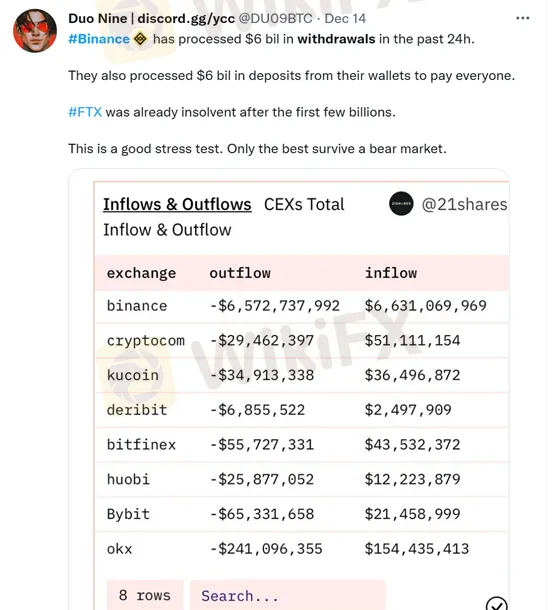

Abstract:With the downfall of FTX, the crypto world has met its serious “winter”, and many investors started to question another exchange giant-Binance. According to Reuters, Binance’s net withdrawals exceeded $3.6 billion last week. Changpeng Zhao, the CEO of Binance says that it should be considered a “stress test” that will prove the company’s solvency.

With the downfall of FTX, the crypto world has met its serious “winter”, and many investors started to question another exchange giant-Binance. According to Reuters, Binance‘s net withdrawals exceeded $3.6 billion last week. Changpeng Zhao, the CEO of Binance says that it should be considered a “stress test” that will prove the company’s solvency.

About Binance

Binance is a global cryptocurrency exchange that provides a trading platform for over 100 cryptocurrencies. Binance has been considered the world's largest cryptocurrency exchange in terms of trading volume since the beginning of 2018.

The name Binance is based on a combination of the words binary and finance. Binance's currency exchange service, which started in 2017, can process around 1.4 million orders per second and offer transactions in more than 150 cryptocurrencies. Changpeng Zhao is the founder and CEO.

About FUD effect

Fear, Uncertainty, and Doubt

Fear, uncertainty, and doubt (abbreviated as FUD) are a collection of mental states that can influence people‘s thinking in a variety of situations, and that are often used together to manipulate people’s behavior. A series of events occurred recently in the crypto world, giving people a feeling of FUD. As we know, Binance is facing a FUD effect now.

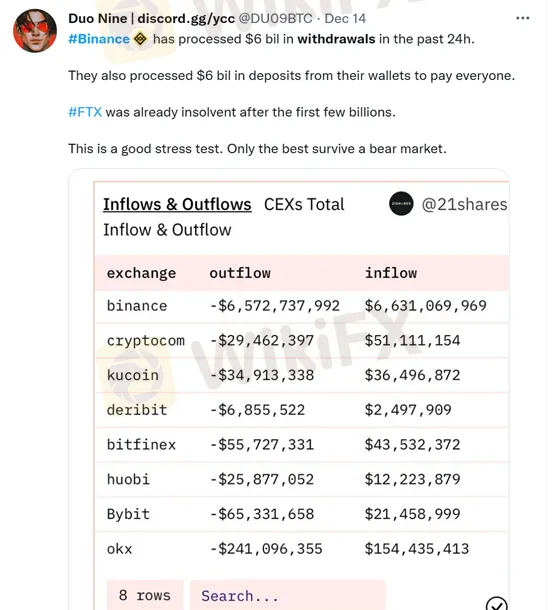

According to Nansen analysts, Binance accounts were emptied of $8.78 billion in assets between December 7 and 13, while $5.12 billion in assets were deposited. The collapse of FTX impacted user confidence and led to significant outflows from CEX accounts, according to Reuters.

Response from Binance CEO

However, Binance CEO Changpeng Zhao said the current situation was good for the company as it would serve as a “stress test” and prove its solvency. He earlier calmed the clients by saying that the industry had become “healthier” after FTXs crash.