Italy’s CONSOB Blocks Five Illegal Investment Sites

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Recently, the Seychelles Financial Services Authority (Seychelles FSA) warns an unregulated broker named Live Capitol.

At first, we thought the broker was just another scam that investors often see on the forex market. However, as our investigation advanced, we found another four unregulated brokers are highly similar to Live Capitol.

Here are the names and websites of the five brokers:

1. Live Capitol

Website: https://www.livecapitol.net/

2. Profited Crypto

Website: https://www.profitedcrypto.online/

3. Flipuniquemarket

Website: https://www.flipuniquemarket.live/

4. Sharesforextrade

Website: https://sharesforextrade.com/

5. TradingMasterClass77

Website: https://tradingmasterclass77.com/en.html

Similarities

First of all, though logos and trade names are different, the website designs of the scammers are very similar. And the awards they have claimed to won are almost the same.

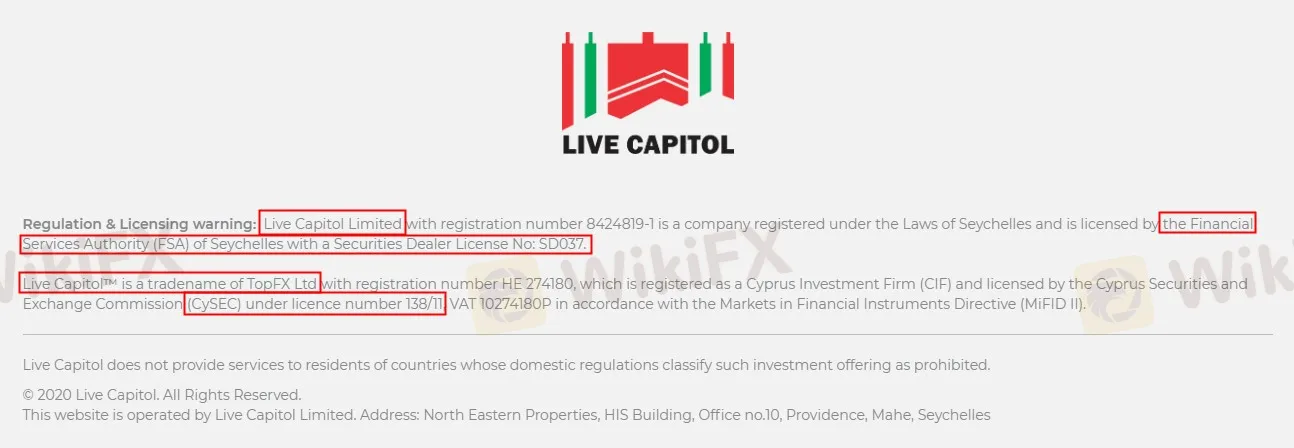

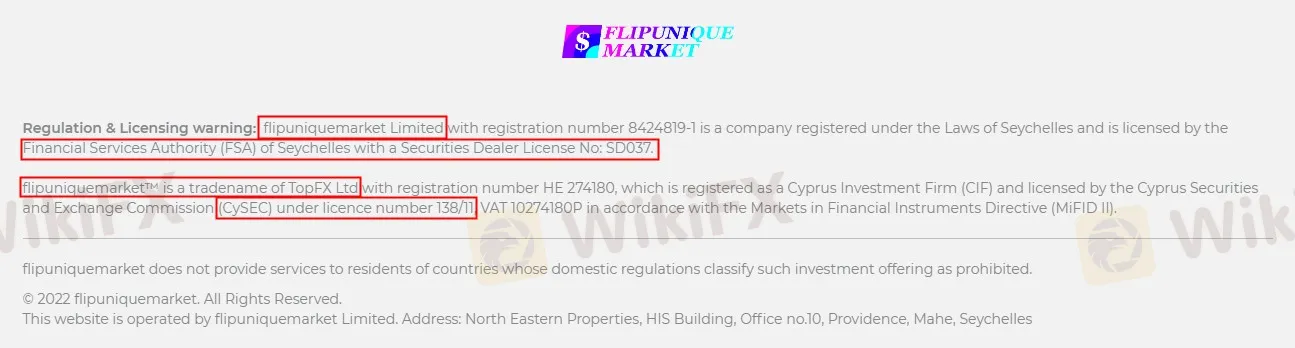

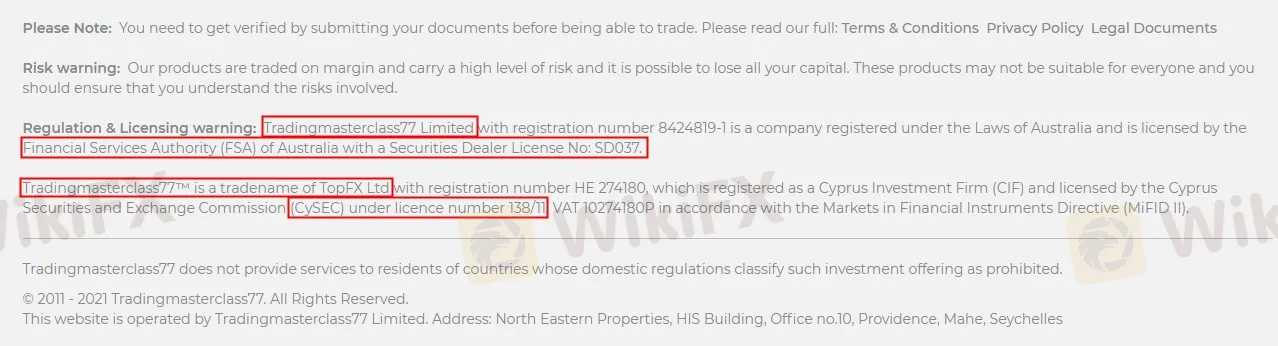

Even their company names are all in the format - 'Trade Name' +LTD. What's more, the regulatory information they claim is also the same! The fraudsters all claim to be the brand names of TopFX Ltd, a company regulated by the Cyprus Securities and Exchange Commission (CySEC) with regulatory number 138/11.

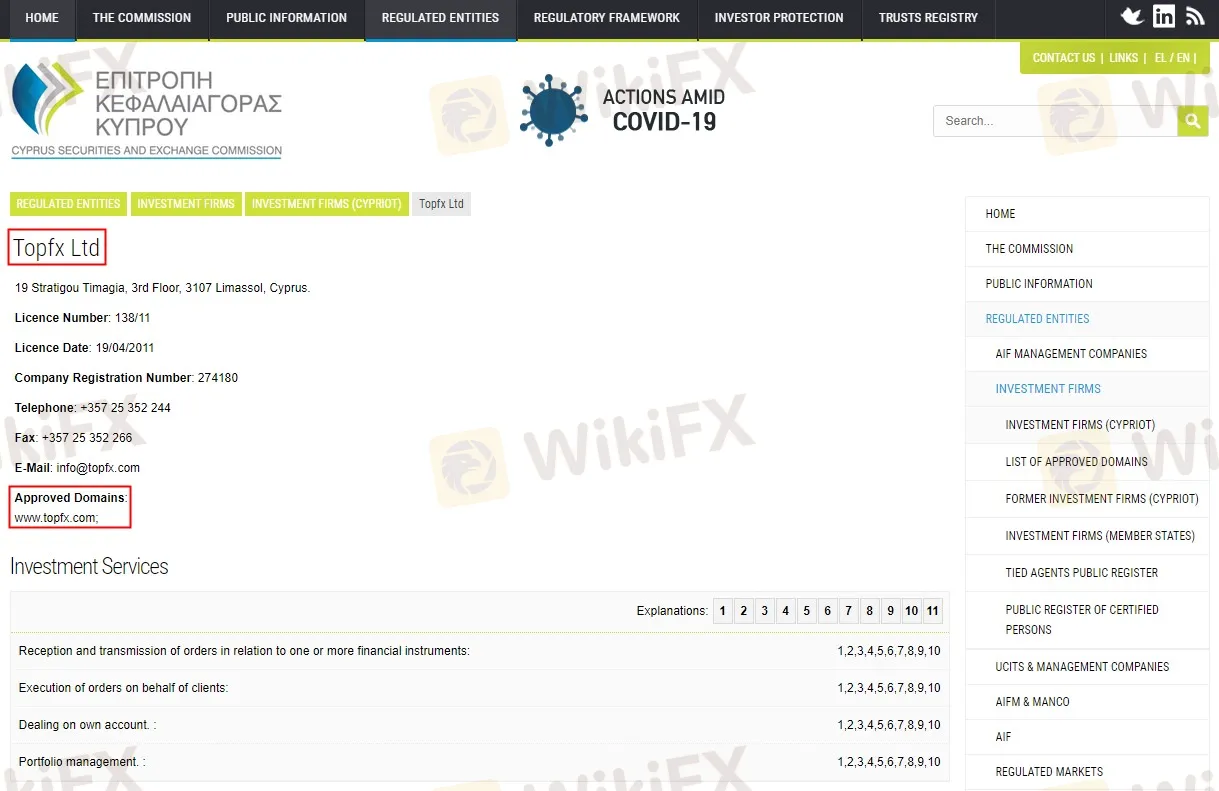

According to CySEC, TopFX Ltd is indeed regulated by CySEC. However, the scammers have nothing to do with regulated companies. And the strongest evidence is that the CySEC-approved website is www.topfx.com, not any of the five above.

We always see scammers claiming to be the brand name of a legitimate company, while no information can approve the scammers having a connection with the company.

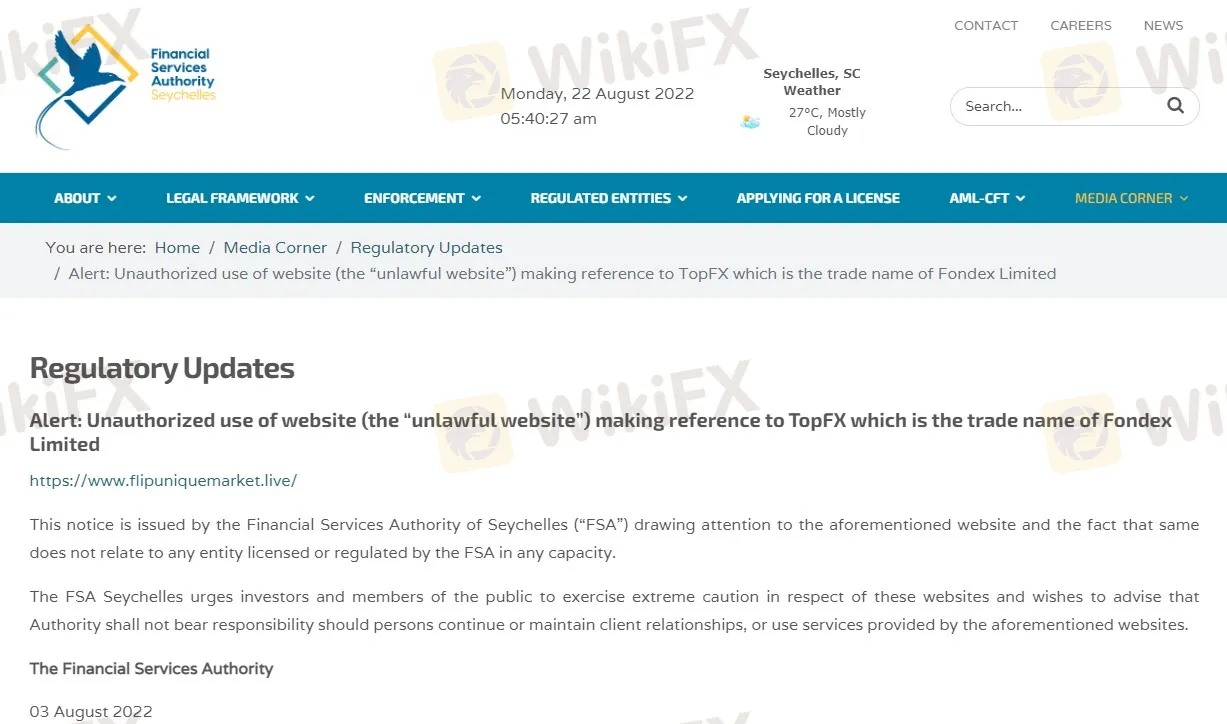

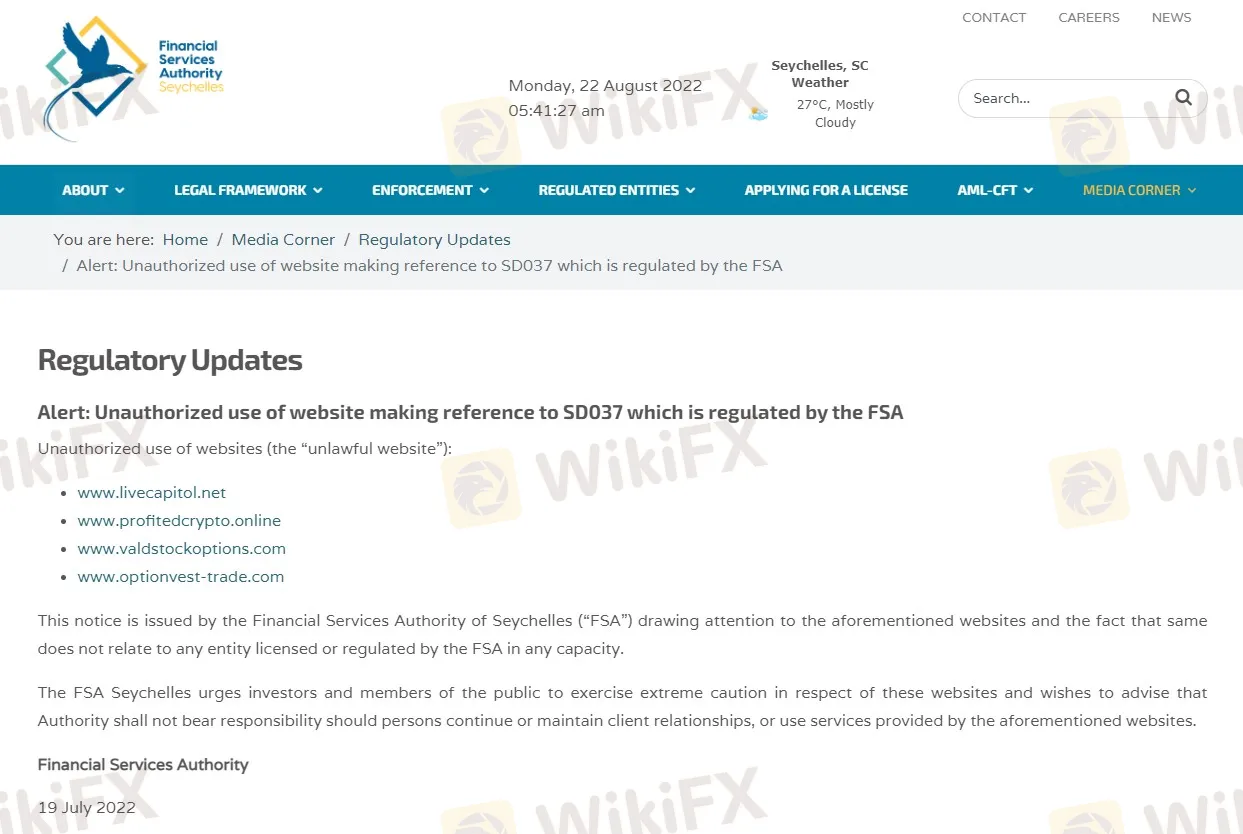

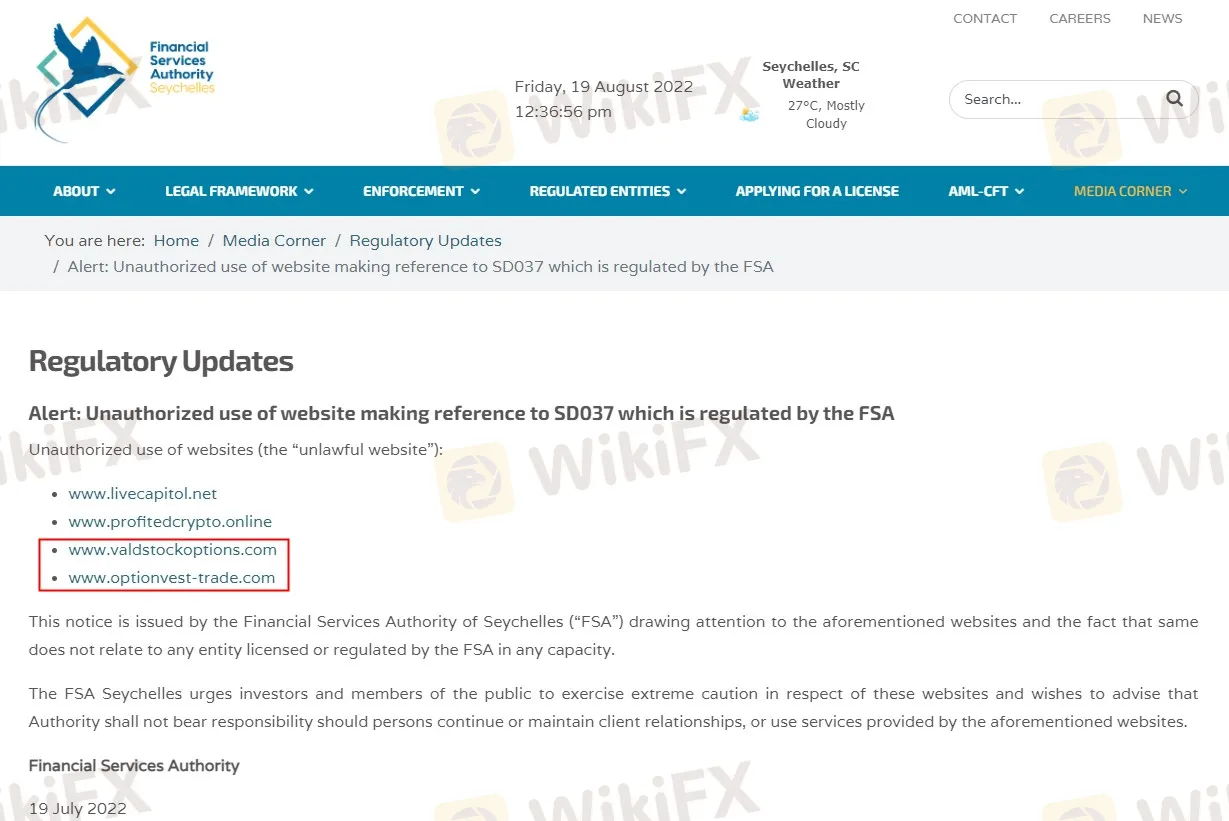

Seychelles FSA Warnings

Moreover, the frauds also claim to be licensed by Seychelles FSA with the number SD037. However, the Seychelles FSA does not authorize their forex activities but issued warnings to them.

And one of the fraudsters - Sharesforextrade - is also warned by CySEC.

Besides, two websites in Seychelles FSA are inaccessible now. Therefore, we suspect the illegal company may have other scam sites or going to create some other new sites. It is recommended that investors stay alert and not fall into this trap.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

ZarVista changed its name from ZaraFX in September 2024. It claims to be a worldwide broker offering various services. It offers the popular MetaTrader 5 (MT5) platform, high leverage of up to 1:500, and various account types tailored to different traders. However, when we look closer, we find many serious risks that anyone thinking about using it should know about. The main problem is how it's regulated - it operates in offshore locations that don't watch financial companies very closely. This gets worse when you add the many user complaints about problems getting their money out, plus a serious legal investigation by Indian authorities in 2025. This review will break down these problems and give you a clear picture of this broker. You need to do careful research, and we suggest you check any broker's current regulatory status and user reviews yourself. A tool like WikiFX can give you current information and important risk warnings.

The Cyprus Securities and Exchange Commission (CySEC) has imposed an administrative fine of €100,000 on Wonderinterest Trading Ltd, a Cyprus Investment Firm (CIF), for multiple regulatory violations identified during the period 2022–2024.