other obligations, given the needs of spiritual activities.

Set Realistic Trading Goals

To stop overtrading and accepting unneeded risks, reasonable buying objectives must be established. Determine your degree of risk tolerance, then establish realistic goals that fit with your investing plan.

Use a Trading Plan

A trading strategy serves as a route map for your trading endeavors. It describes your trading activity's key components, including your entrance and departure strategies, risk management strategies, and more. A trading plan helps you stay on track with your trading approach and reduces impulsive trading.

Manage Your Risk

In currency dealing, risk control is essential. To reduce losses and safeguard your trading money, use suitable risk management strategies like stop-loss orders.

Stay Informed

In currency dealing, it's essential to stay current on news and happenings in the market. Follow economic data, world news, and other elements that might have an impact on the market.

For Muslim merchants, Ramadan offers a special chance to participate in currency dealing and boost their revenue. Forex dealing during Ramadan can be lucrative if you have the proper information, skills, and dedication. To trade successfully during Ramadan, you must select an authorized forex firm, organize your trading activities, establish reasonable trading objectives, use a trading strategy, manage your risk, and remain informed.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.

The Cyprus Securities and Exchange Commission (CySEC) has imposed an administrative fine of €100,000 on Wonderinterest Trading Ltd, a Cyprus Investment Firm (CIF), for multiple regulatory violations identified during the period 2022–2024.